z1b

It’s always nice to see a high-quality dividend payer get cheaper on no material news, especially when the rest of the market is getting more expensive. Such I find the case to be with Amgen (NASDAQ:NASDAQ:AMGN), which made the list of top market movers on September 12th, dropping by 4% on a day in which the Dow Industrial Index rose by 229 points.

As savvy investors know, it’s far better to buy above average dividend growth stocks when they are down versus the other way around. This article highlights why AMGN is worth looking into at the current price, so let’s get started.

Why AMGN?

Amgen is one of the largest global biotech companies, after having been one of the pioneers in this space since 1980. It’s also a member of the prestigious Dow 30 companies, with expertise in inflammatory diseases, oncology, and biosimilars. Over the trailing 12 months, AMGN generated $26.4 billion in total revenue.

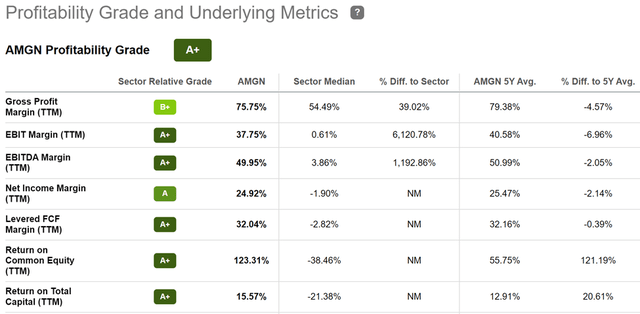

Amgen benefits from its large, diversified product portfolio, with 9 drugs that each generates over $1 billion in sales on an annualized basis. These drugs are not only large sellers, but also have wide margins due to the high barriers to entry in the biotech space. This gives Amgen significant pricing power on its existing products while still growing its top line at a solid pace. As shown below, AMGN scores an A+ grade for profitability, with sector leading EBITDA and Net Income margins of 50% and 25%, respectively.

AMGN Profitability (Seeking Alpha)

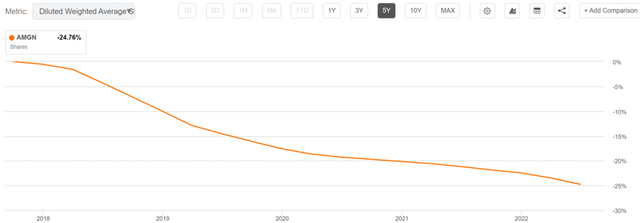

Moreover, as shown above, AMGN generates a very high 123% return on equity. That’s because unlike some companies that repurchase only enough shares to offset executive equity compensation, Amgen has been a net buyer of its stock. As shown below, AMGN has aggressively returned capital to its shareholders over the past 5 years alone, reducing its share count by nearly 25% over this timeframe.

AMGN Shares Outstanding (Seeking Alpha)

Meanwhile, Amgen continues to churn out respectable growth amidst a challenging economic backdrop, with product sales growing by 3% YoY in the second quarter (5% growth excluding foreign currency impacts). This was driven by strong 10% volume growth, with double-digit growth in Amgen’s key drugs Repatha, Prolia, LUMAKRAS, and EVENITY. Importantly, management recently reaffirmed full year adjusted EPS guidance of $17.50 at the midpoint.

Looking forward, Amgen should get a meaningful bump to its top-line growth with its pending $4 billion acquisition of ChemoCentryx, which will add the newly approved vasculitis drug Tavneos. This drug is expected to fit well with Amgen’s current immunology business. Furthermore, LUMAKRAS is proving to be a solid answer to Merck’s (MRK) Keytruda drug, and has been approved in 40 countries now with launch in 25 of them. It’s also worth mentioning that AMGN is tracking well on its biosimilar program, as noted by management during last week’s Wells Fargo (WFC) Health Conference:

And then next on the mountain in the biosimilar franchise, which, as we said, we look at the 11 biosimilars that we’re going to have by the end of the decade is one super blockbuster. And we think the characteristics of the combination of the financial results of those look like a super blockbuster; it’s a great allocation of capital.

We have AMJEVITA coming January 31, 2023. We’re fully prepared as a company and preparing for that launch. It’s critically important, we’re excited about it. Biosimilars was $2.2 billion in 2021; we said that would more than double by 2030. We did say that there’s a little bit of a slowdown or a little bit of a drop in biosimilars in 2022 before we get to the AMJEVITA inflection.

Meanwhile, AMGN sports a strong A- credit rating, and has a strong dividend growth track record of 10 consecutive years. It currently yields a respectable 3.3% that’s covered by a 41% payout ratio, and has a 5-year dividend CAGR of 11.2%.

I see the recent 4% drop in price to $237.62 as presenting a reasonably attractive entry point, as it equates to a forward PE of 13.6, sitting below its normal PE of 14.1 over the past 10 years. Analysts estimate 8% to 9% annual EPS growth over the next 2 years and have an average price target of $250. Morningstar has a $260 fair value estimate. This translates to a potential one-year total return in the 9% to 13% range.

Investor Takeaway

Amgen possesses several key characteristics that I look for when seeking out attractive investments, including a solid growth outlook, wide margins, strong profitability, shareholder friendly management team, and a reasonable valuation. For these reasons, I believe the recent price drop makes AMGN a conservative and attractive long-term investment at current levels.

Be the first to comment