imaginima/iStock via Getty Images

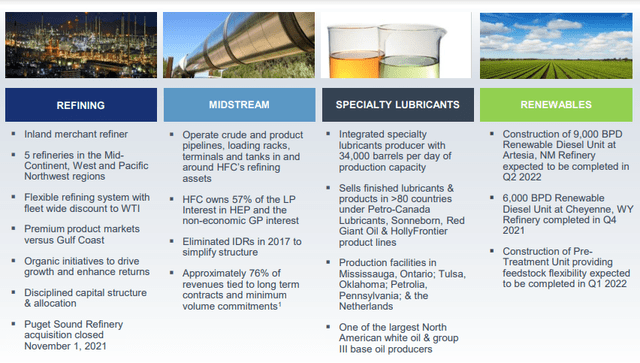

Despite our recent upgrade in Phillips 66 (PSX), we see HF Sinclair as a long-term pick. The Company (DINO) engages as an independent petroleum refiner in the US with an asset footprint across the Rocky Mountains, Midcontinent and Southwest region. HF Sinclair operates through four segments: renewables, specialty products, midstream, and refining. Our internal team expects value creation across all the divisions.

Source: HF Sinclair Investor Presentation March 2022

Looking at EU refineries such as Neste, we can clearly state that our journey to net-zero is set for a bumpy ride. Green energy still misses a few pages from the oil & gas playbook on the topic of consistency. The recent developments regarding Russia are showing us that transitioning to a green economy requires a level of efficiency and scale that the green energy still needs to catch up on, not only regarding output but also shareholders’ return. This teaches us an important lesson: size matters in the green transition, public benefits, tax credits and regulations have set the roadmap. However; it is only when companies start to feel the pressure on the bottom line that they are really feel the incentive to change, this will be a key part of our story.

HF Sinclair’s (HFC) story is complex and encompasses multiple segments of the oil industry, namely midstream and downstream with also ramifications within the chemical sector.

After our deep analysis, we found a few key takeaways both at macro and micro levels that we need to consider before going into the numbers:

Macro takeaways:

- The sector expects tailwinds from the jet fuel industry as demand picks up from a decrease in capacity by 4.5 million barrels (from 2019-2021). Looking at the inventories, we note that is a low point versus a historical average;

- In general, demand is going to outweigh supply as the economy reopens and readjusts. Therefore, we can expect higher margins and utilization rates in refineries.

Micro takeaways:

- Less debt compared to Phillips 66;

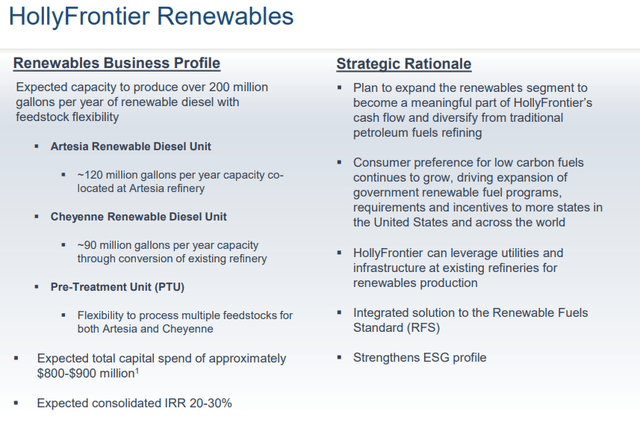

- Focus on expanding capacity into the renewable fuels system (part of the CAPEX has been allocated to reconvert the plants to operate with lower-cost by-products of soybean oils. Looking at growth CAPEX, we are expecting an exposure of 36% in 2022;

- The Sinclair acquisition made up of 75% cash and 25% in stocks, which will be finalized by Q2 2022. This will provide access to downstream opportunities in California that should provide a stable source of cash flows and greater renewable fuels standard adherence. Moreover, it will add pipeline capacity and improve/stabilize gross margins. The acquisition will provide stable cash flows and the reinstatement of the dividend policy. Analysts and shareholders are questioning if the acquisition will indeed be accretive, but management ensures that it will be by the end of the first year. Our pro-forma revenue for the segment brings the total for the Marketing in HF Sinclair from 0% to 22%;

- Better GEO exposure with a strong asset footprint.

