selimaksan/E+ via Getty Images

Investment Overview

Veru’s (NASDAQ:VERU) share price went into meltdown last week, sinking by >35% to a price of $6.6 by market close on Nov. 11. Traded share price at the time of writing is $6.3 – its lowest since early April.

The catalyst for the losses – as close followers of the stock will know – was the outcome of the FDA Advisory Committee vote on whether to approve Veru’s lead drug candidate Sabizabulin as a therapy for hospitalized COVID patients.

A Veru press release reveals that:

The advisory committee voted 8-5 that the known and potential benefits of sabizabulin when used for the treatment of adult patients hospitalized with COVID-19 at high risk of ARDS do not outweigh the known and potential risks of sabizabulin.

Although Sabizabulin was originally developed by Veru as a potential therapy for metastatic breast cancer and prostate cancer – and remains in pivotal Phase 3 clinical studies in both indications – and Veru has a second candidate – Enobosarm, also indicated for metastatic breast cancer and in a Phase 3 study – there’s no question that Sabizabulin’s potential as a COVID therapy is responsible for a significant portion of the current market cap valuation.

Veru stock traded at a price of $2.5 in November 2020, but after the company released positive data from a Phase 2 study of Sabizabulin showing that the therapy had achieved a statistically significant 81% relative reduction in death or respiratory failure at Day 29, shares rocketed in value, briefly touching a high of $21, for a 740% gain.

By April 2022 the stock price had sunk back down to $4.5, but then came interim results from a Phase 3 study of Sabizabulin in patients who are at high risk of developing Acute Respiratory Distress Syndrome (“ARDS”), showing 55% reduction in mortality in the Sabizabulin arm vs. placebo.

The FDA agreed that data was sufficient for Veru to file an Emergency Use Authorization (“EUA”) application – duly filed in June. By mid-July Veru’s share price hit a 5-month high price of $17.

That high was achieved in spite of the publication in May of a short report from Culper Research which criticized Veru’s Phase 3 trial, suggesting that placebo mortality rates were surprisingly high, making the drug’s effect look greater that it really was.

Culper also suggested that the study enrolled too few patients, and at too many locations – 57 in total across six different countries, resulting in a lack of comparable cases. Finally, Culper highlighted the past failures of the management team, many of whom worked at another biotech, GTx Inc., whose share price they alleged had declined in value by >90% under the leadership of Mitchell Steiner, who is now CEO of Veru. Steiner sold $2m of Veru shares as part of an option exercise in August, it was reported.

The FDA opted to hold an Advisory Committee (“AdComm”) to discuss the EUA application with its Pulmonary-Allergy Drugs Advisory Committee, originally scheduled for Oct. 6 but subsequently moved it to Nov. 6. Ahead of this meeting, shares traded at $15, jumping in value from $10, apparently due to optimism based on the FDA’s release of its briefing documents on Nov. 7.

The FDA Briefing Documents – Sabizabulin MoA Questioned

The FDA typically releases briefing documents ahead of its AdComm meeting dates which gives investors a chance to see how the agency may be advising its panel to vote (the panel are not obliged to follow any recommendation).

The 79 page document begins by asking members of the AdComm to consider “uncertainties raised by the agency” in relation to the pivotal trial, which are listed as:

placebo mortality rate, potential for unblinding, imbalance in standard of care, differences in timing of enrollment, potential differences in goals of care, and the proposed population.

The FDA also lists the current standards of care (“SoC”) for COVID 19, which consist of Dexamethasone, based on results of a ~2,100 patient study which “suggested a mortality benefit for the dexamethasone arm compared to usual care showing (22.9% versus 25.7%, respectively),” Baricitinib, apparently based more on its safety profile than evidence of efficacy, and Remdesivir, which failed to better placebo in a clinical trial but is approved nonetheless. In other words, the barrier for approval theoretically ought to be low, given the scale of unmet need.

Veru calls Sabizabulin “an oral agent that targets and disrupts microtubules halting transport of viruses in the cell and cytokine release,” although in its briefing documents the FDA notes that “the mechanism of action (“MoA”) of VERU-111 in COVID-19 is not completely determined,” and observes that most of the evidence for the MoA is derived from studies of a similar drug, Colchicine, adding that:

The Sponsor has not provided any direct evidence to support the antiviral activity of VERU-111. Appropriate cytotoxicity controls were not included in their cell culture antiviral activity assessments, antiviral activity was not observed in the NIH ARDS mouse model; and there was no meaningful reduction in viral shedding in study V3011902.

The Study Itself – Was Data Set Too Small?

The FDA also notes that against its wishes, Veru reduced its sample size from 300 patients to 210, based on “reduction of COVID cases and considerable slowing of the recruitment of patients into the study.”

