PeopleImages

The last two years have been very disappointing for shareholders of chip giant Intel (NASDAQ:INTC). The company has had trouble growing its revenues, which has led to significant underperformance for the stock against some of its biggest peers. While management is looking ahead to a brighter future, there are reasons to believe that we could see a little more pain ahead first.

There’s been a bit of trouble in the semiconductor space lately, as inventories have built up with customers pausing purchases amidst global economic concerns. This process doesn’t work itself out in a matter of weeks, so the situation could take several quarters to resolve itself. Recently, Intel’s CFO spoke at the UBS Global TMT conference, and the following part of the transcript caught my attention. The question asked had to do with how the March 2023 quarter might fare.

And so, we felt like sending a signal to investors to make sure they under said, hey, we won’t be probably out of the woods in terms of inventory digestion at the end of Q4. So, we would model something more no better than seasonal.

And — and as you pointed out, Tim, I mean, depending on the analysis you do, if you go back three years, it’s actually more like low single digit declines. If you go out more like five, seven years, you get more to this 5%, 7%, which I think is the right starting point for seasonality because the last couple of years have been so noisy with COVID and so forth, it’s kind of hard to get good data.

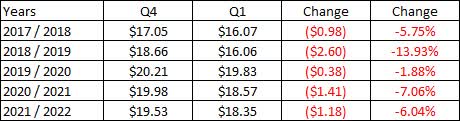

There’s certainly nothing wrong with having seasonality in any business. Pretty much every company out there has better times of the year than others, obviously depending on the industry. If we look at the past five years for Intel, there certainly has been a bit of seasonality as we move from Q4 of one year to Q1 of the next. The following table shows these two revenue periods over the past five years, with dollar values in millions.

Intel Quarterly Revenue (Company Reports)

Over this time, the average has been a little less than a 7% decline from Q4 to Q1. In the CFO quote detailed above, it seems like this mid to high single digit percentage decrease is a good starting point for looking at the March 2023 period. I bring this up because if we look at current analyst estimates, the street is calling for $14.53 billion in Q4 revenues. That itself seems fair, given that management’s guidance for the period was for $14 billion to $15 billion.

However, the street revenue average is currently at $14.35 billion for Q1 2023. You don’t need to be a math expert to realize that’s nowhere near a 5% or even a 7% decline. Yes, there are some high estimates out there that are likely stale and need to be updated, but if Intel were to give official guidance now, it seems almost definite that we’d get a very light forecast. We still have a good month and a half until Intel reports, so it wouldn’t surprise me to see estimates come down a bit by then.

In Q1 of 2020, Intel reported a more than 23% rise in quarterly revenues over the prior year period. That’s the recent growth peak, as revenue growth then slowed during the pandemic and the memory business sale hurt the overall numbers a bit. Current analyst estimates suggest that Q4 2022 will post a 25.6% drop, and that will be the worst of it. However, it’s possible that Q1 2023 could be worse, as the street is only looking for a 21.8% drop currently.

While revenues are dropping, profits are also taking a major hit. Intel could report adjusted earnings per share of less than $2 this year, which would be nearly a 60% plunge over last year. Next year could be even worse, with the street only at $1.25, and analysts only have Intel back to $2.20 by 2025. It’s hard for investors to get excited in a name that may essentially not show any earnings per share growth for half a decade, or perhaps even longer.

In the near term, the significant reduction in profitability is having a major impact on cash flow, especially since Intel is in the midst of a major investment cycle. Adjusted free cash flow is forecast to be negative $2 billion to negative $4 billion this year, and this amount doesn’t include the roughly $6 billion Intel will pay out in dividends this year. The company finished Q3 with about $23 billion in cash, but it also had a little under $40 billion in debt. Unless cash flows swing in a very favorable direction next year, the net debt pile will rise given that hefty dividend payment.

It’s hard to make a very compelling valuation argument for Intel right now, especially against competitor Advanced Micro Devices (AMD). When we look at P/E ratios for the next two years based on current street estimates, Intel goes for 23.53 in 2023 and 16.15 in 2024, whereas AMD which has a much better growth profile and balance sheet goes for 20.28 and 15.64, respectively. Street analysts currently see Intel as worth $32.76, implying low double digit upside from here, but that average target was over $56 at the start of the year and look where we are now.

At this point, I would think Intel needs to be at least at a 10% P/E discount to AMD to even start getting my attention. Based on current estimates, that implies about $26.47 a share, but if you think the street is too positive, then maybe you could shave another dollar or two off that. Intel currently trades at an annual dividend yield of 5%, so the next whole percentage point of 6% would come at $24.33, which is only about 1% below the current 52-week low.

In the end, there looks to be some more pain ahead for chip giant Intel. The company’s CFO seemed to suggest this week that Q1 2023 will see revenues that approximate recent seasonality at best. That would imply that analyst estimates need to come down a bit more, meaning a revenue decline bottom may not be in just yet. With Intel also in a major investment stage, the balance sheet will likely take a bit of a hit in the short term. With the stock currently trading at a premium to competitor AMD, which has a much better short term growth profile, I think investors should wait another quarter or two and see if Intel settles down to the mid $20s before re-evaluating the name.

Be the first to comment