Douglas Rissing

Main Thesis & Background

The purpose of this article is to evaluate the Vanguard Energy ETF (NYSEARCA:NYSEARCA:VDE) as an investment option at its current market price. This is a passively managed sector fund with an objective to “track the performance of a benchmark index that measures the investment return of stocks in the energy sector”.

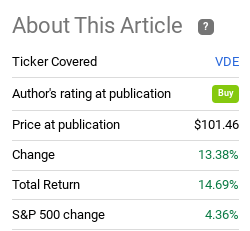

This is my preferred way to capture Energy exposure for a long time. As readers are probably aware, it has had a very strong 2022. In fact, since my bullish article in September, VDE has pumped out a gain of almost 15% and handily beaten the S&P 500:

Fund Performance (Seeking Alpha)

As we approach the new year, I have been reviewing all the funds and sectors I own to see if I should make any changes before tax season ends. With respect to VDE, I am sitting on big gains in 2022 and am reluctant to sell these holdings. In fact, I actually see merit to amplifying my position, which is why I will be keeping my rating at “buy” to wrap up December. I will explain the rationale behind this outlook in the following paragraphs.

Why Now? Energy Recently In A Pullback

It may seem a bit counter-intuitive to be buying the year’s best performing sector now. With a new year brings new possibilities and we very well may see some sector rotations (I do expect Tech to get a marked rebound). In that vein, does it really make sense to be buying Energy with so much economic uncertainty and with the potential for sector rotation with a new calendar year?

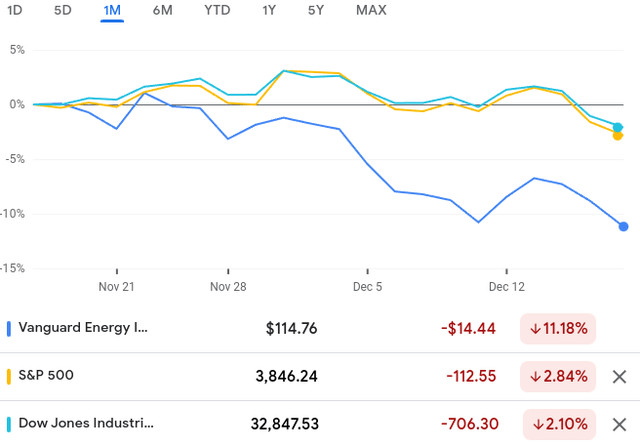

In fairness, I would not suggest investors go “all in” at these levels. If you have missed the boat on owning VDE for 2022, don’t try to make up for it by making a huge bet – that could be a recipe for disaster. But I do see some merit to owning/adding at these levels. A primary reason why is that, despite VDE having a really strong year, it is actually in short-term correction territory. While the broader market has seen some weakness, VDE’s 1-month loss is in excess of 10%:

1-Month Performance (Google Finance)

When I see drops in the 10% or 20% range I immediately get interested. This may seem a bit elementary, but these triggers for “corrections” and “bear markets” often do represent good buying opportunities. I have done well over my investing career buying at these levels regardless of the sector. They indicate a contrarian play and a general risk-off market attitude. Buying when nobody else seems to want to will often work out in this regard.

Of course, there is no guarantee to this. VDE has been dropping fast and it could continue to do so. But let us reflect on 2022 performance for a minute. While VDE is up almost 44% this year, it has not been a completely smooth ride. The fund has seen its share of ups and downs:

YTD Return of VDE (Seeking Alpha)

It looks to me like we are currently in the 4th marked drop for the year. This signals a buying chance for me because after each marked drop in prior months VDE has rallied strongly. Can this time be different? Sure. But buying in to weakness in 2022 has been a play that has worked wonderfully this year and I am inclined to believe that will continue to be the case.

Oil Dropping On Demand Fears – Too Much So In My View

Let us now reflect on some of the reasons why VDE has been performing poorly in the short-term. This will help readers gauge whether or not they want to be buying in – and give me a chance to explain my continued bullishness.

