bjdlzx

One of the best “cheap and good” stocks in the market

Browsing through the top 50 companies in Joel Greenblatt’s Magic Formula Investing, I stumbled upon a small-cap energy company coming out of bankruptcy in Unit Corporation (OTCPK:UNTC). There typically aren’t a lot of energy companies that screen well according to the Magic Formula metric. This metric takes into consideration both earnings yield and ROIC (return on invested capital).

I assume natural gas will be an even more precious commodity during this upcoming winter as the Russia-Ukraine war continues to destroy the natural gas supply chain, finding quality operators that haven’t already run up is a bit of a chore. While it’s always a risk to both be invested in small caps and ones that are reorganizing after bankruptcy, I’m willing to place small bets in oil and gas plays that are currently performing better than most of the market in earnings and ROIC. My thesis is this is a buy and possibly a swing trade after the winter if prices run up and some of these lesser-quality names begin to trade at multiples over the market average.

The company

It’s only fitting to start with the company’s statement at the time of bankruptcy from their website:

On May 22, 2020, Unit Corporation and its wholly-owned subsidiaries filed voluntary petitions for relief under Chapter 11 of Title 11 of the United States Code (Bankruptcy Code).

On September 3, 2020, the conditions to effectiveness were satisfied, and Unit emerged from the Chapter 11 Cases. On emergence from the Chapter 11 Cases all claims in respect of the Company’s 6.625% senior subordinated notes due 2021 (Subordinated Notes) were canceled. Holders of the Subordinated Notes claims became entitled to receive shares of the Company’s common stock, par value $0.01 per share (New Common Stock) under the Plan. In addition, holders of the Company’s old common stock that did not opt-out of the releases under the Plan became entitled to receive warrants to acquire New Common Stock.

The company’s operations are divided into three segments as listed on their most recent 10-Q:

We are primarily engaged in the development, acquisition, and production of oil and natural gas properties, the land contract drilling of natural gas and oil wells, and the buying, selling, gathering, processing, and treating of natural gas. Our operations are all in the United States and are organized in the following three reporting segments: (1) Oil and Natural Gas, (2) Contract Drilling, and (3) Mid-Stream.

- Oil and Natural Gas. Carried out by our subsidiary, Unit Petroleum Company (UPC), we develop, acquire, and produce oil and natural gas properties for our own account. Our producing oil and natural gas properties, unproved properties, and related assets are primarily located in Oklahoma and Texas, and to a lesser extent, in Arkansas, Kansas, Louisiana, and North Dakota.

- Contract Drilling. Carried out by our subsidiary, Unit Drilling Company (UDC), we drill onshore oil and natural gas wells for a wide range of other oil and natural gas companies as well as for our own account. Our drilling operations are primarily located in Oklahoma, Texas, New Mexico, Wyoming, and North Dakota.

- Mid-Stream. Carried out by Superior of which we own 50%, buys, sells, gathers, transports, processes, and treats natural gas for UPC and for third parties. Mid-Stream operations are primarily located in Oklahoma, Texas, Kansas, Pennsylvania, and West Virginia.

As we can see, the company operates a combination of upstream, midstream, and downstream oil and gas projects, these are either wholly owned or joint venture projects through subsidiaries. There are planned and executed divestitures of some of their assets that occurred during bankruptcy and that will occur in the future. However, this is a fully operational company that has been in business since 1963 with 788 employees. With small and micro-cap companies, the length of time that a business has experience doing business is something that I look for.

While an event like COVID can, unfortunately, turn a small company like this on its head, they certainly weren’t the only ones in this circumstance. If oil and gas prices remain strong to stable, even the small operators will profit if they know what they’re doing

Magic Formula Investing

Magic Formula Investing for non-practitioners screens for the highest-scored companies in the stock market by both earnings yield and ROIC. Created by Joel Greenblatt of Gotham Asset Management, the metric for “cheap and good” takes the earnings yield, taught by using EPS/SP or EBIT/EV, gets one percentage, and then adds that together with the ROIC percentage to get a score. An earnings yield of 10% and an ROIC of 10% would have a score of 20.

