Jitalia17

Investment Thesis

BHP Group Limited (NYSE:NYSE:BHP) has reported its best-ever year with record sales and profitability. However, with the worsening macroeconomics and erratic geopolitical scene, it is evident that the stock had also suffered in the past few months, triggered by volatile commodity pricing. Given the cyclical nature of these commodities, investors may want to shift their focus to BHP’s stellar dividend payouts instead. The stellar 11.9% dividend yields would likely continue through FY2023, given its improved profitability then.

Assuming aggressive interest rate hikes by the Feds, we could see a short-term plunge for these commodities, before speculatively recovering by mid-2023. By then, the world and stock market would likely report an excellent bull run as witnessed between 2009 and 2020. Only time will tell.

BHP Continues To Impress With Improved Profit Margins

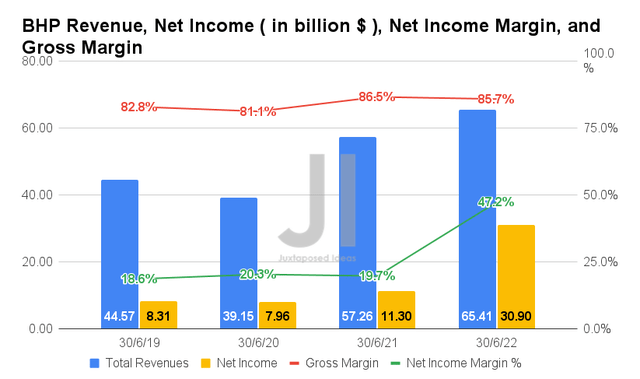

In FY2022, BHP reported revenues of $65.41B and gross margins of 85.7%, representing an increase of 14.2% and a minimal decline of 0.8 percentage points YoY, respectively. In the meantime, the company reported a massive jump in its profitability, with net incomes of $30.9B and net income margins of 47.2% in the latest fiscal year, before adjusting for the $7.1B gain from the Woodside Energy merger. It represents a tremendous increase of 273.4% and 27.5 percentage points YoY, respectively.

BHP Revenues By Segment

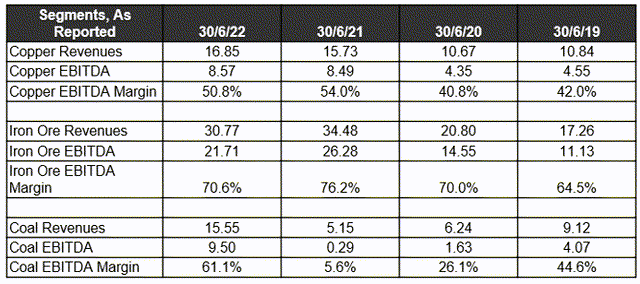

Despite the recently elevated demand and prices of Copper and Coal, it is evident that Iron Ores remain BHP’s main revenue and profitability drivers. It accounts for 47% of the company’s sales and 57.6% of its EBITDA in FY2022. It is no wonder then, that the stock has been massively impacted by the current housing bubble in China, since the country accounts for 55.9% of its revenue. We may see further headwinds in H2’22, since we do not expect to see many catalysts for the turnabout in the property market there, combined with the continuous Zero COVID Policy. President Xi’s upcoming re-election in November may be a potential catalyst for economic recovery by H1’23.

In the meantime, the Copper and Coal segments have done relatively well, with elevated EBITDA margins of 50.8% and 61.1% in FY2022, respectively, compared to pre-pandemic levels. Given the multiple pull factors for domestic and overseas EV/solar adoptions, we expect to see continually elevated copper demand and, consequently, prices ahead, combined with the global push for renewable energy post the Russian-Ukraine crisis.

The coal segment will likely continue to do well for the upcoming winter, given the recent Nord Stream 1 shutdown. We shall see, given the erratic and complicated geopolitical issues and worsening macroeconomics scene thus far.

