cemagraphics/iStock via Getty Images

The first quarter of 2022 is officially done. This has been quite an exciting year for us, dividend investors. Finally, there are plenty of undervalued dividend growth stocks to buy! The two of us are constantly adding to our portfolios, building toward financial freedom one step at a time. That is why each month, we take a step back and review our current results. In this dividend income summary, I’ll review my March dividend income total and share the dividend increases we received.

Why I Invest in Dividend Stocks

I invest in dividend stocks to grow my passive income. One day, my dividend income will be large enough to cover my monthly expenses. That is why we are relentlessly searching for undervalued dividend stocks to buy. To put our hard-earned cash to work.

We save a high percentage of our income each month, to help fuel our dividend stock portfolio. Having a high savings rate is a key pillar of our strategy and helps fuel the fire and push the snowball further downhill. While we are waiting to invest our money in the market, it is earning a high-interest rate in accounts such as Yotta (1% – 2% APY, on average) or SoFi (Recently announced a 1% APY on all savings and a $15 bonus for signing up). If you are looking to earn more on your cash, it is definitely worth checking those products out!

We use our dividend stock screener with every stock purchase. Our stock screener continues to help us find undervalued dividend stocks to buy. This simple, 3-step stock screener is designed to identify undervalued stocks with a strong payout ratio that have a history of increasing their dividend. Fundamental dividend growth investing at its finest.

Building a large dividend income stream takes time, consistency, hard work, saving, and most importantly, investing. I have been investing in dividend growth stocks since 2012. Saving a high percentage of my dividend income allows me to invest as much as possible, so we can retire as soon as possible.

Slowly, but steadily, my income has grown. Brick by brick. DRIP by DRIP. It is really exciting to see the growth and larger dividend checks trickle into my brokerage account.

Each month, we share our dividend income summaries to highlight our growth and progress. It is a fun and helpful exercise that holds us accountable. Further, it helps you, our followers, see the stocks we are purchasing.

Bert’s March Dividend Income

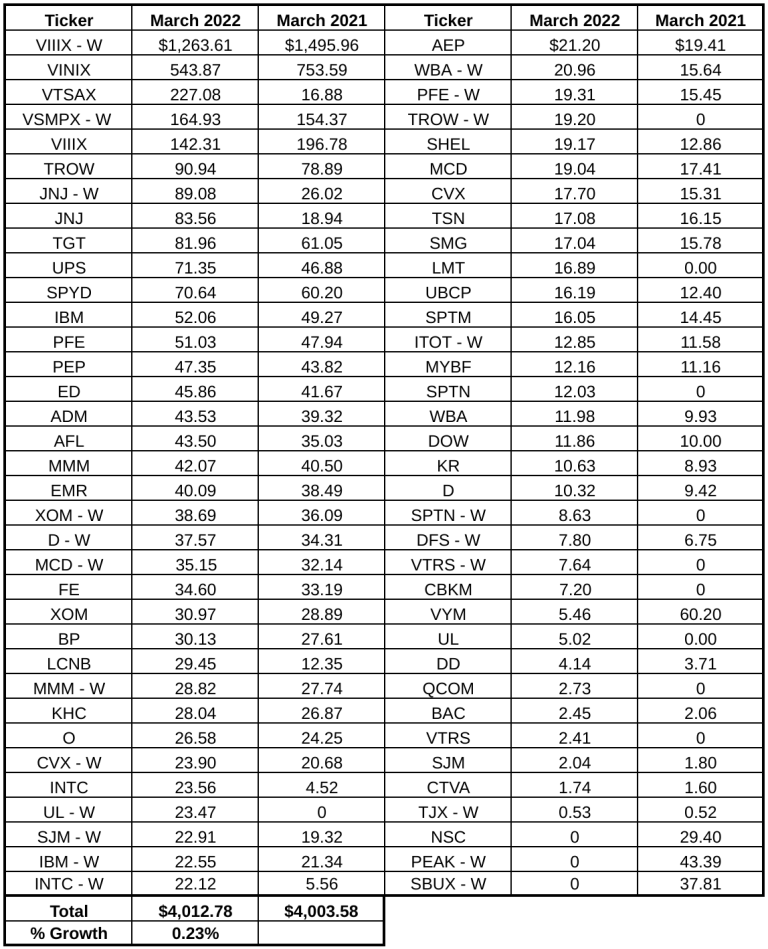

In March, we received $4,012.78 in dividend income! This was a .2% year-over-year increase. We are so pumped up and blessed to have received over $4,000 in dividend income in a month. The following chart summarizes each individual dividend payment we received during the month.

