hapabapa/iStock Editorial via Getty Images

Palantir (NYSE:PLTR) stock dropped close to its all-time low after its earnings announcement failed to please investors. Remarkably, the growth stock is down by approximately 85% from its ATH in early 2021. Palantir is going through a transitory slowdown phase due to a broad economic slowdown and other macroeconomic factors. Despite the stock’s disastrous drop from its top, Palantir remains a dominant market-leading company in its segment. Moreover, Palantir has incredible growth prospects and solid profitability potential. The company’s growth and profitability prospects should improve as the economy stabilizes and expands again. Therefore, Palantir’s stock should appreciate considerably in the coming years, potentially making Palantir one of the top companies to own for the next five to ten years.

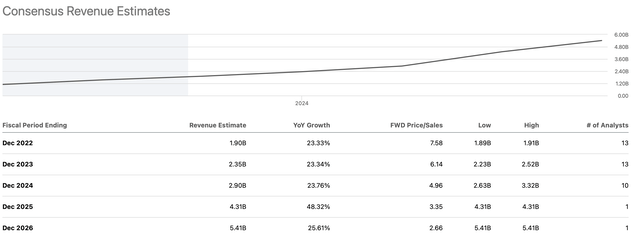

The Technical Image

Palantir: 2-Year Chart

Palantir dropped again recently, trading around its all-time low, roughly 85% from its top in early 2021. The stock is now trading around its critical support range at $6-$7, and further selling pressure could send the stock down into the $5 range. However, despite the potential for near-term downside, Palantir’s stock should stabilize, recover, and move substantially higher in the coming years. With the RSI around 30 and the CCI close to -200, Palantir’s stock is approaching oversold levels. Moreover, the full stochastic and other technical indicators imply that a change to a more positive momentum may be close. Therefore, we should consider an appropriate buy-in range for this stock for a long-term investment.

Why Palantir Is Down Again

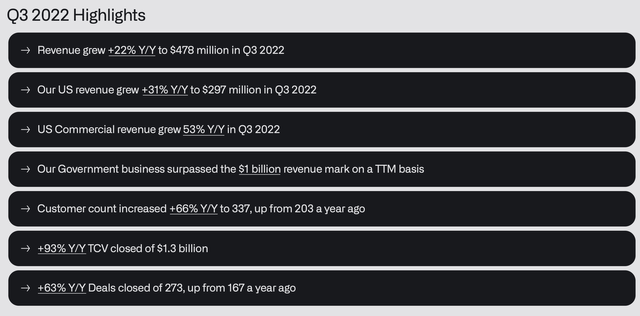

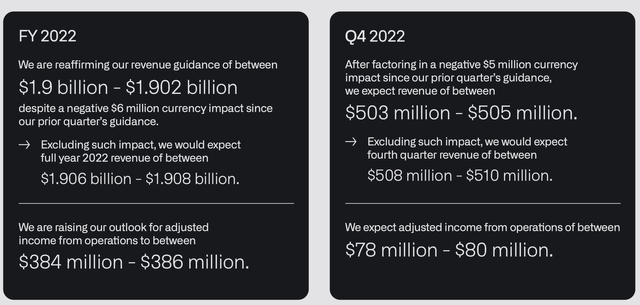

Palantir recently announced earnings for Q3, missing non-GAAP EPS estimates by one cent. The company reported revenues of $477.9 million, beating estimates by $3 million, illustrating an approximate 22% sales growth YoY. Moreover, U.S. revenues increased by 31% YoY to $297 million, and U.S. commercial revenues expanded by 53% in the same time frame. Customer count grew by 66% YoY and 11% QoQ. For Q4, the company expects revenues of $503-$505 million, slightly below the consensus benchmark of $506.51 million. For the full year, Palantir reaffirmed revenues of $1.9 billion and raised its adjusted income from operations from $341-$343 million to $384-$386 million.

