Just_Super/iStock via Getty Images

Investment Thesis

I recently wrote an article about Li-Cycle (NYSE:LICY). This provides a good general overview of the company, but in retrospect, I noticed that there are still some things that I would like to add. In addition, there are now a few new developments, so this article is a current update on the company. For those who are not yet familiar with the company, I recommend reading my first article for a better overview of the structure and overall concept.

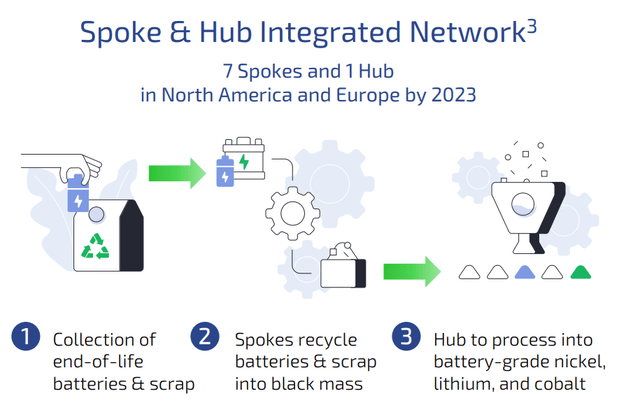

The capacity of the spoke facilities

As we know, the company builds two types of recycling factories: hubs and spokes. The idea behind spokes is that they can be geographically distributed and thus be closer to the suppliers. After all, it is on these suppliers that the whole business is built. Li-Cycle needs end-of-life batteries or other scrap and waste generated by battery manufacturers. The spokes are the first step in the recycling process, creating what is called a black mass. This black mass is then delivered to another facility, the hub. The first one is still under construction and is scheduled to begin production in 2023.

Recently, the company opened its fourth Spoke recycling facility in North America. This is located in Alabama and has a capacity of 10,000 tons of manufacturing scrap and end-of-life batteries per year. Across the four facilities, capacity is now 30,000 tons per year, and the goal is to increase capacity to 65,000 tons per year by the end of 2023.

These 65,000 tons per year would be enough to utilize about 2/3 of the capacity of the hub currently under construction in Rochester, New York.

After my first article, I wondered if there even is enough scrap material and old batteries. How much material can the company receive, or will the hub run at only a fraction of its capacity in the coming years?

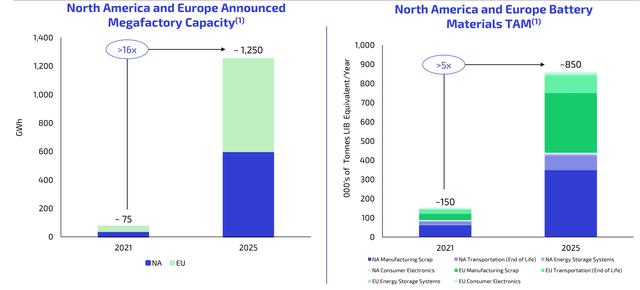

According to the company, by 2025, North America alone will generate 414k tons of battery material per year. While I don’t know how Li-Cycle comes up with that number, theoretically, you should be able to estimate that number fairly accurately. Knowing how many electric cars have been sold in the past and should approximately reach their end of life. In addition, the company has numerous partners who should know how much output they can deliver to Li-Cycle. So I think we can trust that number pretty well.

And apparently, the company is only talking about end-of-life batteries and not about possible scrap at battery manufacturers. In total (batteries, scrap, in North America and Europe), the company expects 850k tons in 2025.

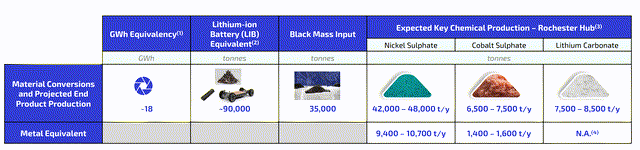

The hub under construction has a total capacity of 90k tons of used batteries (or 35k tons of black mass). So Li-Cycle could handle about 10% of the amount of used batteries and scrap generated in 2025. Whether they can secure 10% of the quantity is not yet certain. If this is a profitable business model, there will be numerous competitors who also want to have the used batteries to convert them back into raw materials. But at least we can see from this calculation that theoretically, there is enough, and tons are increasing in the future anyway. Even 2025 still marks the beginning of this development. The market for electric cars is still very young, and used batteries will not accumulate on a large scale until the 2030s.

