HATICE GOCMEN

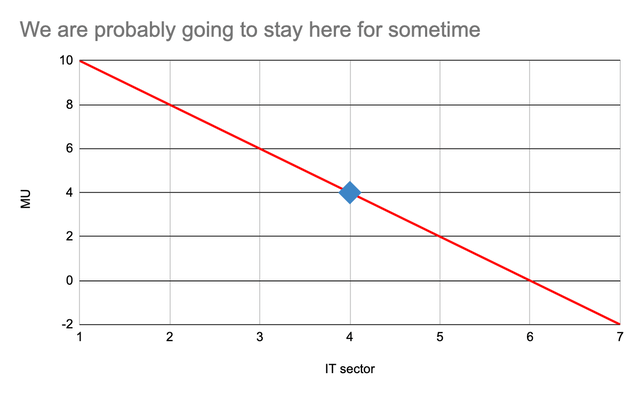

Well, who thought a time like this would come where investors would be worried about holding IT stocks, especially when the economy is still doing good. Looks like the marginal utility of the IT sector is approaching a negative to zero zone for the time being, as there is too much innovation that has happened and incremental benefit has started to fall.

IT sector declining Marginal Utility (self)

IT Stocks

No wonder, many IT companies have started to reduce the headcount – Apple has laid off 100 contract- based recruiters, Netflix has been dismissing ~150-300 employees every month. Microsoft laid off 1800 employees in July. Google gave a warning of more pain ahead.

But you know what, the scenario is not so bad, because every other “non-IT” industry is incorporating technological expertise in operational, business and consumer domain. So, looks like many of these employees will be absorbed by other industries which are looking for technological integration. In fact, the telecom, media, and healthcare industries are already facing a talent shortage according to a PWC survey. So, I feel some realignment of workforce will naturally occur and which is actually healthy in the long term.

Thus, I would recommend investors to stay out of IT stocks, as their golden period seems to have come to a halt and the progress may remain static for a few years going forward. In addition, currency risk is also a play, so IT companies may be vulnerable to the same. Thus IT stocks may move sideways or fall further, and hence it is advisable to not stay heavily invested in this sector.

Banking Stocks

Now comes the good news, which is the banking sector! This sector has been bearing the brunt of low interest rates since the 2008-09 crisis, when the Federal Reserve reduced interest rates to zero to combat recession. Since then, rates have been low and banks haven’t have much leeway to shore up their core income, which comes through lending. U.S. banks’ net interest margin literally shrunk from >6% during 2007 to <2%-3% now.

However, now U.S. banks are likely to benefit the most from substantial rate hikes. It should boost their net interest income.

U.S. banks are optimistic on their NII increase for this year supported by potential rate hikes – JPMorgan Chase & Co. (JPM) has increased its NII forecast to $58 bn for FY23 from $56 bn projected in May, and Wells Fargo (WFC) also expects its annual figure to likely increase by 20% this fiscal.

U.S. Fed Chairman Jerome Powell’s speech at Jackson Hole Summit clearly signals that more rate hikes are in the cards until inflation comes to a stable level, even if it is at the cost of the economy getting hurt by little. The move makes sense, as it would help in taming the ballooning Fed balance sheet and bring long-term stability to the economy. The banking industry stands at a favorable point in rising interest rate scenario.

Post-pandemic also, the banking industry has undergone a massive change from customers becoming now contactless not only in physical terms but also partially in virtual terms. JPM and WFC are incorporating newer technologies (blockchain, AI) for seamless executions whose benefit they would continue to reap in the forthcoming years. In short, the pandemic has pushed them to reach for faster technologies of scale.

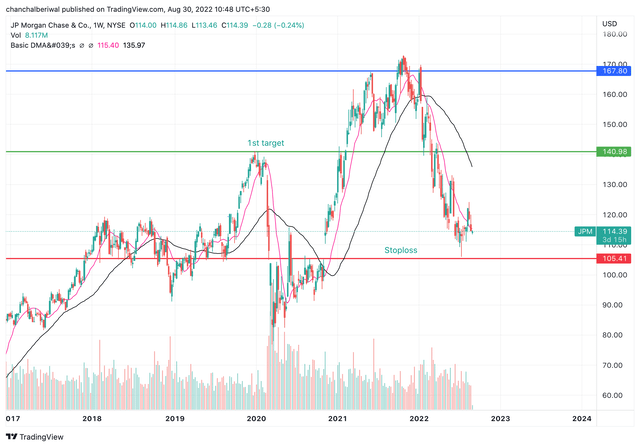

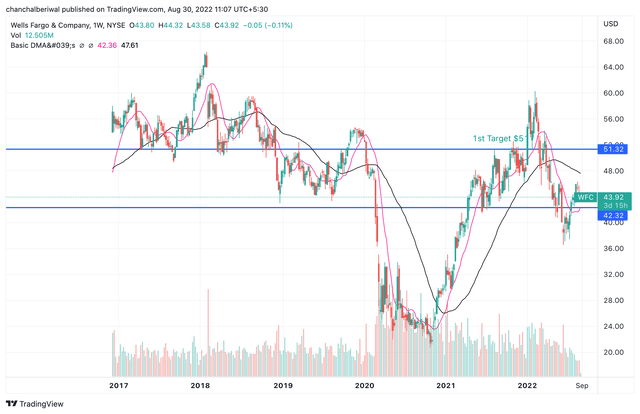

This scenario warrants a portfolio reevaluation and adding sectors which will benefit from rate hikes, with banking being the main one. My quick picks based on top down approach and technical support would be JPMorgan and Wells Fargo.

In the chart below, CMP of JPM ($114) is hovering around its 50 DMA and can be a good entry point, as it is in the support zone. My recommendation would be to buy here with a first target of $140, implying an upside of 23% from here.

JPM’s first target should be 141, implying a 23% upside (trading view)

Similarly, for WFC the stock is near its 50DMA of $42. I thus would recommend to buy on dips for a first target of $51

Be the first to comment