Mario Tama/Getty Images News

This is an abridged version of the full report published on Hoya Capital Income Builder Marketplace on September 22nd.

Real Estate Weekly Outlook

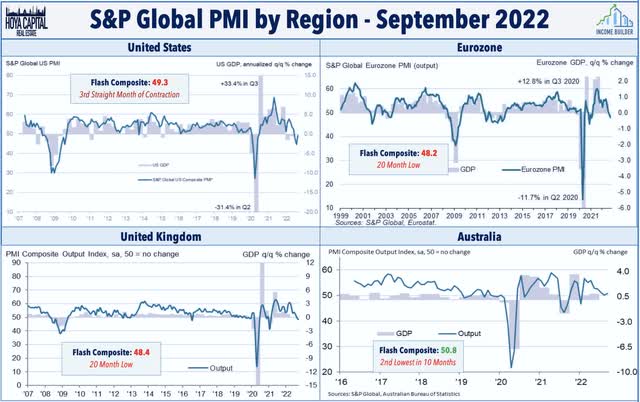

U.S. equity and bond markets plunged to the lowest levels of the year after the Federal Reserve reiterated that further economic “pain” was necessary to cool inflation. Fed Chair Powell’s insistence that the U.S. economy remains “strong and robust” was especially perplexing given recent data showing that the U.S. economy is increasingly likely to record a third-straight quarter of GDP contraction in Q3, which has only occurred once since 1975. Adding further stress to an already fragile global economic and geopolitical environment, central banks around the world responded to another “jumbo” hike with their own monetary tightening actions and currency interventions, sending global benchmark interest rates soaring to post-Financial Crisis highs.

