RapidEye/iStock via Getty Images

Investment Thesis

FuelCell Energy, Inc. (NASDAQ:FCEL) execution has not improved since our previous observation in 2021. The stagnant revenue growth, lack of net income and FCF profitability, share dilution, lacking management execution, and multiple project delays have highlighted how the stock remains not a buy for now and in the foreseeable future.

Those still holding on to the stock should also sell all of their holdings at the next dead cat bounce, given that it is likely to retrace further in the light of its underperformance. There is nothing much to see in its pipeline despite its aggressive revenue guidance of $1B by FY2030, thereby indicating little hope for stock recovery in the near and intermediate-term.

FCEL’s Execution Remains Questionable In FQ2’22

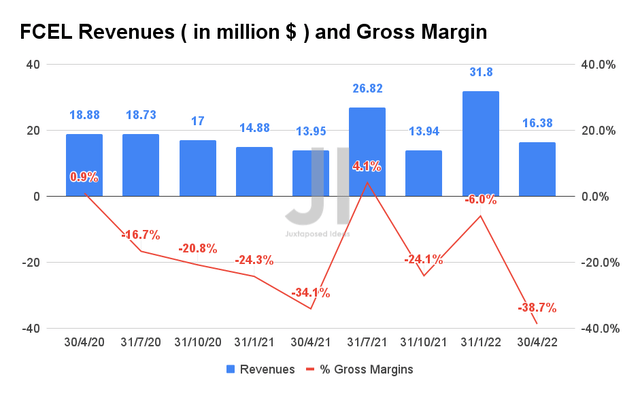

FCEL Revenue And Gross Income

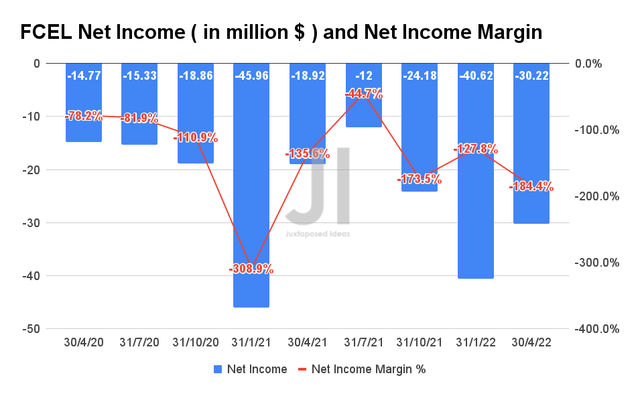

FCEL reported revenues of $16.38M in FQ2’22, with gross margins of -38.7%. Its non-profitability is also apparent in its net income of -$30.22M, with net income margins of -184.4% for the quarter. Therefore, it is apparent that its margins have been declining while its revenues have also remained stagnant in the past few years. Though the incoming POSCO Energy orders may represent a positive note in the short term, it is also a risk given how FCEL depends on a single large customer for its future product sales.

FCEL Net Income And Net Income Margin

In addition, it is important to note FCEL’s delayed timelines for multiple key projects, such as:

- The U.S. Navy Submarine Base in Groton, Connecticut – 9 months delay for the commissioning progress.

- Toyota at the Port of Long Beach – potentially 6 months delay to early 2023.

- The joint development agreement with ExxonMobil Technology and Engineering Company – 7 months delay in achieving its first critical milestone in FQ2’22.

Furthermore, we are not convinced of its potential in the burgeoning fuel cell markets in South Korea and Japan, given how these governments have been developing their own technologies internally and partnerships with other operators. Therefore, we do not expect FCEL to deliver robust revenue growth in the near and intermediate-term.

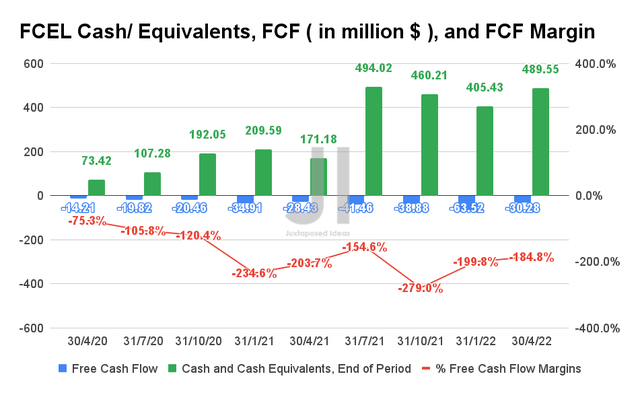

FCEL Cash/ Equivalents, FCF, And FCF Margins

In FQ2’22, FCEL also reported Free Cash Flows (FCF) of -$30.28M and FCF margins of -184.8%, representing minimal improvement YoY. Nonetheless, it is also evident that the company has robust cash, cash equivalents and accounts receivable of $489.55M on its balance sheet due to the continuous share dilution, thereby will be able to sustain its future operations for the next few quarters.