The lower you set the market cap on the screener, the more difficult it is for large companies to screen favorably. Most of the stocks that pop up when you set the screener to its lowest threshold of $50 million turn out small and mid-cap stocks that can grow capital more easily than larger businesses.

The earnings yield

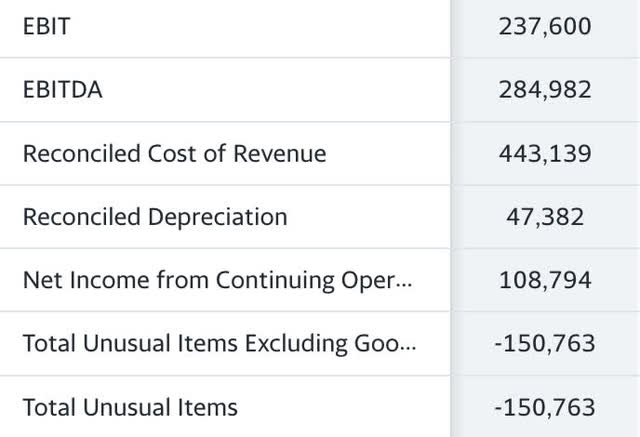

The current earnings yield for Unit Corporation is quite high. The company has a TTM EPS of $9.77 a share with a share price of $54. This gives us an earnings yield of 18% based on GAAP metrics. If we drill down to what the screener most likely uses, EBIT/EV, we get a whopping 54% (EV TTM $433 million/ EBIT $237.6 million)

Yahoo Finance

ROIC calculation

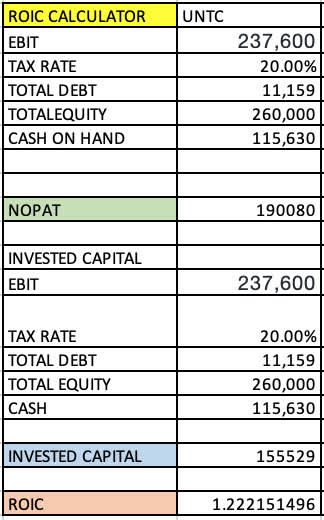

ROIC UNTC (excel sheet, data from 10-Q)

Since the company was negative in earnings last year, there was no tax expense to calculate the average tax rate. In this scenario, I’m using a conservative 20% tax rate going forward even though there will be significant deductions ahead. Total debt and shareholders’ equity numbers are the most recent TTM from the company’s 10-Q.

Here we can see that the company is clocking an enormous 122% return on invested capital. This is obviously due to the optimal timing of coming back on the market when oil and gas prices started to soar. The numbers reflect what is probably the top of the cycle for this company. Even so, if they can double their future retained earnings, new leverage, and or any new equity issues, the market should continue to trade this stock upwards.

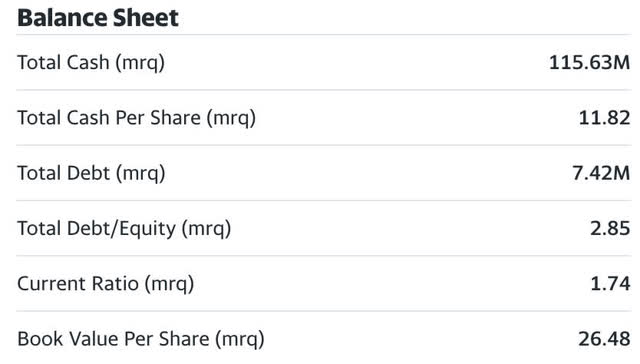

Yahoo Finance

Simply looking at this from an EV/EBITDA ratio, the stock is only trading at 1.52X. Those are some cheap multiples indeed. Even if EBITDA were cut in half, the ratio would still be amazing.

Total Score

With an ROIC of 122% and an earnings yield of 54% using EV/EBIT, we would get a score of 176. For reference, a score of 20 implying an earnings yield of 10 and an ROIC of 10 would be decent. This is certainly the right place at the right time scenario for Unit Corporation. It is up to us to determine how long the right time will last and whether or not we stay in the stock for the medium or long term.

