FG Trade

Investment Thesis

Perrigo Company plc (NYSE:PRGO) is a manufacturer of over-the-counter pharmaceuticals. The company has completed HRA Pharma’s acquisition and applied for FDA approval of new products. In this thesis, I will be analyzing the effects of all these factors on the company’s future outlook.

Company Overview

PRGO offers over-the-counter (OTC) health and wellness products to improve personal wellbeing and provide customers the power to proactively prevent or treat problems that are treated on their own. The company operates in two segments: Consumer Self-Care Americas (CSCA) and Consumer Self-Care International (CSCI). CSCA’s product portfolio comprises cough, cold, allergy, analgesics, gastrointestinal, smoking cessation, infant formula, oral care, animal health category, and contract manufacturing which are distributed in the USA, Mexico, and Canada. This segment contributes 65% of total net revenue. CSCI comprises PRGO’s products such as natural health and vitamins, cough, cold and allergy, personal care and derma-therapeutics, and lifestyle categories with brand value in Europe and Australia. The company also operates its stores in the United Kingdom and parts of Asia under the CSCI segment. This segment generates 35% of the total revenue. The company focuses on acquisitions to boost its inorganic growth and new product innovations to expand the current market share and maintain its organic revenue growth. Last year the company launched many products under both operating segments. The new product revenue of the CSCA segment was $56.1 million, while the CSCI segment’s new product revenue was $73.9 million. The company pays a dividend yield of 2.54%. I believe the company will benefit from the new and previous acquisitions and the latest product launch, which will impact future results positively. The company has completed the acquisition of HRA Pharma. It has also received FDA approval for Omeprazole Magnesium and submitted the first-ever over-the-counter birth control pill application.

Acquisition of HRA Pharma

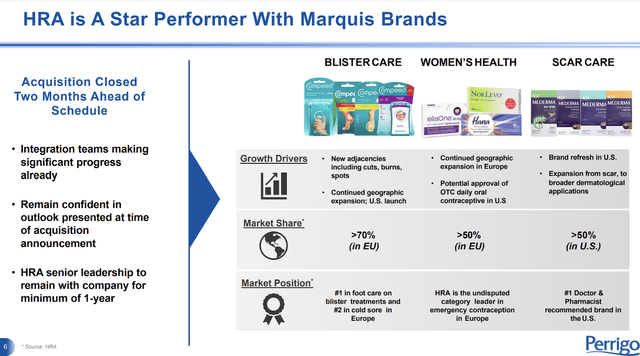

Recently, the company announced the successful completion of the acquisition Héra SAS (HRA). The company closed the deal two months before the scheduled date. With this acquisition, PRGO will own all of the HRA’s brands from blister care, women’s health, and scar care segment. HRA has acquired more than 70% market share of the blister care market, while it has more than 50% market share of the women’s health and scar care segment. HRA is planning to launch its blister care business in the USA and expand its women’s health care business in untapped territories of Europe. HRA will also broaden the scar care product portfolio to a broader dermatological application. PRGO is estimating a high growth outlook for the integration of the HRA with the €55 million-€65 million or $65.8 million to $77.8 million in operating income from 8 Months of HRA integration in 2022.

The company has executed the acquisition for €1.8 billion, or approximately $1.9 billion in cash. I believe this deal will be a primary growth factor for the company because of the outlined expansionary plan of HRA, which is explained in the above paragraph. With this acquisition and expansionary plans in various geographies, PRGO’s earnings will rise significantly and experience robust growth in the coming years.

FDA Application for New Products

PRGO always invests money in product innovation and new product launches to expand its earnings. Recently, the company received FDA approval to sell the Omeprazole Magnesium Delayed-Release Mini Capsules, 20 mg over-the-counter. The company plans to launch the Omeprazole Minis by the end of this year. This is a launch of the first-to-market mini capsule form of omeprazole which is used for the treatment of heartburn. The size of the capsule is 70% smaller than the original version. The product will be promoted under store brand labels. PRGO’s HRA Pharma has applied for FDA approval first over-the-counter birth control pill, which is marketed in the US. This is the first daily birth control pill in the US to be sold over-the-counter (OTC) without a prescription if it gets authorized, and I believe with the recent strict abortion policy, this product can turn out as a big positive for the company which will support the primary catalyst. I think the launch of mentioned products will boost the company’s earnings in the coming quarters as both are the first to the market move.

