andjic/iStock via Getty Images

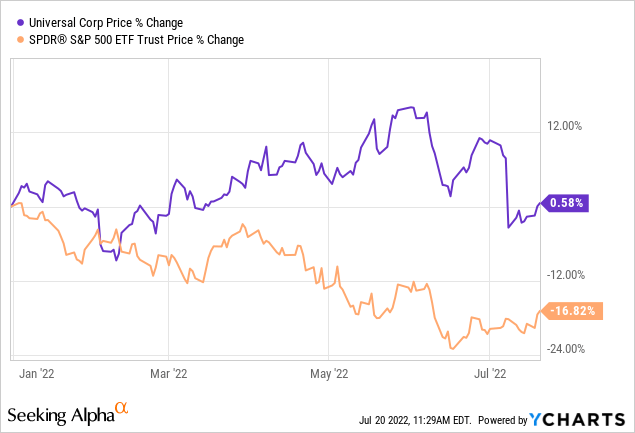

As a result of the several macroeconomic headwinds, including rising inflation, elevated commodity prices, supply chain disruptions, COVID-19 related restrictions in China, rising interest rates, a strong U.S. Dollar, escalating geopolitical conflicts in the Eastern European region and a declining consumer confidence in the United States, the S&P 500 (SPY) has declined by about 17% since the beginning of 2022.

Although many firms have lost a significant portion of their market cap, there are also numerous companies that have (so far) performed relatively well in this challenging environment. One of these companies is Universal Corporation (NYSE:UVV), a firm that processes and supplies leaf tobacco and plant-based ingredients worldwide.

Year-to-date, UVV has significantly outperformed the broader market, as its stock price has stayed flat over the period.

In this article, we will take a look at UVV’s historic performance during times of low consumer confidence to gauge how the stock may perform in the current environment. Then, we will use the Gordon Growth Model to estimate fair value for UVV’s stock.

Performance during periods of low consumer confidence

Consumer confidence is often referred to as a leading economic indicator, which can be used to predict potential changes in the consumer spending trend in the not-so-distant future. When consumer confidence is low, or declining, it signals that people may be reluctant to spend larger sums of money, due to their uncertain financial outlooks. This could potentially lead to lower demand for durable, discretionary, non-essential products. Services may also be impacted, as people likely start saving costs by choosing lower-cost alternatives.

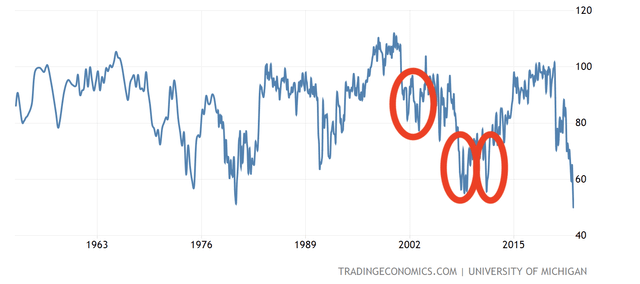

Consumer confidence in the United States has been steadily declining since the beginning of the year, caused most likely by the uncertain macroeconomic environment. Important to highlight that the current level of consumer confidence is even below levels that were observed during the financial crisis in 2008-2009. While consumer spending has remained high in the first half of 2022, we expect the low consumer confidence to result in a slowing spending eventually.

U.S. Consumer confidence (Tradingeconomics.com)

Firms operating in the consumer staples sector are less likely to be influenced by the fluctuating consumer confidence as the demand for their products is thought to be relatively inelastic. Let us take a closer look at how UVV’s stock price has developed in the last 20 years during periods characterized by low consumer confidence. These periods are marked in red circles.

