justocker/iStock via Getty Images

Investment Thesis

Soon after CRISPR Therapeutics (NASDAQ:CRSP) held its Innovation Day on June 21st, the CRISPR-bashing began in earnest. Social media has been awash with criticism about the gene therapy specialists’ pre-clinical and clinical programs, in hemoglobinopathies, immuno-oncology, regenerative medicine and in vivo, and the stock price was down ~7% by COB on Wednesday, to $60.

CRISPR Therapeutics’ stock has actually been climbing in recent weeks – it is up 11% since my bullish note on the company in March, while the S&P 500 is down 14% over the same period – but many market watchers feel its $4.65bn market cap significantly overvalues the company.

The market is demanding more progress in the clinic, despite the fact that CRISPR / Cas9 gene editing technology is, by drug development standards, a very new type of approach, discovered by biologists Jennifer Doudna and Emmanuel Charpentier and discussed in a 2012 paper, before the duo were awarded a Nobel Prize in Chemistry in 2020.

Charpentier is a co-founder of CRISPR Therapeutics, but the company’s rights to CRISPR technology patents are disputed with the Broad Institute of Massachusetts Institute of Technology (“MIT”) and Harvard University – a group led by the research scientist Feng Zhang – who claim to be the first to have adapted the technology for making gene therapy medicines to treat humans.

Broad struck the latest blow in a long-running dispute back in March – see my previous note for more detail – but the situation is so fluid and complex that it is not seen as a major hurdle in the race to commercialize a first drug – a race that CRISPR Therapeutics is winning.

Lead asset Exa-Cel – formerly known as CTX-001 – has a “functionally curative” profile in 2 diseases – transfusion dependent thalassemia (“TDT”) and Sickle Cell Disease (“SCD”), with a pivotal showing that 42 of 44 TDT patients no longer requiring blood transfusions after treatment with Exa-Cel some 37 months later, and 31 of 31 SCD patients becoming vaso-occlusive episode (“VOE”) free after 32 months.

CRISPR Therapeutics says it is ready to submit a Biologics License Application (“BLA”) for the drug to the FDA in Q422, and anticipates that it will achieve the first ever approval for a CRISPR/Cas9 gene editing medicine, despite competition from the likes of Intellia Therapeutics (NTLA), Editas Medicine (EDIT) and “base editing” – a next generation CRISPR-based technology – specialist Beam Therapeutics (BEAM) who all license their technology from the Broad Institute.

CRISPR Therapeutics is partnered with Cystic Fibrosis giant Vertex (VRTX) on the Exa-Cel program, with Vertex having paid handsomely for the rights to 60% of net sales – paying $1bn to increase its share by 10% last year, which gives an indication of how large an opportunity this could be.

Still, investors could point to an SCD therapy developed by bluebird bio (BLUE) – Lovo-Cel – which could also win an approval in 2023 in SCD (see my note here), based on comparable late-stage data generated using its lentiviral platform technology. bluebird’s market cap is ~$320m at the time of writing, and the company will keep 100% of its net sales, so why is CRISPR worth >10x more than bluebird? bluebird has some funding issues, whilst CRISPR has a cash position of $2.2bn (as of Q122), so there are major differences between the 2 companies. Even so, the question is a fair one – are investors paying a premium for CRISPR gene technology, when other approaches work just as well?

Above and beyond Exa-Cel, criticism has rained down on CRISPR Therapeutics’s other programs, which are admittedly much less advanced. There are 3 CAR-T therapies in the clinic – good news, but when we consider that Bristol Myers Squibb (BMY) won full FDA approvals for 2 cell therapies in 2021 – Abecma and Breyanzi, indicated for multiple myeloma and B-cell lymphoma respectively, whilst Legend Biotech (LEGN) and Gilead (GILD) also had cell therapies approved last year, for DLBCL and mantle cell lymphoma, CRISPR’s efforts look mediocre by comparison.

The company has made it into the clinic with a regenerative medicine targeting diabetes mellitus, and has 10 in vivo projects in development, 1 of which has reached the Investigational New Drug (“IND”) submission stage – IND approval is required before in-human studies can begin – but none of this is headline generating news since commercialization of any of these opportunities is realistically years away.

That certainly gives analysts and investors ammunition with which to target CRISPR and drive its share price down, but a more patient investor may benefit from taking a closer look at the data presented yesterday and the opportunities that may present themselves in a few years time, and take a more positive view.

