Sergei Chuyko

We All Make Mistakes

Back in March 2022, I wrote this about Meta Platforms (NASDAQ:META):

…the company looks damn strong. That’s even with the drag from Reality Labs. That’s all fine with me, given that a very large percentage of the $10 billion burn is going to hardware, offices, and people. It’s not simply evaporating. But, even if it does get completely wasted, FB can “heal” from the sin. Profits are drowning the business in cash. That’s good.

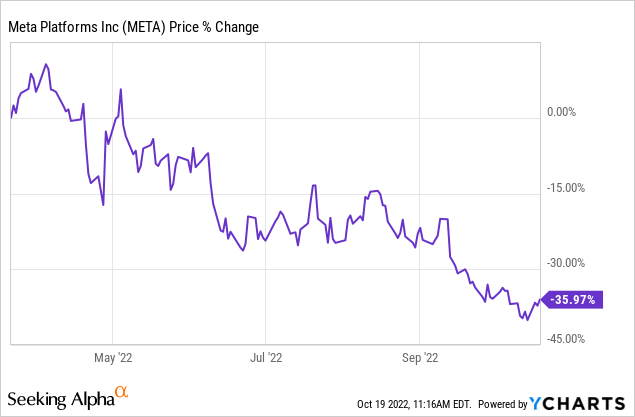

I was saying back then that $210 looked like a fair deal, even a very fair deal. However, here’s what’s happened to the price since publication:

That’s right. Down nearly 36%.

All that said, I haven’t changed my thinking about META for a bunch of reasons that I’ll share here today. I’ll say this many times: META is a Strong Buy.

Price In Perspective

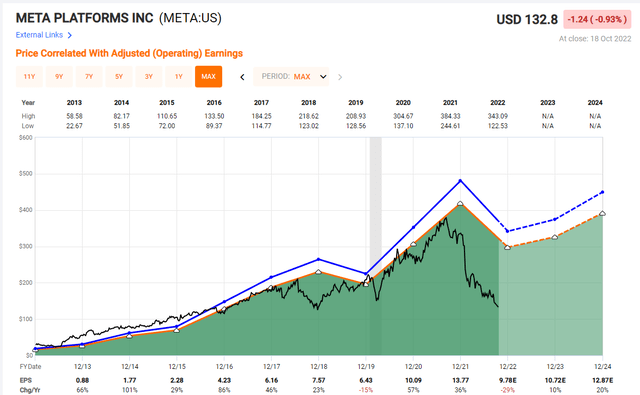

Compared to history, META is even more undervalued than before.

META is Undervalued (FASTgraphs)

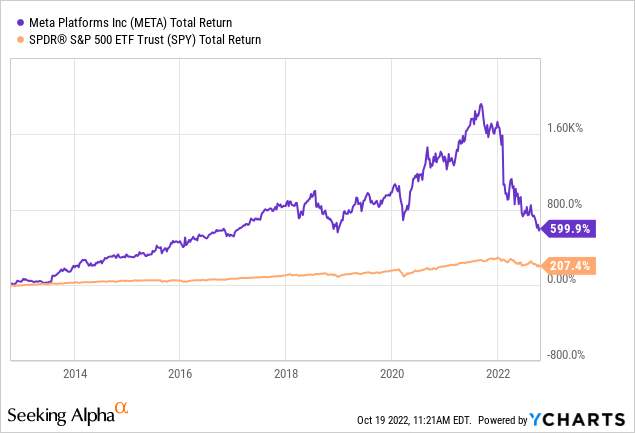

Furthermore, if we look at META versus the S&P 500 (SPY) over the last 10 years, there’s a clear winner.

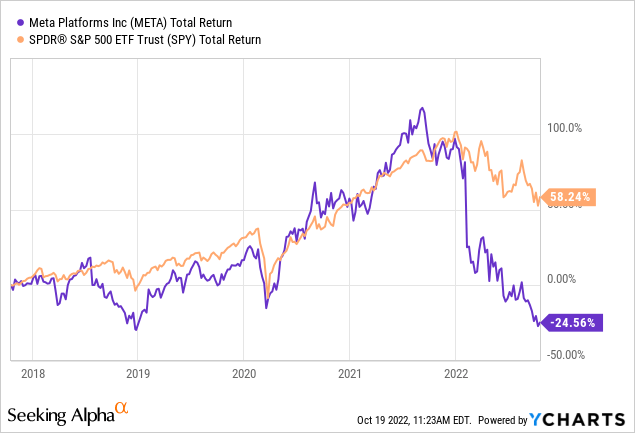

However, as a matter of balance, we do need to look here:

This shows how badly 2022 has destroyed META’s price. Furthermore, 2018 and 2019 weren’t great. Some of 2020 was fine, and the same is true for 2021. But, really, 2022 has been a disaster in terms of shareholder value.

Do We Believe Price or Value?

Well, if we look back at the previous year, we see a train wreck. If we look back 10 years, we still had wild success.

How did this happen? In the short run, META’s price tells us that the company is terrible, but that is very likely driven by external factors or trivial factors, which we’ll review here shortly. In the long run, META has been a winner. We’ll also look at those factors.

