Charday Penn

July 13th was a big day for investors in both Unity Software (NYSE:U) and ironSource (NYSE:IS). This is because of news breaking that the latter will be absorbed by the former in an all-stock transaction at what represents for the latter a significant premium over where the company was trading at previously. In and of itself, I see this development as a positive for investors in both firms. But the fact of the matter is that the market reacted in a very negative way, particularly for investors in Unity. Although it’s possible that some of this negativity it can be attributed to the uncertainty over this maneuver, the pain experienced by Unity was probably more driven by a downward revision and expectations by management and another dilutive development that stands to leave investors with less of the combined firm than they otherwise would have. Upon reviewing the financial performance of both firms, I will say that I am torn on the matter. I believe that the merger represents a positive for both companies. I am also particularly bullish about ironSource. On the other hand, this situation for Unity could definitely be better than it is. While the company is making a great decision in acquiring ironSource, its own fundamentals are rather lacking. Because of this, investors should tread carefully when deciding what course of action to take next.

Unity & ironSource – An interesting combination

According to the terms of their agreement, Unity will be absorbing ironSource in an all-stock transaction that, based on prior closing prices, valued ironSource at $4.4 billion. For each share of ironSource that an investor has, they will receive instead 0.1089 of a share in Unity. Based on their closing prices on July 12th, this would have implied a price per share for ironSource of $4.33. That translates to a 94.2% premium. However, the company did not see that kind of upside. Shares of the business skyrocketed to close at 47.1% on July 13th for a total price of $3.28. Meanwhile, shares of Unity plummeted by 17.5%, dropping from $39.76 to $32.82. Assuming prices don’t change from here, this does still imply a price per unit on ironSource of $3.57, resulting in potential additional upside for its investors of 8.8%.

Before we move further, we should probably discuss exactly why these companies are combining. To do that, it helps to understand what each business is and how it operates. For starters, Unity functions as a platform that helps its customers to create and operate interactive 2D and 3D content. The company has many use functions for its solutions. However, it’s mostly known for its usefulness in the creation of video games. These games can be operated across many platforms, including Windows, Mac, iOS, Android, PlayStation, Xbox, Nintendo Switch, and so many more. They can also involve augmented and virtual reality aspects. The company’s services are so popular that the business claims that content created or operated with its solutions had 3.9 billion monthly active end users at the end of its 2021 fiscal year. To put in context just how important its platform is, it’s worth noting that major games like Pokémon Go and Among Us were built using its technology.

The company operates two main sets of solutions. The first of these is called Create Solutions. Through this, the company helps content creators like developers and artists, as well as designers, engineers, and architects, to create high-definition real-time 2D and 3D content. In addition to being used for the creation of video games, it can also be used for advanced modeling and other applications. Meanwhile, the Operate Solutions portion of the business offers customers the ability to grow and engage their end-user base and to run and monetize their content for the purpose of optimizing end-user acquisition and operational costs. A few products under this umbrella would be its engine agnostic game server hosting and matchmaking platform, as well as Vivox, which serves as a leading provider of voice and text communication services for multiplayer games.

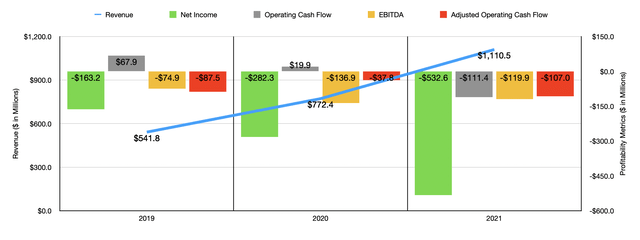

In recent years, the company had done a really solid job of growing its top line. From 2019 through 2021, revenue nearly doubled, jumping from $541.8 million to $1.11 billion. During that time, however, net income plummeted from negative $163.2 million to negative $532.6 million. Operating cash flow and adjusted operating cash flow have been all over the map. But for the most part, these have also been negative. And the same can also be said here of EBITDA.

Moving on to ironSource, it’s important to note that we are now talking about a very different kind of company. At the same time, there are certain overlaps. Whereas Unity is largely a gaming software business, ironSource serves as a business platform for the app economy. The company’s platform is focused on enabling any app or game developer to turn an app that they created into a scalable and successful business by aiding them in the monetization process and by giving them the tools they need to analyze vital data about their operation. Like Unity, ironSource’s platform focuses around two core solutions. The first of these, Sonic, supports developers and app-based businesses by providing solutions for our app discovery, user growth, content monetization, analytics, and publishing. The second solution is Aura. This particular portion of the enterprise allows telecommunications operators to create new engagement touchpoints that deliver attractive content for their users.

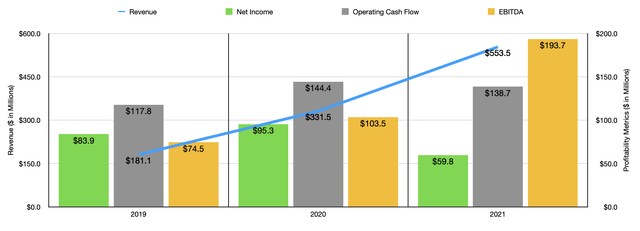

Operationally speaking, the picture for ironSource has been much more impressive. Over the past three years, revenue at the company skyrocketed from $181.1 million to $553.5 million. What’s even more impressive is the fact that, during this time, the company has generated consistent profits and cash flows. Net income over the past three years has ranged from a low of $59.8 million to a high of $95.3 million. Operating cash flow has ranged between $117.8 million and $144.4 million. And EBITDA Has risen consistently, climbing from $74.5 million to $193.7 million.