In this post I’ll take a brief look at the 4 different areas of CRISPR Therapeutics’s pre-clinical and clinical research and try to highlight some points for debate, plus I will try to explain why I believe investors ought to keep the faith. Let’s begin by focusing on the hemoglobinopathy opportunity in more detail.

Hemoglobinopathies

Exa-Cel is CRISPR’s most valuable and prominent asset, no question, and as discussed, its pivotal trial data will go in front of the FDA likely in early 2023, with management sounding very confident it would be approved – Exa-Cel has already been granted Regenerative Medicine Advanced Therapy (‘RMAT’), Fast Track, Orphan Drug, and Rare Pediatric Disease designations.

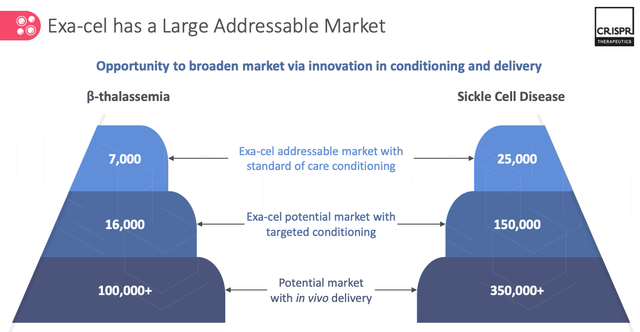

Interestingly, the company is already looking beyond a likely launch of Exa-Cel in 2023, at a potential next generation SCD therapy. The slide below illustrates why.

CRISPR market opportunity for Ex-Cel and next generation TDT / SCD therapies. (presentation)

It may be slightly disingenuous for CRISPR to call the slide an illustration of Exa-Cel’s market, since that only applies to the first layer – the therapy’s addressable market of 7k TDT patients and 25k SCD patients with “standard of care” conditioning.

If we estimate that CRISPR charges $500k for Exa-Cel, if approved, which is ~$100k more than BMY charges for a dose of Abecma – then there is a $16bn market in play, although don’t forget that bluebird’s Lovo-Cel could also be on the market by 2024, and that both therapies are “One and Done” style treatments, so the patient pool will shrink.

That – plus the terms of its deal with Vertex, which sees its earning potential shrink to <$8bn, and its belief in its next generation technology – is presumably behind CRISPR’s decision to develop an antibody drug conjugate (“ADC”) that targets cKit – a type of receptor tyrosine kinase, tumor marker, and stem cell receptor, also known as CD117. In preclinical models, this cKit ADC is demonstrating “high potency with limited toxicity”, depleting Hematopoietic stem cells (“HSCs”) making it ideal for targeting conditioning of patients using Exa-Cel.

As we can see above, this enhancement would open Exa-Cel up to a larger market – as many as ~150k patients in SCD, and its notable that CRISPR Therapeutics’ is developing this as a wholly owned program i.e. not in collaboration with Vertex, although my expectation would be that Vertex would continue to claim 60% of revenues in the expanded market.

Looking further ahead, CRISPR wants to be able to edit HSC’s in vivo. That is the “holy grail” for gene editing biotechs, since it circumvents conditioning and intravenous infusion of engineered stem cells, making for a cheaper and likely more effective medicine.

Intellia currently leads the way in in vivo, releasing data last year from a study of patients with ATTR Amyloidosis showing mean reduction in TTR Serum levels of up to 96% using an in vivo therapy, NTLA-2001. CRISPR Therapeutics, however, is now looking at 3 different approaches to in vivo delivery – Adeno-associated viruses (“AAV”), Lipid Nanoparticles (“LNP”), and targeted LNP.

Granted, these delivery methods were not invented by CRISPR Therapeutics, but you cannot blame the company for jumping on these delivery bandwagons, because safe and reliable delivery of CRISPR/Cas9 is critical, just as it is for messenger-RNA therapies, such as the COVID vaccines.

Delivery has arguably been the single biggest hinderer of the progress of gene editing drugs, and the value of LNPs to the drug development process cannot be overstated. The faster CRISPR Therapeutics gets to grips with the technology, the better its prospects look, both in the clinic and in the marketplace, so it is encouraging to hear that the company is fully focused on this technology.

This could lead to the company developing its own SCD therapy in years to come, or perhaps raises the intriguing prospect of Vertex acquiring CRISPR – the Boston based Pharma certainly has the resources to do that, and it would almost certainly be done at a significant premium to the current share price – CRISPR Therapeutics’ stock traded as high as $200 in the past, before market conditions deteriorated rapidly.

Immuno-oncology

CTX-110 is CRISPR Therapeutics’ first effort at developing an allogeneic cell therapy. Allogeneic is when a donors’ cells are extracted and engineered, before being given to a patient, whilst autologous is when the patient’s own cells are used.

