Theo Wargo/Getty Images Entertainment

We saw it last week when the slightest hint of potential interest-rate easing sent the stock market skyrocketing by 3%: the market is gradually getting tired of being overly bullish. Yes, while it’s true that the high rate environment plus the threat of layoffs and a global recession are looming, many powerful brands (particularly in the tech/growth space) have sunk to pre-pandemic levels that substantially discount the growth they have seen since then.

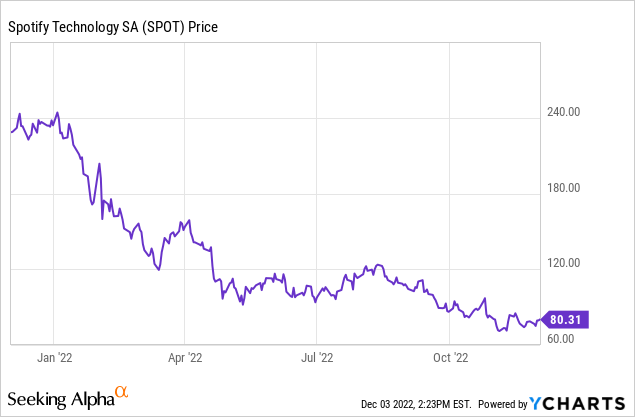

Spotify (NYSE:SPOT), in particular, remains one of my favorite long-term rebound plays. This global streaming leader has seen its share price drop by more than 65% year to date, in spite of the fact that it continues to grow subscribers and add to its diversified stream of non-subscription revenue.

Owing both to the continued collapse in Spotify’s share price plus the fact that its subscribers continue to grow, I am upgrading my view on Spotify to strong buy. I’ll cut to the chase: Spotify at $80 is a steal if your perspective is a long-term one.

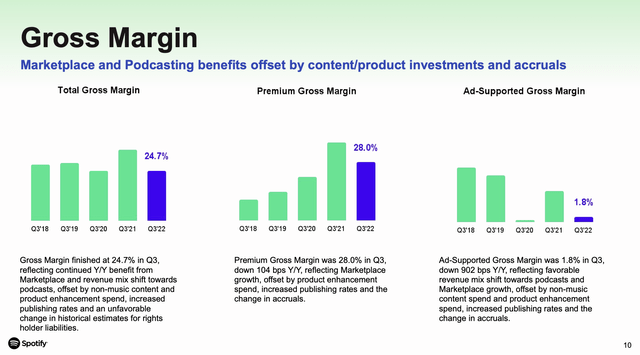

The factors weighing down on Spotify right now are neither company-specific nor permanent. Let’s start here: one of the major gripes against Spotify emerging from its Q3 earnings was its slip in gross margins.

Spotify margins (Spotify Q3 earnings deck)

As seen in the chart above, Spotify’s Q3 gross margin came in at 24.7%, up 10bps sequentially versus Q2 but down 200bps y/y and 50bps lower than expectations. However, the big drag on margins in Q3 was due to a historical accrual adjustment, plus the fact that the U.S. dollar strengthened substantially in Q3, which took a blow on cost of revenue this quarter. Looking ahead to Q4, however, we should benefit from the weakening of the dollar in November plus the fact that the accrual adjustment has already been factored in.

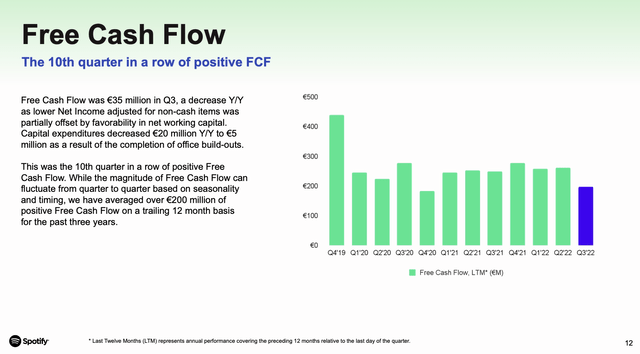

Investors are also worried about overall profitability and the rise in operating expenses, but this is not company-specific: most major companies have reported massive wage inflation eating into operating margins. We like the fact that Spotify remains cash flow-positive; the chart below shows Spotify’s TTM free cash flow stretching back three years:

