adrian825

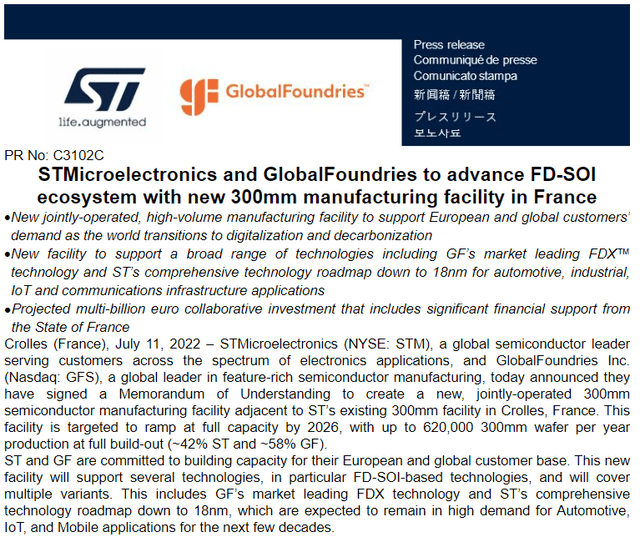

After Intel’s (NASDAQ:INTC) decision to set up a mega factory in Germany, it is now the turn of GlobalFoundries (NASDAQ:NASDAQ:GFS) which has partnered with STMicroelectronics (NYSE:STM) for semiconductor launching a foundry in France.

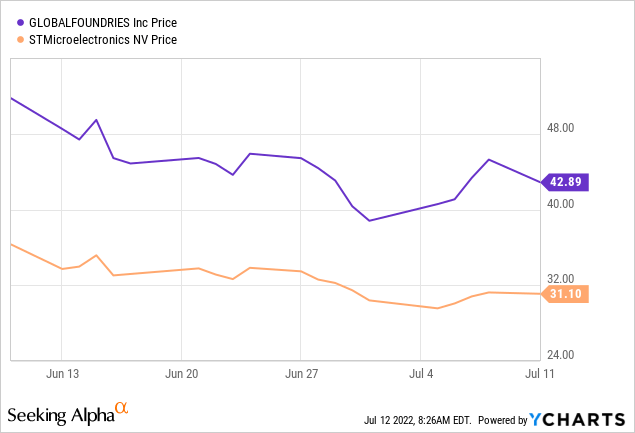

As seen in the chart below, this partnership triggered an upside in the stocks of both companies on July 9, showing that investors seem to be generally positive about the returns on investment.

Consequently, the aim of the thesis is to assess how value can be unlocked through the joint operation between vertically integrated STM and GFS, which is a pure-play foundry operator.

I start with the expenses bearing in mind that the chips business, especially the manufacturing side consumes a lot of capital.

The Partnership

According to an estimate made in June 2021, the cost of setting up a foundry can vary from $15 billion to $20 billion. One year later, with high inflation on both sides of the Atlantic and supply chain-related bottlenecks, this figure should be higher.

Being more granular, this level of investment is for advanced chips also referred to as leading-edge like the 5 nm process nodes used in Apple’s (NASDAQ:AAPL) iPhones and other cutting-edge applications. These require advanced chip manufacturing equipment made by ASML Holding N.V. (NASDAQ: ASML) which can be afforded only by some giant foundry operators like Taiwan Semiconductor Manufacturing (TSM), Samsung Electronics (OTCPK:SSNLF), and Intel.

On the other hand, the GFS-STM joint operation will produce lagging-edge or 300 nm wafers commonly used in cars, communications equipment, and other specialized industrial ICs (integrated circuits). This collaboration deserves to be applauded in view of the semiconductor shortage which has impacted the automobile industry and Europe’s dependence on East Asia which produces where nearly 80% of the world’s chips.

SEC filings for the GFS-STM Collaboration (www.seekingalpha.com)

According to some sources, costs will hover around 5.7 billion euros with stakes divided on a 58%:42% basis between GFS and STM respectively. This is much less than the $19 billion required by Intel for its German mega fab.

Additionally, GFS’s fab will be located in the city of Crolles (near Grenoble) where STM already possesses a manufacturing site. Thus, there should be significant economies of scale in terms of sourcing the materials required for the construction. With STM already having an established supply chain in the region, the French/Italian company can now exercise more leverage on its suppliers.

Thinking strategically, the project will also benefit from the financial support of the French government and is aligned with Europe’s Chips Act whose objective is to produce 20% of the old continent’s requirements compared to only 9% currently.

With the time taken to set up a plant being two years plus another two for getting it to cruising speed, the two partners expect full capacity to be reached in 2026 with a production volume of 620K wafers per year. This would help STM in its objective to increment its annual revenues from $12.7 billion (2021) to $20 billion in 2025-2027. This is an ambitious target and I elaborate further on how it will be done.

Boosting STM’s Growth and Profitability Prospects

In this respect, the collaboration with GFS as well as the organic expansion of its fabs in France and Italy will allow STM to move faster in supporting its European and global customers in their transition to digitalization and electrification. This is a market expected to expand at a CAGR of 9.2% from $483 billion in 2022 to $893 billion by 2029.

The deal also makes sense from a risk-sharing perspective. Potential risks are a natural oversupply of semiconductors sometime in the 2022-2023 period following an overinvestment in production capacity, or recession concerns dampening demand. Here, the fact that STM will be spending only 2.39 billion euros (42% of 5.7 billion) deserves to be highlighted.

