utah778

One of the worst performing stocks since late last year has been Upstart Holdings (NASDAQ:UPST). The artificial intelligence lending marketplace has seen its shares fall from more than $400 to less than $34 thanks to rising interest rates and investors fleeing growth stocks. After the bell on Thursday, the company announced preliminary Q2 revenue results that were quite horrible, sending shares close to their 52-week low.

Just about two months ago, the stock took a dive when the company announced Q1 results that featured terrible guidance. Management guided to fiscal Q2 revenues of $295 million to $305 million, which was quite a bit below the average street expectation of nearly $335 million. Additionally, the yearly forecast for $1.25 billion in revenue was also well below street expectations for $1.40 billion. The yearly guidance number at that point called for more than 47% growth over the prior full fiscal year period.

Thursday afternoon, the company issued a press release calling for fiscal Q2 revenues to be approximately $228 million. This would be a little more than 17.5% growth over the prior year’s quarter. Unfortunately, that’s a massive miss against prior guidance, and the street was looking for more than 53.4% growth to nearly $298 million. Dave Girouard, co-founder and CEO of Upstart, provided the following explanation:

Our revenue was negatively impacted by two factors approximately equally. First, our marketplace is funding constrained, largely driven by concerns about the macroeconomy among lenders and capital market participants. Second, in Q2, we took action to convert loans on our balance sheet into cash, which, given the quickly increasing rate environment, negatively impacted our revenue.

During the second quarter, we improved our unit economics and oriented ourselves toward continued positive cash flow even at lower loan origination volumes. With a low fixed cost base, we expect to continue adding to our almost $800 million unrestricted cash balance as well as to continue repurchasing Upstart shares as it makes sense. And finally, despite limiting hiring to critical areas, we continue to invest in our models and products and are confident Upstart will emerge from this cycle a stronger company.

The problem is how long will this cycle last? The Atlanta Fed GDP Now tracker has basically said the US is in a recession currently, calling for a nearly 2% decline in GDP for Q2. The Fed is expected to raise rates by at least 50 more basis points, while also reducing the size of its balance sheet quite dramatically in the coming years. Even though US Treasury rates have come off their recent highs, 1-Month LIBOR is at its highest point since late 2019, showing the market sees a bit more uncertainty in the financial system and global economies right now.

Upstart cutting back on originations and selling loans on its balance sheet will impact future revenues as well, so we can’t say this Q2 miss was just a one-time thing. At the earnings report in early August, management is going to have to slash its full year revenue forecast, with the only question being by how much. Investors were previously piling into the name for its high growth, but the latest numbers suggest that story has ended for now.

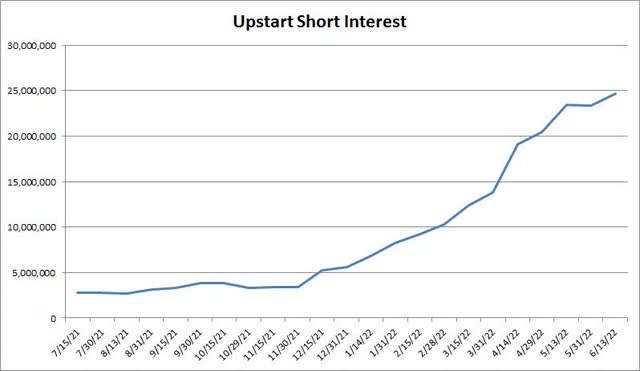

The bad revenue number for Q2 also means that one potential catalyst for the bulls is most likely out the window. As the graphic below shows, short interest is up almost 800% in the past 11 months, so investors may have been hoping for a short squeeze. While part of this increase is due to a rise in the company’s outstanding share count by about 8 million to nearly 85 million in the past 12 months (to late April 2022), it means that Upstart is one of the most shorted names in the market currently.

Upstart Short Interest (NASDAQ)

Shares of Upstart closed at $33.74 on Thursday, but fell more than 17% in the after-hours session to less than $28. At that point shares were only a little more than $2 away from their recent 52-week low, with the last trade of the day being more than 93% off the stock’s all-time high. The average price target of nearly $45 going into the day implied decent upside, but analysts will be slashing their numbers in the coming weeks.

In the end, Upstart announced a massive Q2 revenue miss that has shares nearing their 52-week low again. With interest rates on the rise and economic fears increasing, the company has originated less loans and converted some to cash. Management will have to slash its revenue guidance for the year at next month’s earnings report, and you can expect analysts to cut their numbers quite significantly as well. With the Fed having a long way to go in its current tightening plan, this is a name investors might want to favor on the short side until this current economic cycle runs its course.

Be the first to comment