Spotify TTM FCF (Spotify Q3 earnings deck)

The long-term bull case for Spotify; extremely cheap valuation

When we step away from the near-term pessimism, I still find the long-term bull case for Spotify to be very relevant:

- Spotify continues to roll out new products and prove that it has something for everyone. A brief roundup of major recent updates: In 2021, Spotify rolled out a new paid tier called “Spotify Plus,” its cheapest offering at just $0.99/month. While this tier is still supported by ads, it gives users the ability to skip as many songs as they’d like within an hour, potentially opening Spotify up to a bigger batch of lower-end consumers. In 2022, Spotify also launched Audiobooks for the first time, providing a stream of one-time purchase revenue.

- Successful price increases for Premium. Spotify raised the price of its Family plan in the U.S., the Family/Duo/Student plans in the U.K., and all plans in Brazil. The fact that Spotify reported no meaningful change in churn since the price changes went into effect is a testament of its relative inelasticity when it comes to music streaming. In addition, Spotify has proven itself to be a very sticky platform, with content like podcasts and playlists keeping subscribers hooked to the platform. ARPU (average revenue per user) continues to grow for Spotify.

- Two-sided marketplace. Another nascent revenue opportunity for Spotify: paid marketplace tools for content creators represent another way to fully integrate Spotify into the music ecosystem and expand its wallet share.

- Potential for margin builds and an existing rich free cash flow profile. Higher advertising rates, a mix shift into podcasting, and the general economies of scale that come from paying for music content spread across a bigger base of users will help Spotify to dramatically increase its gross margin at scale, alongside its free cash flow profile.

- Opex savings from hiring slowdown and “work from anywhere”. Spotify announced a remote-work option for all of its employees globally, which I view as a positive move that can reduce Spotify’s real estate footprint and drive lower operating costs in the long run. Recently announced layoffs and a hiring slowdown also show that Spotify remains committed to profitability.

There are, of course, risks to this bullish thesis:

- Economic pressures and layoffs could pressure Premium subscribers to downgrade to Free plans (Ad-Supported users generate far less ARPU than Premium subs)

- More expensive music rights could continue to put pressure on Spotify’s margins.

It’s worth noting, however, that Spotify’s current ultralow valuation more than makes up for any risk. At current share prices near $80, Spotify trades at a market cap of $15.51 billion. After netting off €4.30 billion of cash (against no debt) on Spotify’s most recent balance sheet (at today’s $1.05 to the Euro exchange rate), the company’s resulting enterprise value is just $11.00 billion.

For next fiscal year FY23, meanwhile, Wall Street analysts are expecting Spotify to generate $14.29 billion in revenue (data from Yahoo Finance) – indicating that Spotify is currently trading at just 0.8x EV/FY23 revenue.

Subscriber and listener growth

Unlike many other businesses, macro conditions have not materially impacted the pace of Spotify’s underlying business growth.

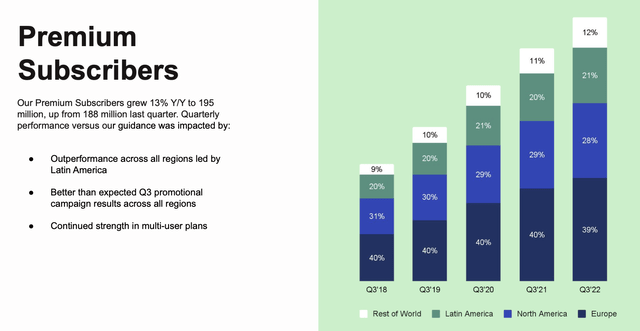

Spotify subscriber growth (Spotify Q3 earnings deck)

As shown in the chart above from the company’s most recent earnings presentation, Spotify added 7 million net-new Premium subscribers in the quarter to end Q3 at 195 million, which came in above the company’s internal guidance of 194 million subscribers. The company continues to see rapid growth in emerging markets, with Latin America specifically outperforming in Q3.