There are no approved allogeneic cell therapies, although they are considered to be potentially faster, cheaper, and potentially more effective than the autologous approach, if safety issues, such as rejection of the donor cells by the patients’ immune system (Graft vs Host Disease) can be overcome.

CTX-110, which targets B-cell malignancies, is progressing towards a late-stage development program, with management having met with the FDA to discuss Chemistry, Manufacturing and Controls (“CMC”) – a critical element of any approval submission – and 15 patients now dosed in consolidation cohorts.

Although management refers to “durable, complete remissions” with CTX-110, it appears to have conceded that the lymphoma market is crowded with autologous therapies – Gilead Sciences Yescarta, Novartis’ (NVS) Kymriah, and BMY’s Breyanzi, which have delivered superior results in larger patient populations that it has been able to do. There may be a market in the ~30% of patients who cannot be infused with autologous CAR-T, and there will be more data to evaluate, but CTX-110 is not likely to be the cell therapy “home run” management may have hoped for.

Unfortunately, CTX-120 – indicated for B-cell maturation antigen (“BCMA”) directed CAR-T does not seem to be much of an improvement on CTX-110, with management commenting that dose dependent responses have been observed, but also that it is “aiming to improve efficacy given competitive context”, and expects to “pivot to next-generation allogeneic CAR-T program for multiple myeloma”, although MM is also a market that is saturated with approved autologous therapies.

CTX-130, CRISPR Therapeutics’ final hope of making a dent in the cell therapy market, targets CD70, which has a high expression in multiple blood cancers, and interestingly, some expression in solid tumors too – a market that has so far proved resistant to cell therapy.

T-cell lymphoma is the initial target – a 5-7k patient population, management believes – and initial studies have delivered some encouraging results, with a 70% Objective Response Rate (“ORR”) and 30% Complete Response rate observed, the best results being at the higher dose levels, albeit in a patient population of just 10.

The results suggest CTX-130 has a shot at standard-of-care status in rare blood cancers, competing against the likes of Kyowa Kirin’s Poteligeo, which has been pegged for peak sales of ~$300m per annum, and Seagen’s (SGEN) Adcetris, which generated $706m of sales in FY21. Management even suggested in the Innovation Day presentation that an accelerated approval may be achievable, and to my mind this seems to be CRISPR Therapeutics’ best shot of making its mark in cell therapy currently.

In the solid tumor cancer renal cell carcinoma (“RCC”), where CD70 has ~80% expression, CTX-130 appears to be struggling in this disease indication, with a single patient registering an OR, out of 14, although that patient’s response has been maintained to month 18, a good enough result to justify further solid tumor trials, perhaps.

What the above tells us is that CRISPR Therapeutics’ has been entirely unable to wave its magic CRISPR wand at the cell therapy sector and match the results of the autologous vanguard, but I wouldn’t necessarily say that no progress has been made, and there are already next generation therapies in development, leveraging proteins Regnase-1 and TGFBR2, for example, to try to remove the “brake” on t cell anti tumor activity. CTX-131, for example, is apparently already proving more effective in RCC than CTX-130.

CRISPR is also looking at base editing, another approach lifted from a rival biotech. When we look at the history of CRISPR patent disputes, it seems to be the case that the technology is only patentable when it is being applied to something specific, and not from the outset, and personally it would surprise me if every gene editing company is looking closely at that technology.

Regenerative Medicine

Diabetes is a huge market – Eli Lilly’s Trulicity is forecast to achieve >$7bn in sales by 2023, although CRISPR Therapeutic’s gene-edited cell replacement candidate VCTX210 is only indicated for Type 1 diabetes. That drug is now enrolling for an in-human clinical trial, whilst VCTX211 is at the IND enabling stage, and being developed in partnership with Viacyte, and a third candidate – VCTX212, also part of the partnership, is indicated for types 1 and 2. VCTX-212 is a “deviceless” approach that will be administered by portal vein injection.

CRISPR Therapeutics’ is touting a “potentially functional cure” for T1D, and focusing on making cadaveric islet transportation – a technique that is proven to work – more scalable, and without a requirement for long-term immunosuppression. VCTX211, for example, has 2 gene knockouts and 4 insertions, designed to reduce immune rejection, induce graft acceptance, and enhance B-cell proliferation.

