AndreyPopov/iStock via Getty Images

Upstart Holdings, Inc. (NASDAQ:UPST) has lost roughly 80% of its value in 2022, and it does not appear that the company’s fortunes will improve anytime soon.

On Monday, the AI-focused lender opened its books to the public and issued a 3Q-22 outlook that is unlikely to satisfy investors. The AI lending company expects significant headwinds in 3Q-22, resulting in another 26% QoQ sales drop.

With no catalyst in sight and potentially higher delinquencies resulting in stricter lending criteria, Upstart’s valuation is likely to fall further.

It Is Getting Even Worse For Upstart

Due to Upstart’s sales slowdown, the company released preliminary results, which I discussed in my previous article entitled ‘Upstart: The Investment Case Just Took A Serious Hit‘. Upstart forecasted sales of $295 to $305 million for 2Q-22, but cut its forecast to $228 million at the start of July due to decreased demand for the company’s loans. Upstart’s new guidance reflected a 23% shortfall to the company’s lower end of guidance.

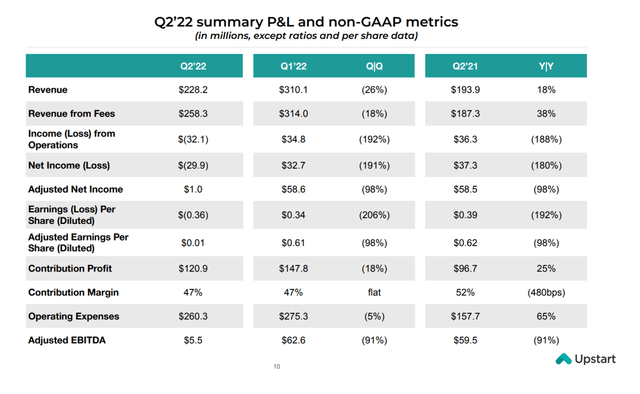

Upstart’s 2Q-22 sales were $228 million, up 18% YoY but down 26% QoQ. Having said that, the artificial intelligence company fell far short of the sales growth rates seen last year, or even earlier this year. Upstart’s sales increased 156% to $310 million in 1Q-22. Upstart’s sales increased 264% to $849 million in 2021, owing to a surge in demand for personal loans during the pandemic.

Aside from slowing sales growth, Upstart’s operations have resulted in higher losses, which is a problem for a company that promised triple-digit annual sales growth rates and reasonable profitability until very recently.

Upstart made a $135 million profit in 2021. While Upstart generated profitable growth last year, the company lost $30 million in the second quarter of this year, and the outlook does not indicate that this will change.

Q2-22 Summary (Upstart Holdings)

Upstart’s 3Q-22 Outlook Is Nothing To Get Excited About

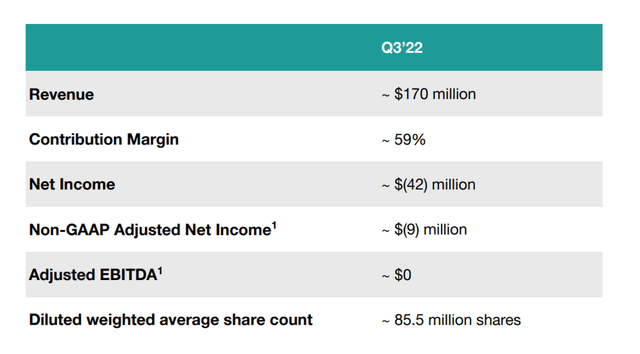

Upstart’s third-quarter forecast does not indicate that business is improving for the lending startup. The company expects to generate only $170 million in revenue in 3Q-22, reflecting another significant drop in sales due to ‘funding constraints in Upstart’s marketplace’. In other words, the number of loans originated by Upstart is decreasing.

The outlook for 3Q-22 is even worse than the revised outlook for 2Q-22 because it calls for only $170 million in revenue, reflecting a 26% drop in sales QoQ amid increasing macroeconomic challenges.

Upstart had a potential sales base of $1.24 billion based on run-rate 1Q-22 sales ($310 million). The new sales base is $680 million, based on expected 3Q-22 revenues. This means that Upstart’s annualized sales potential has dropped by roughly 45% since early 2022, and in a very short period of time.

Q3-22 Revenue (Upstart Holdings)

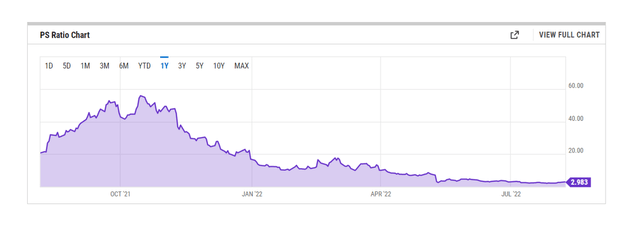

Upstart’s Valuation

At this point, Upstart’s sales-based valuation is no longer viable. The company’s sales are expected to be $1.1 billion, but this estimate may be too optimistic after the company released its 3Q-22 outlook. Adding 1Q and 2Q actual sales to the forecast for 3Q brings the 9M-22 total to around $708 million, indicating that Upstart’s total sales will likely be less than $1.0 billion in 2022.

Nonetheless, Upstart has a sales multiple of 3.0x, and, as previously stated, the sales base is shrinking while Upstart is no longer profitable. This is problematic in terms of valuation.

Why Upstart Holdings Could See A Higher Valuation

The outlook for sales growth is bleak, and there is little that can be done to change that. If Upstart makes a significant acquisition or is acquired, its valuation may rise.

Given that Upstart continues to trade at a high sales multiple despite a shrinking sales base and lower originations, the chances of Upstart achieving a higher valuation are slim. A surge in loan demand and originations, on the other hand, could shake things up for Upstart.

My Conclusion

When it rains, it truly pours. Upstart already reduced its sales forecast in July, but the company expects another 26% drop in 3Q-22 due to weak loan originations.

Even though I believe that artificial intelligence-based lending has a bright future in the credit industry, Upstart’s new 3Q-22 outlook has dashed any remaining hope for a near-term turnaround in Upstart’s stock.

Because Upstart is also not expected to be profitable in 3Q-22 and may need to restructure its business, there is more pain ahead, and the AI-focused lender has more to worry about than its sales base going up in flames.

Be the first to comment