The Debt

Yahoo Finance

The company employs very little debt at the moment with a debt-to-equity ratio of only 2.85%. They were highly levered up pre-bankruptcy and some of the IPO equity raise was a reorganization of previous debt holders’ claims. I don’t blame them for being conservative here. The total debt number I used from the company’s recent 10-Q in the ROIC calculation included some lease obligations that were hybrid and included in their stated total debt. If I’m just referring to the balance sheet summary from Yahoo or Seeking Alpha, this would result in driving the ROIC percentage even higher.

The Dividend

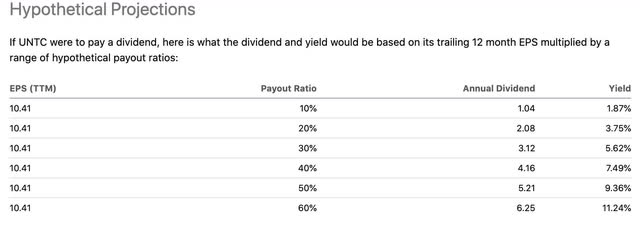

Coming out of bankruptcy, the company is certainly being as careful as possible and making sure that its capital structure is stable and sustainable. At this point Unit Corporation does not pay a dividend, nor have they announced a planned one. Here are some hypothetical projections of payouts based on TTM earnings per share of $10.41:

Seeking Alpha

Catalysts

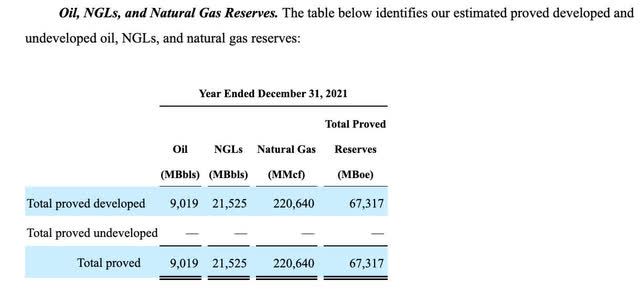

UNTC reserves (2021 UNTC 10-K)

The company has ample reserves and interests in both oil and natural gas. They also operate a midstream segment with 3,800 miles of pipeline in Oklahoma, Texas, Kansas, Pennsylvania, and West Virginia. It’s difficult to find a small-cap oil company that operates in more than one segment of oil production. This is a diversified small cap that operates in up, mid, and downstream refining of natural gas. The company is also divesting some of its non-core assets in upcoming quarters which will lead to income that is more than their normal operations. At current, many of those will command higher and higher multiples as the price of energy increases.

I still believe that natural gas prices spiking in the winter will be a solid catalyst to generate more profit or sell assets at inflated prices to larger operators. The wintertime will bring a lot of options to these small caps and could bring some nice price increases to investors.

Risks

If natural gas prices stabilize, or drop substantially, along with oil, these small-cap oil stocks will track the commodity prices lower in my opinion. Without a dividend, the company also doesn’t attract the income investors that make up a large constituency of oil and gas stock shareholders.

Summary

A small-cap company with a large Magic Formula score. I invest in oil and gas companies, but normally the majors. I do not claim to be an expert in small cap oil companies or special situations. I just follow the numbers and Unit Corporation’s excellent number led me here. The company just coming out of bankruptcy scares me a bit, and its’ annual and quarterly filings are littered with disclosures regarding this subject. However, at an EV/EBITDA of less than 2 and a trailing P/E of 5.64, those are all numbers that ring the margin of safety bell. This is also an experienced operator having been around since 1963.

Small caps that have outlandish plans and pivots away from their old lines of business are normally a red flag for me too. However, this company is straightforward. Oil, gas, drilling, refining, and transporting through pipelines. The stock is up 61% in the past 52 weeks and would seem to have more runway ahead of them at these prices. With a TTM-free cash flow of $151 million, a dividend could be on the table. I would buy cautiously and monitor the oil and gas market through winter and then determine if this is a long or short-term play.

Be the first to comment