The drug has also shown that it can induce stimuli responsive insulin production, and reverse hyperglycemia in a rat model. There is clearly a long way to go here and some competition also – the likes of Moderna (MRNA) is looking at diabetes with its messenger-RNA technology, and powerhouses such as Eli Lilly (LLY), Novo Nordisk (NVO) will not be ceding much ground either in the marketplace or the clinic.

CRISPR Therapeutics does face a huge challenge here, but I at least find the work that has been done to date encouraging – I am not aware of any companies with a better or more developed approach (and I would include Moderna (MRNA) in that), and I will be looking forward to the first clinical data from VCTX210 and hoping for something seismic.

In Vivo

In vivo, as I have mentioned above, is really where any CRISPR company wants to be, and as discussed, Intellia has made the strongest progress to date, but CRISPR Therapeutic’s in vivo pipeline may actually be better than many people think.

Like most gene therapy / MRNA / RANi companies CRISPR is focusing first on liver disease – the organ that is easiest to access, and once again, CRISPR is borrowing technology from rivals, with MRNA and LNP leveraging technology achieving dose-dependent editing of up to 70% in non-human primates. There are 10 programs in development advancing to the Proof-of-concept (“PoC”) stage, with cardiovascular and ocular targets as well as liver.

CTX-310 has reached the IND-enabling stage with preclinical data showing it has achieved 50% reduction in serum triglycerides 1 month after treatment.

Although preclinical data can be jargon heavy and overly reliant on biomarker data and relatively untested theses, with the in vivo pipeline I detect a harmonized approach, and an underlying science that positions CRISPR Therapeutics alongside the likes of Moderna, big-Pharma Pfizer (PFE), and a handful of smaller biotechs such as Arrowhead (ARWR) in RNAi – as a bona fide leader its field – at least in my view.

Within in vivo, there are also partnerships with Bayer in LNP (ocular and hemophilia) and with Capsida, leveraging an AAV delivery technology, and looking at 2 rare diseases, Friedreich’s Ataxia, and Amyotrophic Lateral Sclerosis (“ALS”).

Conclusion – CRISPR Therapeutics Is In A Healthy Place With A Major Near Term Catalysts Upcoming – But Patience Remains Key

It is quite common to hear people describe CRISPR gene editing as junk technology, or for CRISPR Therapeutics’ pipeline to be derided for a lack of progress, borrowing of science developed by rivals, or being simply overvalued.

I can think of no better example of this than bluebird bio’s emergence as a genuine contender for a first gene therapy approval in Sickle Cell Disease, on an infinitely smaller budget and with a far lower valuation, but that would also ignore the fact bluebird has been around for more than a decade, and has burned through >$3bn of investors cash.

CRISPR Therapeutics cash burn is also high – the company made a net loss of $349m in 2020, although it actually made a net profit of $373.5m in 2021, thanks to the Vertex money.

With CRISPR Therapeutics you are looking at a brains trust that is also run in a business-like manner, in my view – the CEO, Dr. Samarth Kulkarni began his career as a consultant at McKinsey, whilst new Chief Medical Officer Dr. Phuong Khanh Morrow served as Vice President and Global Therapeutic Area Head of Hematology, GI Oncology, GU Oncology, and Bone at Amgen (AMGN).

Well funded, CRISPR can attract top people from both the science and business worlds which is important as it ensures the company is not operating in a vacuum, but with a clear direction and desire to be commercially successful.

That would mean nothing if the pipeline really was junk, but despite some disappointments emerging from the Innovation day presentation – the cell therapy division was a low-light – there are some exciting bright spots also, in my view, that could come strongly to the fore in the coming years. I can’t think of any companies noticeably further ahead in fields like diabetes, cardiovascular, or allogeneic, for example.

In the shorter term, the SCD approval – although it has been telegraphed from several years out – is a genuine breakthrough moment for the entire CRISPR industry – proving that functional cures can be developed for diseases.

It’s hard to overstate the importance of that, and so long as opportunities like that are in play I think CRISPR Therapeutics will always have a shot at a double-digit billion dollar valuation – more than double its current valuation – because that is as powerful as medicine can get, and there is persuasive evidence it can be applied to other fields over time.

With the near-term catalyst in play and a first commercialization likely in 2023, CRISPR Therapeutics’ will become a customer facing company for the first time, with a powerful partner in Vertex. I do think it would be a dream scenario for these 2 companies to merge, and rewarding for shareholders, but I think shareholders may have to be patient and keep the faith.

Yesterday’s drop in the share price therefore represents an interesting “BUY” opportunity for me. CRISPR Therapeutics showed us everything it had on Tuesday, and personally, I continue to find their story quite compelling, as I have tried to discuss above.

Be the first to comment