Batteries without Nickel and Cobalt?

There is currently a development at Tesla (TSLA) that they are increasingly using lithium iron phosphate (LFP) batteries. According to S&P Global, half of the vehicles delivered in Q1 contained such batteries. If this development continues with other manufacturers, I see this as a risk for Li-Cycle because less expensive materials can then be recovered from the batteries. On the other hand, the old batteries’ price would also have to be lower.

It is hard to say how this will affect the company at this stage, but I think it is more of a risk than an opportunity as they have focused their entire infrastructure on lithium, nickel, and cobalt so far. Battery manufacturers would be happy to build without expensive materials. And the end customers, i.e. buyers of electric cars, would also like to see this development because it means lower prices. So it seems to be in the general interest to avoid expensive materials as much as possible. As I said, the consequence of this development would be that, in the end, less valuable materials could be recycled, and that is the whole business model of Li-Cycle.

Another much more significant risk is if lithium were removed from batteries. I recently wrote an article about this very issue titled Sodium instead of Lithium. This article was primarily intended for lithium mining companies but would also have implications for Li-Cycle. Because all lithium producers are ramping up their production at the moment, and if there were new materials that would replace lithium at least partially, the price of lithium would drop very much, and so would the resale value after recycling.

In my first article about Li-Cycle, I calculated how much revenue potential the hub in Rochester has. In this calculation, I took current market prices of nickel sulfate, cobalt sulfate, and lithium carbonate. The annual revenue would be just over $1B at current market prices and full capacity. In view of the current market capitalization of $910M, this would be a very high turnover. However, it also illustrates how dependent revenue will be on raw material prices.

Future demand for Nickel and cobalt

After these thoughts, I wondered what the future demand for nickel and cobalt would be. Or, in other words, how dependent the demand is on the sale of electric vehicles.

The global nickel market is projected to grow from $36.27 billion in 2021 to $59.14 billion in 2028 at a CAGR of 7.3% in forecast period, 2021-2028.

The article states that two-thirds of nickel is used to produce stainless steel. The growing demand for nickel is therefore attributed more to the increasing use of stainless steel than to the demand from batteries. Also, one of the world´s largest commodity miners and third largest nickel producer, Vale (VALE), sees demand increasing by 44% by 2030.

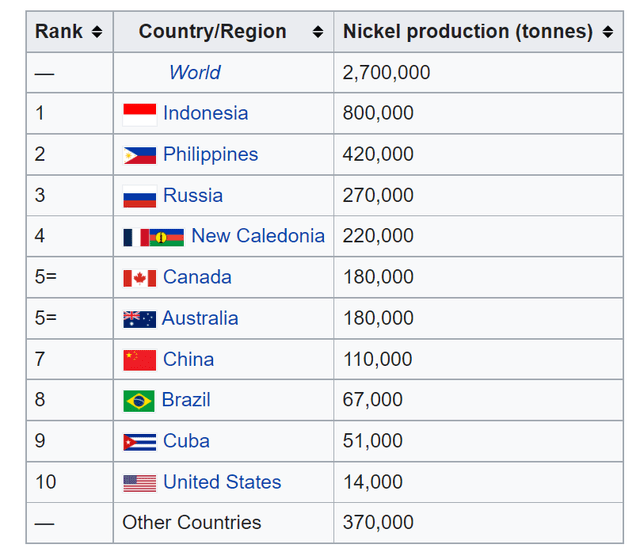

In addition, in 2019, 50% of the production came from only three countries, so all western countries combined produce very little. I don’t know exactly what the consumption looks like, but if you look at these numbers, it should be clear that the West is producing less than it is consuming. Therefore, there will be a great interest in re-using the purchased nickel through recycling.