The Earnings Takeaway

Like most other companies, Palantir is going through a transitory slowdown phase. The macroeconomic landscape is challenging, and growth has dropped off a bit. Instead of seeing 30% YoY revenue growth, we may only see approximately 23-25% YoY sales growth in the next few years. However, once the downturn concludes, revenue growth projections may climb back to around 30% as the company advances. Moreover, Palantir’s operational income guidance illustrates that despite some transitory difficulties, the company will likely become increasingly profitable in future years.

Highlights From Last Quarter

Q3 Highlights (static.seekingalpha.com)

Despite the temporary slowdown effect, we continue to see solid growth and operational numbers from Palantir. We see healthy revenue growth, especially in the U.S. Palantir’s commercial business continues expanding, and the company’s government side of the business illustrates robust growth.

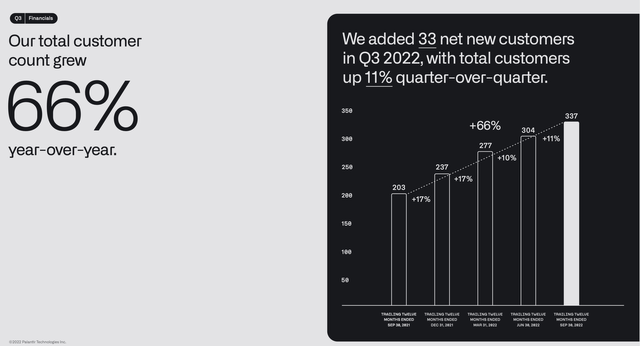

Customer Count

Customer count (static.seekingalpha.com)

The company’s customer count grew by 66% YoY and 11% QoQ, illustrating continued healthy growth in its business. Palantir should continue capturing market share in its commercial business and will likely see exceptional growth for years as we advance.

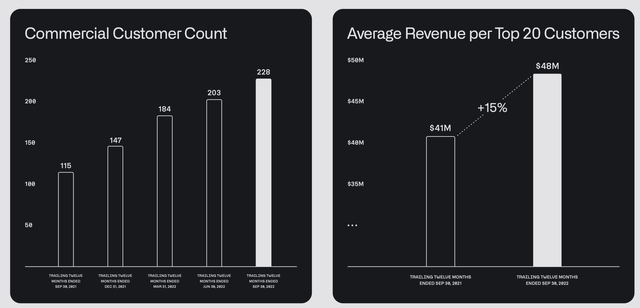

Commercial Customer Count

Commercial customer count (static.seekingalpha.com)

Palantir’s commercial customer count has nearly doubled over the last year, and the average revenue per customer has shot up by 15% over the previous twelve months. This dynamic implies that Palantir should continue robust commercial customer count growth and increase revenue per customer as the company moves forward in future years.

Guidance

Guidance (static.seekingalpha.com)

Despite temporary headwinds from currency fluctuations, Palantir reaffirmed robust revenue growth and income guidance for the fourth quarter and the full year. Moreover, Palantir raised its FY 2022 adjusted income from operations guidance to $384-$386 million, illustrating remarkable resilience and significant earnings growth potential as the company moves on.

The Valuation Perspective

Palantir is a high-growth company with minimal EPS. Therefore, it is challenging to value the company on an EPS basis now. However, Palantir’s market cap has dropped to approximately $14 billion. Provided that Palantir should report roughly $2.4 billion in sales next year, its stock is trading at about six times forward sales. The six times forward sales valuation is relatively inexpensive, as Palantir sold at approximately 36 times forward sales around its top.

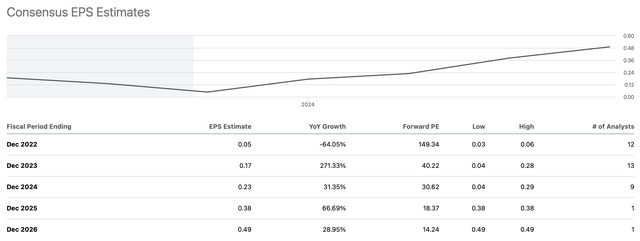

Palantir’s Revenue Estimates

Revenue estimates (seekingalpha.com)

