jetcityimage

A few weeks back, we discussed the operational weaknesses at Bed Bath & Beyond (BBBY) and identified which REITs might have exposure to BBBY’s announcement that they would soon close up to 150 stores. Last week BBBY investor relations posted a list of the first 56 locations to be closed and public REITs were among the property owners. Prior to the pandemic, it seemed a month did not go by without a major national retailer announcing a bankruptcy or restructuring. Identifying the risk of exposure to tenant weakness was just a routine part of the retail real estate due diligence process.

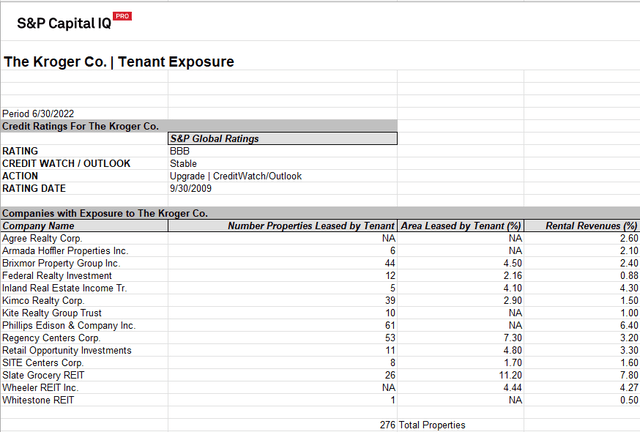

When the Kroger Co. (KR) reported strong Q2 22 results and raised guidance in their September 9 earnings release, I thought the same exercise might help us get some exposure to strength. Grocers drive weekly foot traffic and make the address more valuable to every other tenant in the shopping center. This is what we found.

Kroger Company Landlords

Your neighborhood grocer might not carry the Kroger name, but with all these logos, they are likely nearby.

Our scan of retail REIT property owners reveals that Kroger has relationships across the sector.

The above table carries names that are familiar to REIT investors. Agree Realty (ADC), Brixmor Property Group (BRX), Federal Realty (FRT), Kimco Realty (KIM), Phillips Edison & Company (PECO), and Regency Centers (REG) all have meaningful exposure to the Kroger Company. Lesser-known Slate Grocery REIT (OTC:SRRTF, SGR.U), however, has the most relative exposure with KR leasing 11.20% of SRRTF’s rentable square feet.

Oh, Canada

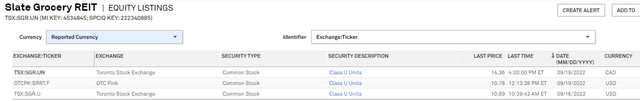

Slate Grocery REIT is an externally managed, Toronto based REIT that owns 110 US grocery anchored shopping centers. It enjoys a compromised existence of two Toronto exchange listed equities and one US OTC foreign ordinary; SGR.UN is traded on the Toronto stock exchange in Canadian dollars, SGR.U is traded on the Toronto exchange in US dollars, SRRTF is the foreign ordinary traded on the OTC in US dollars and this foreign ordinary structure is how we have owned it, traded it, valued it, and receive dividends.

This cross-currency pricing structure is further confused by the reporting agencies, but Slate Grocery simplifies it by reporting its operations in US dollars and paying its monthly dividend in US dollars. Our observations will be referenced only in US$.

The Proposition

While we had traded Slate Grocery, we didn’t become really interested until late 2020 when they were identified in a broken property transaction with Armada Hoffer (AHH), a REIT with which we have long been intimate. AHH had negotiated the sale of a small portfolio of grocery anchored shopping centers to SRRTF and then COVID hit. In the newly uncertain environment, SRRTF backed out of the trade; needing to create liquidity, AHH agreed to the sale at a 20%+ discount. AHH gained the desired liquidity; SRRTF made a bargain acquisition. We were intrigued.

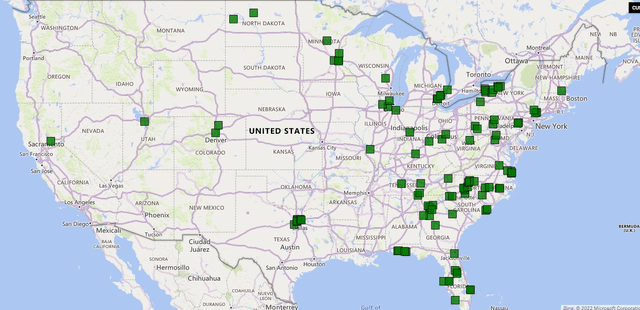

Since that time, SRRTF has coordinated a number of other seemingly advantaged acquisitions. Their assembled portfolio is a geographic mis-mash but may be evolving to status as an attractive asset to cash flush acquirers of grocery anchored retail.

The portfolio is unspectacular, but the metrics have wiggle room to realize value in a whole company sale.

If you consider peer valuations like KIM at 13.3x FFO, PECO at 14.4x FFO, and REG at 14.9x FFO, Slate Grocery trades at a material discount. SRRTF currently trades at 10.2X 2022 consensus FFO/Share, so a buyout at 13x would be a win-win for both buyer and seller in today’s fragile market. The heavy Kroger Company imprimatur helps as well.

If an acquirer is targeting grocery anchored retail, SRRTF is a bargain portfolio. Consider STOR’s latest news in the net lease market.

Pluses and Minuses

Not only does SRRTF trade at a 10% discount to consensus NAV, but its $0.864 (annualized) monthly dividend translates to an 8.01% dividend yield as measured against its $10.78 share price (nearly twice the peer set’s average yield). Detracting from that fat yield, most custodians consider SRRTF a Canadian entity and will subject your dividend to foreign tax withholding.

Like other small cap, US assets-but Canada based foreign ordinaries, SRRTF suffers in a lack of trading volume. If you need liquidity, this issue is not for you.

At today’s pricing, Slate Grocery is a high dividend yield available at a discount to NAV. I own a little in hope that it will become a premium price acquisition.

Be the first to comment