spxChrome/E+ via Getty Images

Underlying Security Symbol: TreasuryDirect.gov

I am old enough to have seen hyperinflation and stagflation of the early 1980’s. Hard to believe my first mortgage rate was 13.75%. A 3-month certificate of deposit hit 18.65% in 1980. That is not a typo.

Back then, I was a bond girl. Over the next 40 years, we experienced a remarkable bond bull market. I sold every one of the bonds I bought at substantial premiums. Over the past 20 years, seniors, who only wanted to put their savings in a government bond that could sustain their income needs, were faced with decreasing income. Seniors never expected to receive less than 1% on their savings and very small cost of living increases in their social security payments. You starve, or you go into the stock market or you learn how to fix toilets and buy rental income property.

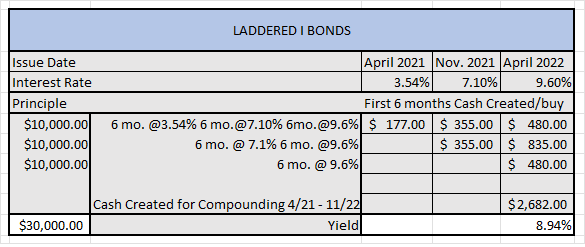

How quickly times change. Early last year in 2021, the U.S. Government I Bond interest rate increased to 3.54%. I bought the maximum allowed for me which is $10,000 per social security number per year. I am guaranteed to receive that rate for at least 6 months. Then the rate re-adjusts based on inflation. Thinking inflation was increasing I waited until the rate reset to buy the additional $10,000 allowed for my spouse.

In November, the interest reset at 7.1%. I bought the other allowed $10,000. The original $10,000 will now also receive 7.1%.

Now it is April 2022, and the rate increase has been announced. The new rate is 9.6%. I will now buy $10,000 of this bond in May. And, all three buys will now earn 9.6%. The rate will again reset this coming November, and I am betting on another increase.

Technically, this is called building a bond ladder.

This bond really doesn’t help seniors who need income because the interest is compounded. But it does help those of us who want to stash some cash safely in case we may need it in 5 years. There are some advantages for younger folks who want to use the funds for education. Many articles are available on this subject. Just yesterday, the WSJ published an article on this I Bond.

Be aware that if the economy tanks and interest rates fall, the reset could result in a lower interest rate. That means all my buys will reset to the new rate; higher or lower. Other important facts about this investment include:

- Not liquid for 1 year; you cannot sell it and get your money back.

- Redemption fee of 3 months interest payment for the next 5 years, but you can sell it and get your money back.

- Your broker cannot buy this for you; you have to create your own account at www.treasurydirect.gov

Where else can you find a government-guaranteed instrument with this kind of yield? Answer is nowhere.

MM MoneyMadam

Editor’s Note: The summary bullets for this article were chosen by Seeking Alpha editors.

Be the first to comment