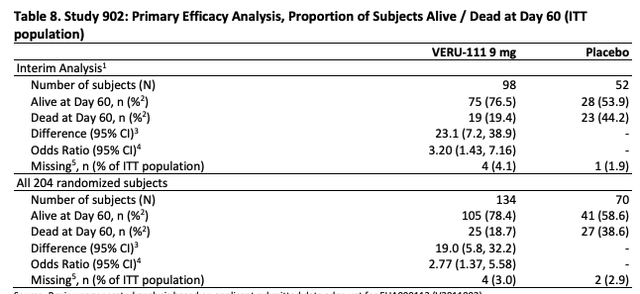

At day 60 of the clinical study, the interim analysis was as shown in the table below:

Veru Study 902 interim analysis day 60 (FDA)

The FDA notes that:

The study met the pre-specified success criterion at interim analysis, indicating a statistically significant improvement in mortality in the VERU-111 arm compared to placebo and allowing for the study to stop early for efficacy.

It’s therefore worth noting in response to claims that the study did not include as many patients as, say, Pfizer’s study of antiviral Paxlovid – ~2,200 patients enrolled – or Eli Lilly’s study of Bebtelovimab – ~1,600 patients enrolled – or many other studies of different COVID therapies – that the study was ended because it was deemed to be successful in the eyes of independent observers, due to results suggesting a statistically significant efficacy profile.

Nevertheless the briefing documents outline concerns around the small sample size and how a smaller data set is more vulnerable to “potential imbalances between study arms” and asked AdCom members to consider this before voting.

The High Mortality Rates and Issues With Unblinding

The FDA also considers the apparently high mortality rate in the placebo arm, noting that:

the Sponsor utilized a reasonable assumption that the placebo mortality rate would lie between 15% and 30%, consistent with other studies with comparable severity. However, the Day 60 mortality rate at the final analysis in the placebo group in Study 902 was 39.7%.

The agency goes on to discuss patients enrolled in Bulgaria:

Notably, at one site in Bulgaria, seven patients were randomized to receive VERU-111 and 6 patients were randomized to receive placebo. All patients belonged to the least severe group of randomized patients with a baseline WHO Ordinal Scale score of 4. While all subjects in VERU-111 treated group remained alive, 3 out of 6 subjects (50%) in the placebo group died by Day 60.

The FDA also mentions two other studies recently conducted in which the mortality rates were 16.5% at Day 60, and 35% at Day 90, and observes that the differences in mortality generally occurred after Day 29.

With regard to unblinding i.e. doctors, nurses and patients being aware of whether they had received the placebo or the drug, the FDA notes that many patients would have required capsules to be opened for enteral administration, and notes the difference in colour between the drug product – yellow powder – and placebo product – white powder. If patient or caregiver had become aware that either placebo or drug were being, used, it could have lead to subconscious bias, the FDA notes, or performance bias which:

does have the potential to bias efficacy outcomes of trial endpoints such as mortality in randomized clinical trials.

Further Concerns – Pre and Post treatment with SoC, Colchicine Data

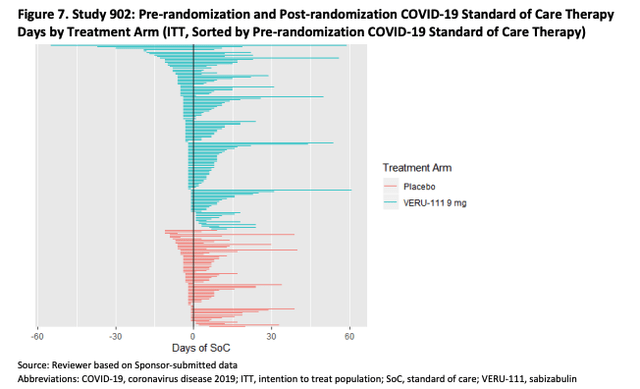

To summarize a lengthy discussion in the briefing documents, the FDA highlights that patients in the treatment arm appear to have received a slightly higher level of standard-of-care therapy prior to being administered with Sabizabulin, and after treatment, as we can see from the tables below

FDA Briefing Documents (FDA)

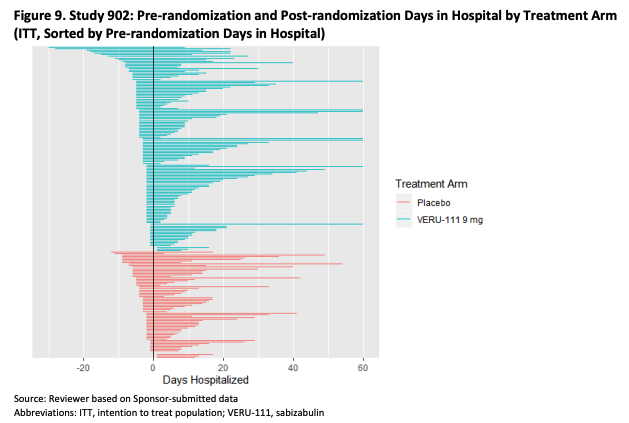

Furthermore, patients receiving placebo also appear more time in hospital pre-randomization, as per the table below.