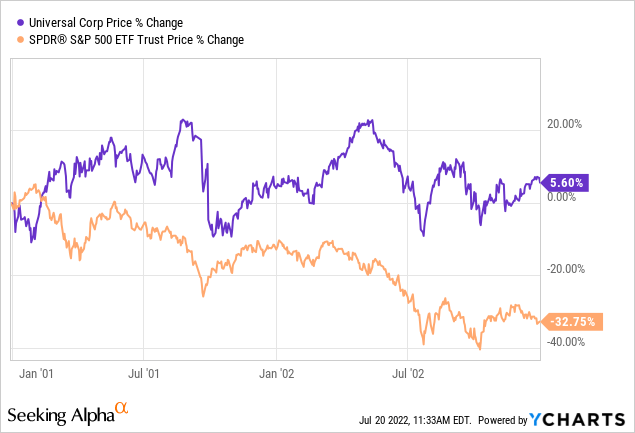

2001-2003

While the S&P500 lost more than 32% between 2001 and 2003, UVV’s stock price was up by about 6%, substantially outperforming the broader market.

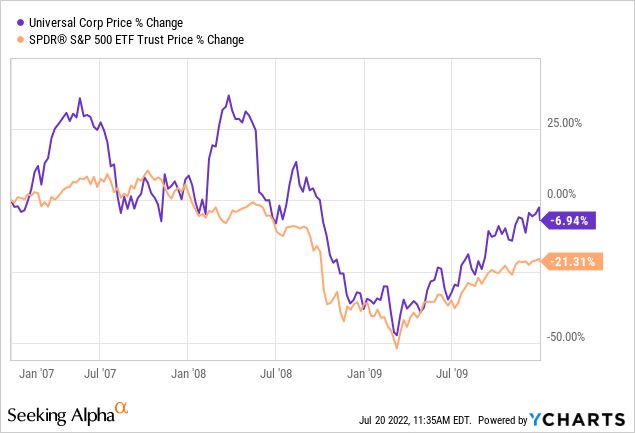

2007-2010

Between 2007 and 2010, both the SPY and UVV ended up in negative territory, however, UVV lost only 7% of its market value, compared to the decline of 21% of the broader market.

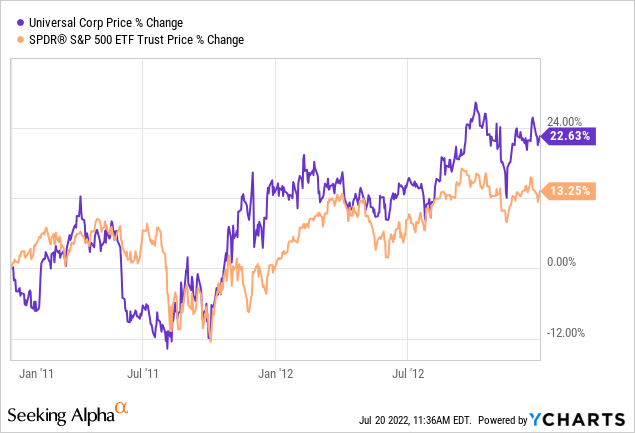

2011-2013

In this time period, the firm once again outperformed the broader market by gaining more than 22%, in contrast with the 13% gain of the SPY.

To sum things up, UVV has outperformed the SPY in three out of three times, in periods characterized by low consumer confidence. Although past performance is not always a reliable indicator of future performance, in our opinion, UVV is well-positioned in the current market environment to maintain its outperformance.

For this reason, we believe that UVV’s stock could be an attractive buy from this point of view.

In the next section, we will look at the valuation of the firm and will determine the fair value of the stock.

Valuation

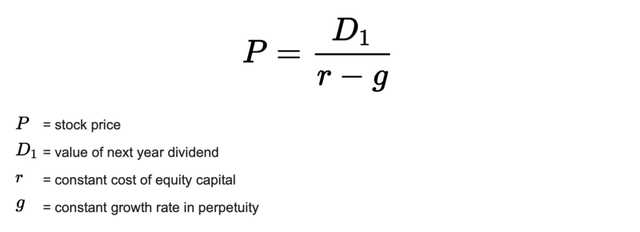

Gordon Growth Model

The Gordon Growth Model (‘GGM’) is a simple dividend discount model, which can be applied to value the equity of dividend-paying firms. The following formula describes the mathematics behind the GGM.

