Khanchit Khirisutchalual/iStock via Getty Images

The question of when inflation will peak consumes financial and commodity markets, and with good reason. When pricing pressure finally ebbs, the pressure on rate hikes and the headwinds for the economy will ease, if only on the margins. But every thousand-mile journey has to start somewhere.

“We’ve got to see a peak in inflation before the [stock] market will be substantially higher,” predicts Ed Yardeni, president of consultancy Yardeni Research.

Some economists are optimistic that a peak is near. The Fed’s increasingly aggressive rate hikes, combined with a sharp slowing in money-supply growth offer reasons for hope, a number of analysts say.

One way to keep tabs on hints of inflation’s peaking (or not) is to monitor the absolute change in the inflation indexes. On this front, there are clues that a peak may be near, but some indexes suggest otherwise.

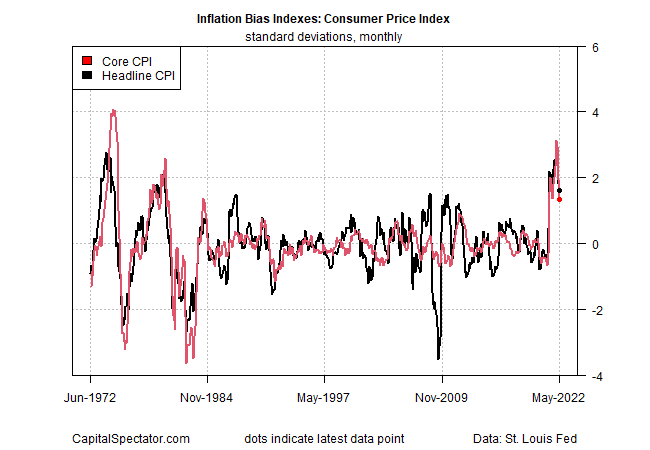

Let’s start with what I’m calling Inflation Bias Indexes. The methodology is taking the underlying index, calculating its one-year change, taking the monthly difference and then transforming the results into standard deviations around the mean.

In the first chart, headline and core estimates of the Consumer Price Index (CPI) through May suggest that a peaking process is already underway. Encouraging, although we’ve been here before only to find it was a false dawn. Is this time different? Only time will tell.

Author

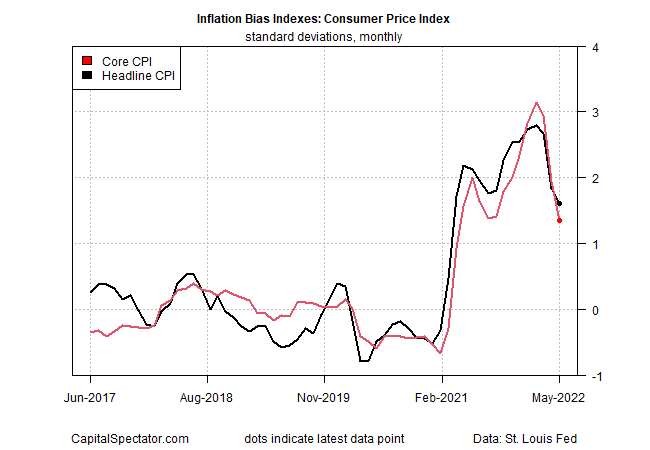

Zooming in on the data highlights that the reversal in pricing pressure appears to have legs.

Author

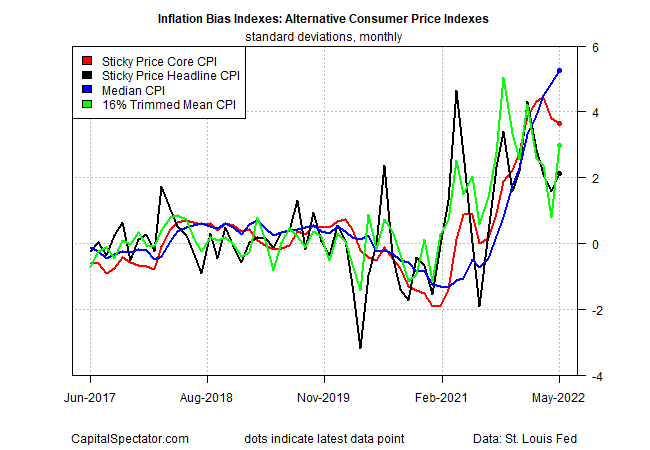

As a reality check, let’s check how several alternative measures of inflation compare. A pair of so-called “stick price” estimates of CPI from the Atlanta Fed, along with the Cleveland Fed’s median CPI and 16% Trimmed-Mean CPI.

Author

On these fronts, there’s still room for doubt about peaking inflation. Notably, the overall profile is mixed, suggesting that it’s premature to start celebrating inflation’s peak. Let’s see if the June CPI numbers change the outlook.

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment