JJ Gouin/iStock via Getty Images

Northern Oil and Gas, Inc. (NYSE:NOG) expects a dramatic increase in its free cash flow from 2022 to 2025. Management also announced that new acquisitions will likely drive future production up while also reducing its leverage. In my view, most investors didn’t have enough time to review the expectations of management because the current stock price appears quite undervalued. In my opinion, if management reports in 2025 what it is expecting, the stock price will likely be over $83. Finally, even considering the risks, in my opinion, the stock price cannot fail much more from its current price mark.

Northern Oil and Gas, Inc.

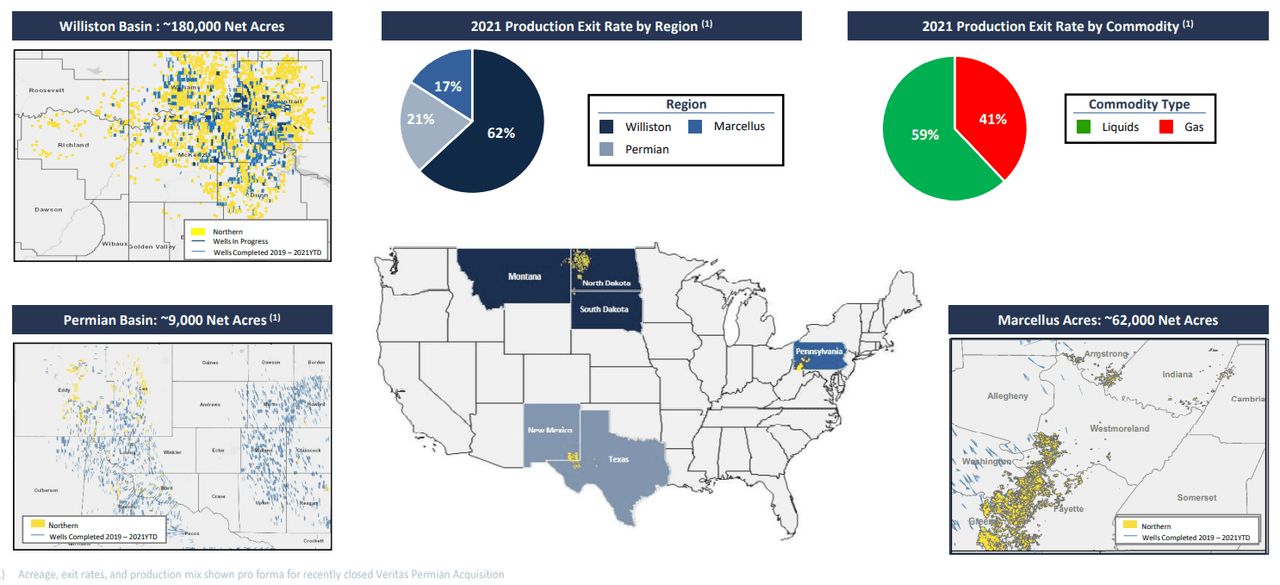

Northern Oil and Gas, Inc. presents itself as a non-operated working interest franchise across the United States.

Presentation

With 287k million boe (barrel of oil equivalents), the company’s production is divided into the Williston basin, Permian basin, and the Appalachian basin.

10-k

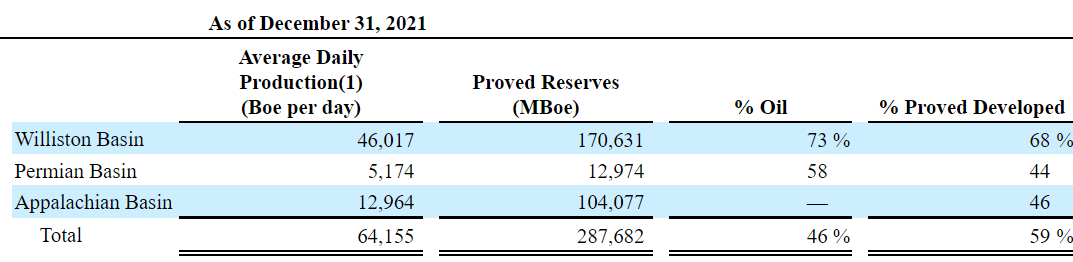

If I can get straight to the point, let’s note that we are assessing a company that expects a dramatic increase in its FCF. Management believes that FCF will increase from $375 million in 2022 to $1.3 billion in 2025. I am not that optimistic in my calculations, but the company did catch my attention as management claims to be trading at 4.2x 2022 earnings.