Gordon Growth Model (Wallstreetprep.com)

Before applying the model, we have to make sure that the firm fulfills a set of criteria:

- The company pays a dividend

- Stable dividend growth is expected at a constant rate in perpetuity

- The firm is relatively unaffected by the business cycle fluctuations

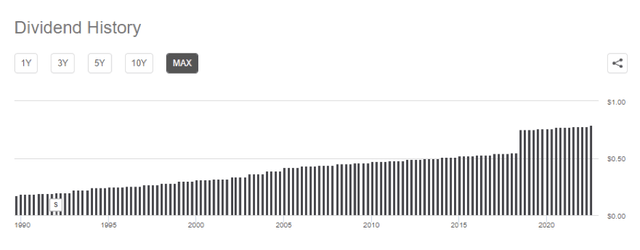

Also, a plus, if a firm has a strong track record of steadily increasing dividend payments.

UVV has a strong track record of returning value to its shareholders in the form of dividend payments. The firm has been paying dividends for the last 50 years, even managing to increase the payout in each year. The current annual dividend is $3.16 per share. For this reason, we believe that the Gordon Growth Model is a suitable valuation method for this company.

Dividend history (Seekingalpha.com)

To determine the fair value using the GGM, two key assumptions need to be made:

- What is the required rate of return?

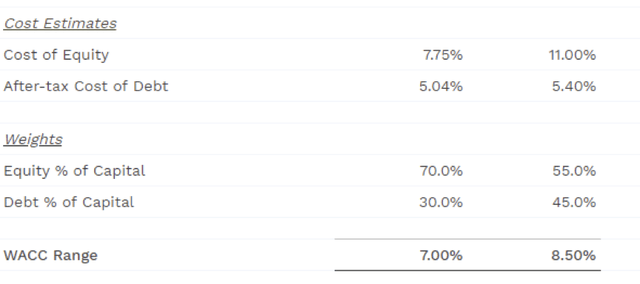

For the required rate of return, we usually prefer to use the weighted average cost of capital (‘WACC’) of the firm. The WACC of UVV is in the range of 7% to 8.5%.

2. What could be a reasonable assumption for the stable and constant dividend growth rate in perpetuity?

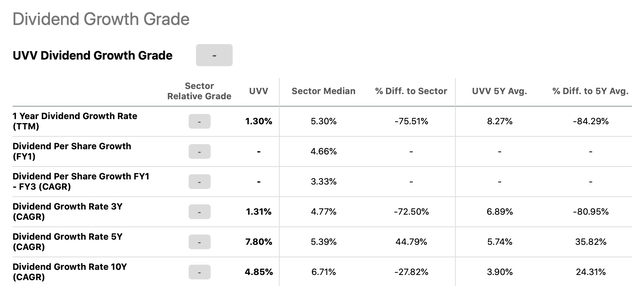

The following table summarizes the dividend growth rate for several different periods. In our opinion, some of these figures, especially the 7.8%, may not be representative due to the sharp jump in dividend payments in 2018.

Dividend growth (Seekingalpha.com)

However, between 2010 and 2017, the dividend has been increasing steadily at a relatively constant rate. In this period the CAGR was about 2%. We will refer to this value as our most likely scenario, however, to account for uncertainty, we will conduct our analysis using a range of 1% to 3%.

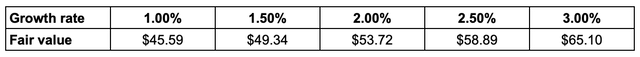

The following table summarizes our results:

Based on the assumptions used, the fair value of UVV’s stock is estimated to be in the range of $45 to $65 per share. As the stock is currently trading at around $55 per share, we believe that the current price level could be an attractive entry point.

As the stock has a strong track record of outperforming during times of low consumer confidence, and it appears to be in the middle of the fair value range according to the Gordon Growth Model, we believe that UVV could be an attractive option for dividend and dividend growth investors at the current valuations.

Key takeaways

UVV has historically outperformed the broader market during times of low consumer confidence. We believe that one reason for this outperformance is the relatively inelastic demand for the firm’s products. For this reason, we believe UVV may be well-positioned to continue to outperform in the near future.

Because of UVV’s long track record of safe and sustainable dividend payments, it could be an attractive option for investors looking for dividend and dividend growth.

Based on the GGM, the stock appears to be fairly valued.

For these reasons, our rating on UVV is “buy” right now.

Be the first to comment