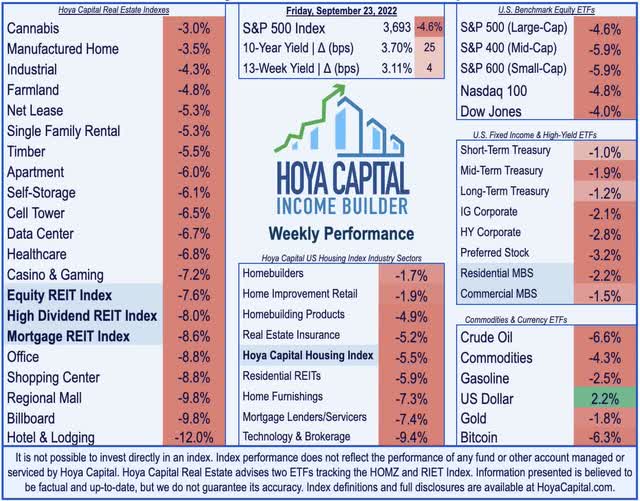

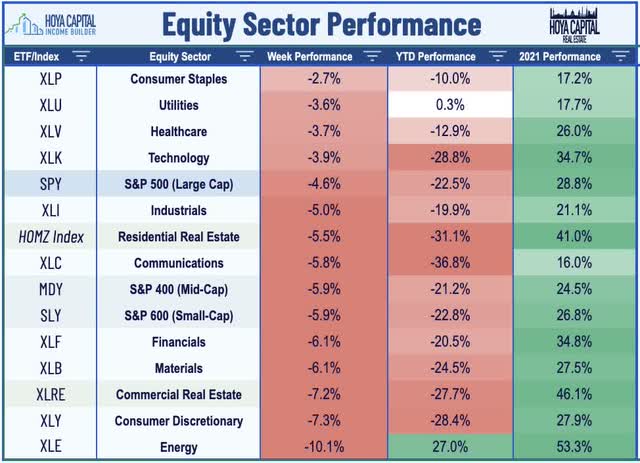

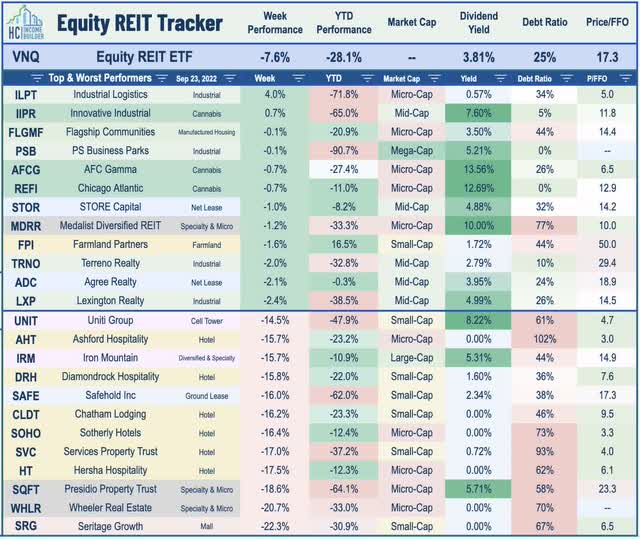

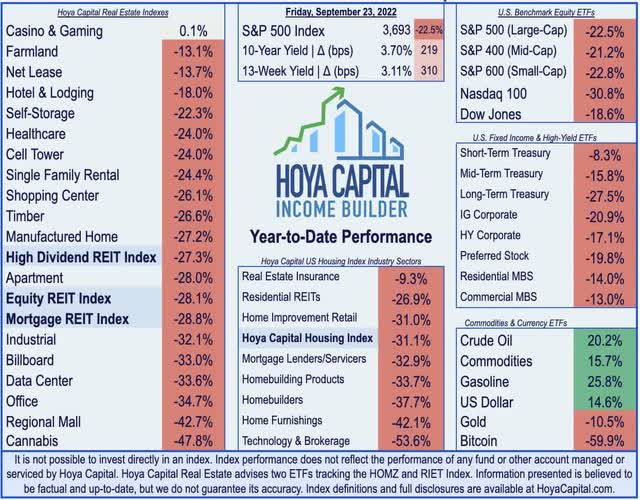

Declining in five of the past six weeks and effectively erasing all of the benchmark’s gains since the start of 2021, the S&P 500 dipped another 4.6% on the week. The nearly 22.5% decline in the benchmark is the 5th worst performance through the first 183 trading days in history. The Mid-Cap 400 and Small-Cap 600 each slid nearly 6% while the tech-heavy Nasdaq 100 extended its drawdown from its late-2021 highs to over 30%. Real estate equities posted their worst week since the turbulence seen during the depths of the pandemic in early 2020 with the Equity REIT Index sliding nearly 8% on the week with all 18 property sectors in negative territory while the Mortgage REIT Index dipped nearly 9%. Homebuilders were a relative bright spot on data showing that housing market conditions have been more stable than some feared amid a historic surge in mortgage rates.

The carnage across equity markets this year has been relatively tame compared to the historically brutal year for fixed income securities with the Bloomberg Aggregate Bond Index extending its year-to-date declines to nearly 14%. For context, the worst annual decline in the bond index was 2.9% in 1994. In the wake of another “jumbo” Fed rate hike, the 10-Year Treasury Yield jumped 25 basis points to 3.70% while the U.S. Dollar Index surged more than 2% to fresh 20-year highs, adding further stress to import-heavy international economies including Japan, which was forced to intervene in the FX market to support the yen for the first time in 24 years. Crude Oil plunged 6% despite an escalation in the Russia/Ukraine War while attention turns to the U.S. Gulf Coast region with Tropical Storm Ian expected to impact gasoline and natural gas supplies as it makes landfall in the week ahead.

Real Estate Economic Data

Below, we recap the most important macroeconomic data points over this past week affecting the residential and commercial real estate marketplace.