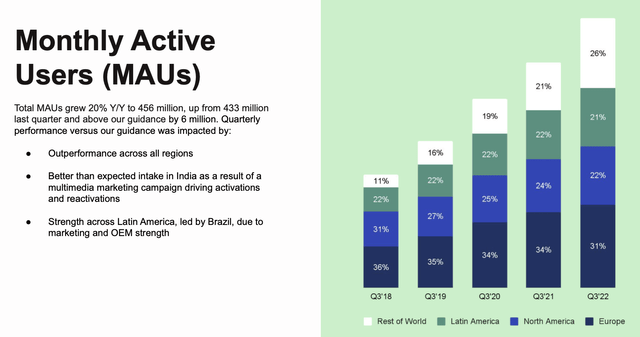

Overall listeners/MAUs also grew, up 20% y/y in the quarter to 456 million, with improved traction in India as a result of a marketing blitz.

Spotify MAU growth (Spotify Q3 earnings deck)

Excluding the company’s exit from Russia, management called out that year-to-date active user additions are at a record high. It also expects to add 7 million Premium subscribers in Q4 and 23 million new MAUs, at roughly the same pace as in Q3.

Revenue diversification

The other positive driver that investors should keep constant tabs on is Spotify’s continued exploration of additional monetization and products. In late September, Spotify rolled out audiobooks to all of its U.S. users, with a library that has already reached above 300k titles. See the Audiobooks home landing page below:

Spotify Audiobooks (Spotify.com)

Audiobooks are a one-time purchase and available to both free and Premium subscribers. Per CEO Daniel Ek’s remarks during the Q&A portion of the Q3 earnings call around the company’s audiobook strategy (key points highlighted):

And what that enables us to do is to leverage all the key technology, so all the pillars that we built Spotify throughout the year. So freemium, personalization, ubiquity, all of those facets.

And in addition to that, obviously, it enables us to go and take the scale of the existing audience base and cross-sell to new verticals to gain ground faster. So when you look at that from music to podcasting, the reason why we’ve been so successful is because we’ve been able to upsell people who never listened to podcasts before to start listening on Spotify, and that is what got us to the #1 position in podcasting.

And so our belief when you look at the audiobooks market is that while books is a pretty big industry, audiobooks is still a niche offering only enjoyed by tens of millions of consumers around the world. And if you think about that from first principles, it’s pretty clear that audiobooks should be something that should be enjoyed by hundreds of millions of people, if not billions of people, around the world. So to grow that market is absolutely key for us.”

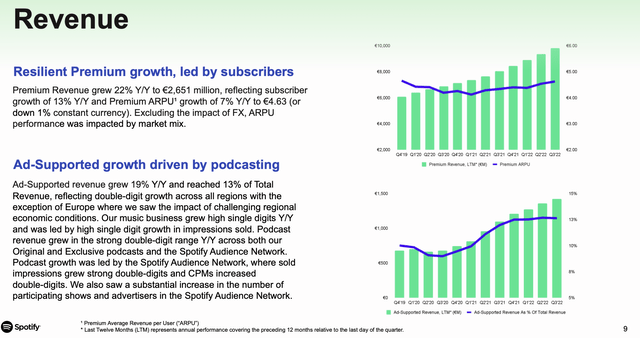

Spotify also continues to lean into advertising revenue. In spite of global advertising headwinds (brands are obviously pulling back on discretionary marketing spend as consumers pinch their wallets), ad-supported revenue still grew 19% y/y in Q3 (roughly the same pace as MAU growth) and contributed to 13% of Spotify’s overall revenue.

Spotify ad revenue growth (Spotify Q3 earnings deck)

Key takeaways

I find very little reason for pessimism on Spotify when the stock is trading at just $80. Spotify continues to widen its subscriber and listener network while offering an ever-broadening scope of monetizable products. The company has remained FCF-positive for years and economies of scale will only continue to boost its gross and operating margins. Take advantage of the crash in this stock to load up.

Be the first to comment