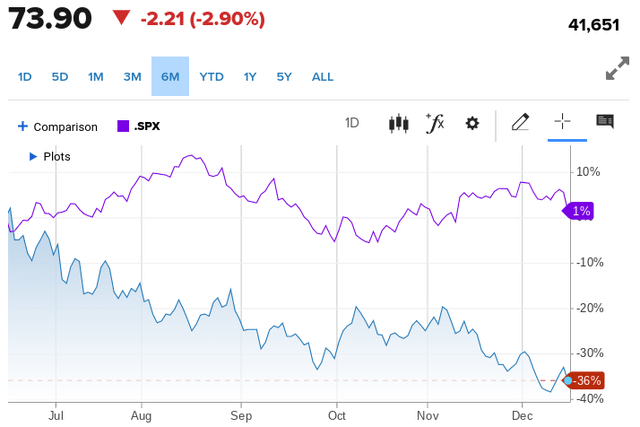

The key driver for these losses is, in my view, the sharp decline in oil’s price. Over the past six months, worries over supply-chain issues from the Russia-Ukraine conflict have subsided. Further, broader concerns over economic growth in China and the West have clouded the investment outlook for owning and storing crude. The net result is a consistent decline in the price of WTI crude:

6-Month Return (WTI Crude) (CNBC)

This is certainly not the type of chart oil/energy investors want to see. However, I view it as a buying opportunity for both oil and VDE because I think the decline is not truly commensurate with what demand will be in 2023.

There are multiple reasons I feel this way. One, I believe the market is under-estimating the Chinese recovery potential in 2023. In the second half of this year, China witnessed a significant drop in demand driven mostly by renewed COVID-19 lockdowns. This remains a definite headwind for oil demand (and global economic activity) going forward, but I view recent concessions by the Chinese government as a signal that 2023 will be a much stronger environment. In the wake of public protests, the government announced some of the following measures aimed at opening up the country:

- Lateral flow tests would replace PCR tests in most scenarios where a result is needed (PCRs are still needed for schools, hospitals and nursing homes)

- Lockdowns to continue but only apply to more targeted areas (i.e. certain buildings, units) as opposed to neighbourhoods or cities being shut down

- Areas identified as “high-risk” should come out of lockdown in five days if no new cases are found. (Several cities in China have endured months-long lockdowns even with only a handful of cases).

- Schools can remain open with student attendance if there’s no wider campus outbreak

To me these changes may not be dramatic but they signal a willingness by the Communist Party to respond to public concerns. I suspect a similar trend to play out in 2023 and for pro-growth initiatives emerge. If I am correct that will mean a definite increase in oil demand which will help smooth out demand concerns originating out of America and Europe.

Two, OPEC+ has been signaling it will take steps to eliminate glut supply from the market. While political leaders in the U.S. have been suggested the market is under-supplied to curry favor with voters, OPEC+ has taken a different view.

Heading in to Q4 this year the cartel pledged steep output cuts to support the market amid the worsening economic outlook and weakening prices. For perspective, the cuts amounted to the following:

OPEC+ Production Cuts (World Bank)

The conclusion I draw here is similar to the China development. OPEC+ has signaled it will take action to keep demand and supply in balance. With oil down 36% in the past six months, I don’t see them allowing the price to drop much further before taking more action. This puts the bottom on prices very close to current levels – in my opinion – and supports why I see a strong case for continuing to buy in this environment.

The “Inflation Trade” Still Resonates

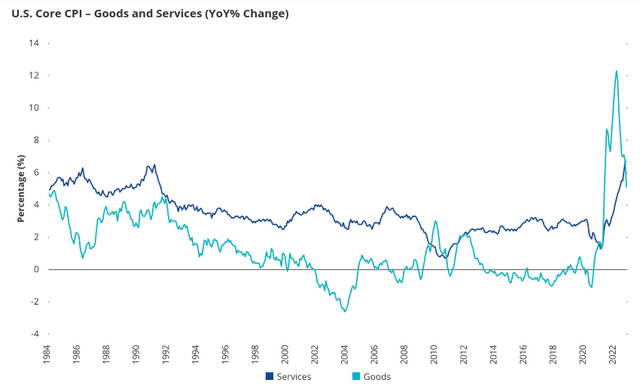

I now want to look at the market more broadly to give another reason why I continue to like Energy and VDE. Simply, the “inflation trade” is one that is not going away. This includes Energy and oil, but also other commodity plays like metals and traditional inflation hedges like Real Estate. The market has been making a big deal about inflation “peaking”, but the reality is the current inflation level is still very high by historical standards. In fact, the CPI for services has been accelerating of late, counter-balancing the decline in the CPI for goods:

US Inflation (Department of Labor)

What I am getting at here is that investors are going to enter 2023 continuing to look for ways to combat inflation. This is not a theme that will disappear with the onset of a fresh calendar. Energy stocks and ETFs will have merit in early 2023 just like they did in early 2022 because investors need exposure to areas that can benefit from inflation to protect their broader portfolio that is likely negatively exposed to inflation (think the S&P 500’s performance this year!). Therefore, I simply don’t see the logic behind getting out of this sector now. Where else are investors going to find such a reasonable inflation hedge that is sitting in correction territory? For me, this is a no-brainer.

Dividend Growth Continues To Impress

My next point takes a look at the income stream. Back in September I noted how the fund had a dividend yield nearing 4% with strong dividend growth of 35% on a year-over-year basis. This included distributions from Q1 – Q3. The good news is that since that time, VDE has actually seen accelerating dividend growth in its Q4 payout, as shown below:

| Q4 2021 Distribution | Q4 2022 Distribution | YOY Growth |

| $.94/share | $1.36/share | 45% |

Source: Vanguard

I think it is pretty clear why I find this attractive. VDE is not only a growth play for me at this time but also an income play. This is a win-win, and further supports my bullish rating on this fund.

“Windfall” Taxes No Longer A Concern

My final point touches on a key risk I highlighted in my last article. This was with respect to “windfall” taxes, which have been discussed within the Biden administration and have generated traction in Europe as well. The idea being that Energy companies are earning “too much” profit right now and the extra profit should be taxed. The merits of this can be hotly debated, but for this review I am simply going to suggest my outlook is this action has little chance of becoming reality now.

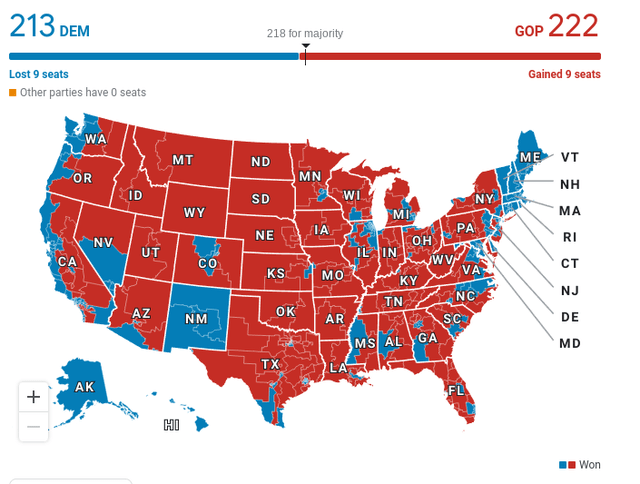

This stems from the Republican takeover of the House of Representatives in November:

Electoral Map (USA) (Associated Press)

This removes complete Democratic control of Congress and will limit the ability of the Democrats to push forward the entirety of their agenda. In my view, the chances of any Republicans supporting extra taxes on the Energy sector in this inflationary environment are very minimal, and there almost certainly won’t be enough support to get it to pass in the House. This is a welcome development for the Energy sector going forward, as higher taxes are never anything investors want to see. It makes me more comfortable owning VDE for the next two years than I otherwise would have been.

Bottom-line

VDE has been a big winner in 2022. While I don’t see similar gains in 2023, I still see gains overall. I think the recent pullback gives investors a chance to buy in to a sector with solid prospects at a nice discount. An economic recession in the U.S. and Europe is a concern, so do not be blind to that risk.

But I view the potential for China’s re-opening, OPEC+’s commitment to a balanced supply-demand equation, and investors looking for inflation hedges as all reasons to stay long despite domestic recession concerns. As a result, I will look to continue to add to my VDE position on weakness in the weeks ahead, and suggest readers give this idea consideration at this time.

Be the first to comment