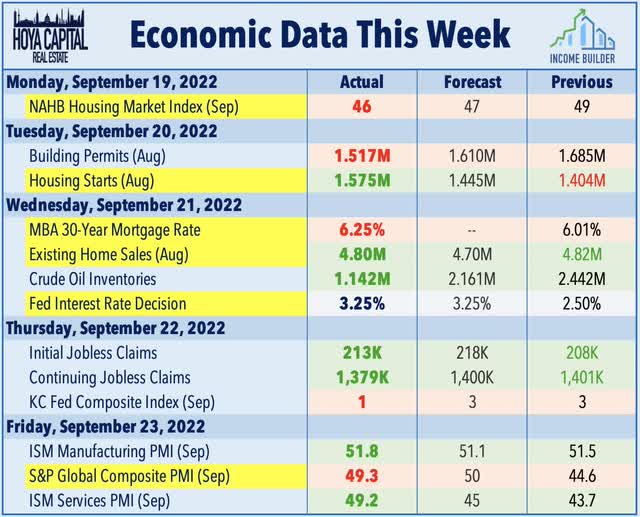

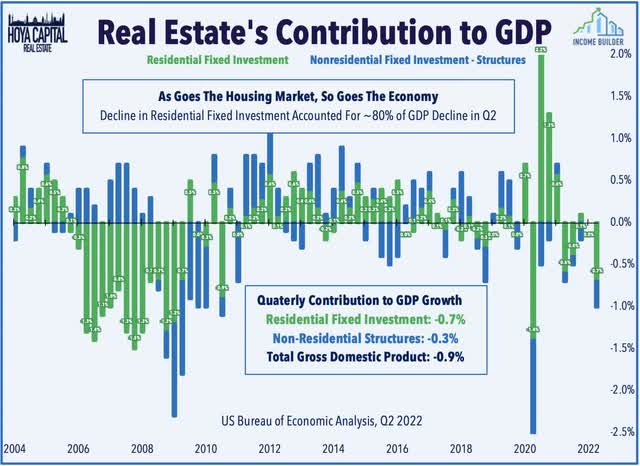

Investors parsed another slate of downbeat economic data this week, which prompted another downward revision to the Atlanta Fed’s GDPNow model, which is now dangerously close to projecting a third-straight quarter of GDP contraction. The Atlanta Fed’s model – which accurately foretold the unexpected contraction last quarter – now forecasts GDP growth of just 0.3% in Q3 – down sharply from its 2.6% forecast two weeks ago. The Atlanta Fed’s metric tracking the Blue Chip consensus – based on the monthly Blue Chip Economic Indicators survey – now projects negative GDP growth at the median in its latest survey. Since 1975, the U.S. has recorded three-straight quarters of negative GDP growth only once – during the Great Financial Crisis from Q3 2008 – Q2 2009. The S&P Global Composite PMI Index this week showed that the economy was in contraction in all three months of Q3.

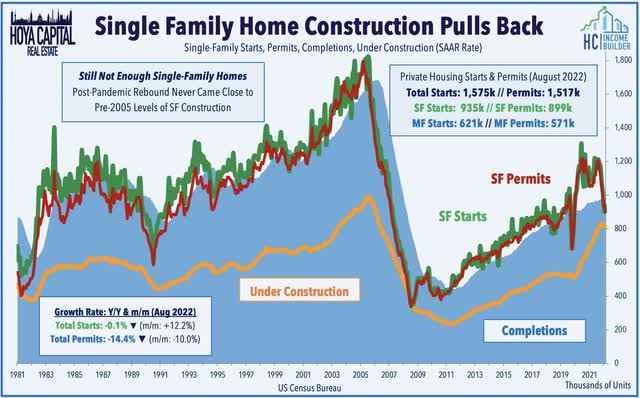

The downward revision was prompted by a mixed slate of home construction data as the Census Bureau reported a steep drop in single-family building permits in August, which overshadowed a better-than-expected rise in total housing starts driven by strength in multifamily construction. Consistent with downbeat homebuilder sentiment data earlier in the week, single-family permits fell to an 899k annualized rate in August, its lowest level since June 2020. Of note, despite the post-pandemic uptick in single-family home construction activity amid an unprecedented surge in housing demand, construction levels remained significantly below the long-term historical averages. Existing Home Sales data this week shows the result of this lingering undersupply of housing as that inventory levels actually declined in August – remain near historic lows – despite the rate-driven housing cooldown.

