Justin Sullivan

AMD (NASDAQ:AMD) pre-released earnings for the third-quarter on October 6, 2022, unfortunately just shortly after I wrote “AMD: Buy When Others Are Fearful”. AMD’s pre-release is quite significant regarding the size of the revenue drop the semiconductor firm experienced in the third-quarter due to a further deterioration in the PC market. While I think that AMD has long term potential, in part related to the enormous metaverse opportunity and AMD’s very successful EPYC data processor series, I think that short term uncertainty and lowered expectations are going to weigh on AMD for a while. Falling gross margins are a game-changer because they signal the end of the current expansion cycle in the chip industry. For those reasons, I am changing my recommendation to hold.

AMD pre-released Q3’22 earnings

On October 6, 2022, AMD released its Q3’22 results three weeks early due to a major deterioration in operating conditions in the third-quarter.

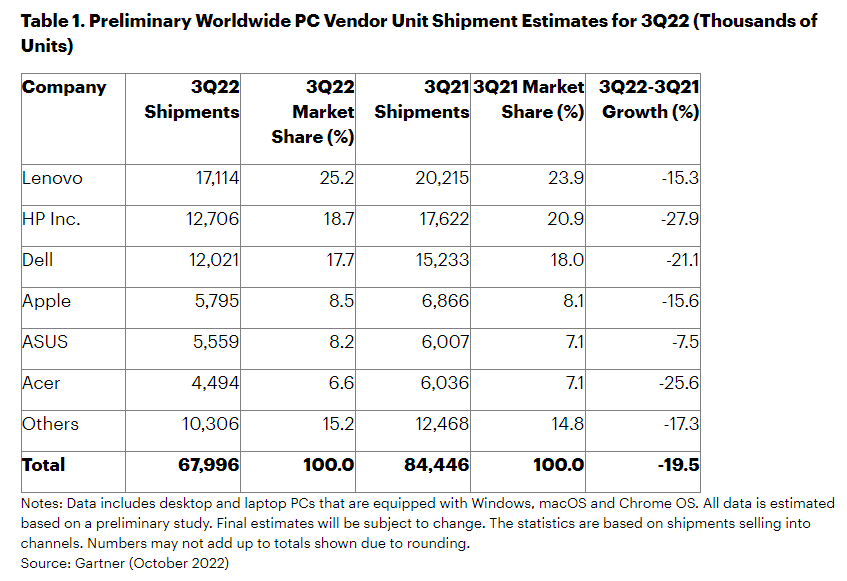

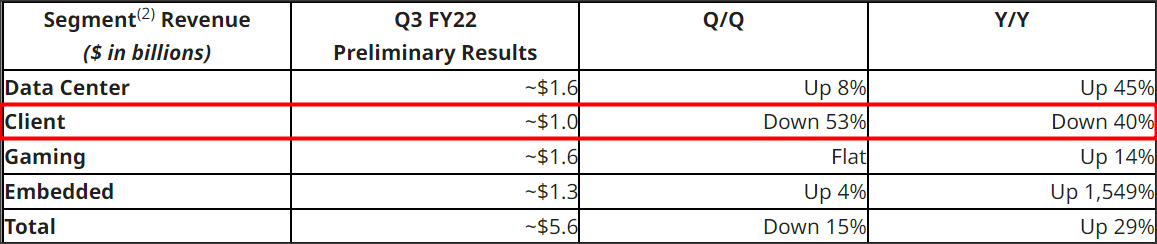

AMD disclosed in a release that its revenues in the third-quarter were just $5.6B which was a full $1.1B below the mid-point top line forecast just a quarter ago. Three months ago, AMD expected revenues of $6.7B +/- $200M due chiefly due to rapidly declining growth in the Client segment. The Client segment is a new reporting section for AMD which includes the sale of Ryzen desktop and laptop processors. Demand for processors has waned in FY 2022, largely because PC shipments are falling after the COVID-19 pandemic which saw device sales surge to a record in Q1’21. Since then, however, shipments for PC, laptops and mobile devices have dropped sharply. According to the newest data about PC shipments just made available by consulting company Gartner, PC shipments fell significantly in the third-quarter which ties together with AMD’s profit warning.

According to Gartner, PC shipments dropped a massive 19.5% in the third-quarter which represented the largest drop since the mid-nineties, indicating that the PC/laptop market is in much worse shape than feared. According to Gartner’s earlier outlook, the company projected a 9.5% decline in PC shipments in FY 2022 and a 7.6% drop in total device sales (which includes mobile phones). The latest data from Gartner combined with AMD’s profit warning, however, paints a pretty dark picture of the state of the PC and device markets and things may even get worse for AMD in the short term.

From Lenovo to Apple, major PC and laptop manufacturers saw significant decreases in PC shipments in Q3’22, indicating that the down-turn is as broad-based as it is steep.

Source: Gartner

Weakening PC demand was cited by AMD as a top reason for the collapse in revenue growth in the Client business. AMD’s $5.6B in Q3’22 revenues still represented 29% year over year growth, however, and the firm’s other segments, especially Data Centers, continued to perform well for AMD. The Data Center business still generated 45% year over year revenue growth and has a new quarterly revenue baseline of $1.6B. But clearly, growth is slowing down hard for AMD and it already created significant headwinds for AMD’s valuation.