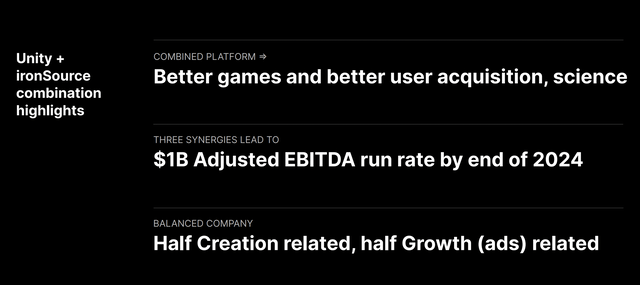

By combining the two companies, the hope is that clients are able to create better games that are capable of achieving greater user acquisition. While both firms touch on creation, gaming services, publishing, user acquisition, and monetization, ironSource focuses more heavily on the latter items, effectively complementing and building off of the creation tools championed by Unity. The hope is that this combination will create a one-stop shop for clients interested in the gaming and other digital markets. However, there is also a financial side to this. Over the first three years following the completion of the merger, management expects to generate annualized synergies of $300 million. That, combined with continued growth from the companies, should help adjusted EBITDA to climb to $1 billion per annum by the end of 2024.

Given the market’s reaction to the announcement of the merger, it might be tempting to think that the investors in Unity are really being hurt. However, I see the opposite occurring. Although smaller, ironSource does have a better history of growth and, unlike Unity, it is capable of generating consistent and improving profits and cash flows. And on top of that, the terms of the deal don’t look outrageous. At present, the management team at ironSource expects revenue for the current fiscal year to come in at between $750 million and $780 million. At the midpoint, that would translate to a year-over-year increase of 38.2%.

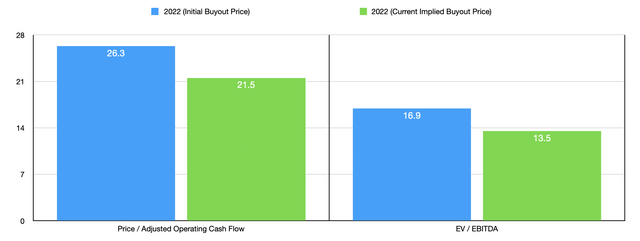

Meanwhile, EBITDA should come in at between $230 million and $240 million. That compares to the $193.7 million reported for 2021. No guidance was given when it came to operating cash flow. But if we assume that it will increase at the same rate that EBITDA should, then we should anticipate a reading this year of $168.3 million. Using these forward numbers, we get a price to operating cash flow multiple for the company of 26.3. Meanwhile, the EV to EBITDA multiple of the company is even lower at 16.9. That is due in part to the fact that the company is debt free and has cash on hand of $444.7 million. As a note, these are the numbers based on the original announced acquisition price of ironSource. If we use the company’s current price, these multiples would be 21.5 and 13.5, respectively. Free cash flow positive company that is growing that rapidly, this is a good price to pay. If anything, I’m surprised Unity isn’t paying more.

While I extol how attractive this deal is for investors in Unity, it is true that shares of the company plummeted after this announcement. But in my opinion, this has less to do with the merger and more to do with three other developments. For starters, as part of the announcement, Unity stated that it was revising down its expectations for the current fiscal year. Instead of revenue coming in at between $1.35 billion and $1.45 billion, the bar has been dropped to between $1.30 billion and $1.35 billion, with management citing tough industry conditions as a cause. Second, the company announced that after the transaction is completed, they would make effective a $2.5 billion share buyback program.

While this may make sense for a company that is currently undervalued, it doesn’t make sense for a firm that is likely to continue generating cash outflows. And finally, Unity also announced that it would be closing a $1 billion convertible debt issuance from Silver Lake and Sequoia, with the notes coming due in 2027 and carrying an annual interest rate of just 2%. While the payout on these notes is low, they are subject to conversion at $48.89. After already giving 26.5% of the combined company to investors in ironSource, this maneuver will dilute shareholders by another roughly 4.7%. Of course, if management can use that cheap capital to grow attractively, it may well be worth it. However, the company already has $1.70 billion in other convertible debt on top of that and it comes across as unwise to take on these types of debts while simultaneously considering significant share buybacks and dealing with consistent cash outflows on the side of Unity. Of course, this final consideration might be fixed as a result of the strong positive cash flows achieved by ironSource. But if that were the case, an argument could be made that investors in that enterprise should have ended up with more of the pie.

Takeaway

At this point in time, the picture for Unity and ironSource is very interesting. On its own, I am quite bullish regarding ironSource. If I had to rate Unity on its own, I would be more neutral. At the same time, their fates now seem intertwined. If management is correct in what the future holds, the strong financial position of ironSource will prove instrumental in making the combined company truly viable. This alone could be a good justification for investors to buy into the combined business. But if you are to do that, the best course of action would likely be to acquire stock in ironSource outright because of the additional merger arbitrage opportunity of 8.8%.

Be the first to comment