Justin Sullivan

Citigroup (NYSE:C) is trading at 0.55x tangible book. In my view, this is a great buying opportunity. In the recent decade, the trading playbook with Citi has always been to buy at a deep discount to tangible book (~0.5-0.6x) and sell at or just slightly above 1x tangible book.

Citi was not a long-term hold as it would be bound to slip on some banana peel somewhere in the world and frankly, its business model was flawed and much weaker than peers such as JPMorgan (JPM) and Bank of America (BAC).

This has all changed with the new CEO Jane Fraser and the refreshed strategy.

The key issues with the prior business model

I have written on these issues for several years, but to recap the key issues are:

- Citi as a U.S. G-SIB bank was a disadvantaged owner of so many consumer banks globally. There are limited to no synergies in a global consumer bank, it delivers mediocre ROE, Citi cannot compete effectively in local markets and most importantly it increases Citi’s overall capital requirements. In other words, it makes absolutely no sense.

- Citi management was under pressure to deliver promised short-term returns (e.g. ROE 12%), and thus it was forced to cut corners on investments in controls, technology whilst starving the business of much-needed investments.

- Citi’s U.S. consumer bank is predominantly Cards driven (and thus riskier) and not as diversified as the likes of JPM and BAC. Most importantly, it does not benefit from the low cost of funds its peers enjoy.

Jane fixed it (mostly)

The refreshed strategy under the new CEO is very sensible. Citi is selling all of its consumer banks globally and repivots to a wealth management business model mostly centered in Asia and the U.S. which are very attractive geographies.

There are several advantages to this strategy. Firstly, Citi is releasing capital (~$15 billion), and most of the divestitures are sold at or above book value. The sizeable Mexico franchise is likely to be sold at a premium of ~2x tangible equity.

I remind you that Citi is trading at 0.55x tangible equity currently.

Secondly, the divestitures also support reduced capital requirements for the overall Citi franchise. The incremental capital requirements for Citi are driven by annual CCAR results (otherwise known as the Stress Capital Buffer (“SCB”) and the G-SIB score. A simplified Citi supports reduction in both.

As a point in case, Citi’s capital requirements are currently increased to 13% from 11.5%. This is due to higher SCB as well as G-SIB scores. Consequently, Citi was forced to pause its share buybacks and build capital instead.

In the medium term, management is expecting the capital requirements to revert back to 11.5% to 12% supported by these divestitures. By the end of 2023, Citi is likely to find itself in a position of substantial excess capital.

Secondly, Citi is finally investing in the franchise and in a big way. Citi is modernizing and digitizing its infrastructure and controls. There is an upfront investment involved but this will pay off in the medium term. Citi’s CFO highlighted one example in Citi’s finance function at a recent Barclays financial services conference:

If I think about my financial organization every quarter we close our books and we get comfortable, I get comfortable that those numbers are materially accurate and timely as they get produced. In running that process, I’ve got thousands of people that are working through reconciliation along the way to make sure that those numbers meet that standard. I’ve got thousands of people that work on ensuring we’ve got proper controls that are there. As we bring in new systems, as we enhance the operations, as we streamline processes, we won’t need to have such an inefficient approach to getting to that quality output and that will do a couple of things. It will allow for us to get that information a lot more rapidly, and it will allow for us to streamline, if you will, the number of resources that we have doing those types of things.

These transformations and consent order-related expenses will end up driving efficiencies down the line across the firm.

Combining these investments with the expected divestitures, in my view Citi is no longer too large and/or complex to manage.

The macro-environment and interest rates

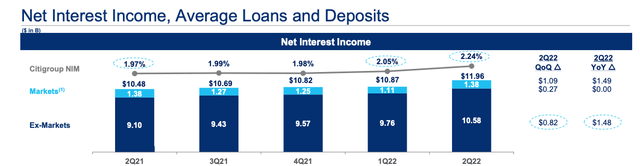

Interest rates are a huge tailwind for Citi’s strategy. Citi guides to an incremental $2.5 billion of the net interest income (“NII”) with a parallel shift of 100 basis points in rates. This is already playing out in the quarterly results and will be turbocharged in the next few quarters:

NII growth (Citi Investor Relations)

As can be seen above, Citi’s ex-markets NII has increased by ~$1.5 billion year on year and is projected to continue to increase in subsequent quarters.

This tailwind should not be underestimated.

Citi is also guiding for strong loan growth in Cards in the back half of 2022 which is a very positive sign. Whereas loan losses are running at levels that are 50% lower than expectations throughout the cycle.

Whilst there are plenty of uncertainties in the outlook, Citi is conservatively reserved and has been building some reserves in the second quarter as well as expects modest reserves to build in the 3rd quarter.

What are the risks?

The key risk is a deep recession that is characterized by massive job losses in the economy (say an unemployment rate well above 6%). Citi may need to absorb additional loan losses in such a scenario.

More importantly, the Fed may ease interest rates back to 0% and stay there for a very long time. This will impact all banks’ profitability. A zero-interest rates backdrop is not a good environment for banks to operate in but even then, I expect Citi to earn above its cost of capital.

Having said that, the Fed’s overnight rate of between 2% to 4% is goldilocks for banks. Whilst I do not have a crystal ball in terms of the direction of rates in the medium term, I see a low probability of the economy going back to ZIRP.

In my portfolio, I use a barbell approach now where I hold banks but also recently opened a position in long-duration bonds (TLT) as well as other long-duration assets.

Final thoughts

Currently, this is an exceptionally positive macro setting for banks with strong tailwinds from interest rates. The market is fearing the deep recession scenario. Tactically, I think it is a good time to allocate to banks. My base case is that we are living in a frictional inflationary economy, especially so that supply chains are being rewired and critical industries are onshored.

Citi presents a compelling risk/reward on a relative and absolute basis at 0.55x tangible book. It is no longer as risky as some perceive it to be due to recency bias. Citi is no longer too complex to manage. I like the new management team strategy and the early signs are that the execution is robust. The second quarter results were exceptional, especially in the Institutional Client Group (“ICG”).

In my next article, I will undertake a deep dive into the strategy in ICG and explain why this is the crown jewel of Citi and a much-underappreciated asset.

Be the first to comment