ugurhan

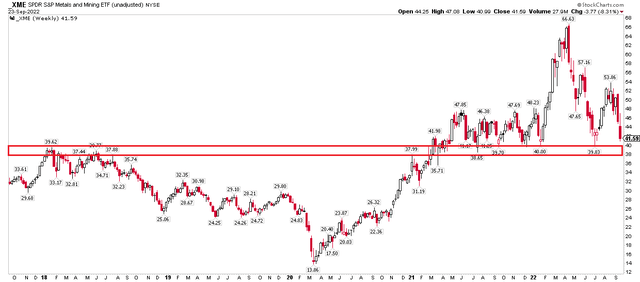

Metals and mining stocks have pulled back hard as inflation risks have quickly shifted to fears of recession. The SPDR S&P Metals and Mining ETF (XME) surged from $40 to $66 during the first half of 2022 but has since dipped back toward support around $40 after a summer rally to above $53. The $38 to $40 range could be a favorable entry point on XME. One industry company reports earnings this week and features bullish prospects.

XME: Cyclical Metals Stock Retreat to Support

According to CFRA Research, Worthington Industries, Inc. (NYSE:WOR), an industrial manufacturing company, focuses on value-added steel processing, manufactured consumer, building, and sustainable mobility products in North America and internationally. It operates through Steel Processing, Consumer Products, Building Products, and Sustainable Energy Solutions segments.

The Ohio-based $2.5 billion market cap Metals & Mining industry company within the Materials sector trades at a low 6.5 trailing 12-month GAAP price-to-earnings ratio and pays a 2.6% dividend yield, according to The Wall Street Journal. Importantly ahead of earnings due out Thursday morning this week, WOR’s short interest ratio is elevated at 6.9%.

On valuation, Seeking Alpha rates it with just a C. Its trailing P/E ratios, using both GAAP and operating, look good, but earnings are expected to drop in each of the next three years, including 2022. As a result, according to CFRA Research, a $4.74 per-share profit amount renders a P/E two years ahead above 10. That’s not quite as rosy but still not too expensive.

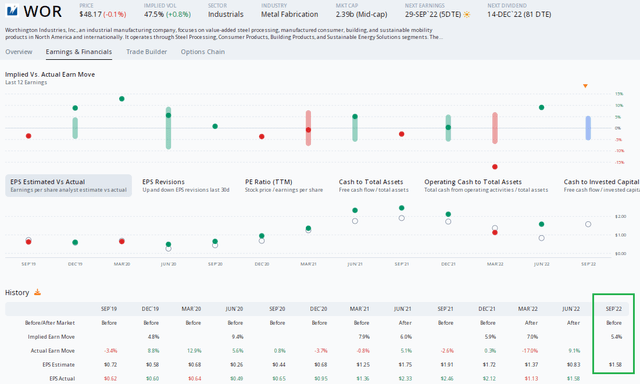

WOR: Earnings Outlook & Key Profitability Ratios

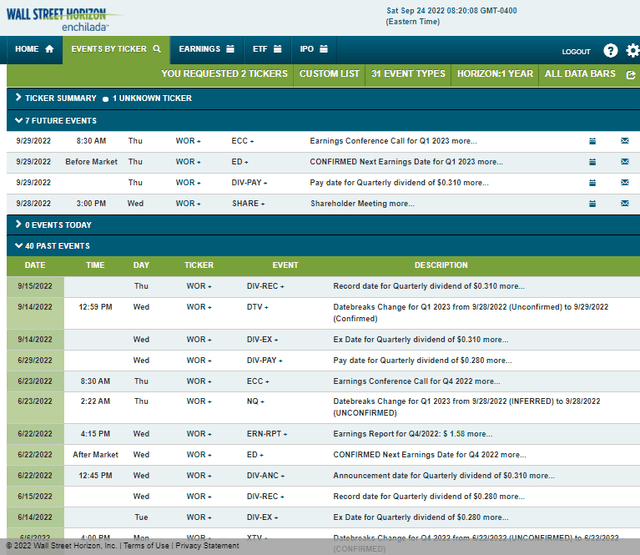

Looking ahead, Wall Street Horizon shows a big week on tap. First is an annual shareholder meeting that begins at 3:00 pm ET. Then the big potential stock-price volatility catalyst is Worthington’s Q1 2023 earnings report due out Thursday BMO with a conference call immediately to follow. You can listen live here. Finally, a dividend pay date hits Thursday.

Corporate Event Calendar

The Options Angle

Option Research & Technology Services (ORATS) data show a consensus EPS forecast of $1.58 for the September quarter. That would be a steep drop from a $2.46 EPS print in the same period a year ago. Meanwhile, options traders price in a somewhat small 5.4% post-earnings stock price swing using the nearest-expiring at-the-money straddle. Given two big reactions after the past pair of earnings reports, that appears to be cheap premium. Being long options into earnings could be the play – but with what directional bias? Let’s turn to the charts.

Worthington: A Small Implied Stock Price Move Post-Earnings

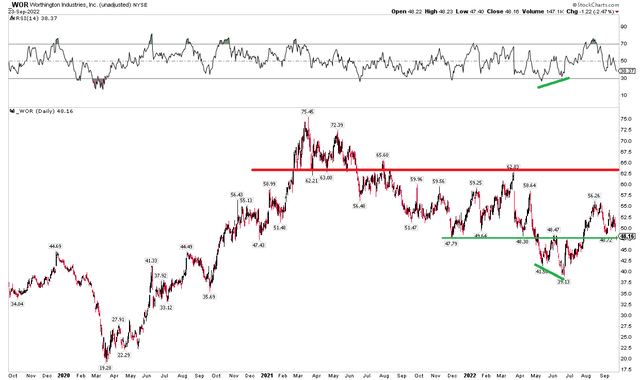

The Technical Take

WOR shares have been trending lower off their early 2021 high above $75. A decline to under $40 in June has held up well so far, as the broad market retests its mid-June low. I also notice that on the final plunge under $40, there was bullish momentum divergence as seen in a higher low in the RSI (14) indicator while price notched a new low. Traders often look for turns in momentum as harbingers of price inflections.

The stock looks good here with a stop under $47. Look for resistance around $63, as illustrated in the chart below. So, into earnings, long calls or a long vertical call spread using strikes corresponding to those price levels might be a good play.

WOR: Bullish Divergence, Shares Near Support

The Bottom Line

Worthington’s earnings growth appears weak while its P/E ratio is attractive right now. Much will depend on how the broad economy performs – do we enter a deep recession? In which case more EPS downside risks are likely. The good news for the bulls is that the stock shapes up well from a risk/return standpoint heading into earnings this week. Overall, I think the stock is a buy given a decent valuation and possible bullish reversal signs.

Be the first to comment