jetcityimage

Introduction

My thesis is that Schwab (NYSE:SCHW) has a stellar future as we move to a world with higher interest rates. Net interest revenue went up $361 million from $2,183 million in 1Q22 to $2,544 million in 2Q22. Bank call reports show that more of this type of revenue makes its way to the bottom line than other types of revenue. As such, GAAP net income and adjusted net income went up from $1,402 million and $1,591 million, respectively, in 1Q22 to $1,793 million and $1,981 million, respectively in 2Q22 per the 2Q22 release.

The Numbers

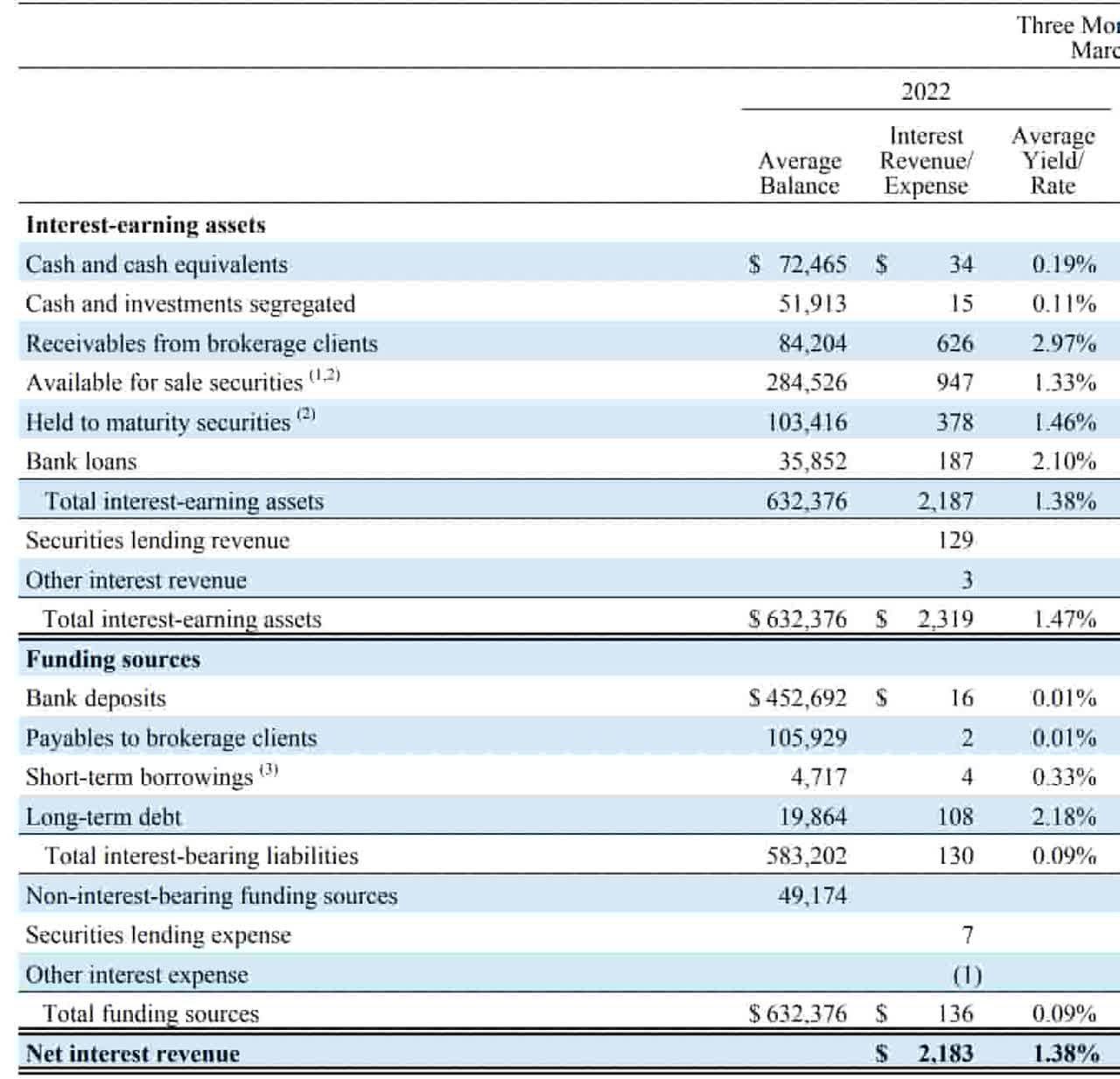

Interest revenue went up from 1Q22 to 2Q22 because the average yield burgeoned from 1.47% to 1.73% as rates increased. We see from the 1Q22 release that the net interest revenue was $2,183 million after $136 million in expenses on the $2,319 million interest revenue:

1Q22 net interest revenue (1Q22 release)