Perrigo Financials

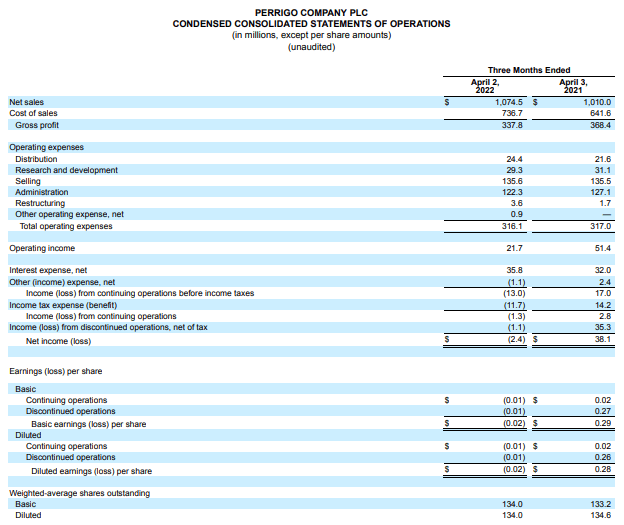

SEC:10Q PRGO

PRGO reported net sales of $1.07 billion, a 6.5% increase from $1.01 billion in Q1 2021. This includes an organic net sales increase of 9.7%, primarily driven by strong demand for cough products globally and infant formula in the United States. The company saw a significant rise in the cost of sales from $641 million in Q1 2021 to $736.7 million, majorly due to inflationary headwinds. I believe the inflation will have a negative impact on the gross margins in FY22, but the situation in the coming quarters will see an improvement compared to Q1 2022, given the several approvals for product distribution and the acquisition of HRA Pharma. The company reported diluted loss per share from continued operations of $0.01 compared to diluted EPS of $0.02 in Q1 2021 and diluted loss per share of $0.01 from discontinued operations, compared to diluted EPS of $0.26 in Q1 2021. The company reported a total loss per diluted share of $0.02, compared to EPS of $0.28 in the Q1 2021. The decline can be attributed to the high cost of production due to global inflationary pressure. Q1 2022 result reflected positive revenue growth, but the gross margins were disappointing, and the EPS missed market estimates by 21%.

However, the company has provided strong guidance for FY22 both in terms of revenue and EPS growth. The company has raised the FY22 revenue guidance from 3.5%-4.5% to 8.5%-9.5%. The company also raised the FY22 adjusted EPS guidance from $2.10-$2.30 to $2.30-$2.40. As per my analysis, the primary factor behind the revised guidance is the acquisition of HRA Pharma, with HRA Pharma’s expected contribution to FY22 EPS at $0.35. I believe HRA Pharma will drive significant growth for the company in the coming quarters.

President and CEO, Murray S. Kessler, stated:

First quarter earnings were in-line with our expectations, despite significant and increasing cost headwinds and a significantly strengthening U.S. dollar. We now expect full year 2022 cost headwinds to increase by approximately $125 million versus prior year as compared to our original expectation of an increase of $80 million. While price increases and procurement actions are expected to offset inflation for the full year, adverse foreign exchange rate movements and to a lesser extent business disruption in Ukraine and Russia are likely to remain. With the addition of HRA Pharma and higher expectations for organic net sales growth, we expect to more than offset these headwinds and have raised our net sales and adjusted EPS guidance for the year.

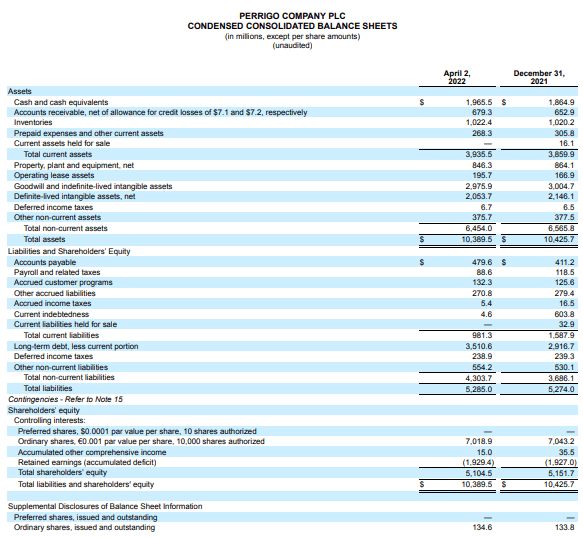

SEC:10Q PRGO

PRGO has cash and cash equivalent of $1.96 billion, an improvement of $100.6 million from the previous quarter. The company has long-term debt of $3.5 billion as of April 2, 2022. I believe the long-term debt is a cause of concern for the company as it has increased the interest payment burden due to the recent interest rate hikes and a credit ratings downgrade by S&P and Moody’s in the Q1 2022. Going ahead, the management should work on improving the leverage position of the company.

Key Risk Factor

Inflationary Headwinds: The company has experienced a significant impact of inflation which is reflected in the recent quarterly result. The inflation has resulted in a significant rise in the cost of production. The freight cost also experienced a drastic rise resulting in contracted margins for the company. The other factors resulting from inflation, like the interest rate increase employed to tackle inflation in the economy, have resulted in increased stress of interest payment on the company. Also the credit ratings downgrade by S&P and Moody’s for the company played a big part in the recent interest rate hike. The company faces these inflationary headwinds, and it is important for the management to address these issues.

PRGO Stock Valuation

PRGO has a market cap of $5.52 billion. The company is trading at a share price of $40.55, a YTD increase of 3.2%. PRGO’S stock price has sustained the recent volatility in the market and recovered quite well. PRGO is trading at a PE multiple of 17.51x with an FY22 EPS estimate of $2.31x. I believe the company is undervalued at current price levels with high growth potential from its acquisition of HRA Pharma and FDA approval for several products. I estimate a significant upside from the current price levels and recommend a buy position in the stock.

Conclusion

PRGO has experienced a solid organic revenue growth and is expected to continue this growth for the rest of FY22. The acquisition HRA Pharma is a great strategic buy by the company as I believe it will drive significant earnings growth for the company in the coming quarters. The company faces the risk of rising inflation and contracted margins as an effect of inflation but I think the future growth prospects offset the inflationary headwinds and provide a favorable risk-reward profile for the company. I assign a buy rating for PRGO after considering all these factors.

Be the first to comment