Vertigo3d/iStock via Getty Images

It’s been an exciting few years for Riot Blockchain (NASDAQ:RIOT) shareholders. The stock has had some sensational moves as the company pivoted into the Bitcoin mining industry. The move has proven to be an inspired decision as Riot can rank itself among the leaders in the Bitcoin mining industry thanks to the extreme effort put forward by the leadership team. When I wrote this article about Riot Blockchain the company still had a new feeling as it pertained to the recent shift. Right now Riot Blockchain seems to have figured out its business model and is executing to the best of its ability.

The Issue of Offerings

The company is definitely run well but its only real product is Bitcoin and its overall profitability depends heavily on the price of the token at the time of production. Because of this Riot must find ways to hold the Bitcoin on its balance sheet at disadvantageous prices, relying on money from other sources. One of the popular sources in the Bitcoin mining industry is secondary offerings. Riot has recently filed to sell another $500 million worth of stock to fund operations and future investments. The long-term Bitcoin bulls will argue that it is perhaps better to raise money from offering stock if it allows the company to hold Bitcoin and sell at advantageous prices down the line, but one has to ask how much dilution is tolerable? Today we will discuss Riot Blockchain’s current situation and what shareholders can expect now that the sensational moves in Bitcoin (BTC-USD) seem to have paused.

Before we get started, if you’d like definitions of a few key terms concerning cryptocurrency, please see the Crypto Cheatsheet in my previous article. But of course, crypto veterans feel free to skip this section.

Riot Blockchain – Production Update

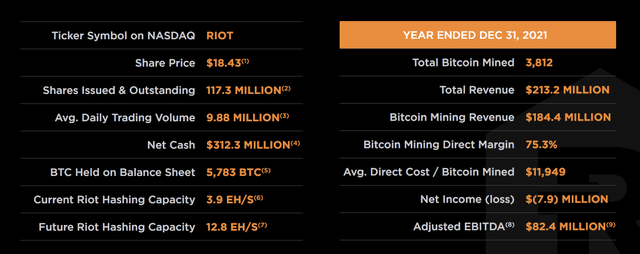

Riot’s recently announced their Q4 2021 earnings results and there were a few notable highlights.

Riot Blockchain

The company mined a staggering 3812 Bitcoin in the calendar year 2021, with an average cost of $11,949 per token. The mining numbers on the cost per token represent notable improvements over the figures put forward last year as Riot’s mining costs were trending closer to $15,000 per token (discussed here), and production was 1078 nowhere near the 3800 mark. This is a result of the leadership team’s aggressive approach to acquiring, maintaining, and deploying Bitcoin miners, as well as the ambitious decision to acquire and now expand the Whinstone Mining facility in Texas (discussed in greater detail here).

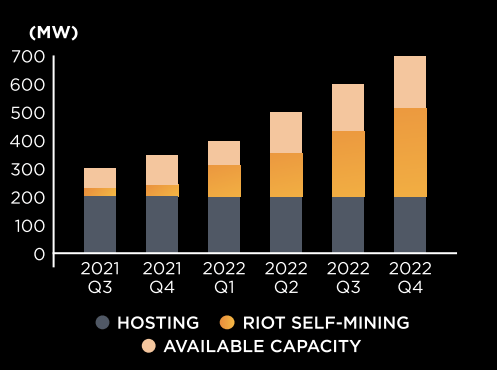

Riot also engages in hosting services to other individuals and companies who are looking for an advantageous location to stage their mining fleets. We can see that the majority of Riot’s overall mining capacity increases have to do with the company’s actions and not the hosting services.

Riot Blockchain

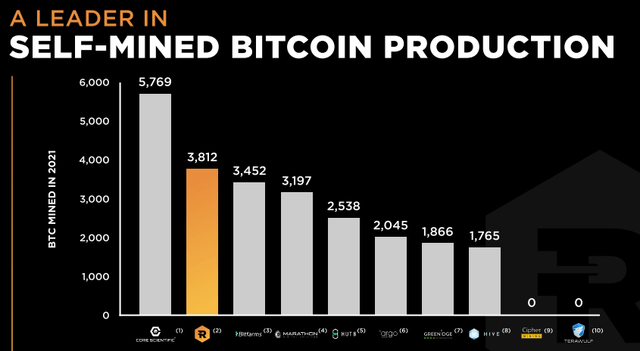

RIOT Is Leading The Way

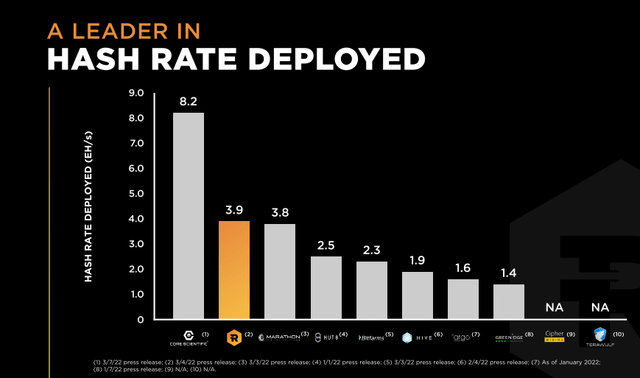

As we touched on before, Riot stands among the biggest names in the industry when you consider self-mined Bitcoin production.