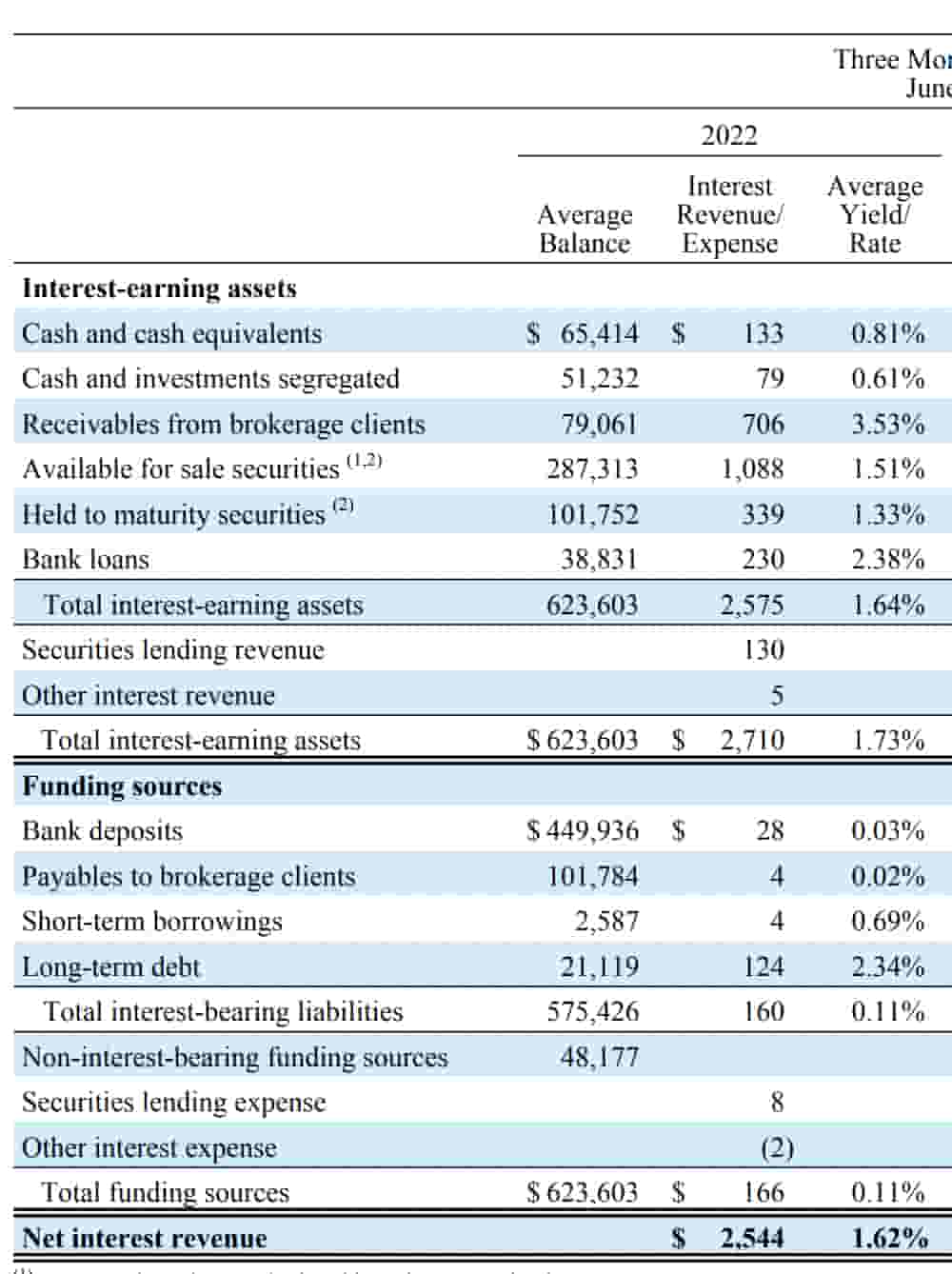

The 2Q22 release shows that net interest revenue was $2,544 million after $166 million in expenses on the $2,710 million interest revenue:

2Q22 net interest revenue (2Q22 release)

It is crucial that the average yield went up 26 basis points from 1.47% to 1.73%. This allowed Schwab to generate more interest revenue even though the level of interest-earning assets went down from $632.4 billion to $623.6 billion.