I always like to include a few observations in the remainder of the section about our dividend income, growth, and any trends worth highlighting!

Observation #1: This was a Frustrating Vanguard Quarter

Lanny hit the nail on the head in a recent article. He discussed Vanguard’s first quarter dividends and a key observation – that several vanguard funds posted disappointing dividends in the first quarter. He was not the only Diplomat to feel a Vanguard crunch this quarter. If you look at the chart above, our top dividend payments came from Vanguard….and they decreased compared to last year.

This serves as a great reminder that dividend increases, especially in funds where you can’t control every holding, are not guaranteed. We rode a strong wave of consecutive Vanguard dividend increases. This quarter was a slight speed bump!

Observation #2: Holy Johnson & Johnson (JNJ)!

If you are a long-time follower, you know that my wife and I each purchase one share of Johnson & Johnson every week. It has been a blast watching this position grow over the past year. Not only from a market value standpoint but a dividend one as well.

Look at the chart above. Can you see how much our dividend income grew from JNJ due to this consistent, automated investing strategy? My income grew $64 compared to last year while my wife’s income grew $63. I highly recommend initiating a weekly investment strategy if you can, whether you buy VYM like Lanny, JNJ like us, or another investment.

Observation #3: We Own A lot of Individual Holdings

The one interesting thing is that we received 67 individual dividend payments between our two accounts. Since my wife and I hold the same stocks in different accounts, we received two dividend payments from the same company on multiple occasions (like Johnson & Johnson). I’ll never shy away from buying an undervalued dividend growth stock. However, transparently, it would be great to slim down the number of holdings or to stop adding new companies to our portfolio.

The Impact of Dividend Increases

We love dividend increases. We can’t say it enough (trust us, if you see our Twitter feed – you know EXACTLY what I’m talking about). Who doesn’t love the feeling of seeing your dividend income grow without lifting a finger? That’s part of the reason why we think dividend investing is the best and easiest form of dividend income. That’s why we are always writing about dividend increases and recording videos about the recent dividend increases announced!

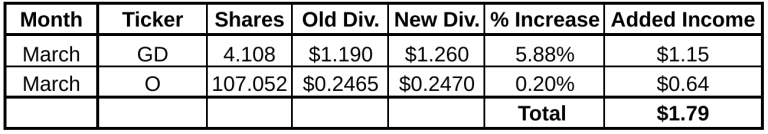

Each month, in our dividend income summaries, we demonstrate the impact each dividend increase has on our forward dividend income. Unfortunately, in March, it was a VERY light month for dividend increases. The following chart summarizes the impact of each dividend increase:

I told all of you that this was a light month. We only received two dividend increases. In total, the small dividend increases from General Dynamics (GD) and Realty Income (O) may help us get a cheeseburger at McDonald’s! But hey, a small dividend increase is better than no dividend increase. I’ll never complain about more dividend income….even if it is only $1.79!

Summary – March Dividend income

How could we not be excited about receiving $4,000 in income without lifting a finger. Each month, each dividend motivates us to continue pushing harder to reach financial freedom. March 2022 wasn’t a gentle nudge. It was a full-body shove of motivation. Like always, we are going to continue saving as much as we can and moving cash from the sidelines and into income-producing assets.

How did you perform in March? Did you set a dividend record? What was your largest dividend payer? How many individual dividend stocks do you own in your portfolio? Would you slim down your holdings if you were me?

Bert

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment