Lemon_tm/iStock via Getty Images

Written by Nick Ackerman, co-produced by Stanford Chemist. This article was originally published to members of the CEF/ETF Income Laboratory on April 14th, 2022.

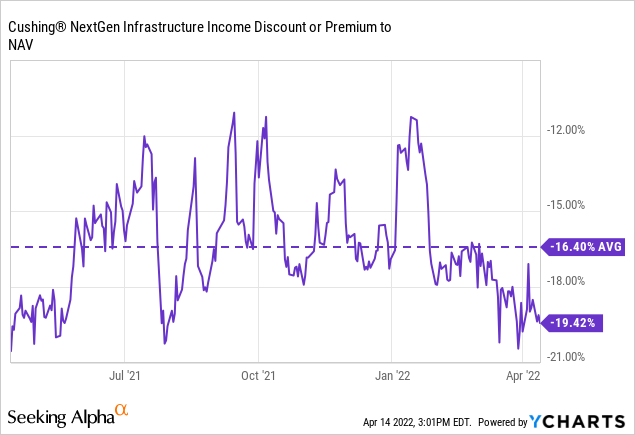

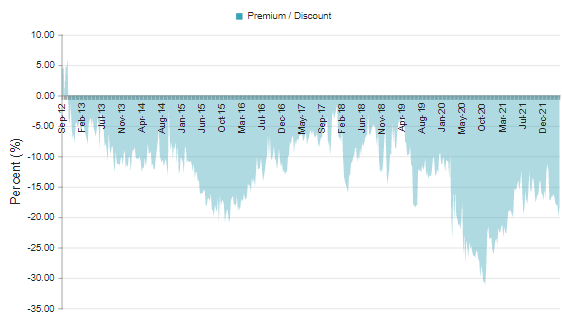

The Cushing NextGen Infrastructure Income Fund (NYSE:SZC) continues to catch my interest. The fund has been on what seems to be a perpetually deep discount since the crash of March 2020. Even before that, the fund ran at a discount but not as deep as it has been these days. Even on a shorter-term basis, we are seeing an even deeper discount over the last year than usual.

The fund has several problems that I believe investors see. The one that gets brought up the most would be the historically poor performance. Of course, the rebuttal to that is investing is about the future. You don’t drive forward using your rearview mirror; you drive looking through the windshield at what could happen next. On top of this, the fund is not what it used to be either. It changed its name and investment policy on April 3rd, 2020.

It was a fund primarily focused on energy only. These days, the investment policy has been broadened to allow more flexibility. Primarily, they invest in infrastructure and just about anything that can fit under that broad umbrella. That also includes technology and communication infrastructure companies. So we see some names that you might not expect to show up on occasion.

The Basics

- 1-Year Z-score: -1.43

- Discount: -19.42%

- Distribution Yield: 5.72%

- Expense Ratio: 1.89%

- Leverage: 28%

- Managed Assets: $200 million

- Structure: Perpetual

SZC will “seek high total return with an emphasis on current income.” To achieve that objective, the fund will “invest at least 80% of its net assets, plus any borrowings for investment purposes, in a portfolio of equity and debt securities of infrastructure companies, including: [i] energy infrastructure companies, [ii] industrial infrastructure companies, [iii] sustainable infrastructure companies, and [iv] technology and communication infrastructure companies. The Fund will invest no more than 25% of its Managed Assets in securities of energy master limited partnerships (“MLPs”).”

The fund is limited in its capacity to hold MLPs to 25% since they are a regulated investment company. This wouldn’t be a restriction if they were structured as a C-corp as several other infrastructure/MLP funds. Overall, the fund can invest in quite a vast amount of holdings that pertain to the infrastructure space.

Another negative of the fund for some larger investors is the size. It is a smaller fund and that often translates into lower liquidity as daily volume is low. Some investors who want to get in and out in large chunks of shares quickly could run into issues.

The fund’s expense ratio comes to 1.89%. This comes to 2.25% when including leverage expenses. This figure also includes the 0.25% management fee waiver they have in place. They had announced this in a press release with their latest distribution announcement that it would be in place for another twelve months. Their borrowings are based on a variable rate; as interest rates rise, this will add some costs going forward.

Performance – Strong Year, Relatively Speaking

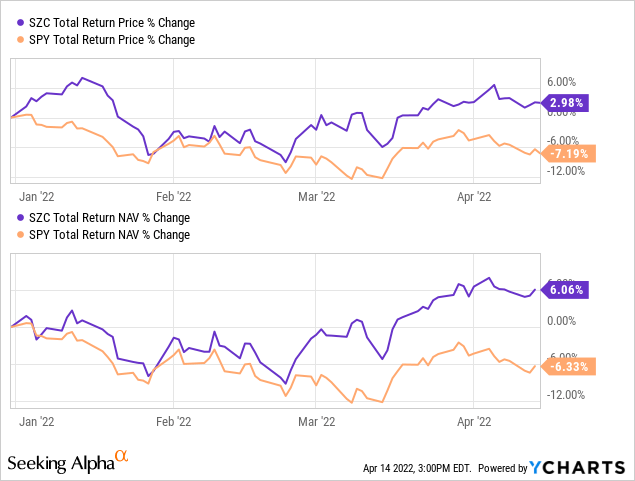

One thing that SZC has been able to pull off more recently in terms of performance is positive total returns. This is at a time when, relatively speaking, many other investments are negative on a YTD basis. The fund still holds a significant allocation to energy, so the strong returns in that sector have resulted in SZC benefitting. The chart below shows YTD performance on a total price and NAV return basis. I’ve also included the S&P 500 SPDR (SPY) for context.

Ycharts

At the same time, the fund’s discount has only widened for the year. This resulted from the share price not quite keeping up with the fund’s actual NAV return. The current discount is materially deeper than it had averaged over the last year.

Ycharts

Even further, it is substantially deeper than the fund had averaged since the fund’s launch. It is true that it is a different fund now than it had been. However, in my opinion, it is a safer fund than it was previously as it is a bit more diversified. It can hold more conservative holdings such as utilities now or even various REITs. Previously, it was focused primarily on energy.

SZC Discount History (CEFConnect)

(Ycharts has errors with SZC’s longer-term discount history that wouldn’t allow me to provide an average.)

Investing is about looking forward, but based on these historical figures, it gives us an idea of the valuation and where the fund currently stands.

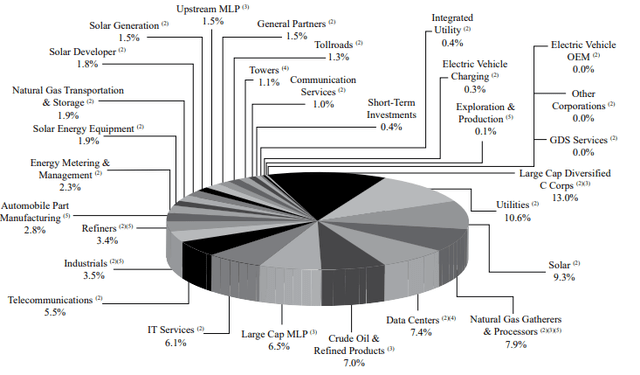

Distribution – Due For A Boost

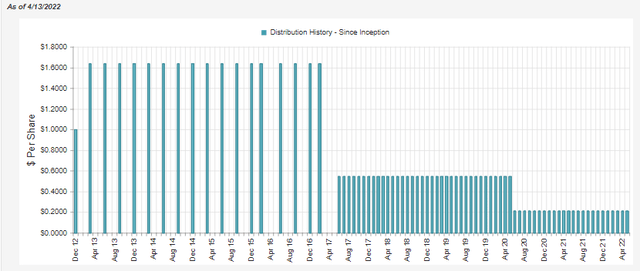

The distribution was gutted in 2020 due to the pandemic and collapse of energy companies. Since then, they haven’t boosted the distribution. That has led to a rather low distribution rate of 5.72%. While I believe that is still quite attractive, other CEFs can offer much more. Even those in the energy/infrastructure space. On a NAV basis, it comes to a distribution rate of 4.61%.

SZC Distribution History (CEFConnect)

In one way, this isn’t necessarily a terrible thing. The fund will grow as they retain assets, primarily by offsetting gains with carryforward losses or just leaving unrealized gains to accumulate. That can add more liquidity the larger the fund gets. It can also mean that, relatively speaking, the expense ratio will also reduce if the actual expenses stay flat. Though we know leverage expenses are likely to inch higher.

It also means a higher share price for investors, all else being equal. Except for CEFs, most investors focus on the income component – which could lead to another reason why the fund’s discount remains rather stubborn.

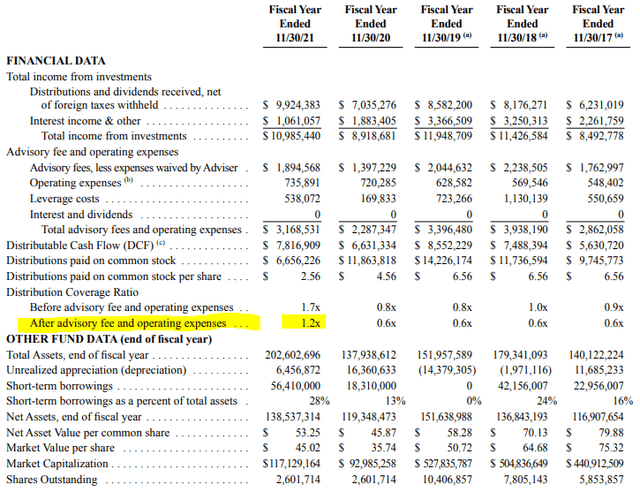

At the end of their last fiscal year, the coverage sat at 1.2x, as reported by the fund itself.

SZC Annual Report (Cushing (highlights from author))

This coverage is simply looking at the distributable cash flow. That is, the dividends, interest, and return of capital distributions received from the fund’s MLPs. This doesn’t account for the potential capital gains that can be generated from the fund.

In fiscal 2021, they had generated nearly $34 million in realized capital gains. That alone would have been enough to cover the payout to investors 5x over.

SZC Annual Report (Cushing (highlights from author))

The reason why we didn’t see any increase in the distribution or a year-end special would have been due to the capital loss carryforwards.

The Fund utilized $29,293,315 of capital loss carryforward during the fiscal year ended November 30, 2021. As of November 30, 2021, for federal income tax purposes, capital loss carryforward is comprised of short-term capital loss of $1,439,532 and long-term capital loss of $14,348,388.

As these dry up, the fund might be in a position where they have no choice but to increase the payout to investors. Either that or the fund could be subject to excise tax as an RIC. In that scenario, no one but the government wins.

These losses plus the return of capital distributions from the underlying MLPs mean that distributions for shareholders have been predominantly ROC over the last couple of years.

For the fiscal year ended November 30, 2020, the Fund’s distributions were 13%, or $1,533,965, ordinary income, and 87%, or $10,329,853, return of capital. For the fiscal year ended November 30, 2021, the Fund’s Distributions were expected to be 100%, or $6,656,226, return of capital. For Federal income tax purposes, the distribution of short-term capital gains is treated as ordinary income Distributions.

SZC’s Portfolio

SZC generally provides a quarterly fact sheet. At this time, I wasn’t able to find it. I had also reached out to Cushing, and I have not received a reply from them (though we are heading into a holiday weekend, and it has been less than 24 hours.)

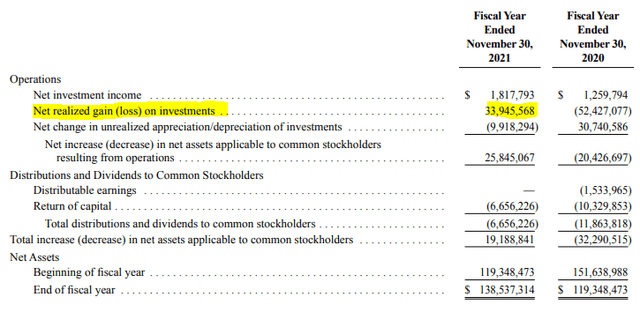

With that out of the way, here was the fund’s positioning from their latest Annual Report available. It was for the period ending November 30th, 2021. When we last looked at the fund, it was for the positions as of September 30th, 2021. So it does give us a bit of an update. In that report, we can see that they get quite detailed on the breakdown of their fund.

SZC Portfolio Breakdown (Cushing)

Interestingly, they list a total of 60 positions total. If you don’t include the two holdings in money market funds or the short position in Enphase Energy (ENPH). This could mean that with how detailed the breakdown above is, it is likely represented by one holding by itself.

At that time, the fund listed 79.5% listed in common stocks. There was another 35.9% listed as MLP holdings. REITs are making up 10.7% of the fund, with fixed income coming in at 9.5%. Short-term investments came in at just 0.6% – which is great because we want our funds to invest, not sit in cash. These allocations account for the leverage the fund utilizes. That would appear to be why the MLP exposure can be above the 25% limit.

At that time, Clearway Energy (CWEN) came in as the largest position. They had noted that it was the second-largest contributor to the fund’s performance in their prior fiscal year. This is a renewable developer. However, they noted that DCP Midstream (DCP) was the top contributor and MPLX LP (MPLX) was the third-largest contributor. These are good old-fashioned energy midstream plays.

MPLX is particularly popular as a high-yield MLP play. The current distribution rate comes to 8.16%. They had also notably operated through 2020 without having to cut the payout to unitholders.

MPLX Distribution History (Seeking Alpha)

DCP and MPLX were relatively smaller positions towards the end of November 2021 for SZC. DCP was a 0.99% allocation, and MPLX was a bit of a heftier weighting at 3.11%.

Conclusion

SZC remains a worthwhile investment, in my opinion. While I’m not optimistic about fossil fuel energy over the long term, the fund has the flexibility to invest in renewables. That’s basically what I’m looking for in the space from my infrastructure funds, those with flexibility. At the same time, SZC’s discount remains attractive. I’m not so confident this discount will close as investors continue to stay away from these funds that were hit particularly hard through 2020. So on that basis, I wouldn’t expect a lot from the discount contraction, but it could be a bonus if it happens.

Be the first to comment