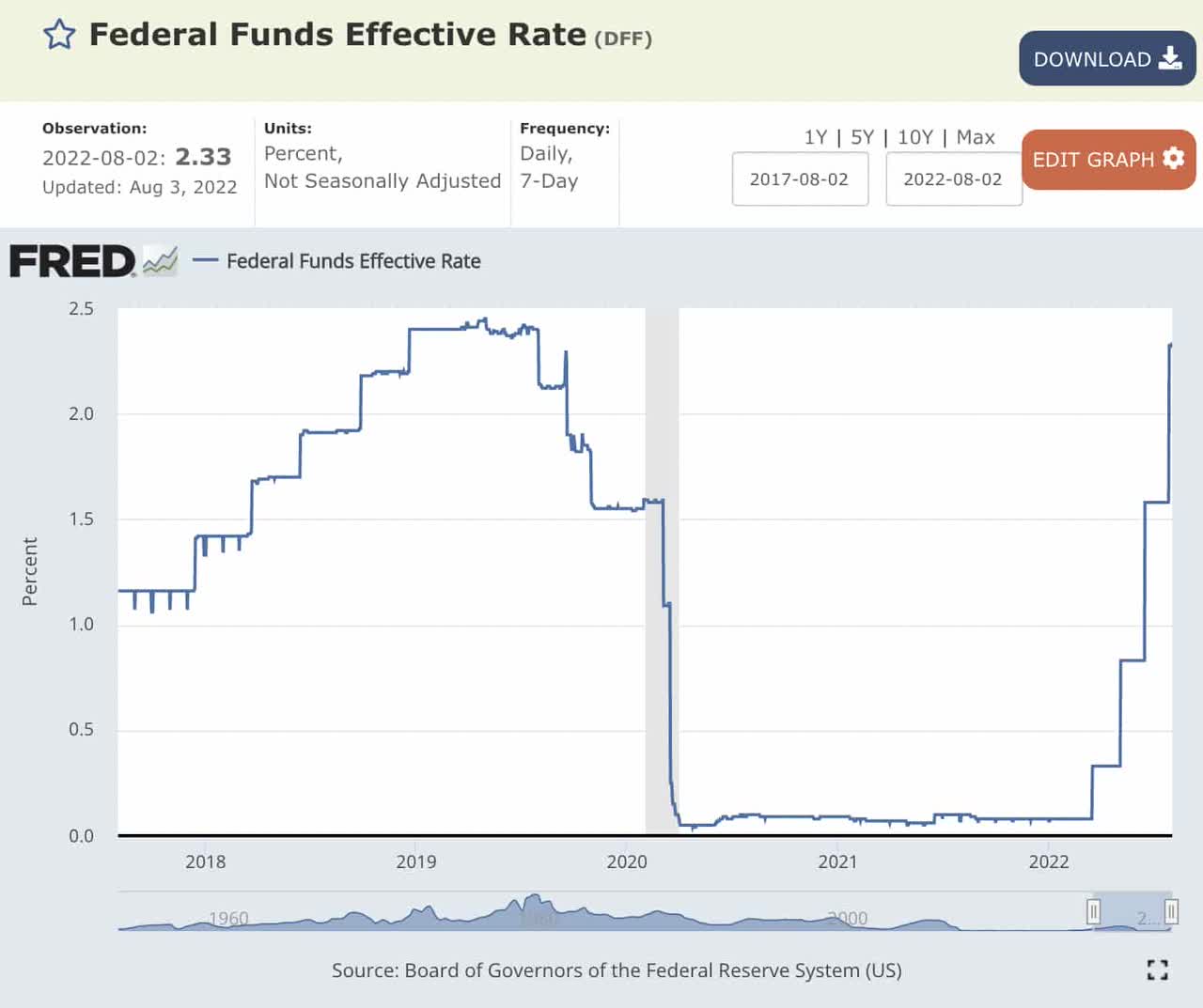

One of the intriguing things about these numbers is that the 2Q22 period was in an environment where interest rates were lower than they are today and lower than they are expected to be in the future. The FRED Federal Funds Effective Rate went up from almost 