Riot Blockchain

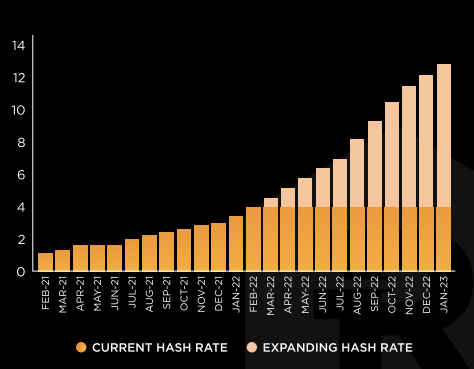

We can see from the charts below that Riot’s overall hash rate has been steadily improving and it looks set to go parabolic in 2022 due to the aggressive investment from the leadership team.

Riot Blockchain

As a reminder, hash rate is a Bitcoin-specific term and can be found in the cryptos cheat sheet linked above. Improving a firm’s overall hash rate increases its probability of earning the reward or token. To do this companies must not only acquire a large mining fleet come over they must also maintain and deploy them. We have seen companies face significant challenges with their spectral fleet deployment. In fact, Bit Digital (BTBT) (discussed here) previously faced challenges with the Chinese government’s Bitcoin crackdown and had to migrate a significant portion of its fleet to Bitcoin-friendly territories in order to operate undisturbed. Riot generally does a good job at keeping its fleet up and running, and due to its preference for mining in North America investors should be able to enjoy some security.

Riot Blockchain

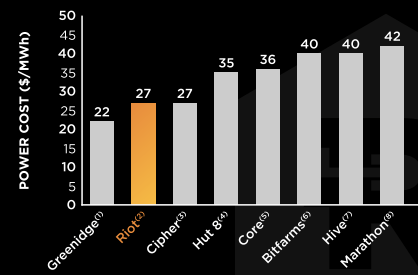

One of the major concerns for Bitcoin miners is the energy costs. Bitcoin mining is incredibly energy-intensive and the major players bend over backward to find ways to minimize the cost. The Riot data facility in Whinstone Texas was acquired in part to address these costs. We can see from the data below that this decision has borne fruit for the company. They rank among the best in the industry at managing these costs.

Riot Blockchain

Since Riot cannot directly impact the cost of Bitcoin, cost management is perhaps one of the most important metrics the judge the firm against as this will drive gross profit margins directly along with the wildly volatile price of Bitcoin.

Riot Blockchain

There’s no guarantee that Bitcoin will fly to $100,000 per coin in the future. In fact with the Federal Reserve’s recent decision to raise interest rates and curb inflation, there could be some short-term headwinds for the Bitcoin investment thesis. Bitcoin has been touted in many circles as an excellent hedge against inflation and some of the more bombastic moves we have seen in the past have been in response to loose monetary policy possibly eroding the value of the dollar. Despite this Riot is now aiming to improve its overall hashrate to 12.8 EH/s by January 2023.

Increasing Bitcoin Scarcity

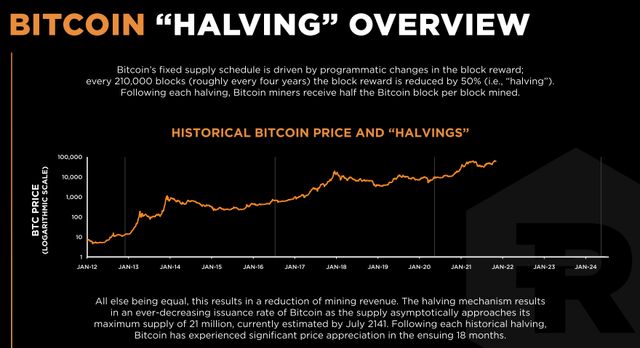

One key risk that is becoming more and more prominent with time is the built-in increased difficulty of Bitcoin. As we mentioned earlier Riot is aggressively improving its hashrate, but much of this is by necessity. There can only ever be 21 million Bitcoin tokens and recently the 19 millionth token was mined. As more Bitcoin has been mined, the built-in cryptographic formula for the remaining tokens becomes more difficult to solve. This phenomenon is commonly referred to as the scarcity of Bitcoin. The increasing difficulty is tracked in many ways but one of the most popular is the ‘halving’. This is a programmatic change that occurs every 210,000 blocks.

Riot Blockchain

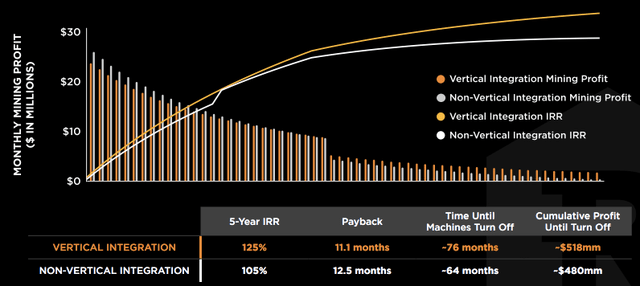

Basically, as blocks are solved the difficulty increases, and at these 210000 block milestones, the reward is half of that in the prior milestone. This forces Bitcoin miners constantly increase their overall hashrates creating somewhat of a mining arms race due to limited supply. This has been troublesome in the past, but Riot’s leadership team has taken the decision to become a vertically integrated Mining Company and acquired ESS Metron an electrical equipment solutions provider in December 2021.

The Takeaway

Riot is doing an excellent job increasing its fleet and overall hashrate but Bitcoin’s current price action isn’t doing them any great favors. The sensational moves seem to have cooled off for the time being and the company may choose to issue more stock in the future to fund its aggressive investments while it waits for the next massive move for Bitcoin. I believe Riot Blockchain will get that move but the question is when. Investors should be wary of the effect continued dilutions will have on long-term positions. I like to think of these mining companies as long-term call options in the current crypto climate. The move can happen at any time and Riot is already at depressed prices. For this reason, I rate the stock a hold and will revisit the stock when Bitcoin’s price action improves.

Be the first to comment