fredrocko/iStock Unreleased via Getty Images

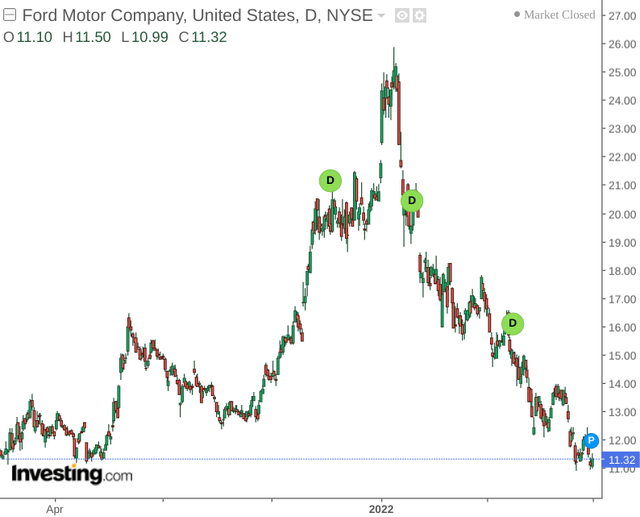

Investment Thesis: Ford Motor Company (NYSE:F) could see long-term upside as a result of resiliency in SUV sales as well as a rebound in truck sales and growing demand for the F-150 Lighting.

After a period of growth last year, we have seen Ford Motor Company take a significant dive in 2022, against a backdrop of a decline in sales growth driven by supply chain issues and a challenging inflationary environment.

The purpose of this article is to determine whether Ford Motor Company has the potential to see renewed longer-term upside going forward after the recent decline.

U.S. Truck and SUV Sales Performance

For the purposes of this article, I would like to consider longer-term performance across the U.S. market – as this market accounted for over 40% of Ford’s overall sales as of 2021.

I consider sales performance for models across the SUV and Trucks segments – as these segments account for the majority of U.S. sales as a whole.

Specifically, I choose to compare sales by brand for the years 2017 and 2021, in order to determine:

- Which brands account for the majority of the company’s sales

- Whether sales performance across important brands have been increasing or decreasing

- Whether Ford is becoming more or less dependent on key brand offerings to sustain overall sales growth

To answer the above questions, I chose to collate quarterly sales data from U.S. sales reports for the years 2017 and 2021 on SUV and Truck brands. The quarterly sales figures were then averaged across the year for each model, in order to remove the effects of seasonal fluctuations.

The collated data from the reports is available here, and the averaging of sales performance by brand was calculated using SQL.

Average sales in 2017

| Brand | Average Sales | Percentage of total sales (%) |

| F-Series | 82728 | 47.61% |

| Escape | 26773 | 15.41% |

| Explorer | 21452 | 12.34% |

| Edge | 12569 | 7.23% |

| Transit | 12230 | 7.04% |

| Expedition | 4645 | 2.67% |

| E-Series | 4610 | 2.65% |

| Transit Connect | 3037 | 1.75% |

| Police Interceptor Utility | 2918 | 1.68% |

| Flex | 1836 | 1.06% |

| Heavy Trucks | 978 | 0.56% |

Average sales in 2021

| Brand | Average Sales | Percentage of total sales (%) |

| F-Series | 93783 | 41.73% |

| Explorer | 28874 | 12.85% |

| Escape | 18007 | 8.01% |

| Transit | 12587 | 5.60% |

| Bronco Sport | 12419 | 5.53% |

| Edge | 11107 | 4.94% |

| Ranger | 10841 | 4.82% |

| Expedition | 10790 | 4.80% |

| EcoSport | 5297 | 2.36% |

| E-Series | 4933 | 2.19% |

| Bronco | 4455 | 1.98% |

| Maverick | 3268 | 1.45% |

| Transit Connect | 3265 | 1.45% |

| Mustang Mach E | 3252 | 1.45% |

| Heavy Trucks | 1862 | 0.83% |

| Flex | 0 | 0.00% |

According to the above, we note that:

- While the F-Series accounted for nearly 50% of average sales in 2017 – this was down to just over 40% in 2021.

- Average sales for the F-Series, Explorer and Escape models accounted for 75% of average sales in 2017, while this had decreased to 62% in 2021. Nonetheless, average sales of the F-Series and Explorer were still higher in 2021.

