piranka

DISCLAIMER: This note is intended for US recipients only and, in particular, is not directed at, nor intended to be relied upon by any UK recipients. Any information or analysis in this note is not an offer to sell or the solicitation of an offer to buy any securities. Nothing in this note is intended to be investment advice and nor should it be relied upon to make investment decisions. Cestrian Capital Research, Inc., its employees, agents or affiliates, including the author of this note, or related persons, may have a position in any stocks, security, or financial instrument referenced in this note. Any opinions, analyses, or probabilities expressed in this note are those of the author as of the note’s date of publication and are subject to change without notice. Companies referenced in this note or their employees or affiliates may be customers of Cestrian Capital Research, Inc. Cestrian Capital Research, Inc. values both its independence and transparency and does not believe that this presents a material potential conflict of interest or impacts the content of its research or publications.

We Think There Is Upside Ahead In Splunk Stock – The Question Is For Whom?

When a company whose stock you own is acquired, even at a profit, this is usually a mixed blessing. It can deliver you a solid gain, or maybe bail you out of a poorly-timed purchase, or at least help you cut any losses and get cash back into your account. The trouble is that the very fact that someone else has issued a vote of confidence with a fat checkbook indicates upside potential – potential that common stock holders with modest positions may well miss out on, since they have little choice but to sell.

Right now is a wonderful time to be alive if you manage a large and undeployed bag of state retirement systems’ money in the form of a buyout fund. Companies of excellent quality such as SailPoint Technologies (SAIL) are being acquired for modest premia and, as we noted in our coverage of that particular acquisition, are likely to generate solid gains for whichever particular Retired Janitors have their money parked with the buyout shop in question.

We’ve long noted that we believe Splunk (NASDAQ:SPLK) to be an acquisition candidate. If you’re not familiar with the name you might like to catch up on our prior notes on the stock (here). We own the name in staff personal accounts, for two reasons – one, following the March announcement that a buyout firm had acquired a material position in the company, our view that the business was ripe to be sold only hardened in conviction; and, two, the company is making very good progress moving from upfront to subscription sales. And so we’ve been of the view that holding SPLK with a little patience can deliver solid returns, either through the organic growth of the company, and/or through the sale of the business.

The company reports its Q2 (the July quarter) on Wednesday August 24th. Ahead of that, with markets selling off after the big run from June, how does the stock look?

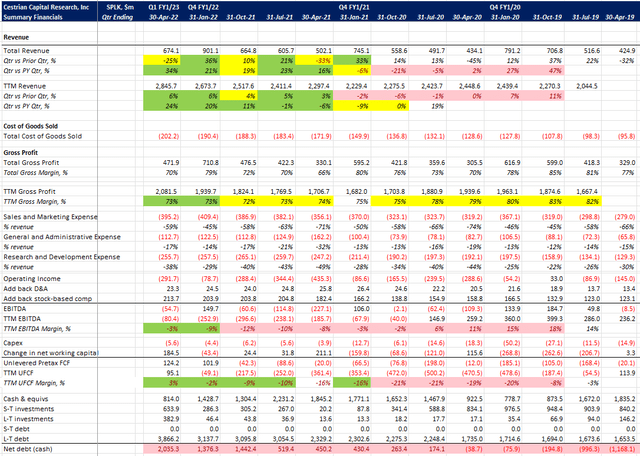

Let’s deal briefly with fundamentals. Here are the numbers up to and including the April quarter.

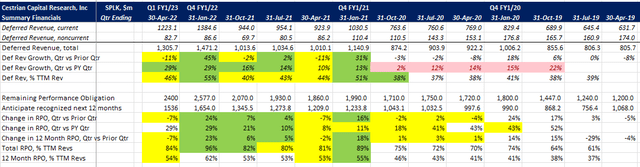

SPLK Financials I (Company SEC Filings, YCharts.com, Cestrian Analysis) SPLK Financials II (Company SEC Filings, YCharts.com, Cestrian Analysis)