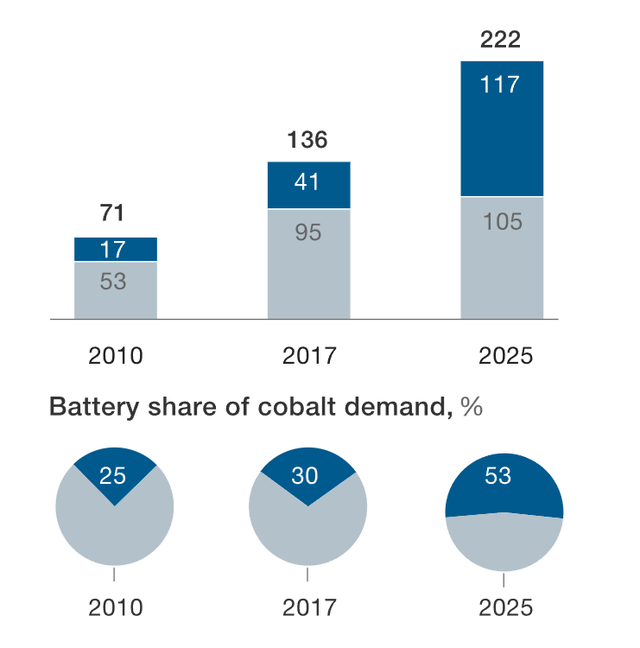

For cobalt, the increase in future demand is more dependent on electric vehicles. Similar to nickel, there are only a few producing countries, mainly in Africa. But even without the demand coming from batteries, cobalt demand would increase. Blue represents batteries, gray other uses.

I wanted to add this info about nickel and cobalt, as it is currently a big part of Li-Cycle’s business model. However, it is also outside the control of the company. Suppose in the future, battery manufacturers build their batteries without cobalt and nickel. In that case, there will be nothing to recycle, and the future demand for cobalt and nickel would not matter for the investment thesis of this company.

There are unknown factors

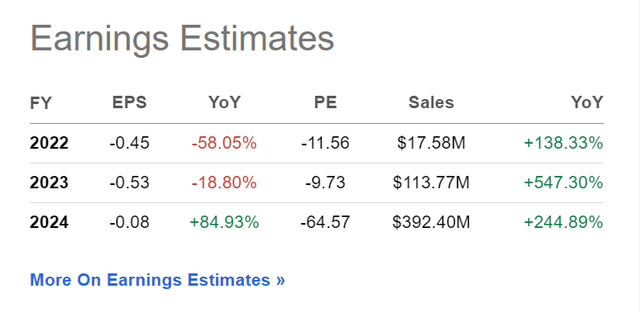

Although Li-Cycle’s business model is relatively simple to understand, many unknowns remain. How exactly does it change the company’s revenue outlook and future margins if batteries become more and more cobalt and nickel free? And while I’m on the subject of margins, this is also a big unknown. The company itself says it will be cash flow positive from 2024 when everything is built and running, but how margins will look then is a big guessing game at the moment.

Why I am still bullish

The first reason why I am bullish is that everything is a matter of price. The company already has four spokes running, and for the hub in Rochester, most of the CapEx is already spent. However, they still have cash and not excessive debt. The market cap is only $910M, and the enterprise value is only $600M. After all my research, I believe the estimates for revenues should be quite accurate. So the company is generally cheaply valued even though they are already very far along in building its infrastructure and creating partnerships. If the market capitalization were significantly higher, let’s say higher than $3B, this would worsen the risk-reward ratio significantly.

Furthermore, at the moment, most of the batteries are still built with cobalt and nickel, and the company generally operates in a rapidly growing and very promising market. The world is producing more and more batteries, which will have to be recycled in the future. So the second reason I’m bullish is a general structural tailwind. And even if, at some point in the future, fewer and fewer batteries are built with cobalt and nickel, it’s probably still worth recycling the iron, the lithium, and whatever other materials are used.

And the third reason is that lithium is still the most important material to recycle. I mentioned above that at full capacity, there is $1B revenue potential. Of that, 2/3 comes from lithium alone. So the worst case for the company would be the complete loss of nickel and cobalt and a substantial collapse of lithium prices. However, batteries cannot consist only of air and love. There are few materials suitable for batteries because they must have some properties, among other things, be able to store as much energy as possible with as little weight as possible. Lithium is currently still the best solution.

Conclusion

Even though there are risks, I believe there is still a great opportunity here. The company has a lot going for it. They are one of the first movers in the battery recycling market, which I think will be very big and important in the future. The whole infrastructure is about to start, and given the prospects, the market capitalization is very low. If the worst case happens, the company will significantly underperform its expectations. But if the worst case does not occur, the stock could multiply in the next few years.

Be the first to comment