- Sales of the company’s new Bronco Sport brand accounted for just over 5% of total average sales in 2021 – which is impressive considering that this model was only recently introduced to the market.

From a holistic standpoint, we can see that sales for the F-Series and Explorer models have continued to remain strong. At the same time, Ford Motor Company has managed to diversify its sales by introducing newer models like the Bronco Sport which have shown strong popularity. In this regard, the company is not as dependent on the F-Series, Explorer and Escape models to sustain sales growth.

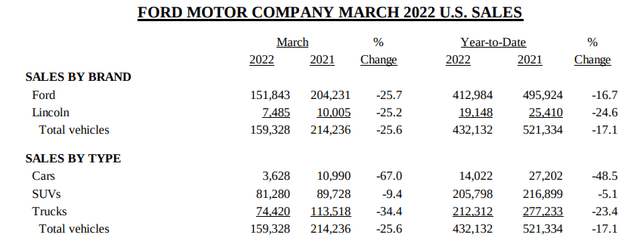

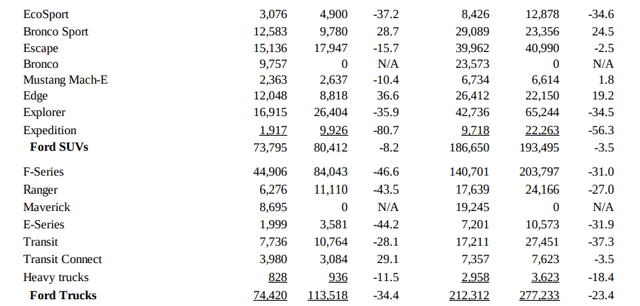

When looking at March 2022 sales, supply chain issues including a global semiconductor chip shortage along with concerns on inflation and fuel prices have led to lower sales overall.

Ford Motor Company: March 2022 U.S. Sales Reports

However, we can see that SUV sales showed the lowest decrease on a percentage basis, both on a quarterly and year-to-date basis.

Additionally, it is also noteworthy that both the Bronco Sport and Edge models showed strong double-digit growth on a quarterly and year-to-date basis.

Ford Motor Company: March 2022 U.S. Sales Reports

From this standpoint, while sales of cars and trucks have taken a significant dive – the SUV segment has helped to cushion the blow to overall sales somewhat.

Financial Position

With the SUV segment having proven to be more resilient than that of the trucks segment – it is likely that we could continue to see a deeper decline in truck sales in the short to medium-term – as higher fuel prices reduces demand.

However, should we see SUV models like Bronco Sport and Edge continue to show strong growth – then there is a possibility that we should start to see downside flatten out at or near the current level.

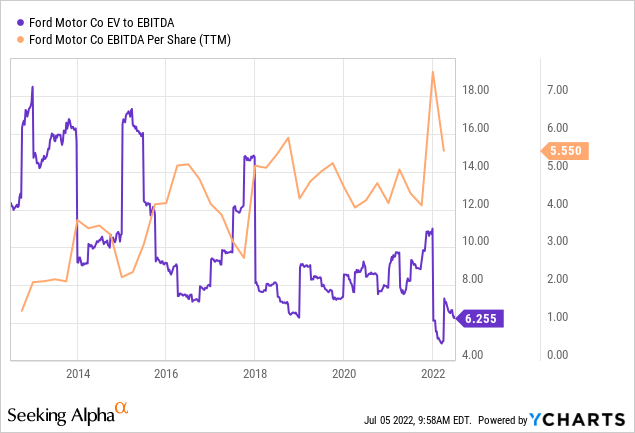

When looking at the 10-year trajectory of the EV/EBITDA ratio of Ford Motor Company, we can see that this ratio is trading near a 10-year low, while EBITDA itself is still near a 10-year high – in spite of the recent pressures.