Homebuilder Lennar (LEN) was one of a small handful of S&P 500 companies in positive territory for the week after reporting surprisingly solid results amid pressure from surging mortgage rates, recording a 13% year-over-year increase in home deliveries – in line with its prior guidance – while gross margins remained near record-highs. LEN noted that while “sales have clearly been impacted by rising interest rates, there remains a significant national shortage of housing, especially workforce housing, and demand remains strong.” Results from KB Home (KBH) were a bit shakier, however, as the homebuilder dipped 4% on the week after reporting a jump in its cancellation rate to 35% in the quarter – significantly above Lennar’s 21% rate. Providing fourth-quarter guidance that was weaker than the Street expected, KBH noted that while “the long-term outlook for the housing market remains favorable, the combination of rising mortgage interest rates, ongoing inflation, and other macro concerns has caused many prospective buyers to pause on their homebuying decision.” Residential fixed investment – which took 14 years to recover to its pre-GFC level – is likely to again be a drag on GDP growth in the back half of 2022 given the brutal rate environment.

Equity REIT Week In Review

Best & Worst Performance This Week Across the REIT Sector

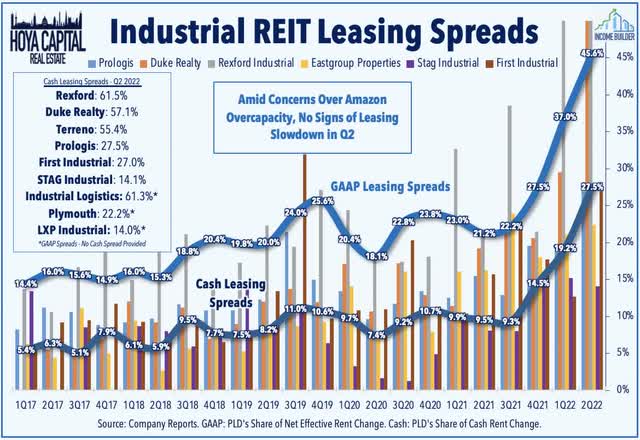

Industrial: Industrial Logistics (ILPT) was the best-performing REIT on the week after successfully refinancing $1.24B in debt secured by a portfolio of 104 industrial properties. The small-cap externally-managed REIT remains one of the weakest performers on the year, however, after its ill-timed acquisition of fellow small-cap REIT Monmouth, which it financed with a short-term bridge loan but has struggled to refinance. This week, we published Industrial REITs: Headlines Worse Than Reality. Demand for well-located logistics and warehouse space continues to significantly outstrip supply through the end of Q2, even as early effects of the global economic cooldown become apparent. Just as valuations were recovering from the Amazon (AMZN) dip on news that the e-commerce giant pumped the breaks on its aggressive pandemic-fueled footprint expansion, the sector has taken a fresh leg lower after FedEx (FDX) announced a similar “cost management” move last week, citing weakening global demand. While we’ve been vocal in recent months that the global economic outlook has weakened more substantially than policymakers and Fed officials have been willing to acknowledge, the magnitude of the selloff in industrial REITs appears quite a bit overdone as industrial real estate demand is fundamentally less ‘economically sensitive’ than many presume.