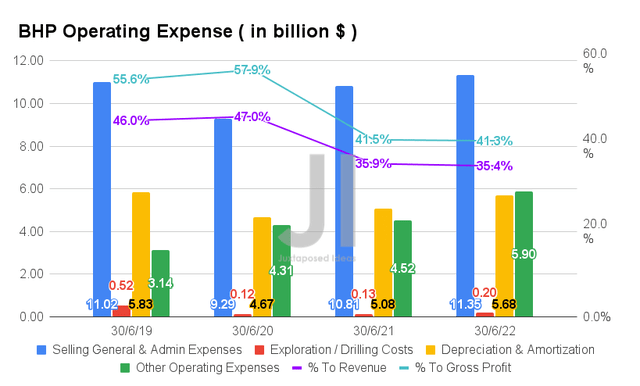

BHP has also shown excellent cost management thus far, with total operating expenses of $23.13B in FY2022. Though it represented a notable increase of 12.6% YoY, we must also note that the ratio of these costs to its growing sales has moderated significantly by now.

By the latest fiscal year, BHP reported expenses representing 35.4% of its revenues and 41.3% of its gross profits, representing a noteworthy decline of 0.5 and 0.2 percentage points YoY, respectively, despite the rising inflation and supply chain constraints thus far. Otherwise, a massive improvement of 10.6 and 14.3 percentage points YoY, respectively, from FY2019 levels. Thereby, triggering much improvements in BHP’s profitability indeed.

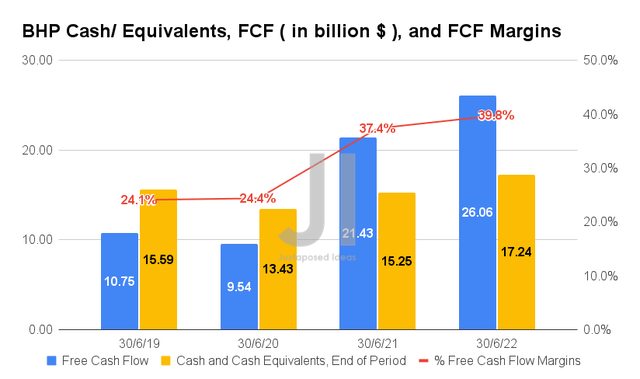

Therefore, we are not surprised by BHP’s robust Free Cash Flow (FCF) generation thus far, with an FCF of $26.06B and an FCF margin of 39.8% in FY2022. It represented an increase of 21.6% and 2.4 percentage points YoY, respectively. Despite the $0.14B of share repurchase and $17.85B of dividends paid in FY2022, the company still reported a massive war chest of $17.24B in cash and equivalents on its balance sheet by the end of FY2022. Thereby, indicating its massive liquidity for certain M&A deals moving forward.

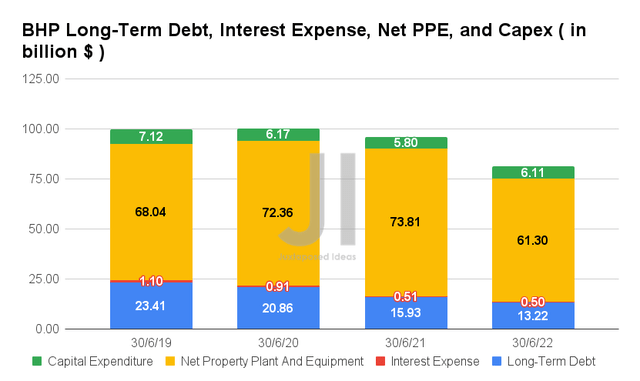

BHP has also been diligently deleveraging over the past three years, from $23.41B in FY2019 to $13.22B in FY2022, representing a massive decline of 43.5%. Thereby, contributing to its continuous decline in interest expenses to $0.5B by the latest fiscal year. With only $3.74B maturing over the next two years, the company remains well poised for massive expansion and growth ahead, significantly helped by the strong commodity prices for now.

In the meantime, BHP continues to invest in its capabilities, with capital expenditures of $6.11B and net PPE assets of $61.3B. The company also expects to increase its iron ores production capacity, from 282.8M tons in FY2022 to 290M metric tons in FY2023, thereby, highlighting higher Capex costs ahead. However, investors should not be worried since these investments would eventually be top and bottom lines accretive. Thereby, boosting its stock performance ahead.

