Spencer Platt

Thesis

Philip Morris International Inc.’s (NYSE:PM) Q2 earnings release demonstrated that the company’s IQOS growth cadence remains on track despite worsening macro headwinds and ongoing supply chain disruptions. Coupled with solid full-year guidance (despite downgraded adjusted EPS estimates), the market also anticipated a robust card heading into its earnings.

We presented in our previous article that PM’s valuations have improved markedly. However, we were not ready to turn bullish until we observed more constructive price action. We are pleased to update that PM has likely bottomed out in July, as it held its lows robustly. It’s also consistent with the lows seen in November 2021 and March 2022, corroborating the $85 support zone.

We remain cautiously optimistic that Philip Morris should be able to climb out of its nadir from FY23 as comps get lighter and overcome some of its transitory headwinds. Therefore, buying sentiments should return subsequently.

Notwithstanding, we postulate that PM’s valuations remain relatively well-balanced; therefore, we are not convinced of pulling the buy trigger now. However, if PM returns closer to the lows in March or July 2022, we posit that an entry point at those levels may be possible for investors to consider adding more positions.

As such, we reiterate our Hold rating on PM for now.

Philip Morris’ Recovery Is On Track

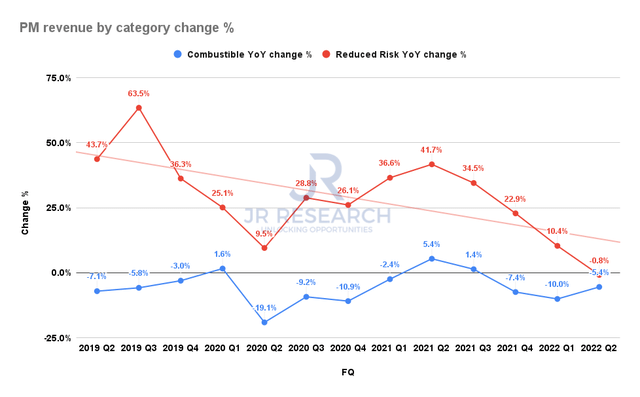

Philip Morris revenue by category change % (S&P Cap IQ)

As seen above, Philip Morris’ combustible products’ revenue growth has stabilized since Q1’s bottom. Based on management’s commentary on forward trends, we are confident that it should help lift the company’s topline growth moving forward, in line with its FY22 guidance.

However, the normalization in growth cadence for its reduced-risk products (RRP) is still ongoing, as RRP notched another quarter of below-trend growth. Notwithstanding, we are also confident that its growth rates should stabilize in H2, as the company laps challenging comps from FY21, coupled with the improvement in the current headwinds faced. The company also expects continued margins improvement moving forward, as CFO Emmanuel Babeau articulated:

So we expect in the course of 2023, [margin] seems to gradually improve. So inflation is not temporary. [But,] I think for the rest, a lot of the headwinds that we are seeing in H1 are temporary. And then clearly, for H2, we are expecting an improvement in the margin. Certainly, that would be skewed to a large extent to Q4, but already the deterioration in Q3 on the gross margin would be lower. We are just following the growth, and we are putting the right level of investment to cope with the growth. [In] Q4, we’ll be clearly seeing a better improvement with the better mix. (Philip Morris FQ2’22 earnings call)

PM’s Valuation Remains Well-Balanced

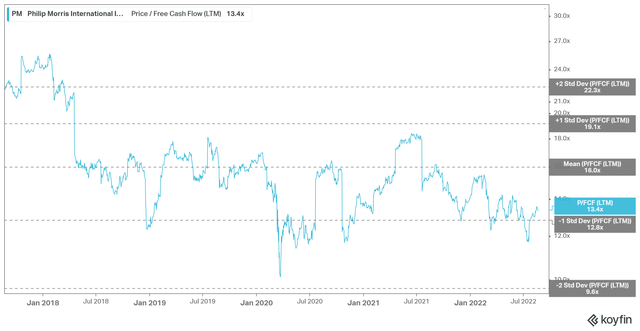

PM TTM P/FCF valuation trend (koyfin)

On a 5Y basis, PM’s TTM P/FCF seems pretty well-balanced based on where its valuation found robust buying support previously. As seen above, we gleaned that PM has been consistently supported whenever it fell below the one standard deviation zone from its 5Y mean. However, we also observed that the market was generally reluctant to re-rate PM above its 5Y mean over the past five years. Therefore, we postulate that the market has generally de-rated PM, requiring higher free cash flow yields to hold its stock.

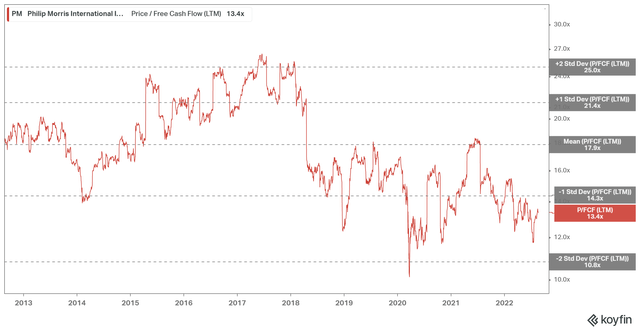

PM TTM P/FCF valuation trend (10Y) (koyfin)

On a 10Y basis, it’s pretty clear that the market has been rejecting further buying upside above its 10Y mean, corroborating our previous analysis. It also appears that it’s having some trouble holding on to its one standard deviation zone below its 10Y mean, highlighting a material de-rating by the market. But, we postulate that if PM falls closer to the two standard deviation zone below its 10Y mean, investors should find an entry point attractive.

Is PM Stock A Buy, Sell, Or Hold?

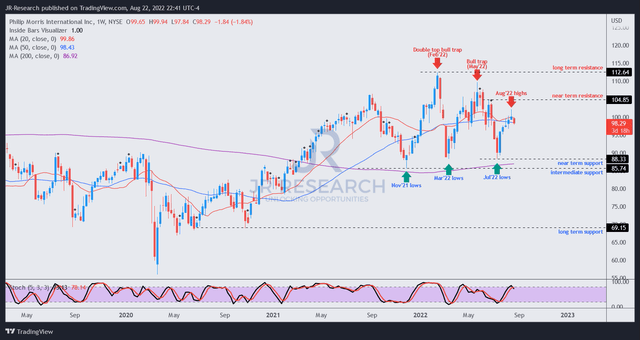

PM price chart (weekly) (TradingView)

As seen above, PM has been robustly supported above its $85 support zone since November 2021. Therefore, we are confident that a successful re-test of that support level should subsequently afford investors’ confidence in adding exposure.

Notwithstanding, it appears that the resistance levels have moved lower since February 2022, as the market rejected further buying upside at another lower August high. Therefore, we urge investors to be cautious in adding at the current levels.

As such, we reiterate our Hold rating on PM and urge investors to wait for a deeper pullback in PM.

Be the first to comment