Presentation

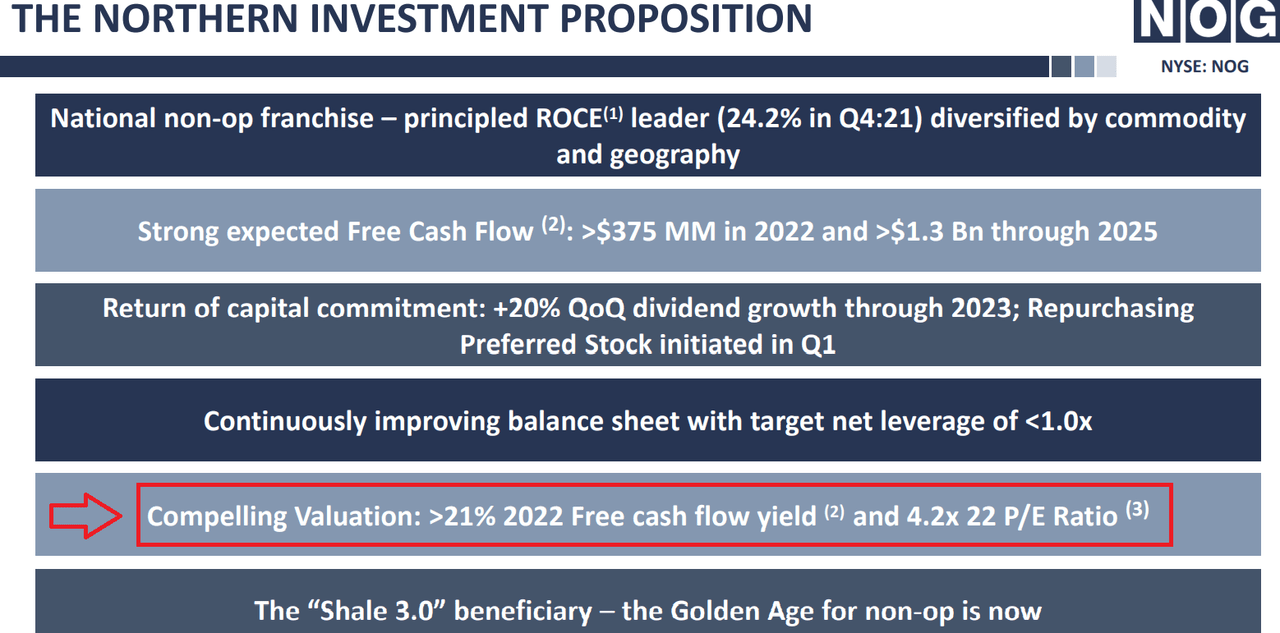

Northern Oil and Gas, Inc. acquired a significant amount of assets in the past, and expects to acquire many more in the near future. It is very relevant to note that management targets deals that will not lower Northern’s return on capital employed (ROCE), which was larger than 20% in Q4 2021. If management really delivers the promised CFO growth, I would expect significant increases in the stock price.

Presentation

Expectations Of Other Analysts Include Reduction In Debt And Significant FCF Generation

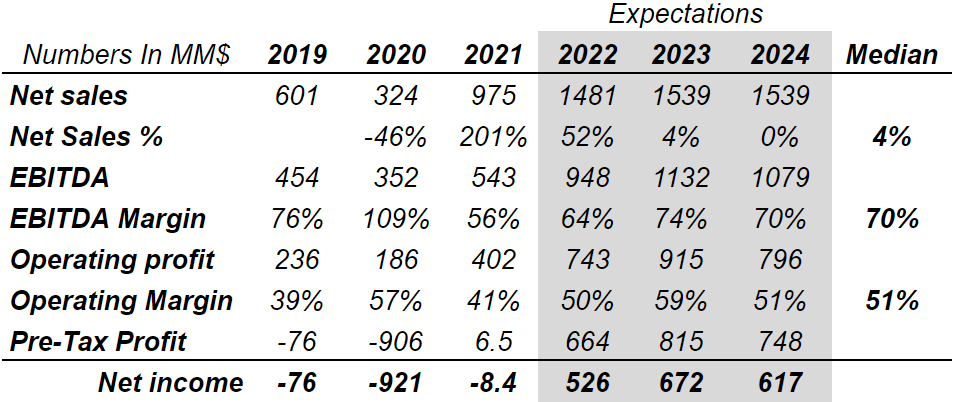

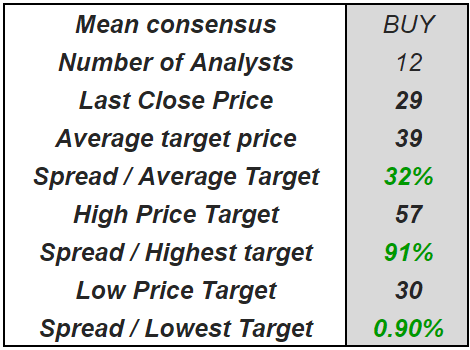

Analysts expect 52% sales growth in 2022, with an EBITDA margin close to 70% from 2022 to 2024. Their expectations also include an operating margin of around 51%, and positive net income in 2022, 2023, and 2024.

marketscreener.com

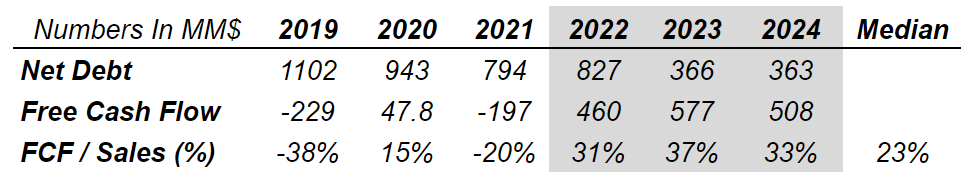

Luckily, analysts are also expecting that beneficial financial figures will likely help Northern Oil and Gas reduce its debts. The free cash flow is also expected to grow from $460 million in 2022 to $508 million in 2024. In sum, the FCF margin would grow from 31% in 2022 to 37% in 2023. With these figures, most analysts believe that the company is worth between $29 and $57.