1.75% to nearly 2.5% in late July but this was after the 2Q22 period ended:

Historical Federal Funds Effective Rate (FRED)

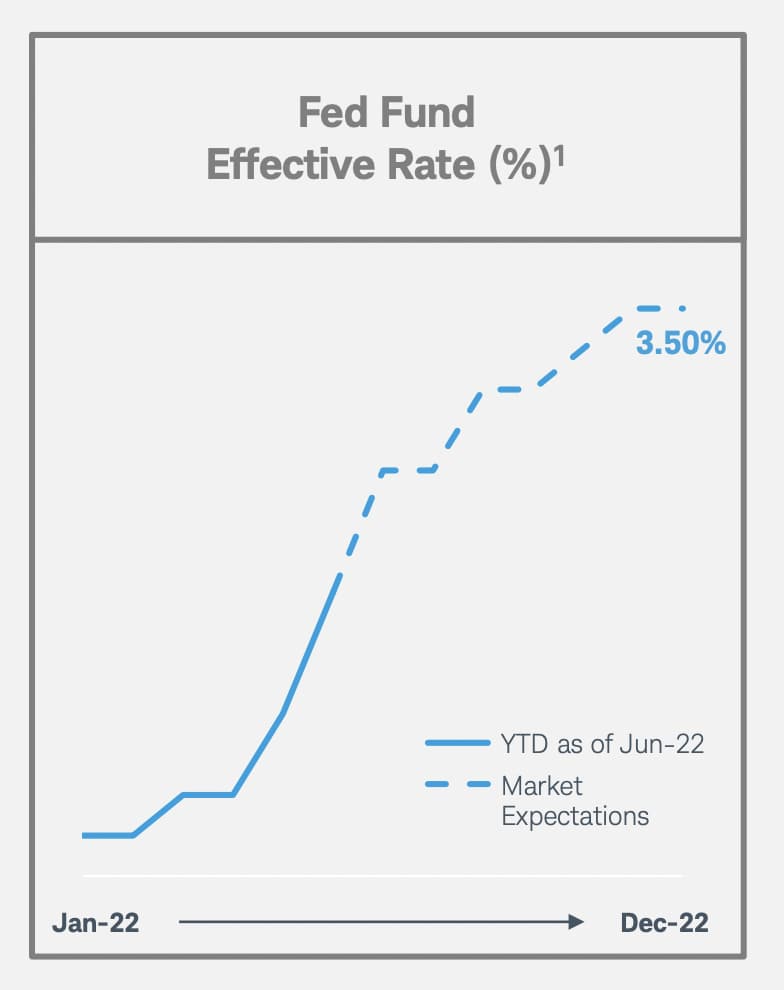

In the July 2022 Summer Update, it is shown that this effective rate is expected to continue climbing up to 3.5% in the near future:

