Jae Young Ju

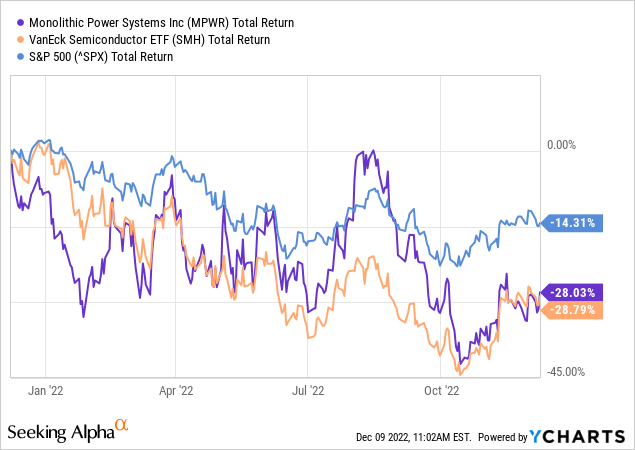

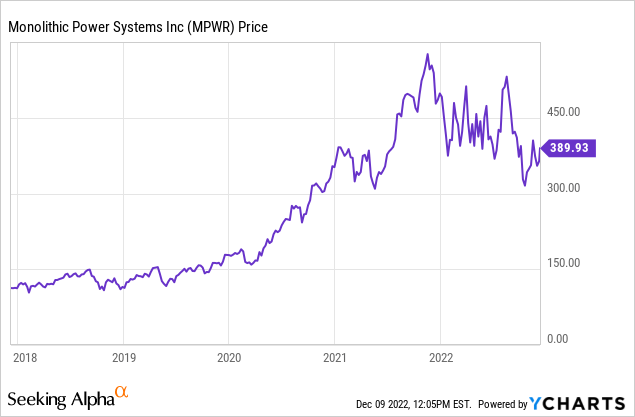

The stock of Monolithic Power Systems (NASDAQ:MPWR) is up 52%-plus since my initial Seeking Alpha Buy rating back in September 2020 (see MPower: EVs A Prime Catalyst). However, the stock is down 24% over the past year as the 2022 bear market has mauled the broad semiconductor sector as represented by the VanEck Semiconductor ETF (SMH) (see below). As its name suggests, MPWR leverages innovative and proprietary technology processes to offer high-performance power solutions to the computing, industrial, automotive, and consumer markets. Given the correction in the stock price, and considering MPWR continues to demonstrate impressive growth, today I’ll take a look at the company to see if investors might now have an opportunity to invest at a relatively attractive entry point.

Earnings

MPWR released its Q3 earnings report in late October, and it was, once again, a strong beat on both the top and bottom lines. Revenue of $461 million (+57.2% yoy) beat consensus estimates by $30.41 million. Non-GAAP EPS of $3.25 was a $0.31 beat. GAAP earnings of $2.57/share were up 78.5% yoy.

Q3 GAAP gross margin was 58.7% compared with 57.6% for the prior-year quarter. That being the case, MPWR joins Broadcom (AVGO) as one of the few semiconductor companies that continues to post strong revenue and margin growth (see AVGO’s strong results posted yesterday).

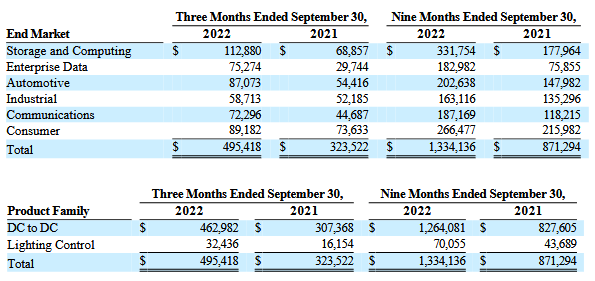

The following graphic shows MPWR’s results across its end markets and by product family:

Monolithic Power

What this graphic shows – again similar to Broadcom – is strong growth all across MPower’s various end markets. Note that – despite the current doom and gloom “enterprise” narrative being painted by analysts – MPower’s Enterprise Data revenue grew a whopping 153% yoy while Storage & Computing revenue grew 64% yoy.

Going Forward

The mid-point of the company’s Q4 revenue guidance ($460 million) came in below consensus. However, note that if MPWR were to achieve that revenue level, it would be up 45.6% as compared to the $336.5 million that MPWR delivered in Q4 of last year.

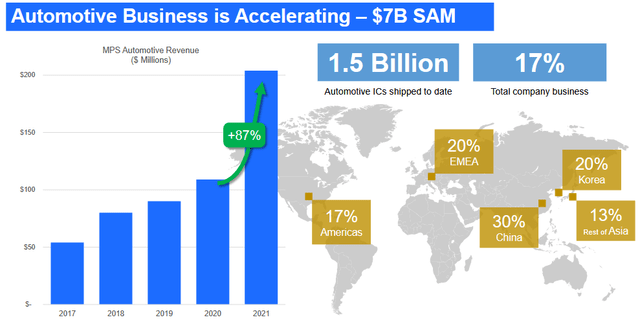

That’s because, in addition to the Enterprise and Data and Storage and Computing segments, MPWR continues to demonstrate strong growth in its Automotive business with its well-diversified footprint and an expanding TAM driven by the EV transition (slides are from MPWR’s November Presentation):

That’s because MPWR continues to deliver electrification solutions that save power and space. The company estimates that its new products across digital cockpit, lighting, electrification, advanced driver assistance systems (“ADAS”), and body control solutions represent an incremental $400/car opportunity going forward. The company also reports that it has $1 billion of design wins in the pipeline.

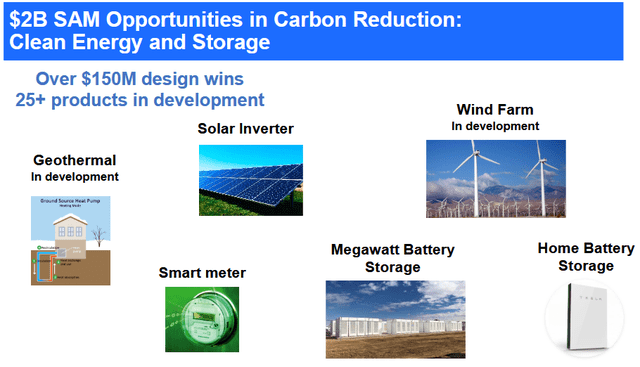

MPWR also is a growing presence in the clean-energy market, with strong product development and a growing number of design wins:

Shareholder Returns

Since 2005, MPower has returned ~50% of cash generation to shareholders through dividends and stock buybacks. In February, MPWR increased the quarterly dividend from $0.60 to $0.75/share (25%). Given the company’s outstanding financial performance throughout this year, I would expect the dividend to be raised to as much as $1.00/share come February 2023. If the company decided on a lower dividend increase, I would expect it to announce a significant share-buyback program.

The current $3/share dividend obligation equates to a 0.78% yield. That being the case, while MPWR is demonstrating significant dividend growth, in my opinion, the primary investment opportunity here continues to be capital appreciation.

Valuation

MPower currently trades with TTM P/E ratio of 48x and a forward P/E of 31x per Seeking Alpha. While that is arguably a rather rich valuation level, investors should consider the outstanding revenue and earnings growth MPWR continues to deliver, its diversified end markets and geographic footprint, and its strong margin. In addition, many of the markets in which MPWR has design wins are relatively “sticky.” That is, once an IC gets tested, qualified, and gets a design win in an EV, for instance, it is relatively hard to “unseat” that device is given the cost, risks, and time to redesign circuit boards, re-test, re-qualify, etc.

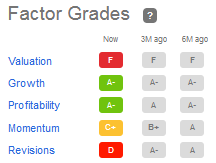

Perhaps not surprisingly, Seeking Alpha gives MPWR an “F” grade on valuation, considering its TTM P/E is more than 2x the average S&P 500 company:

Seeking Alpha

And, the company gets a “D” for “revisions” which is somewhat amusing to me considering that the rating appears to be based on the Q4 revenue guidance being a bit light while the Q3 EPS report itself blew away revenue and earnings estimates with strong top and bottom line growth. Meanwhile, what matters most to me, are the “A” ratings for Growth and Profitability, of which MPWR has clearly earned.

Summary and Conclusion

I like this company – its broad portfolio and growth across multiple end-markets, and its strong margin – all of which remind me of Broadcom. As does its dividend growth – which appears to have a long run-way going forward. While the current valuation is high, the company deserves it given its 57%+ revenue growth in Q3 and its guidance to grow an estimated 45% in Q4. Given that MPWR earned $2.57/share in Q3 alone, and the current dividend obligation is only $3 annually, that bodes well for another significant boost in the quarterly dividend come February – which could be as much as $1.00/share given the company’s strong financial performance in FY22.

That said, investors cannot ignore the market’s current negative sentiment and the macro environment of high inflation, higher interest rates, and slowing global economic growth as a result of Russia’s war with Ukraine which broke the global energy and food supply chains and continues to be a strong negative headwind for investors. That being the case, my advice is for investors who already own the stock to continue to hold it, and for investors wishing to establish a position to be patient in order to take advantage of market volatility and scale into MPWR with opportunistic purchases on dips.

I’ll end with a five-year stock price chart and note that MPWR was trading below $320 in October. I would nibble on MPWR in the $340 range and if the stock were to drop below $320 again, I would establish a full position. That is why the company is on my personal watch list.

Be the first to comment