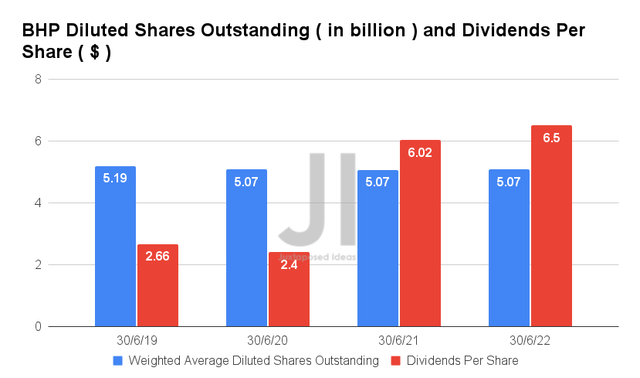

In the meantime, BHP also returned much value to its long-term investors, with a continuous dividend hike to $6.5 in payouts and 11.9% in yield in FY2022. It represents a massive increase of 7.9% and 7.58 percentage points YoY, respectively. Combined with the stellar earnings, it is no wonder that the stock had rallied by 9.4% since its recent earnings call. However, all of those gains have also been digested by now, due to Powell’s hawkish commentary further contributing to the pessimistic market condition.

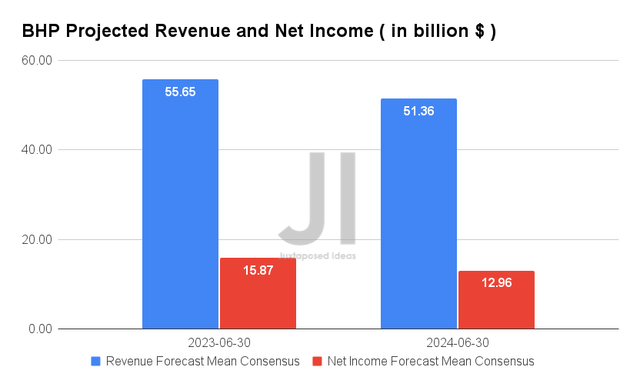

Over the next two years, BHP is expected to report an adj. revenue and adj. net income growth at a CAGR of 3.01% and 9.32%, respectively, between FY2019 and FY2024. Naturally, this is slower than pre-pandemic revenue growth CAGR of 11.31% and pandemic levels of 13.70%. However, investors must take note of the impressive projected growth of its net income margins from 18.6% in FY2019, 47.2% in FY2022, and finally settling at 25.2% in FY2024.

For FY2023, BHP is expected to report revenues of $55.65B and net incomes of $15.87B, representing a massive moderation of 14.9% and 48.6% YoY, given the potentially cooling market and lower commodity prices then. We shall see.

So, Is BHP Stock A Buy, Sell, or Hold?

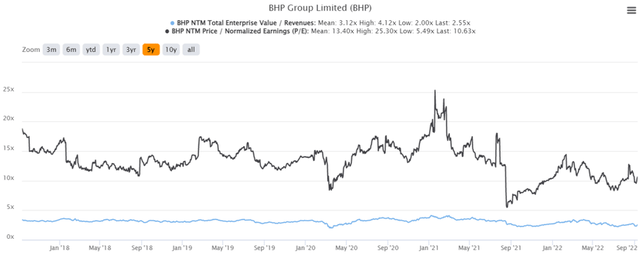

BHP 5Y EV/Revenue and P/E Valuations

BHP is currently trading at an EV/NTM Revenue of 2.55x and NTM P/E of 10.63x, lower than its 5Y mean of 3.12x and 13.40x, respectively. The stock is also trading at $54.54, down -31.5% from its 52 weeks high of $79.66, though at a premium of 15.1% from its 52 weeks low of $47.35.

BHP 5Y Stock Price

Consensus estimates remain bullish about BHP’s prospects, given their price target of $77 and a 41.18% upside from current prices. We expect the company to continue its robust dividend yields for the next two bi-annuals, before moderating by FY2024. Long-term investors should also reinvest their dividends since BHP will remain highly relevant through the next decade, given the insatiable demand for these commodities.

New investors may potentially wait for another pullback before adding in the mid-$40s. However, we reckon investors with a higher risk tolerance may nibble at current levels for short-term dividend yields of over 10%. Why not?

Be the first to comment