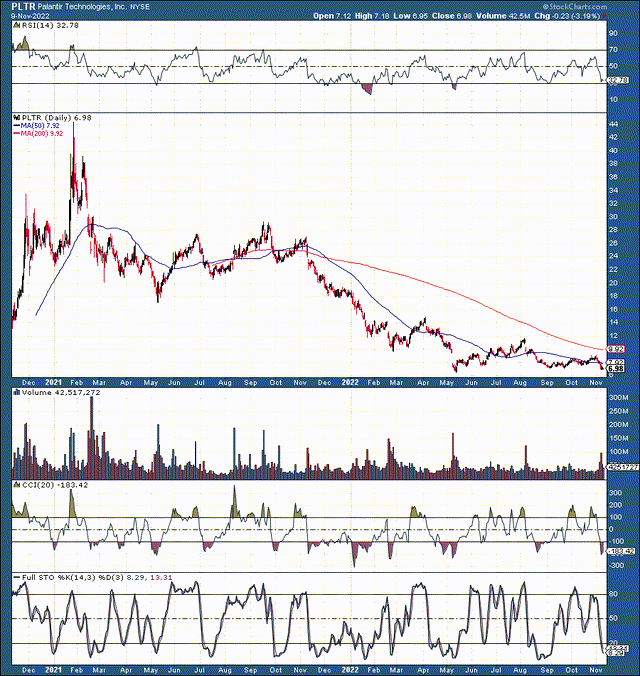

Palantir’s EPS Estimates

EPS estimates (seekingalpha.com)

Moreover, many companies with poorer growth dynamics are trading at substantially higher multiples today. For instance, Nvidia (NVDA) likely does not have the growth prospects that Palantir presents, yet, its stock is trading at approximately 11 times forward sales. Microsoft (MSFT), essentially a value company, trades at about seven times forward sales estimates. Numerous companies with questionable growth prospects trade at higher multiples than Palantir now. As the economy recovers, Palantir’s stock should command a higher P/S multiple, and its share price will likely move substantially higher as we advance. Moreover, Palantir has shown the ability to generate profits. Thus, we should see significant profitability improvements in future years, and we can also evaluate Palantir on a forward P/E basis.

What Palantir’s financials could look like in future years:

| Year | 2022 | 2023 | 2024 | 2025 | 2026 | 2027 | 2028 | 2029 | 2030 |

| Revenue Bs | $1.9 | $2.4 | $3.1 | $4 | $5.1 | $6.5 | $8.2 | $10.2 | $12.6 |

| Revenue growth | 23% | 26% | 29% | 29% | 28% | 27% | 26% | 25% | 24% |

| EPS | $0.05 | $0.17 | $0.23 | $0.34 | $0.49 | $0.65 | $0.86 | $1.16 | $1.55 |

| Forward P/S | 5.8 | 5.8 | 6.7 | 6.7 | 6.2 | 6.1 | 5.9 | 5.7 | 5.7 |

| Forward P/E | 41 | 40 | 39 | 35 | 32 | 29 | 26 | 23 | 20 |

| Price | $7 | $9.20 | $13.3 | $17.1 | $20.7 | $25 | $30.4 | $36 | $45 |

Source: The Financial Prophet

Despite relatively low P/S ratio projections of approximately 5-7, Palantir’s stock will likely move substantially higher in the coming years. As revenues increase, Palantir’s EPS growth could be 30% or higher in future years. While these projections may seem modest, we could see Palantir’s stock appreciate by more than 500% in the next few years, making Palantir one of the top companies to buy and hold for the next decade.

Risks to Palantir

Market participants should consider several potential risks associated with a Palantir investment. While the growth story is strong at Palantir, shares are still costly by traditional metrics. Furthermore, the company’s earnings are minimal and may not increase as much as I envision. Moreover, if the company’s growth picture were to turn less bullish, the stock could head south. Moreover, if Palantir lost favor with the government or had a data breach, the stock could experience a notable decline. Please consider these and other risks carefully before investing in Palantir.

Be the first to comment