William_Potter/iStock via Getty Images

Underlying Security Symbol: WMT, ADM, AEM, DVN

Although these market swoons are very painful, I have no choice but to continue to work the portfolio for income. I did put a little cash in a 3-year Treasury ladder. I had some DVN assigned last week and I have to put that money to work.

I looked at many call possibilities, and I am sharing them with you today. If the call buyers are right, these stocks should provide nice income now and in the future. However, it is important to realize most call options expire worthless. So, you have to be happy owning the underlying stock in case you are not called away.

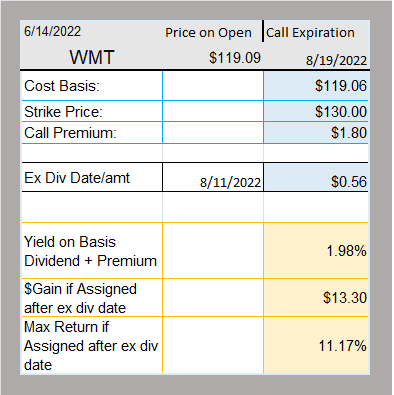

Retail: A beaten-down segment. Consider WMT.

WMT Option Strategy with 11.17% Return Potential (Author)

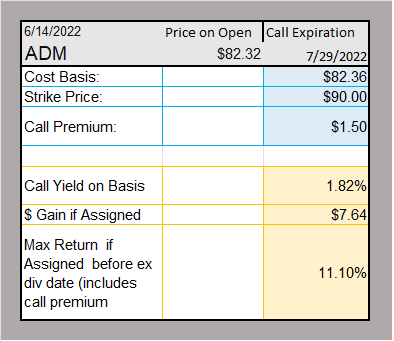

Food: ADM is a good consideration.

ADM Option Strategy with 11.10% Return Potential (Author)

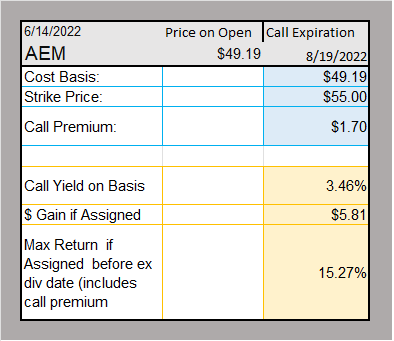

Metals: AEM; gold is a traditional hedge for inflation.

AEM Option Strategy with 15.27% Return Potential (Author)

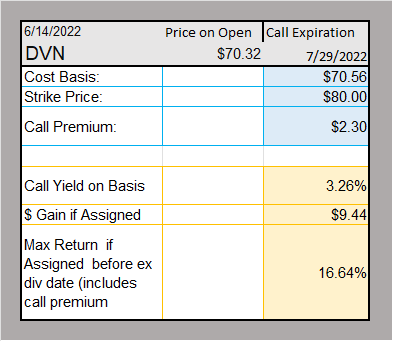

Energy: Still the favored sector. Consider DVN.

DVN Option Strategy with 16.64% Return Potential (Author)

Call premiums can be volatile, so check the prices you can get through your trading broker. I am constantly amazed at the resilience of the call options market. Very different from 2008. Are these call buyers too optimistic? Time will tell. These are some ideas to keep you occupied thinking of positives the market has to offer rather than watching your portfolio value go down.

– MM MoneyMadam

Data from Schwab.com and Marketxls

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment