Boarding1Now/iStock Editorial via Getty Images

Investment Thesis

Aviation stocks have been battered since forming their top in March/April 2021, as the market parsed the airlines’ ability to sustain their reopening cadence. Delta Air Lines (NYSE:DAL) has also suffered a 43% decline (from March 2021’s highs) and lost its bullish bias since August/September 2021.

Airlines also had to deal with surging fuel costs, uneven recovery in business travel, and worsening macros. However, tight capacity has helped offset some headwinds, giving leaders like Delta tremendous pricing power. As a result, the company’s sanguine corporate update in early June has helped calm some of those fears.

Notwithstanding, the market has continued to batter DAL in June, sending it to lows last seen in September/October 2020. However, we posit that DAL could be at a near-term bottom, sustained by a potential bear trap, as the recent flush-out seems near-completion.

Our valuation analysis also suggests that DAL seems reasonably valued and provides an attractive risk/reward profile.

Accordingly, we rate DAL as a Buy, with a near-term price target (PT) of $36.5, implying a potential upside of 22.4%, as of July 5’s close.

Delta Air Lines Needs To Sustain Its Margins As Growth Normalizes

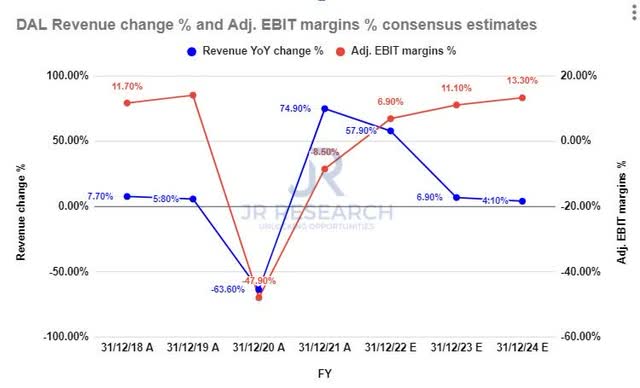

Delta revenue change % and adjusted EBIT margins % consensus estimates (S&P Cap IQ)

We believe the market is justified in battering DAL stock since its highs in 2021, as growth normalizes after its massive recovery from its COVID debacle.

Despite management’s optimistic outlook, the consensus estimates (bullish) suggest Delta’s revenue growth could fall to 6.9% in FY23 before normalizing to 4.1% by FY24.

Notwithstanding, Delta is expected to improve its operating leverage as the recovery tailwinds could continue to lift its profitability outlook. We believe that outlook is credible, given its pricing power despite higher fuel costs. Delta also does not expect fuel costs to remain at the current levels “forever.” CEO Ed Bastian accentuated (edited):

We’re at the point now we’re not going to grow anymore probably through the end of this year with the existing seats that we have in the market. There were reports out there that we were canceling about 100 flights a day into the summer. It’s probably not accurate. We’re not canceling flights as much as we’re just not growing and that was some of the growth that we had embedded in the future few months because we don’t want to outstrip our resources or our capabilities. I don’t think fuel prices are going to stay at this level forever. I think that will help us because I think the demand is not really tied to the crack spread. The demand is tied to people wanting to travel. (Bernstein 38th Annual Strategic Decisions Conference)

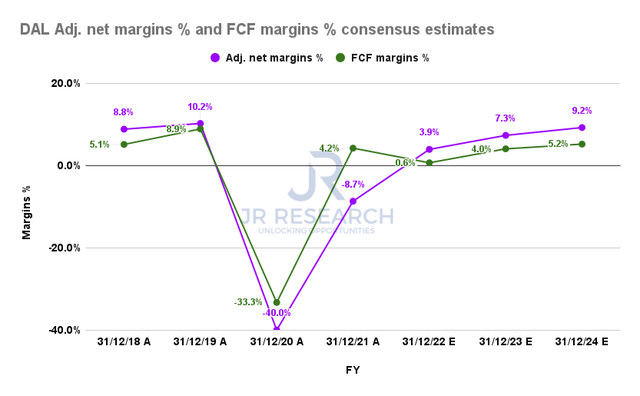

Delta adjusted net margins % and FCF margins % consensus estimates (S&P Cap IQ)

Consequently, Delta is also projected to continue improving its adjusted net margins and free cash flow (FCF) profitability, despite revenue growth normalization.

Therefore, the challenge remains for management to prove that it can tremendously lift its leverage despite worsening recessionary fears that could curb travel spending.

A recent commentary by Morning Consult Travel & Hospitality suggested that consumers could be cutting back on travel spending in the summer, given the current inflationary environment, which has impacted gas prices and airfares. It highlighted (edited): “Many consumers are taking those revenge trips at the beginning of the summer for the holiday weekend, and then probably pulling back and staying a little bit closer to home for the rest of the summer.”

Consequently, the uncertainty in the market is palpable as the market parses on the impact on DAL’s valuation.

DAL Could Be Forming A Bear Trap

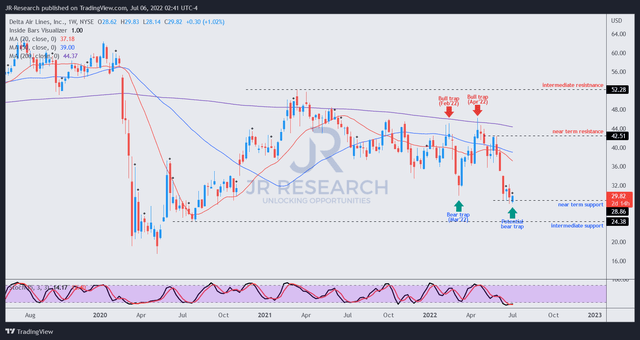

DAL is in a dominant bearish flow after the initial double top bull trap (significant rejection of buying momentum) in March/April 2021. Consequently, it sent DAL into its bearish bias from September 2021, which it has not recovered from.

Furthermore, DAL formed another two noteworthy bull traps in February and April 2022, which rejected a decisive retaking of its bullish momentum. However, we believe the recent steep liquidation in June has sent DAL into a near-term bottom, with a potential bear trap (significant rejection of selling momentum) forming.

As a result, investors can consider using the potential bear trap (pending validation) to add exposure.

DAL – Valuation Points To An Attractive Risk/Reward Profile

| Stock | DAL |

| Current market cap | $19.12B |

| Hurdle rate (CAGR) | 15% |

| Projection through | CQ4’26 |

| Required FCF yield in CQ4’26 | 5.5% |

| Assumed TTM FCF margin in CQ4’26 | 4% |

| Implied TTM revenue by CQ4’26 | $49.23B |

DAL reverse cash flow valuation model. Data source: S&P Cap IQ, author

Our reverse cash flow model indicates that DAL could meet our TTM revenue target by CQ4’26, with an implied hurdle rate of 15% at the current levels.

We also used an FCF yield higher than its current yield of 3.85%. However, it’s critical to note that Delta needs to deliver its operating leverage gains, given its weak FCF margins. Investors must observe that carefully, as it remains the most critical risk to our valuation thesis.

Is DAL Stock A Buy, Sell, Or Hold?

We rate DAL as a Buy, with a near-term PT of $36.5, implying a potential upside of about 22%.

Our price action analysis indicates that DAL could be forming a near-term bottom with a potential bear trap (pending validation).

Our valuation model indicates that the risk/reward for DAL is attractive at the current levels and suggests a lower-risk buy opportunity, consistent with its price action.

Notwithstanding, DAL remains deeply mired in a bearish flow. Delta also needs to prove its ability to improve its FCF margins as revenue growth normalizes, which is the most critical risk to our modeling.

Be the first to comment