FDA Briefing Documents (FDA)

Alongside this, the FDA discusses whether certain patients may have been on a “trajectory of clinical improvement,” and whether this could have affected outcomes, suggesting that “the protocol rules for duration of treatment imply that VERU-111 treatment could have been given for <21 days,” which clouds the overall efficacy picture (how long do patients need to be treated for?).

There’s also discussion of “goals of care,” suggesting that not knowing this information (which was gathered from some patients but not all, the FDA notes) may introduce variability into a limited study. Some patients may have been expecting to survive, but others, thanks to unknown comorbidities, may have been in terminal decline.

Finally, the FDA looks at previous studies of colchicine, noting that studies of this drug with a similar MoA to Sabizabulin have “failed to provide evidence of the efficacy of this microtubule disruptor on mortality or other clinically relevant outcomes in COVID 19.”

Result – A Split Vote Against EUA and What Didn’t Happen

What do I mean by what didn’t happen? Let me explain.

When the FDA released briefing documents ahead of another AdComm meeting – this time evaluating Phase 2 results of a drug indicated for Amyotrophic Lateral Sclerosis (“ALS”) developed by the biotech Amylyx (AMLX), they expressed numerous concerns around the trial protocols and results, making most observers believe the drug would not be approved.

After the documents were released, Amylyx’ share price dropped from ~$25, to ~$15, yet in his opening statements at the actual AdComm meeting, FDA official Billy Dunn suggested that, so long as Amylyx’ founders promised to withdraw the drug from the market if a post-marketing study failed to support the data from its Phase 2 study, the drug could be approvable, given the unmet need.

The founders agreed to do so, and the AdComm voted 7:2 in favor of approving the drug, which was duly approved at the end of September.

In some ways the case for Sabizabulin is similar to that of Amylyx’ Relyvrio. High unmet need owing to inadequate standards of care, a small clinical trial data set where data is arguably inconsistent, and briefing documents that could be described as leaning towards a negative assessment of the drug’s suitability for approval.

In the case of Sabizabulin however, the FDA did not apparently suggest that Sabizabulin could be awarded its EUA subject to carrying out a post-marketing study – most members of the AdComm were in favor of conducting a further study, but before an EUA was awarded, not after. As such, that window of opportunity may now have been closed on Veru.

Nevertheless, five of 13 members of the AdComm did vote in favor of an EUA, and it should be noted that the FDA usually, but not always, follows the recommendation of its AdComm. Those voting for were likely swayed by the unmet need and Sabizabulin’s safety profile, although they were not necessarily voting for an EUA to be approved, but that based on the available evidence, Sabizabulin may do more harm than good.

Conclusion – A Negative EUA Verdict Isn’t A Foregone Conclusion But Possibly The Likelier Outcome

The most famous example of the FDA going against its AdComm was the approval of Biogen’s (BIIB) Alzheimer’s drug Aduhelm – in that instance, 10 of 11 panel members voted against approval, but the drug was approved nonetheless, with admittedly disastrous consequences. The CMS refused to provide reimbursement for Aduhelm, and the drug has been all but shelved.

Could the FDA go against its AdComm and give Sabizabulin an EUA? I don’t think it’s impossible, since unlike Aduhelm, Sabizabulin seems to have a clean safety profile. Additionally, many of the concerns raised by the FDA are to do with the small sample size, yet the trial was halted early due to signs of strong efficacy. The level of unmet need is also significant – current standards of care have not shown themselves to be anything more than mildly efficacious.

In its press release responding to the AdComm outcome, Veru includes comments from Erik Swenson, M.D. Professor of Medicine, Physiology, and Biophysics, University of Washington, and former Chairman of the Pulmonary Allergy Drugs Advisory Committee, who first observes that 300 people are still dying every day in the US from COVID, and goes on to state:

In a recently published well-executed double-blind placebo-controlled trial of patients with respiratory compromise and at high risk of developing ARDS, sabizabulin reduced absolute mortality at 60 days by 20.5%, compared to 0-6% for all other available drugs. In the long history of drug trials for patients with severe respiratory failure over many decades, there has never been a drug to show such dramatic protection.

As such, although I wouldn’t go so far as to say Sabizabulin will win an EUA, I wouldn’t necessarily rule it out either. Veru is a polarizing company in which short interest in the stock is ~16%, according to MarketBeat, whilst bulls remain highly confident that Sabizabulin is the future of therapy for hospitalized COVID patients with ARDS.

The company’s market cap today is ~$500m, and although a failure to win an EUA would be damaging to the stock price, there are two pivotal trials of the drug in prostate and breast cancer ongoing, while Veru also has Enobosarm, and two other earlier stage assets, a cash position of >$125m, and a net loss of across the first three quarters of 2022 of $43m. Its sexual health division also generated $37m of revenues across the same period.

We do not know when the FDA will make a final decision, but it is almost guaranteed to move the share price significantly in one direction or another.

The reality is that the risk/reward is probably too high for the everyday retail investor, and that those presently short and long the stock will likely not be changing their opinions on Sabizabulin until the verdict is announced.

Be the first to comment