Federal Funds Effective Date Since January (July 2022 Summer Update)

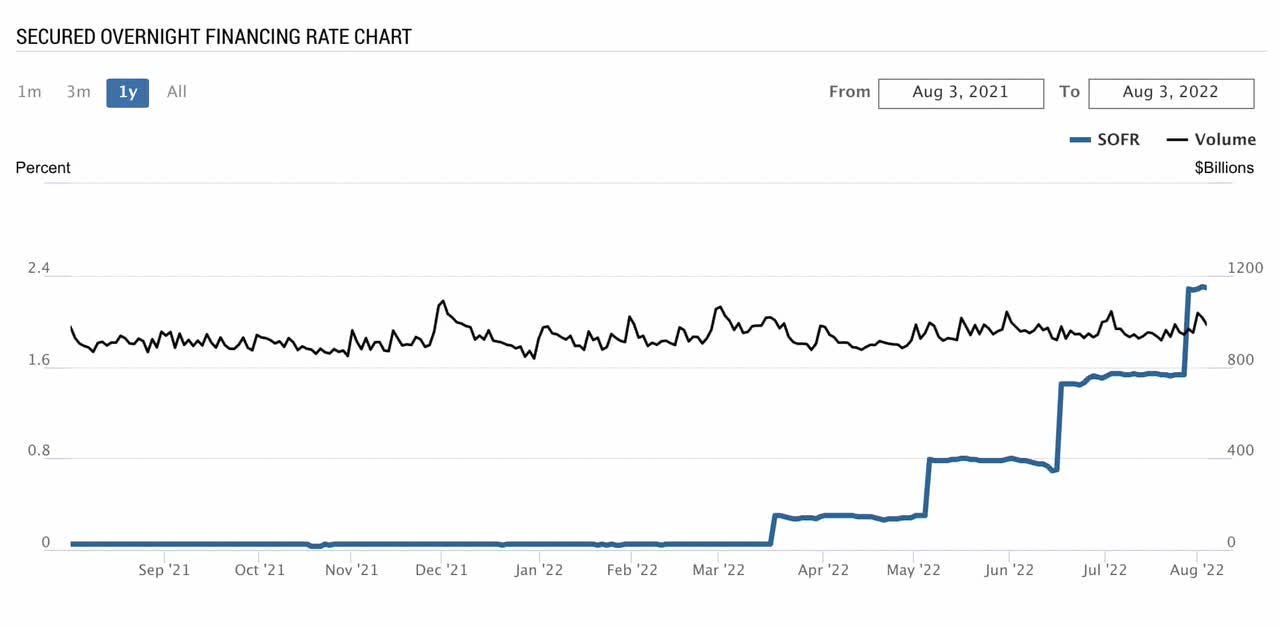

The Secured Overnight Financing Rate (“SOFR”) is replacing the London Interbank Offered Rate (“LIBOR”) but rates are going up no matter how we look at things. The Federal Reserve Bank of New York shows that the SOFR was under 1.5% for most of 2Q22 and it went above 2.25% starting on July 28th:

SOFR (Federal Reserve Bank of New York)

Valuation

The 2Q22 adjusted net income is $1,981 million such that the adjusted annualized net income is $7,924 million. I think Schwab is worth 20 to 22x this amount or $158 to $174 billion.

The 2Q22 10-Q shows 1,897,087,826 total shares as of July 29th based on 1,817,794,131 common shares plus 79,293,695 nonvoting shares. Multiplying this by the August 9th share price of $69.04 gives us a market cap of nearly $131 billion. There is also $10.7 billion in preferred shares that should be included because the adjusted net income figure does not include the $141 million in preferred stock dividends. As such, the sum of the common market cap and preferred shares comes to $141.7 billion.

I think the common stock is undervalued as the sum of the common market cap and preferred shares is less than my valuation range.

Be the first to comment