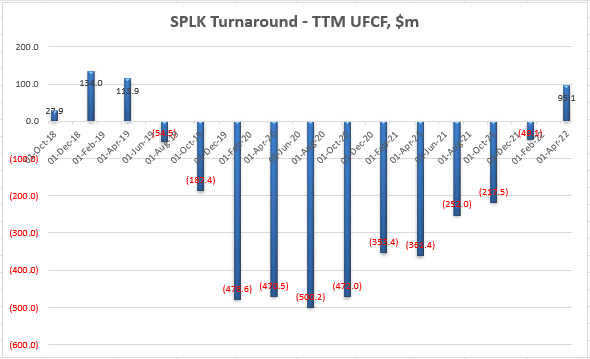

That’s a lot of numbers. If you want to cut through it all, and say, well, show me how this turnaround is proceeding? Here’s the Gen Z snippet version (albeit displayed in Gen X Excel formatting).

SPLK TTM Unlevered Pretax FCF By Quarter (Company SEC Filings, YCharts.com, Cestrian Analysis)

Easy to understand. Before it began the move to subscription, it generated plenty of cashflow. Then it started billing on the never-never rather than upfront. So the company ate cash for a living. Then the rolling snowball gathered enough regular subscription payments that trailing twelve month unlevered pre-tax free cashflow just turned positive once more. Good, then bad, now good again, but fledging-good not settled-good. Clear, right?

The July quarter will bring what it brings, but we would be surprised if the story was knocked too much off track, since the company now has two Silicon Valley technology funds wandering the halls, and a new CEO to boot. The company does not now lack expertise or experience in managing through the course it has chosen.

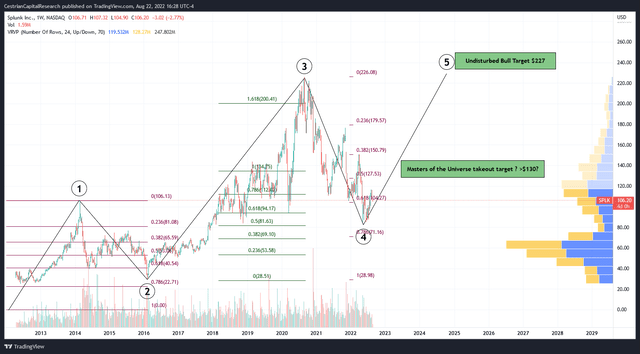

Now, the chart – which matters more at this stage in our view. You can open a full page version of this chart, here.

SPLK Chart (TradingView, Cestrian Analysis)

We believe Splunk is a buy at these levels. This is because:

- We believe the business model has reached a level of predictability as to make large earnings misses relatively unlikely. Anything can happen on any one earnings report, and we can offer no certainty for Wednesday’s earnings of course, but as a trend? This company ought to be getting more predictable now.

- The stock has been beaten down by the 2022 market correction and now nestles deep in a Wave 4 low. If our chart logic is correct then we believe the stock is in a Wave 5 up now and if true, the stock could reach new highs – above the prior $226-ish peak. This assumes no sale of the company but instead that the new CEO continues to drive the business as an independent.

- Looking at the volume profile on the right of the chart – which tracks the volume of shares traded in each price zone since IPO – the last high volume node ends at around $126, and historic volumes really start to drop off after $141 or so. Which can act as a useful guide for where a sale of the company might take place. Over $141 and the overwhelming majority of shareholders (by volume) will be in the money. At $126, many shareholders will be in the money. That’s an 18-33% premium from here so not an unusual sale premium for a company that is still working through its problems (as opposed to being today’s hot stock that four buyers fight over) – because in such matters, shareholder memories are skewed toward the recent, and the big drop in the last eight months or so will still be smarting for many.

And on that rather boring basis we believe Splunk is worthy of buying. Your upside may be limited to a modest takeout premium in the event of an inglorious bid tomorrow, but, with a recent low fairly proximate you could consider a stop-loss placed just below that low $80-s level plumbed in May, so you have around 1.5:1 upside:downside risk even on a very low-priced sale of the company; you would have just shy of a 3:1 risk/reward on a sale north of $141, and there’s every possibility of more upside should the company not be sold.

Cestrian Capital Research, Inc – 23 August 2022.

Be the first to comment