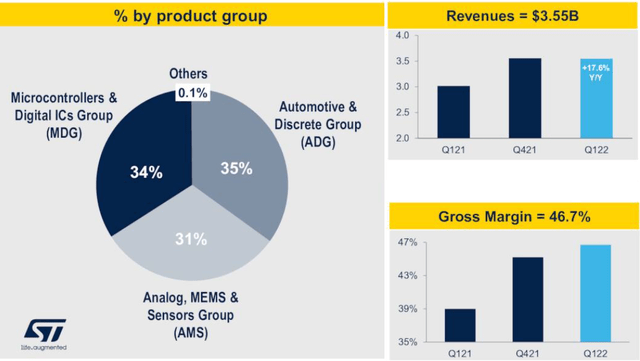

It will also strengthen STM’s position as a well-diversified designer, developer, and manufacturer with sales spanning Europe, the Middle East, Africa, the Americas, and the Asia Pacific. In this case, the company sales are balanced in the Automotive, Analog, Microcontrollers, and Digital ICs Group segments as shown in the charts below.

Revenues by segment and quarter, Gross margins (www.seekingalpha.com)

In addition to growth, STM’s value proposition to its shareholders also emphasizes profitable growth with gross and operating profit margins expected to rise by about 4% and 3.5% respectively from 2022 to 2025/2027. This objective should be supported through the use of FD-SOI or fully-depleted silicon-on-insulator technology which permits significant benefits for chip designers with features like very low power consumption, and easier integration with technologies like RF for connectivity purposes.

Looking into STM’s latest reported quarter or Q1-2022, gross margins increased by 7.7% on a year-over-year basis thanks to favorable pricing and improved product mix. As for operating margins, these increased by 10.1%, and going forward, the company expects these to be sustained as additional expenses incurred in research should be more than offset by sales.

Thus, at a non-GAAP price-to-earnings multiple of 9.26x, which is undervalued relative to the sector by more than 50%, STM is a buy. Adjusting with a 20% upside, the company could climb back to $37.7 based on its current price of $31.4.

As for GFS, it is primarily because of its differentiated version of FD-SOI which is already been used in its Dresden facility in Germany in 2020, that it was able to ink the deal.

Boosting GFS’ European Presence

One advantage for GFS with the joint operation is that it will have dedicated foundry capacity within the new facility and which will be managed by its own staff. Additionally, the supplier of substrate for FD-SOI is French-based Soitec with whom it already has a deep relationship. Considering that GFS will obtain 58% of the product revenues and that one 300 nm wafer can fetch around $1,634, 620K of these can bring up to $588 million (58% of $1.014 billion). This remains a conservative estimate based on 2020 values given that there was a 20% rise in chip prices just last year.

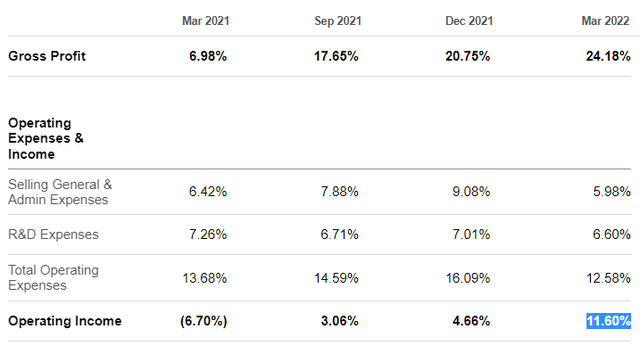

Looking at finances, the company has profited from the tight supply by selling more and charging higher prices. Thus, for its quarter ending in March 2022, it generated record revenues which were up by 37% year-over-year beating guidance by $40 million. Gross margins at 24.2% also constituted a record, beating guidance by 3.3%, showing pricing power, or passing additional costs to clients. Equally important are the operating margins of 11.6% constituting nearly a 7% increase from the December quarter as shown in the quarterly statement below. This shows that GFS is being able to control operating costs in an environment characterized by higher wage inflation.

Quarterly Income statement with gross and operating margins (www.seekingalpha.com)

Coming back to the deal with STM, the project will lead to a doubling of French semis production capacity in key areas of need and contribute to Europe’s industrial resilience. At the same time, with semiconductors proving to be essential components present in televisions, cars, planes, washing machines, air conditioner temperature sensors, and solar panels, the demand for electronic devices of all kinds has increased dramatically since the start of the pandemic.

Here, despite its small size compared to Intel, GFS, with cash of $3.26 billion and debt of $2.56 billion is prioritizing a partnership strategy to scale. For this matter, the company’s conservative capital allocation strategy also merits to be emphasized, as it involves expanding its New York and German fabs while selling off part of its U.S. assets, namely to ON Semiconductor (ON).

Consequently, at a forward price-to-book multiple of 2.5x, which implies an undervaluation of more than 30% with respect to the IT sector, the company is a buy. Applying a 30% upside to the current share price of $41.5, I obtain a target of $54.

Conclusion

Therefore, given the tremendous opportunities available in semiconductor manufacturing, and the high level of investments required, this partnership is a win-win for both companies, and this, not only in terms of sales but also for the bottom line thanks to economies of scale and FD-SOI technology. In concrete terms and being conservative, over $1 billion of value will be created, signifying that both stocks are buys.

This said investors, will note that shares of both GFS and STM have lost about 36% of their value since the beginning of this year when it became evident that several interest rate hikes would be required by central banks around the world to address the inflation issue which could result in headwinds for the U.S. and other economies. Along the same lines, two months of lockdowns in China to stop the spread of Covid have also impacted investors’ sentiment. Therefore, it is recommended that investors price the volatility factor in their investment decision.

Be the first to comment