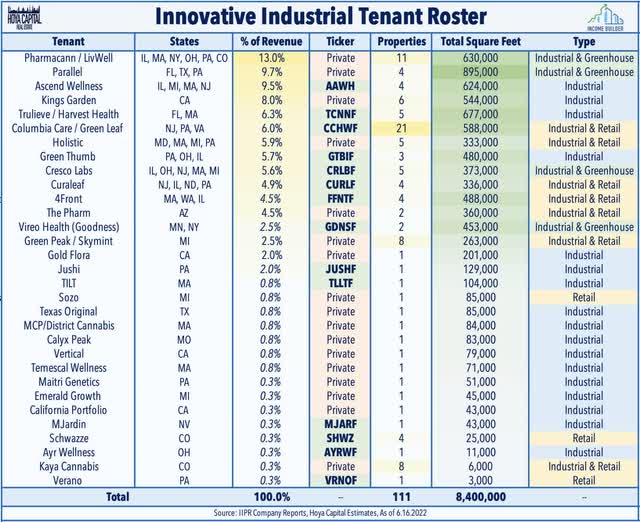

Cannabis: Innovative Industrial (IIPR) – which has been slammed this year on concerns over credit and rent payment issues among its cannabis cultivator tenants – was one of two REITs in positive territory this week after disclosing in an 8-K that it reached a confidential settlement with Kings Garden which had defaulted on its rent and property management fees in July. Kings Garden leases six properties from IIPR which comprise roughly 8% of IIPR’s revenue in 2021. Research firm Compass Point upgraded IIPR to Buy from Neutral, citing the positive indication from the combination of the settlement and the dividend hike which “sent a signal that management is confident of its ability to collect lease payments from its tenants.” The ten largest publicly-traded cannabis REIT tenant operators have plunged between 50% and 80% over the past year, hurt in part by a slowdown in stimulus-fueled sales growth and by a far more-difficult capital raising environment amid tightening credit conditions.

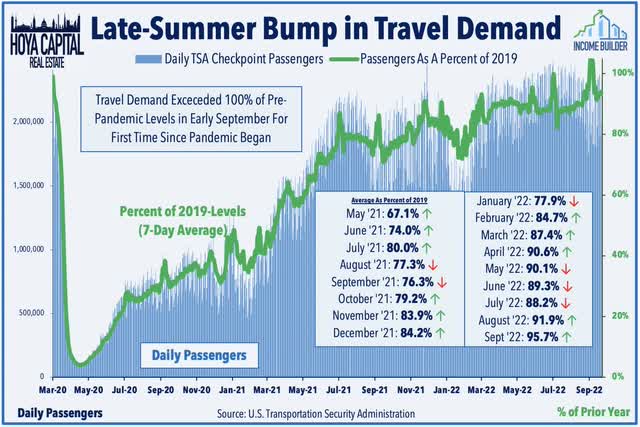

Hotels: Posting a double-digit decline this week for the first time since the depths of the pandemic in 2020, hotel REITs were slammed despite data showing that travel demand has held up rather well in September despite the mounting recession fears. Pebblebrook (PEB) slid more than 13% on the week after providing an update on recent operating trends. PEB noted that its Revenue Per Available Room (“RevPAR”) exceeded the comparable pre-pandemic level in July by 3%, but reported that demand cooled in August as its comparable RevPAR was back to 3% below pre-pandemic levels. Also of note, PEB commented that in early September, it “saw a significant spike in occupancy as business travel returned following the holiday period.” For the first time since the pandemic began, occupancy in the most recent September week exceeded 80%, with every day but Sunday exceeding 80%. According to recent TSA Checkpoint data, travel demand has trended at levels that are 95% of pre-pandemic throughput levels following a late-summer demand surge.

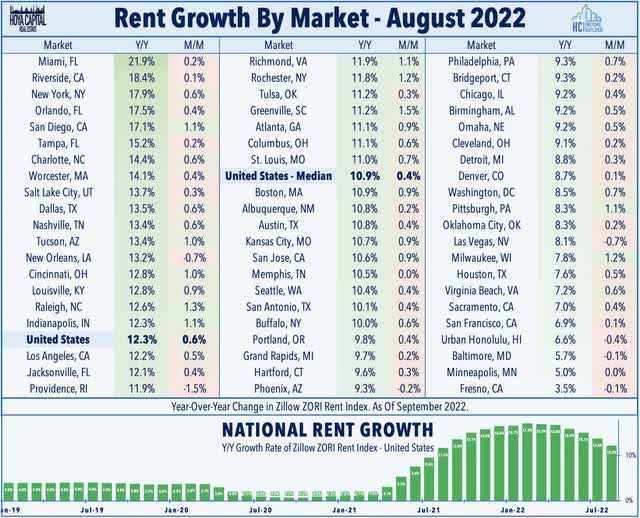

Apartment: Apartment Income (AIRC) performed roughly in line with its peers this week after providing an upbeat operating update amid recent signs that the rate-driven housing market cooldown is beginning to moderate rent growth. AIRC noted that it achieved blended rent growth of 14.0% in August, the highest among the coastal apartment REITs that have provided recent updates. It projects that occupancy will “continue to increase” into year-end and that full-year operating expenses are expected to remain roughly flat. AIRC commented, “the economy is unusually turbulent, but AIR’s early prospects for 2023 are excellent. At year-end, the expected earn-in from 2022 leasing activities is expected to provide approximately 5% Same Store Revenue growth in 2023, with expected loss-to-lease providing the opportunity for additional growth.” Recent data from Zillow (Z) shows that national rent growth has cooled from its early 2022 peaks but remained higher by more than 12% year-over-year in August amid a lingering undersupply of housing.