marketscreener.com marketscreener.com

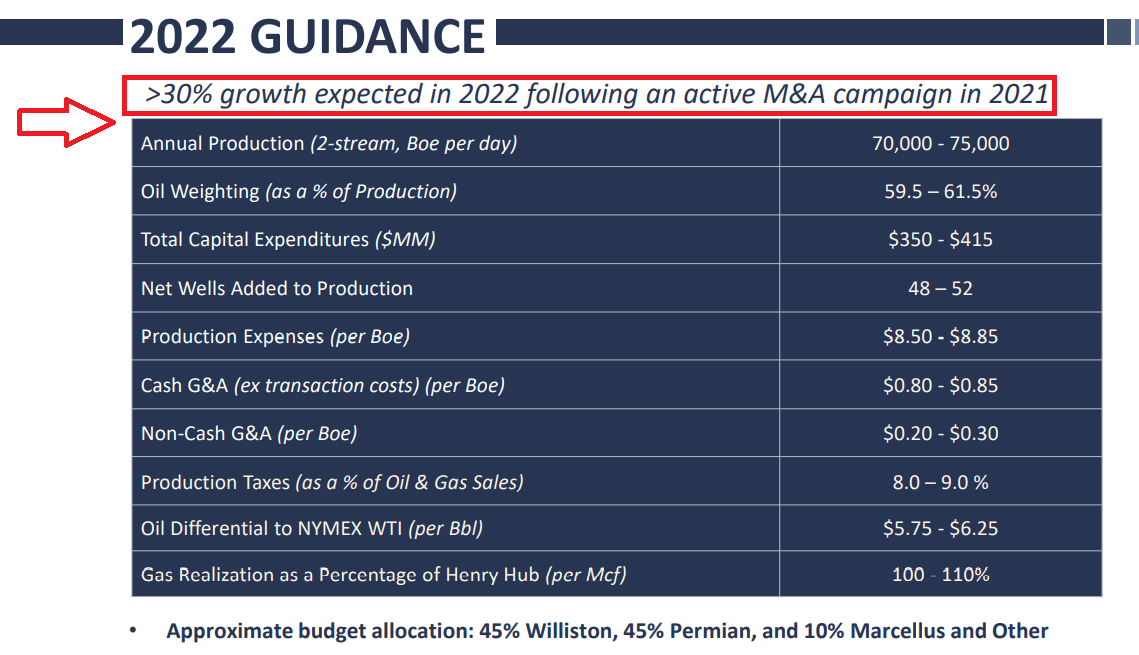

The guidance given by Northern was also optimistic. The company expects 45-82 net wells added to production by 2022. Management believes that future FCF would be sufficient to make capital expenditures of $350-$415 million.

Presentation

Debt Reduction, More Acquisitions, And Diversification Could Imply A Fair Price Of $83

In my view, if Northern Oil continues to diversify its operations across multiple basins, and the average working interest continues to be less than 10%, future FCF will likely not be volatile.

As of December 31, 2021, we have participated in 7,436 gross (680.8 net) producing wells with an average working interest of 9.2% in each gross well, with more than 50 experienced operating partners. Source: 10-k

Besides, if the company continues to acquire assets in different basins, both sales growth and FCF will likely increase. Even without a significant amount of cash in hand, if the oil price continues to trend north, future FCF will help the company acquire new assets. In the last annual report, the company noted that it intends to continue its diversification.

We also believe that we can further diversify our risk with acquisitions in multiple basins, focusing on accretive acquisitions of top tier assets with top tier operators in the premier basins in the United States.

Our “ground game” acquisition strategy is to build a strong presence in our core basins and seek to acquire smaller additional lease positions at a significant discount to the contiguous acreage positions typically sought by larger producers and operators of oil and gas wells, focusing on near term drilling opportunities. Source: 10-k

Besides, under this case scenario, I would expect a significant reduction in the debt, so that the company’s leverage stands at 1.0x Debt / Adjusted EBITDA. If Northern Oil and Gas, Inc. reduces its debt, the cost of debt will likely decrease. As a result, the weighted average cost of capital (WACC) could decrease, which may lead to an increase in the Northern Oil and Gas’ valuation.

We intend to use a significant portion of our expected free cash flow in 2022 to further reduce our borrowings under our Revolving Credit Facility with the objective to bring our leverage closer to our target of 1.0x Debt / Adjusted EBITDA. Source: 10-k

