Liudmila Chernetska

About a month ago, I discussed the surprising Q3 earnings report that was delivered by Lumen Technologies (NYSE:LUMN). The communication services provider shocked many investors by announcing the elimination of its dividend, the biggest reason many were still in the struggling stock. Since then, shares have fallen even more, and there is reason to believe the pain might not be over just yet.

Since the Q3 report, analysts have continued to trim their revenue estimates for the company. Some of these cuts are based on divestitures being finalized, while underwhelming performance in certain segments adding to top line weakness. Currently, the street is expecting about $14.8 billion in total revenue for 2023, which would be down another 15% plus on top of this year’s expected 11% decline. This company generated more than $22.5 billion back in 2018, but the overall circumstances are much different now.

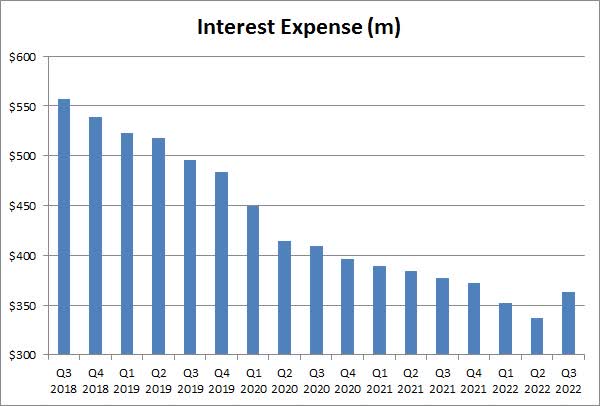

Despite the large revenue decline, Lumen has worked to keep its adjusted profitability at a decent level. Management has brought down operating expenses quite a bit, and as the chart below shows, quarterly interest has come down dramatically. Reducing the debt pile and refinancing a number of other debt issuances were key to helping the bottom line, saving hundreds of millions a year over time.

Lumen Quarterly Interest Expense (Company Filings)

As part of the two deal closings this year, Lumen management detailed that the company would lose $2.8 billion in annual revenue and $1.8 billion in adjusted EBITDA, based on Q4’s projected impact. On the flip side, capital expenditures would come down by about half a billion as well. However, management has not yet detailed how much the overall cash flow picture would be impacted, so at this point we likely won’t get a full set of guidance until early February.

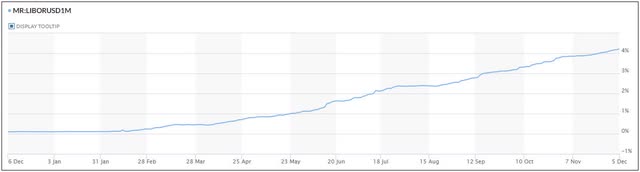

Unfortunately, one of the major headwinds I previously talked about is only getting worse right now. 1-Month LIBOR rates have surged past 4.20% as the chart below shows, after being at just 10 basis points a year ago. Since the end of Q3 alone, this key lending rate has jumped over a full percentage point. Lumen finished the third quarter with just over $9 billion in variable rate debt, so annual interest costs have risen by about $100 million since then as a result, holding all else equal. Remember, the company had a bunch of interest rate swaps settled earlier this year, so there isn’t any protection against rising rates here unless a new deal has been struck recently.

1-Month LIBOR Chart (Marketwatch)

The surge in LIBOR wouldn’t have been as big of a deal a year ago, not just due to hedges, but because of the size of the business. Now, Lumen will be working on a lower revenue base, so it has to work to get down expenses in tandem. The debt pile has come down quite a bit thanks to cash from the divestitures, but we won’t see the full impact of these moves until the next earnings report. Lumen paid back over $2.3 billion in Q3, and tender offers were accepted for another $3 billion in early October, but those interest savings won’t be fully realized as LIBOR continues to surge.

When you have this much variable rate debt on the balance sheet, this kind of surge can have a tremendous impact on your profitability and cash flow. Holding all else equal, the LIBOR rise on over $9 billion in debt over the past year implies nearly $400 million in extra pre-tax interest expense. That kind of added expense may have been part of the reason why the dividend was eliminated, with the board instead deciding to go with a share repurchase plan. With the Fed expected to raise rates at least once more, it’s possible that 1-Month LIBOR could hit 5% or more before topping out.

Lumen shares hit a new low during Monday’s trading, closing the session at $5.20. As the chart below shows, it’s been all downhill recently, with a dropping 50-day moving average (purple line) not helping the technical picture. With the average price target on the street currently at $7.60, analysts see more than 46% upside from current levels in this name. Of course, a year ago that average number was $12, for what it is worth.

Lumen Last 12 Months (Yahoo! Finance)

At this point, the drop in the stock is making the potential power of a buyback quite ridiculous. Lumen’s market cap as of Monday was just under $5.38 billion, so $1.5 billion could repurchase a lot of shares. We don’t know if any shares have been bought back yet, so it might be interesting to see if we get news on that front in the coming weeks. The announcement of an accelerated share repurchase plan could be welcome news for investors, signalling that the board and management think shares are undervalued here.

In the end, Lumen shares have hit a new low, as investors keep bailing on the name after the dividend elimination. The rise in LIBOR rates is negating some of the interest savings from debt repayments, which will reduce profitability and cash flow next year. With shares this low, the buyback gains a lot of power if executed in full, but the timing of that catalyst remains uncertain. For now, investors have a lot of questions about how 2023 will look, which could keep sales coming until we get more clarity from management.

Be the first to comment