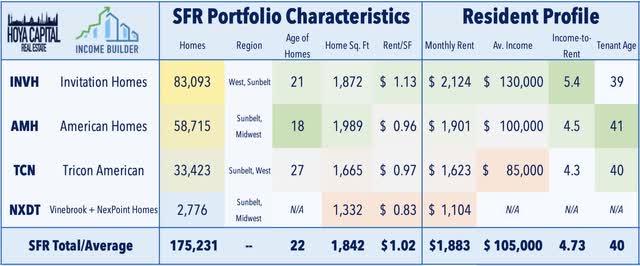

Single-Family Rental: Sticking in the residential sector, this week, Bluerock Residential Growth (BRG) announced that its Board of Directors approved the distribution to its shareholders of all of the outstanding shares of common stock of Bluerock Homes Trust, which will become the holder of the Company’s single-family rental business which is expected to be completed on October 6th before the opening of the NYSE American. Bluerock Residential – which will continue to hold the Company’s multi-family rental business – expects to complete the previously announced acquisition by affiliates of Blackstone Real Estate (BX) promptly following the completion of the Spin-Off. Joining the trio of SFR REITs – Invitation Homes (INVH), American Homes (AMH), and Tricon Residential (TCN), Bluerock Homes Trust will trade on the NYSE American under the symbol “BHM” and will own interests in approximately 3,400 homes, including 2,000 through preferred/mezzanine investments.

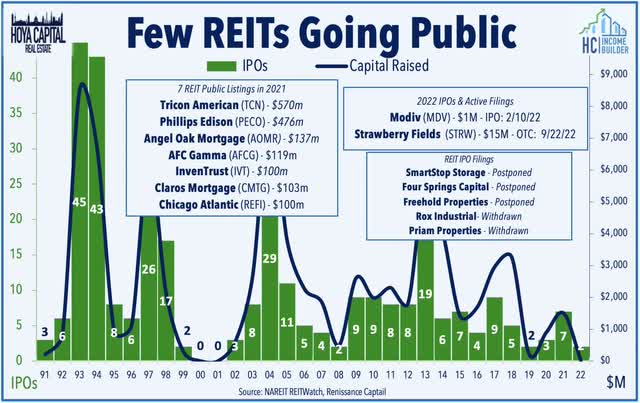

Healthcare: Amid an otherwise brutal capital raising environment, there were a few REITs daring enough to make moves into the public markets. After initially filing for a direct listing back in April, Strawberry Fields (OTCQX:STRW) began trading this week on the OTCQX Best Market. Strawberry Fields is an internally-managed REIT focused on skilled nursing and other healthcare-related properties with a portfolio consisting of 79 properties with an aggregate of 10,426 beds located primarily in the Sunbelt and Midwest. Like its skilled nursing peers Omega Healthcare (OHI) and Sabra Healthcare (SBRA), STRW typically leases these properties to third-party operators under long-term triple-net leases with annual rent escalations of 1% to 3%. Elsewhere, American Healthcare REIT filed a registration statement with the SEC, proposing a listing on the NYSE under the ticker symbol “AHR.” The REIT was formed in 2021 from the merger of two Griffin-American portfolios and owns 313 medical office buildings, senior housing, skilled nursing facilities, hospitals, and other healthcare facilities, in 36 states and the UK.

Another week, another wave of REIT dividend hikes. American Tower (AMT) – the largest equity REIT in the world – hiked its quarterly dividend for the second time this year, declaring a $1.47/share dividend, a 2.8% increase from prior its dividend. Elsewhere, hotel REIT Hersha Hospitality (HT) resumed its dividend that had been suspended since March 2020, declaring a $0.05/share quarterly dividend, representing a forward yield of roughly 2.1%. STORE Capital (STOR) – which announced last week that it will be acquired by GIC and Blue Owl’s Oak Street for $32.25 in cash – hiked its dividend by 6.5%, becoming the 108th REIT to raise its dividend this year. STOR also reiterated that under the terms of its merger agreement, following the payment of this dividend, the company may not pay further dividends, except as necessary to preserve its tax status as a REIT. REITs have been exceedingly conservative in their dividend distribution policy since the pandemic with dividend payout ratios declining to just 65.3% in Q2 – well below the 20-year average of 80% – leaving a cushion to maintain dividends in the event of a deepening recession.