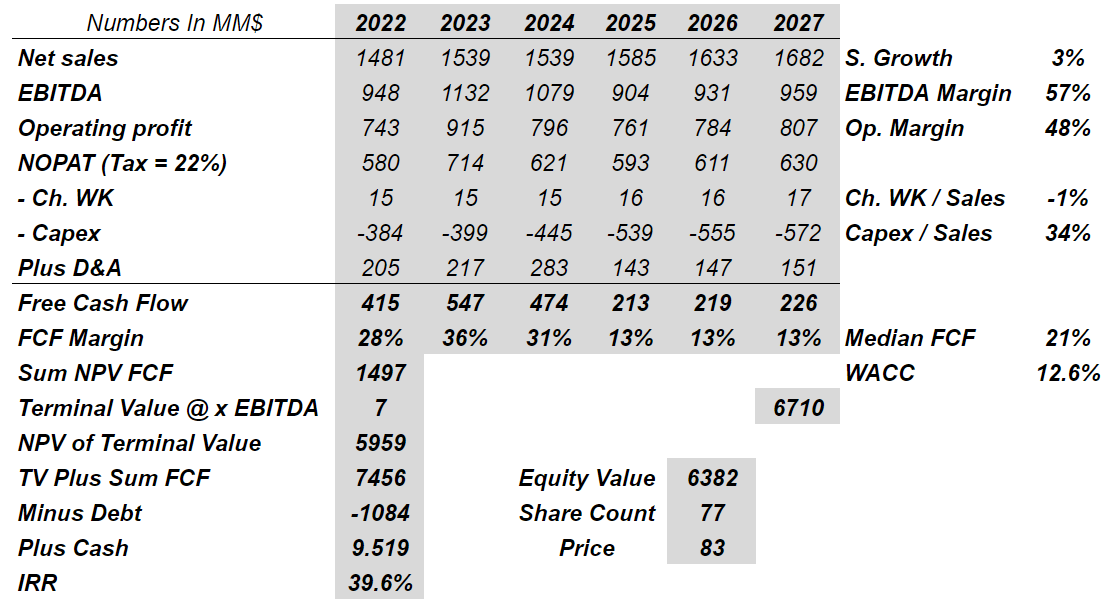

I used some of the figures reported above. From 2025 to 2027, I assumed sales growth of 3%, an EBITDA margin of 57%, operating margin of 48%, and a capex/sales ratio of 34%. The result is 2022 FCF of $415 million and 2027 FCF of $226 million. My median FCF margin would therefore stand at 21%.

With a WACC of 12.6%, the sum of free cash flows would imply a valuation of $1.497 billion. Besides, with an exit multiple of 7x, the terminal value discounted at 12.6% implies a valuation of $5.9 billion. Adjusting with the net debt, the implied fair price should be close to $83.

YC

Risks Include Impairment Of Reserves, Failure To Foresee Future Production, And Assessment Of Proven Reserves

In 2020, Northern had to significantly reduce the value of its oil and gas assets because the crude oil price declined. Management may have to reduce the value of its assets again in the future, which would lead to fewer FCF expectations. Keep in mind that the expectations of future oil production would decline. If equity researchers and financial analysts note the reduction in the FCF, the stock price will likely decline.

In 2020, we were required to write down the carrying value of certain of our oil and natural gas properties, and further writedowns could be required in the future.

In addition to commodity prices, our production rates, levels of proved reserves, future development costs, transfers of unevaluated properties and other factors will determine our actual ceiling test calculation and impairment analysis in future periods. Source: 10-k

Northern may also miscalculate the future oil production to be obtained from future proven reserves. Engineers may fail to assess future capital expenditures and oil and gas prices. Besides, governmental regulations or taxation could increase, which may lead to a significant reduction in the future free cash flow.

We base the estimated discounted future net cash flows from our proved reserves using specified pricing and cost assumptions. However, actual future net cash flows from our oil and natural gas properties will be affected by factors such as the volume, pricing and duration of our oil and natural gas hedging contracts; actual prices we receive for oil, natural gas and NGLs; our actual operating costs in producing oil, natural gas and NGLs; the amount and timing of our capital expenditures; the amount and timing of actual production; and changes in governmental regulations or taxation. Source: 10-k