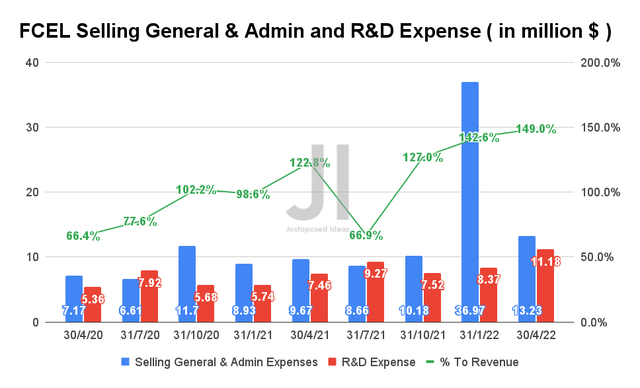

On the other hand, FCEL has been increasing its selling, general, and admin/ R&D expenses steadily over time, with a total of $24.41M in FQ2’22. The company’s operating expenses had also grown over time against its stagnant revenue growth in the past five years. By FQ2’22, FCEL’s operating expenses had accounted for 149% of its revenue, drastically increasing by 6.4 percentage points QoQ and 26.2 percentage points YoY. Assuming similar expenses moving forward, the company is expected to report up to $155M in operating expenses for FY2022, on top of a $50M capital expenditure. Given its apparent net income and FCF non-profitability, it is evident that FCEL would need to look elsewhere to fund its high operational costs moving forward.

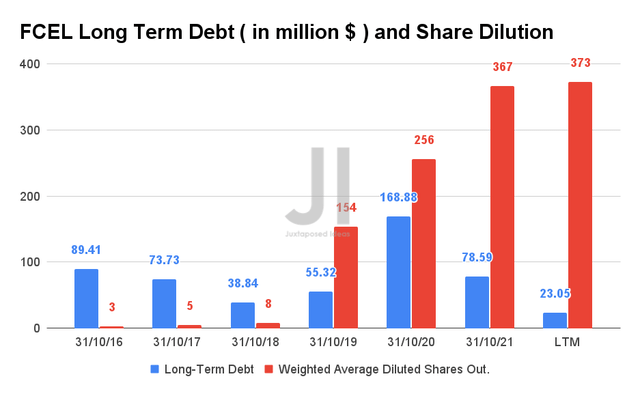

As evident from the chart, FCEL has been relying on a mix of debt, share dilution, and share-based compensation (SBC) to fund its historical operations. In June 2021, FCEL proceeded with a $500M stock offering to raise capital. As a result of the massive dilution in the past three years, long-term investors would have been diluted by 4662% over time, with a total share count of 373M in FQ2’22 as compared to 8M in FY2018.

In addition, FCEL spent a total of $4.29M in SBC expenses in FY2021, with $3.16M already accrued in H1’22. Given FCEL’s increasing R&D and Capital expenses for FY2022, there is no doubt that the company would rely on more debt and dilution in the short term, despite its $1.3B worth of backlog by FQ2’22 and 34.9 megawatts of projects in progress.

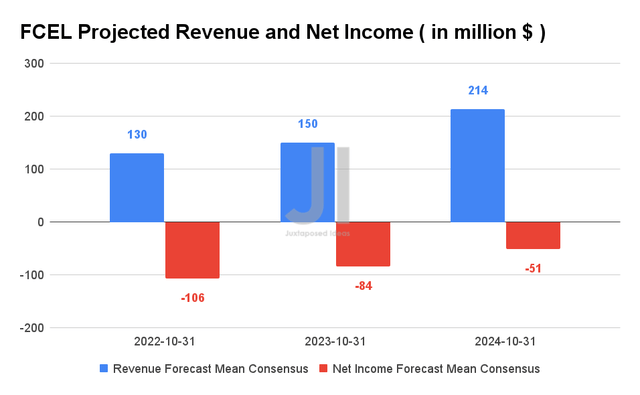

Over the next three years, FCEL is expected to report revenue growth at a CAGR of 45.42% while potentially reporting net income profitability from FY2025 onwards. Consensus estimates also expect the company to report revenues of $130M and net income of -$106M in FY2022, representing YoY growth of 86.8% and in line, respectively. However, given its lackluster historical execution and multiple project delays, we are uncertain if FCEL is able to achieve its rather ambitious revenue growth to over $300M by FY2025 and $1B by FY2030 in its FQ2’22 earnings call. Only time will tell.

So, Is FCEL Stock A Buy, Sell, or Hold?

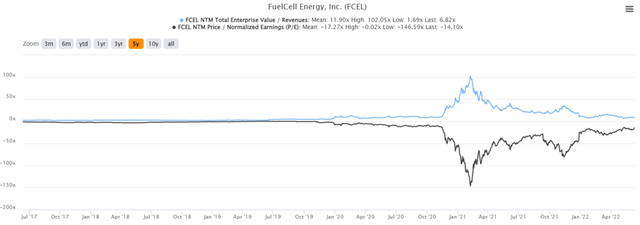

FCEL is currently trading at an EV/NTM Revenue of 6.82x and NTM P/E of -14.10x, lower than its 5Y mean of 11.90x and -17.27x, respectively. The stock is also trading at $3.30 on 13 June 2022, down 71.6% from its 52 weeks high of $11.63, nearing its 52 weeks low of $2.87.

FCEL 5Y Stock Price

It is also evident from the price chart above that the FCEL stock has been rather volatile in the past five years, with the recent price correction potentially leading to another bottom similar to that in late 2019s. Combined with the fact that the company will not be reporting net income and FCF profitability for at least the next three years, we do not expect to see the stock recover anytime soon.

In the meantime, anyone looking for sustainability stocks should look elsewhere, since FCEL’s execution does not look promising, despite its prospects in the carbon capture technology. Investors may otherwise consider Plug Power (PLUG) for its green hydrogen potential or Enphase (ENPH) for its stellar solar microinverters, since both companies continue to deliver comparatively better performances.

Therefore, we rate FCEL stock as a Sell for now.

Be the first to comment