Latest Results, Valuation and Risks

At the end of February, HF Sinclair announced a net loss mainly due to special items. HF Sinclair’s CEO stated: “despite heavy planned and unplanned refining maintenance and weather-related downtime in the fourth quarter, HF Sinclair delivered solid financial results in 2021, highlighted by record earnings in our Lubricants and Specialties business and the closing of our acquisition of the Puget Sound Refinery. Looking forward to 2022, we remain constructive on the macro environment and are focused on the execution of our strategic initiatives: the successful completion and start-up of our renewables business, closing on our acquisition of Sinclair and accelerating returns of capital to our shareholders.” The narrative thanks to renewable business is changing. ESG funds with some sectors excluded by the “E” criteria might be tempted to outright exclude oil & gas from their portfolios, which equals to treat all the pipelines and refineries as “stranded assets”, which is not completely the case, with the right amount of CAPEX those can be converted into more greener assets and may also serve other purposes. In HF Sinclair we see a player that is successfully investing in greener assets that will reshape its margin over the medium long-term.

Source: HF Sinclair Investor Presentation March 2022

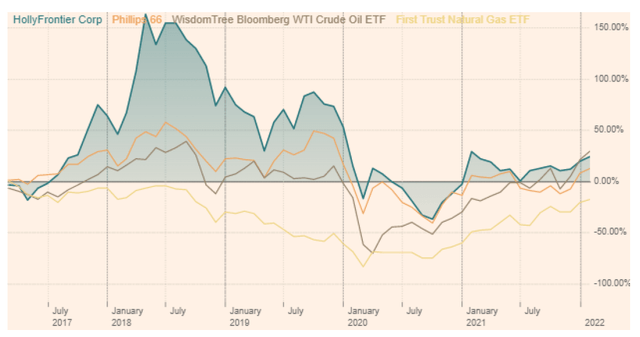

From a stock market performance standpoint, we see that HF Sinclair has outperformed Phillips 66 over the most part of the time period considered, this is due to the different segment mix: where refining, up until now, accounted for ~85% of revenues for HF Sinclair with margins averaging at 8.19% (pre-Covid).

Source: FT

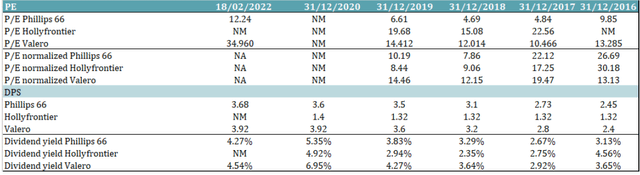

In terms of multiples, we need to take into consideration that Phillips 66 has had a lot of extraordinary items over the year that contributed to a lower P/E compared to HF Sinclair. However, after we normalize those, we get a clearer picture, and indeed, they trade at similar normalized multiples over the time frame considered.

Source: Mare Ev. Lab Team

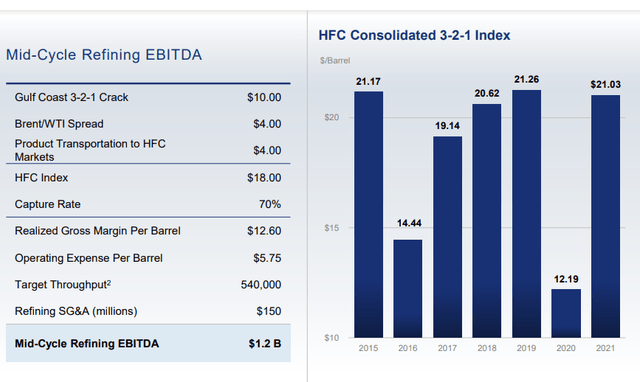

In terms of dividend yields, the argument favors Phillips66 over HF Sinclair: smooth growth in dividends, compared to the interruption in 2021 for HF Sinclair, also dividend yield is higher for Phillips 66. Looking at the valuation, we based a forecast EBITDA of $1.8 billion for 2022, but over the long term, we take into consideration a mid-cycle EBITDA at $1.5 billion, including refining but also lubricants & specialties and the renewable diesel division, subtracting then for corporate expenses and financial indebtedness, we arrive at a target price of $45 per share versus the current $30.85 per share. Dividend reinstatement, better bottom line profit due to the Sinclair acquisition and BTC in place prolonged to 2031 under BBB plan make the call.

Source: HF Sinclair Investor Presentation March 2022

Downside risks to our target price are narrower Brent-WTI delta, RIN costs, integration risk on Sinclair acquisition, and declines in the crack spread on Rocky Mountain performance.

Source: HF Sinclair Investor Presentation March 2022

Be the first to comment