Mortgage REIT Week In Review

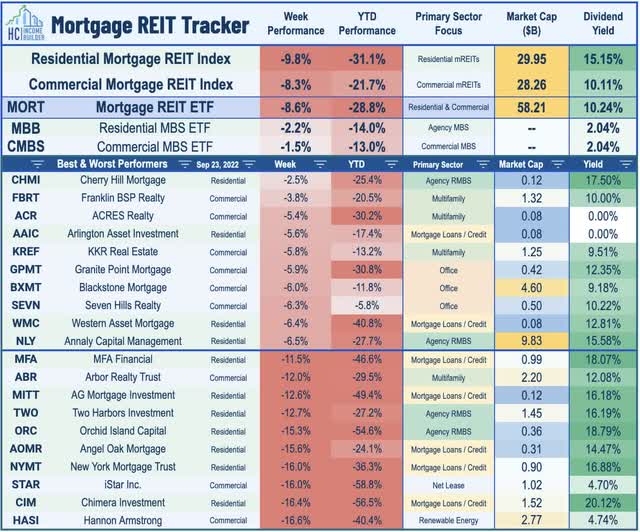

Mortgage REITs were slammed this week as hawkish Fed commentary added to the historic pressure on mortgage-backed bond (MBB) valuations, which extended their drawdown to levels that are twice as deep as the next previous drawdown. Chimera Investment (CIM) dipped more than 15% after reducing its quarterly dividend by 30% to $0.23/share – the 5th mortgage REIT to reduce its dividend this year compared to 13 mREIT dividend hikes. Two Harbors (TWO) dipped more than 12% after announcing a 1-for-4 reverse stock split which is expected to take place on November 1st. TWO also held its quarterly dividend steady at $0.17/share, payable October 28th. Ellington Financial (EFC) declined about 8% on the week today after reporting that its estimated book value per share (“BVPS”) was $15.99 as of August 31st – down about 2% from its $16.32 estimate BVPS at the end of July.

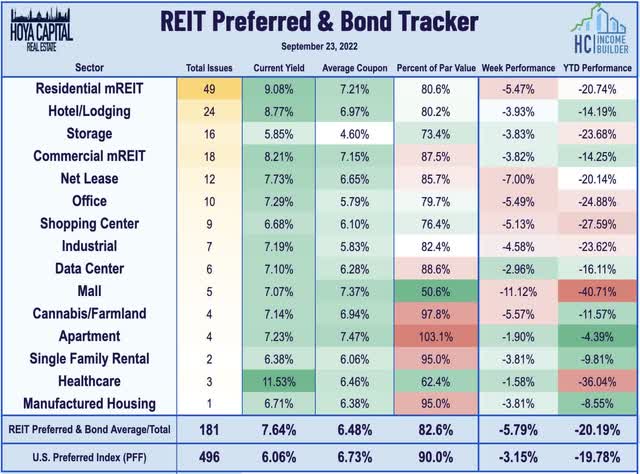

REIT Capital Raising & REIT Preferreds

One of the worst weeks on record for corporate credit and preferred securities, the REIT Preferred Index dipped 5.8% on the week – underperforming the broader iShares Preferred and Income Securities ETF (PFF) which declined 3.5% – and pushing its year-to-date declines to over 20% on a price return basis. Of note, the more actively-traded REIT preferreds saw far more muted declines than issues with less liquidity, and performance dispersion among similar securities from the same issuer was also unusually wide. Among the most significant laggards on the week was the preferred suite from troubled mall operator Pennsylvania REIT (PEI) – which slid more than 15% on the week – while the preferred suite from AG Mortgage (MITT) also posted double-digit declines.