Here’s some recent bad news to chew on:

But, I’ve pointed out previously that there is always bad news with META. For example, here are three myths I previously busted:

- Myth #1: The Buybacks Destroyed $20B.

- Myth #2: Reality Labs Was a $10 Billion Waste.

- Myth #3: Peter Thiel Has Abandoned Meta.

Again, with a company like META, which is very high profile, there will always be negativity. It’s a lightning rod. I don’t see that changing.

Importantly, price tends to move in the short run in relation to the news cycle. But, in the longer run, value shines through. Here’s one quick view of underlying strength.

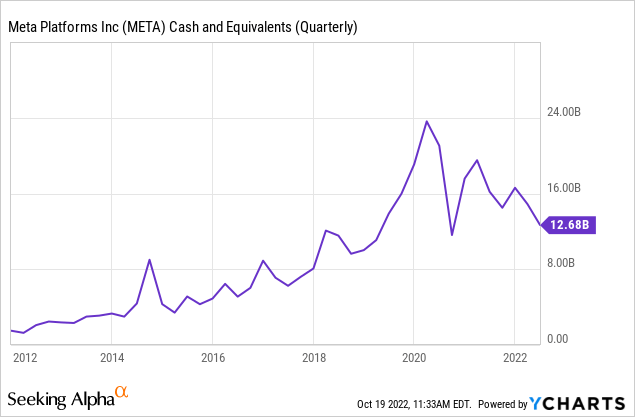

Actual cash continues to accumulate in the business. META accumulates and then invests. This will be crucial information. I’ll come back to this idea soon.

First, yes, let’s admit that billions and billions are wasted. But, billions more greatly improve the company over time, making up for various mistakes. Let’s explore this a bit more. It’s the central idea here today.

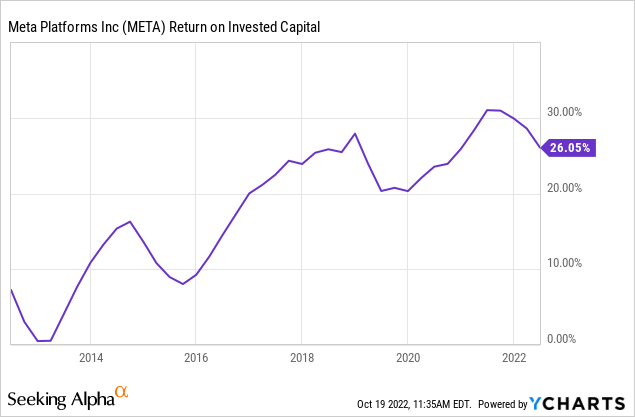

Return on Invested Capital (‘ROIC’)

If you’re not familiar with ROIC:

Return on invested capital (‘ROIC’) is a calculation used to assess a company’s efficiency in allocating capital to profitable investments. The ROIC formula involves dividing net operating profit after tax (‘NOPAT’) by invested capital. ROIC gives a sense of how well a company is using its capital to generate profits.

Further, as Lyn Alden states:

However, some companies are able to develop economic moats around their business that keep competitors at bay and allow the company to generate superior ROIC for decades, with a wide gap between their ROIC and WACC. These economic moats include prime real estate locations, network effects, high switching costs, patents, cost advantages, trusted brands, and oligopolies.

A blue chip stock in my opinion is better-judged by how wide its moat is, rather than based on size of the company. This is more of an art than a science, but the key quantitative indicator of a moat is a consistently high ROIC for long periods of time.

And, how does ROIC compare to META’s Weighted Average Cost of Capital? First, a definition:

Weighted average cost of capital (‘WACC’) represents a firm’s average after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of debt. WACC is the average rate that a company expects to pay to finance its assets.

META’s WACC is somewhere between 8% and 9% according to at least three sources:

Now, here’s the secret:

META’s ROIC is about twice as high as its WACC, which is outstanding.

Even with all the screw-ups, even with the “Metaverse” investments via Reality Labs, and even all the bad news, META is generating well over 20% ROIC versus just 8-9% WACC. This business is pumping cash then intelligently reinvesting, better and better over time.

It’s a bit shocking – even to me – but META is actually getting better at investing back into the business. It’s pretty hard to “fake” ROIC, or lie. This flies in the face of the bad news, including what we hear from the analysts.

Adding It All Up

I was wrong about buying META earlier this year based on META’s price. However, the actual business, and the profits tell us that META is doing exceptionally well. Right here, right now.

Therefore, META continues to be a Strong Buy. When a company continues to do well over a long period, investors accumulate wealth. It can look horrible and feel terrible to hold a stock when the price is falling. The trick is to hold, not sell, when the business is getting stronger.

Furthermore, as the price drops in this situation, that’s when accumulation should increase, not decrease. You get more for your money plus your cost basis gets lower and lower.

No matter what you decide to do, increasing your contributions after a severe market decline is likely to be more rewarding than buying during normal times.

Buying more when the market drops, or a stock drops, often feels bad. It can look like good money chasing bad money. But it is at these times where your money gets the most traction and generates the greatest wealth.

I say this in reference to META’s business over the longer term, and the fundamentals. The price isn’t accurately reflecting the underlying strength. It’s that simple. Again, I rate META as a Strong Buy.

Be the first to comment