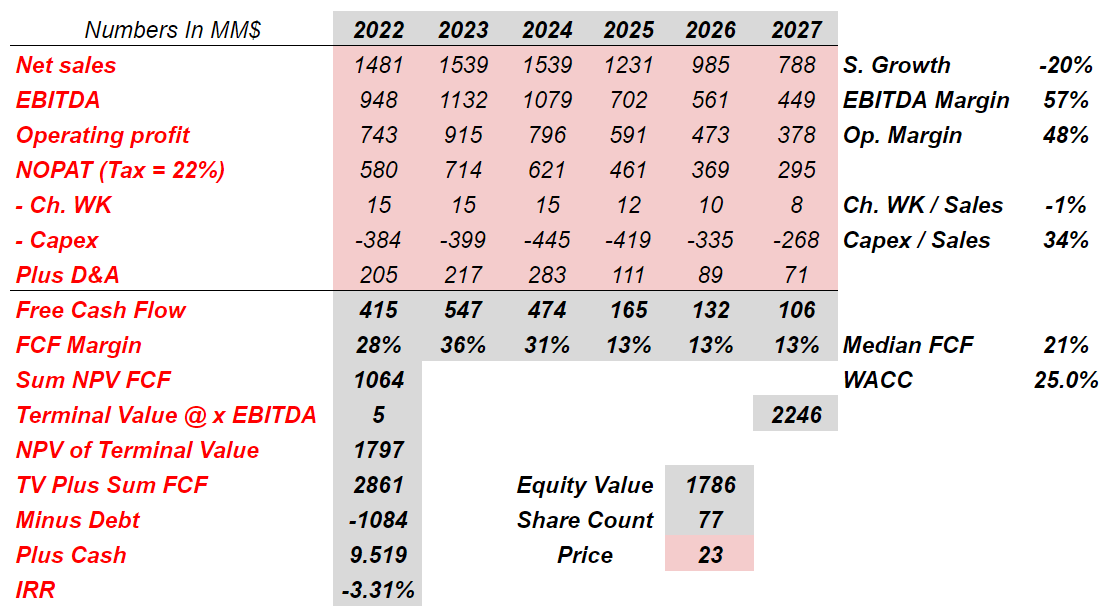

Under the previous traumatic assumptions, I believe that sales growth of 20% and an EBITDA margin close to 55% would be appropriate. I also included conservative changes in working capital and a ratio of capital expenditures over sales close to 35%. The results included 2027 FCF around $105 million. If we sum everything with a WACC of 25%, and use an exit multiple of 5x, my implied enterprise value should be between $2.5 billion and $3 billion. Finally, the fair price should be close to $23.

YC

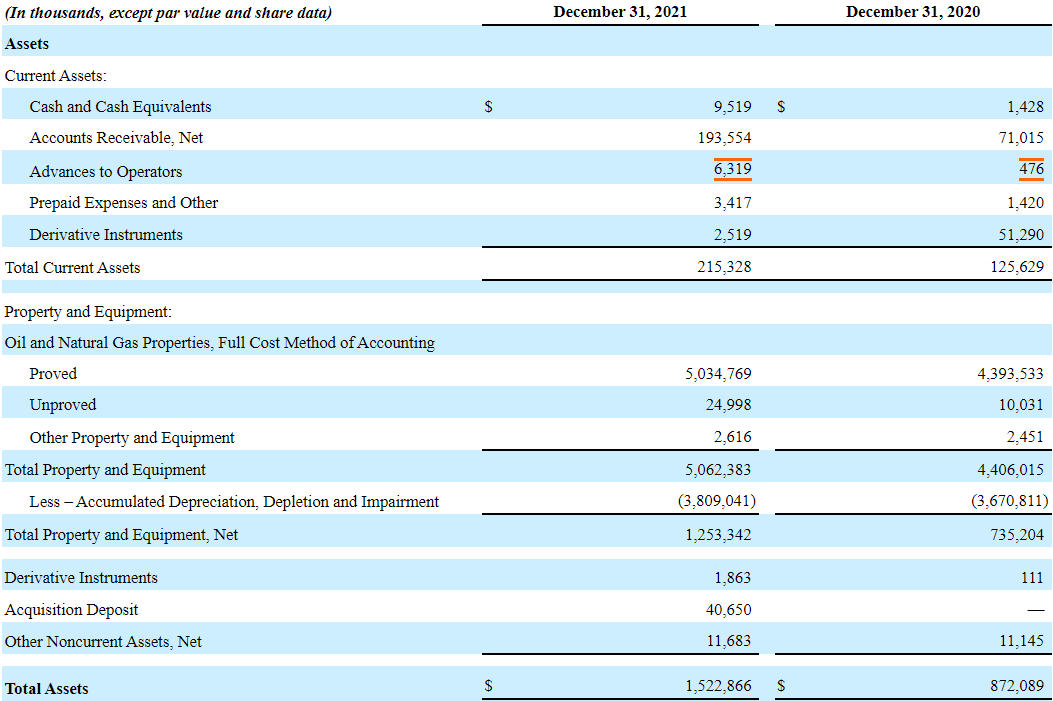

Balance Sheet

With $1.52 billion in total assets and $1.3 billion in total liabilities, I believe that the balance sheet is healthy. The company’s net total property and equipment is equal to $1.25 billion, and cash in hand is $9 million.