ycharts.com

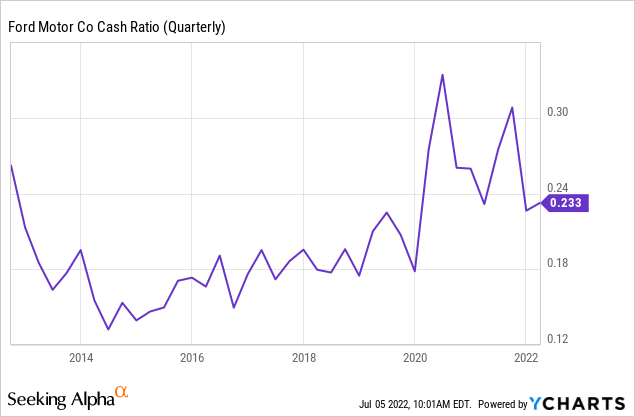

From a cash standpoint, an analysis of the cash ratio has shown a significant uptrend over the past five years. This indicates that Ford Motor Company is in a better position to fund its short-term debt obligations using cash and cash equivalents.

ycharts.com

Should we see cash and earnings metrics continue to improve in spite of the pressure on sales growth – then we could see investor interest in the stock start to rise once again.

Additionally, Ford has taken steps to buyback significant levels of debt incurred during the COVID-19 pandemic – most recently a buyback of up to $5 billion of higher-yield debt in late 2021.

With Fitch having recently upgraded Ford and Ford Credit’s outlooks to positive, such a move appears to have been good for the company’s credit rating and also signals that Ford has significant cash reserves to be able to invest further in boosting electric vehicle sales as part of the company’s Ford+ plan.

In the near-term, I take the view that if inflation and fuel price growth starts to cool off in the second half of this year and we see sales growth across the Trucks segment start to rise once again – then this could prove to be a key driver of growth for the stock.

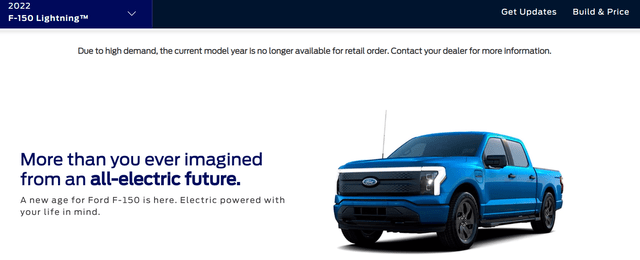

With preliminary reports that sales for Ford Motor Company were up by 31.5% in June – driven by a 26.3% rise in deliveries of F-Series trucks and 1,837 sales of Ford’s F-150 Lightning all-electric truck – truck sales appear to be making a significant recovery. EV sales have risen by over 76% from that of the previous year – which reportedly makes the company the second-best seller of plug-in models behind Tesla (TSLA).

Longer-term, if we see strong sales growth of Ford’s F-150 Lighting over the next couple of years – then this could mark a significant opportunity for Ford to carve out a significant competitive advantage in the electric trucks market.

Risks

With winter approaching and fears of higher fuel prices and inflation on the way – Ford Motor Company is not without risk.

While the recent rebound in truck sales have been encouraging, it is yet to be seen whether strong demand will continue into the winter months. It could be the case that customers decide to postpone purchases across this segment as a result of higher fuel costs.

Moreover, while demand for the F-150 Lightning has been encouraging, ongoing supply chain issues could make it difficult for Ford to adequately meet demand. The company has already reported that the current model year is no longer available for retail order due to high demand.

Additionally, while initial demand has been encouraging – the electric vehicles market is set to become significantly competitive worldwide – with other players like Volkswagen (OTCPK:VLKAF) reportedly selling more electric cars in Europe compared to Tesla.

While Europe is a less significant market than the United States for Ford – lack of growth in electric vehicle sales across that market could translate into lower sales growth across Europe overall as EV sales become more mainstream in the coming years.

Additionally, lockdowns in China earlier this year have caused upset to global supply chains. With Changan Ford in China being one of the largest production bases for Ford outside the United States – the effects of supply disruptions might result in potentially lower sales figures later this year – if such disruptions have impeded meeting demand effectively.

Conclusion

To conclude, I take the view that Ford Motor Company has shown resilience in a challenging macroeconomic environment. SUV sales remained resilient while truck sales saw a decline – and we appear to be seeing a recovery in the latter across this quarter.

While macroeconomic concerns could place downward pressure on the stock in the short to medium-term, I take the view that Ford Motor Company continues to have a strong business model and resilient financials.

For these reasons, I take a long-term bullish view on the stock.

Be the first to comment