Design Cells

Oil may run out, liquidity may dry up, but as long as ink flows freely, the next chapter of Life will continue to be written.”― Alex Morritt

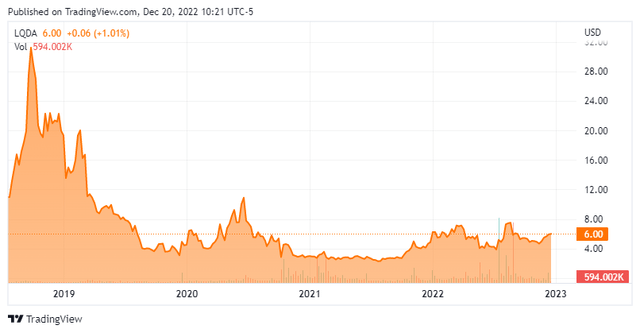

Today, we take a look at Liquidia Corporation (NASDAQ:LQDA). As you can see from the chart below, the stock of this small biopharma concern has been a roller coaster ride for shareholders, thanks mostly to litigation challenges. Which way will the equity head next in trading? An analysis follows below.

Company Overview:

Liquidia Corporation is a small biopharmaceutical company based just outside of Raleigh, NC. It distributes a generic treprostinil injection in the United States. It is partnered with Sandoz with this effort. In addition, its drug candidate YUTREPIA, which is an inhaled dry powder formulation of treprostinil for the treatment of pulmonary arterial hypertension, won a tentative approval from the FDA in November of 2021.

Company Presentation

Pulmonary arterial hypertension or PAH is a rare, chronic, progressive disease caused by hardening and narrowing of the pulmonary arteries that can lead to right heart failure and eventually death, with an estimated prevalence in the United States of approximately 30,000 patients. The stock currently trades around six bucks a share and sports an approximate market cap of $375 million.

Liquidia has developed products using its proprietary PRINT® engineering technology. This allows the company to engineer and manufacture highly uniform drug particles with precise control over the size, three-dimensional geometric shape and chemical composition of the particles.

Company Presentation

Third Quarter Results:

On November 8th, the company posted its third quarter numbers. Liquidia had a GAAP loss of 14 cents a share on flat revenues of $3.2 million. It should be noted, unit volume of treprostinil injections increased significantly. However, Liquidia only received 50% of the proceeds this quarter compared to 80% in the same period a year ago as a result of achievement of predetermined cumulative sales thresholds within their promotion agreement with Sandoz.

Litigation Headwinds:

The launch of YUTREPIA has been held up by litigation around some key patents. The legal battle has been with United Therapeutics (UTHR) and its partner MannKind (MNKD) with its competing product Tyvaso DPI which was approved in the second quarter of this year. Many analysts such as from BAML believe YUTREPIA is ‘a more functional, and low-resistance delivery device‘ compared to Tyvaso. Ladenburg Thalmann believes YUTREPIA’s ‘portability, titratability, tolerability, and durability could distinguish it from Tyvaso‘.

The litigation saga around these patents has been ongoing for more than a year now. Every legal setback pummels the stock, every positive on the litigation front triggers a rally in the shares. A Seeking Alpha article in September gives a good synopsis on where thing currently stand in this legal battle. A chronical logical order of legal events was also provided by the company latest earnings press release.

Analyst Commentary & Balance Sheet:

Several insiders and beneficial owners have purchased shares since April totaling approximately $15 million. Some $11 million of this occurred during an approximate $50 million secondary offering in April. No insider sales have been registered so far in 2022. Approximately six percent of the outstanding float is currently held short.

The analyst community appears sanguine around the company’s prospects. Over the past four months, five analyst firms including BTIG and Needham have reissued Buy or Outperform ratings on the equity. Price targets proffered range from $14 to $20 a share. Wedbush seems the lone pessimist, maintaining a Sell rating and $3 price target on LQDA. They noted that YUTREPIA’s latest legal setback will push back the product launch until mid-2024 at the earliest.

The company ended the third quarter with just under $100 million worth of cash and marketable securities on its balance sheet after posting a net loss of $9.1 million for the quarter. Liquidia has long term debt of approximately $20 million.

Verdict:

The current analyst firm consensus is for Liquidia to lose approximately 75 cents a share in FY2022 as revenues rise some 10% to $14 million. Similar losses are expected in FY2023 with a wide range of sales estimates (roughly $9 million to $20 million).

YUTREPIA does seem to have great potential if it can get past its litigation challenges. Tyvaso did $129.5 million worth of revenues in the third quarter of this year, which was up 17% on a year over year basis. With several analysts believing YUTREPIA is superior in many ways to Tyvaso, the product could quickly gain market share when it is launched.

The question is if/when the stock starts to reflect that potential given the initial launch currently appears more than 18 months out barring some sort of legal reversal. The market is not rewarding patience at the moment. However, insiders are voicing confidence in the company’s potential by buying the stock and the company appears to have enough cash on hand to make it to the launch of YUTREPIA. Therefore, I am taking a small ‘watch item‘ holding of LQDA via covered call orders. Less patient investors probably should wait until we get closer to the launch of YUTREPIA and/or positives on the litigation front emerge.

Excess liquidity is the leading source of all bubbles.”― Naved Abdali

Be the first to comment