10-k

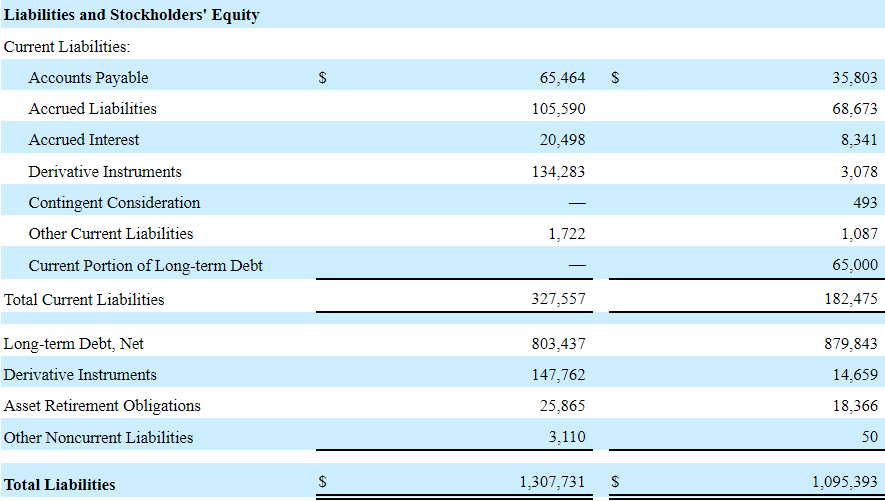

Northern Oil reports $803 million in long-term debt, with derivative instruments worth $281 million. I expect FCF of more than $400 million in 2022, so I am not really worried about future debt obligations.

10-k

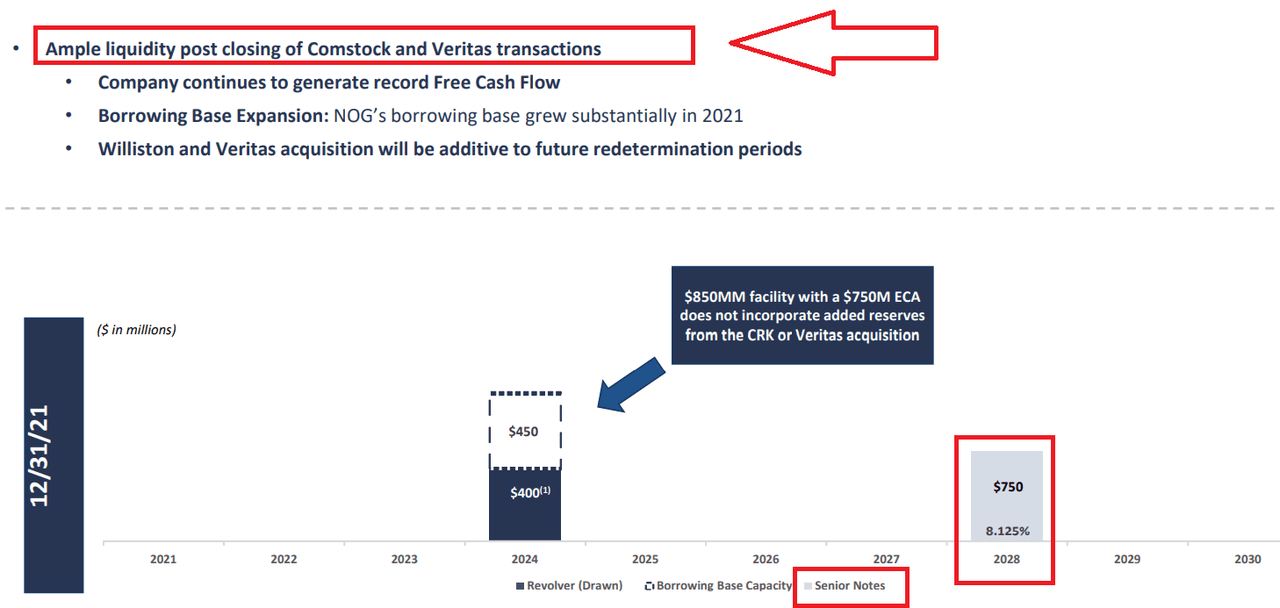

With regards to Northern’s liquidity and debt obligations, I should add that management expects to receive liquidity from two recent acquisitions. Besides, the company noted future plans with regards to its revolver debt and senior notes.

Presentation

Conclusion

With impressive FCF expectations through the year 2025, recent debt reduction, and promising M&A operations, Northern Oil and Gas appears quite interesting right now. With conservative assumptions about future EBITDA margin and FCF generation, I obtained a valuation that is significantly more elevated than the current stock price. Even considering risks related to impairment of reserves and failure to foresee future production, in my view, the upside potential appears larger than the downside risks.

Be the first to comment