AMD: Q3’22 Preliminary Results

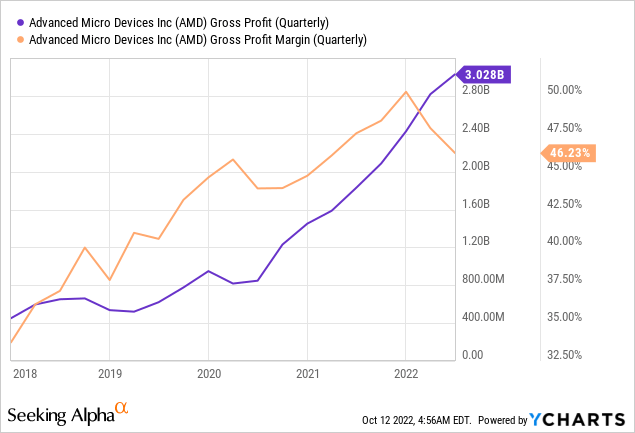

Pressured gross margins: the end of the market cycle

Due to the slowdown in the Client business, AMD is seeing a decline in its gross margins… which I have previously singled out as being the canary in the coal mine for chip companies. This is because contracting gross margins are the result of waning pricing and volume strength which clearly is the case here. AMD disclosed a gross margin of 50% (non-GAAP) for the third-quarter which is below the 54% gross margin expected in AMD’s previous outlook. I believe AMD’s gross margins (in %) have now effectively peaked and are possibly set for another sequential decline in Q4’22 if the PC market continues to weaken.

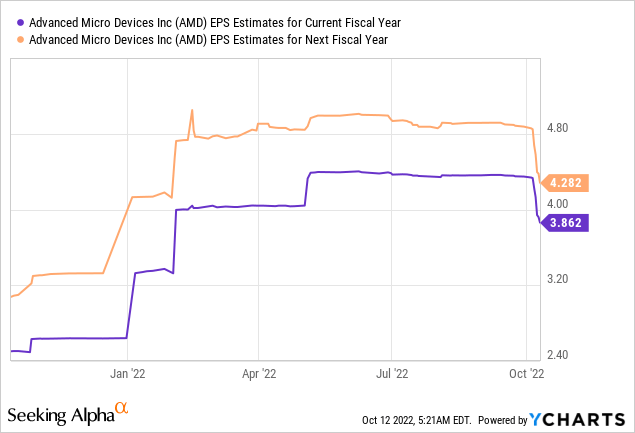

Revisiting AMD’s valuation – Estimate risk

AMD has a much more compelling valuation now after the profit warning sent shares into a tailspin. I still believe that AMD has an attractive long term growth curve due to its aggressive investments in Data Centers and due to the recently closed acquisitions of Xilinx and Pensando. However, AMD has now significant estimate risk and analysts have already begun to mark down their projections for the company’s FY 2022 and FY 2023 earnings.

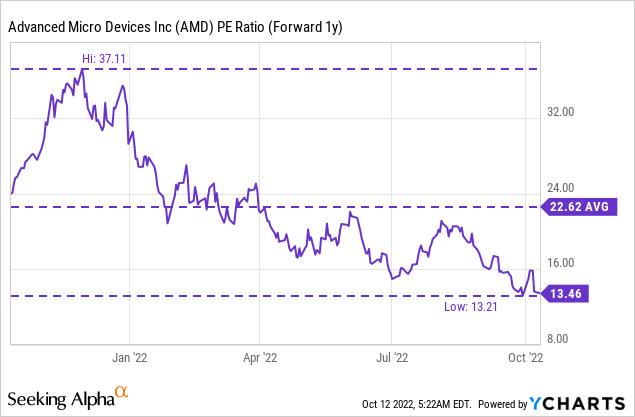

AMD is now selling at its lowest P-E ratio in a year, but with EPS estimates falling, the P-E ratio may go up considerably going forward.

Risks with AMD

The obvious risk after AMD’s profit warning is that AMD’s gross margins will continue to decline in the coming quarters which would effectively put an end to the current semiconductor expansion cycle. Additionally, AMD is set to face down-ward pressure on its average selling prices, especially in the consumer- oriented Client and Gaming businesses. Strong pricing for processors and especially graphic processing units have led AMD to post record results last year and weakening pricing at a time of contracting volume shipments indicate that AMD’s gross margins will likely continue to decline in the short term.

Final thoughts

The timing of my last article was quite unfortunate. While I like to buy a quality enterprise at a decent valuation — which is what AMD offers — I must also acknowledge the changing operating conditions that have led both Gartner and AMD to release very concerning new information lately. I believe that AMD’s profit warning is a game-changer, especially the decline in gross margins, and that I have over-estimated AMD’s potential in my last work, unfortunately.

If the PC market decelerates further in Q4’22, which I expect, AMD is set to see a continual decline in Client revenues. Even more concerning is that AMD’s gross margins have started to trend down and that pressure on average selling prices is building. For those reasons, I must down-grade AMD to a hold!

Be the first to comment