2022 Performance Check-Up

Nearing the end of the third quarter, Equity REITs are now lower by 28.1% on a price return basis for the year while Mortgage REITs are lower by 28.8%. This compares with the 22.5% decline on the S&P 500 and the 21.2% decline on the S&P Mid-Cap 400. Within the real estate sector, casino REITs are the lone property sector in positive territory for the year – but barely – while fourteen of the eighteen REIT sectors are lower by at least 20%. At 3.70%, the 10-Year Treasury Yield has soared 219 basis points since the start of the year to levels well above its prior ten-year highs of 3.25% seen back in late 2018. The Two-Year Treasury Yield, meanwhile, closed the week at its highest level since November 2007. With the dip this past week, REITs are back in the basement of the performance tables among the ten major asset classes this year, getting leapfrogged this week by Emerging Markets (EEM) and International (EFA) stocks.

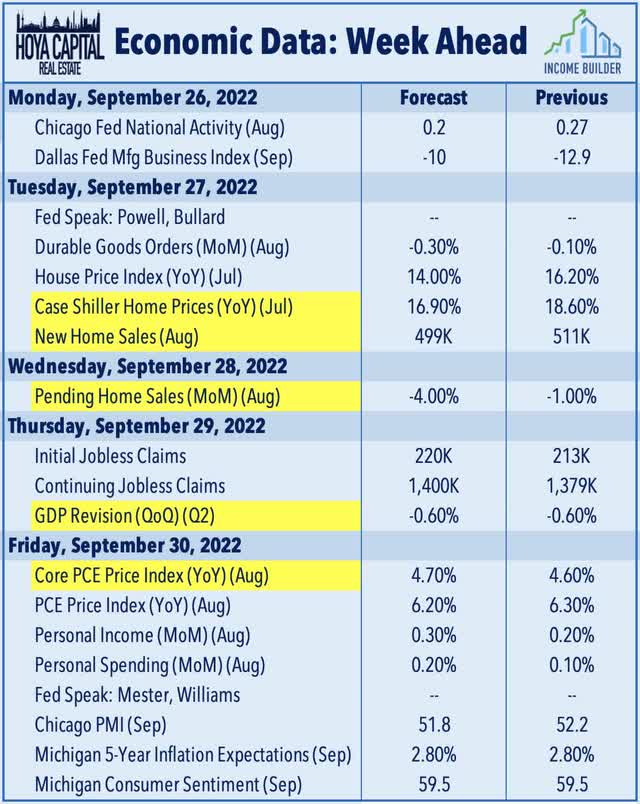

Economic Calendar In The Week Ahead

It’ll be another busy week of housing data, inflation reports, and “Fed speak” in the week ahead. On Tuesday and Wednesday, we’ll see New Home Sales and Pending Home Sales data for August which are expected to echo the continued slowdown seen in Existing Sales and Housing Starts data this past week. We’ll also see home price data on Tuesday with reports from Case Shiller and the FHFA but due to the significant lag in these indexes, the full effects of the recent cooldown won’t be fully reflected for several more months. On Thursday we’ll see the final revision of second-quarter Gross Domestic Product data which is expected to confirm that the U.S. was indeed in a technical recession in the first half of 2022. Finally, on Friday, we’ll see another critical inflation report with the Core PCE Index – the Fed’s preferred gauge of inflation – which has been one of the early indicators showing signs of peaking price pressures in recent months.

For an in-depth analysis of all real estate sectors, be sure to check out all of our quarterly reports: Apartments, Homebuilders, Manufactured Housing, Student Housing, Single-Family Rentals, Cell Towers, Casinos, Industrial, Data Center, Malls, Healthcare, Net Lease, Shopping Centers, Hotels, Billboards, Office, Farmland, Storage, Timber, Mortgage, and Cannabis.

Disclosure: Hoya Capital Real Estate advises two Exchange-Traded Funds listed on the NYSE. In addition to any long positions listed below, Hoya Capital is long all components in the Hoya Capital Housing 100 Index and in the Hoya Capital High Dividend Yield Index. Index definitions and a complete list of holdings are available on our website.

Be the first to comment