Hispanolistic/E+ via Getty Images

You always need to be cognizant of six sigma events that can have ugly impacts on your portfolio and account for the approximate probabilities. – Mohnish Pabrai

Introduction

Twitter

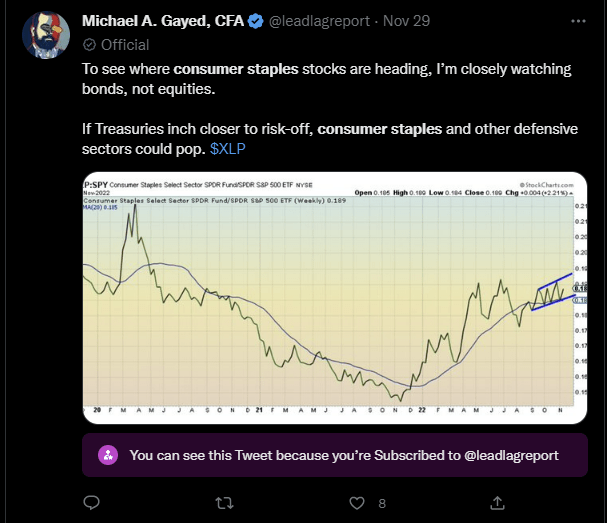

Recently, I shared some content with the Super Followers of The Lead-Lag Report Twitter account, positing the merits of an investment in the consumer staple space at this juncture.

If you’ve been following some of my recent commentary across various portals, you’d note that I’ve expressed some concerns about the signals emanating from Treasuries, Gold, and Lumber. Do consider that traditionally, this seasonal period has worked very well for risk assets. Besides, it looks increasingly likely that we could be on the cusp of a slowdown in Fed rate hikes. Both these conditions should ideally serve as ample ammunition for risk-on momentum to roll on, but ironically, it’s the defensive segments of different markets that are exhibiting some strength. Investors would do well to pay heed to this recent positioning and consider rotating towards the defensive side of the equity market, such as staples.

The Case For VLGEA

Within the staples space, one little-known stock that may be considered is Village Super Market, Inc. (NASDAQ:VLGEA). As you can see from the image below, relative to other staple stocks, the stock offers good value, as the ratio has now dropped to levels seen back in 2004-2005, and may be due to a pop.

Coming back to this story, it’s a business that has been around for the last 85 years. Currently, VGEA operates a chain of 34 supermarkets, the bulk of which are in New Jersey (more than 3/4th of the total chains). VLGEA benefits from being the second-largest member of the Wakefern Food Corporation (it also owns 12.5% of Wakefern’s stock) which provides the former with scale benefits in purchasing, distribution, marketing, etc. On account of its association with Wakefern VGEA also benefits from the usage of brands such as Fairway and ShopRite that have strong brand recall and abet purchasing decisions.

VLGEA also has some other strengths that are worth highlighting.

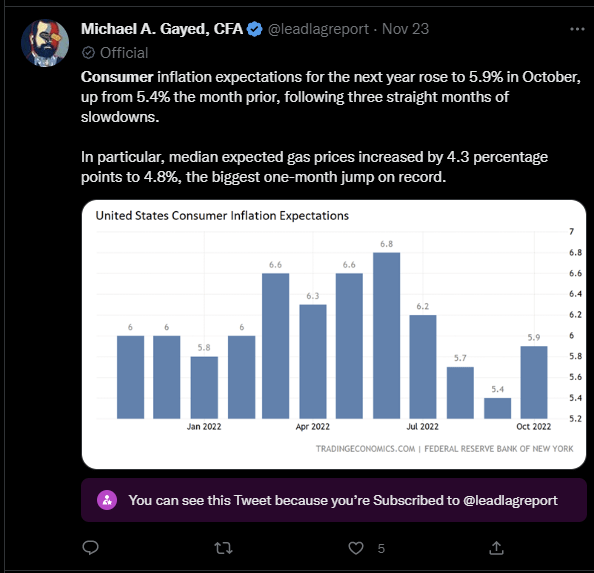

A lot of questions have been asked about whether inflation has likely peaked and whether this is likely to be a dominant headwind going forward. Well, as noted in The Lead-Lag Report, it would be imprudent to jump to any concrete conclusions as recent inflation expectations for next year recently surged after showing signs of a decline.

Twitter

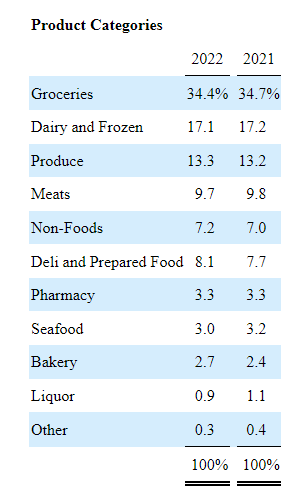

For something like a VLGEA, this does not have to be a major concern. As noted in the image below, the company’s product portfolio is oriented around goods that have very low-price elasticity of demand.

10-K

So even if one is faced with recessionary conditions, you’d expect VLGEA to face steady demand and also bring through useful doses of price increases to compensate for higher input costs. In fact, the company recently reported fairly healthy Q1 same-store sales numbers, which were up by 4.3% YoY; much of this was attributed to retail price inflation, which could well continue.

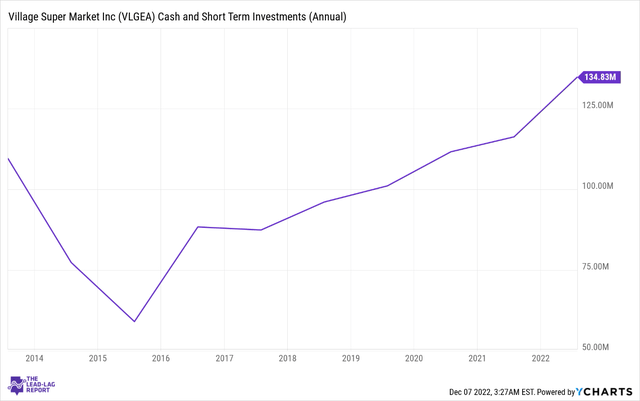

VLGEA also offers some interesting qualities with the cash dynamic. In an increasingly recessionary environment, I’d imagine investors would be prepared to pay a premium to own companies with a healthy touch of defensiveness to their balance sheets. Interestingly enough, VLGEA has been quietly building its cash balance, which is currently at its highest point in over 10 years!

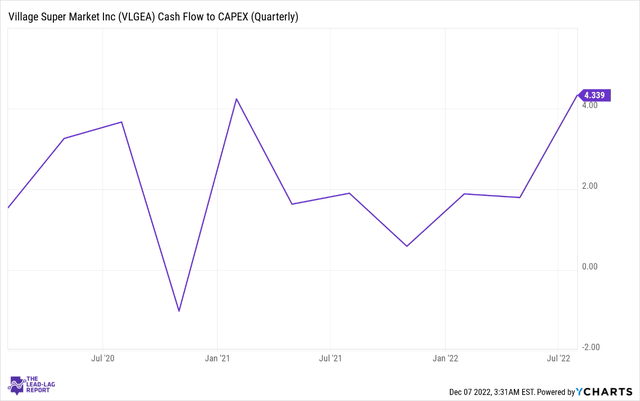

VLGEA has also exhibited useful operating cash flow generating qualities, which enable it to comfortably cover its investments. Over the last 5 years, the quarterly operating cash flow has only been able to cover the CAPEX by a little over 2x, but recently this has almost doubled and currently hovers at well over 4x!

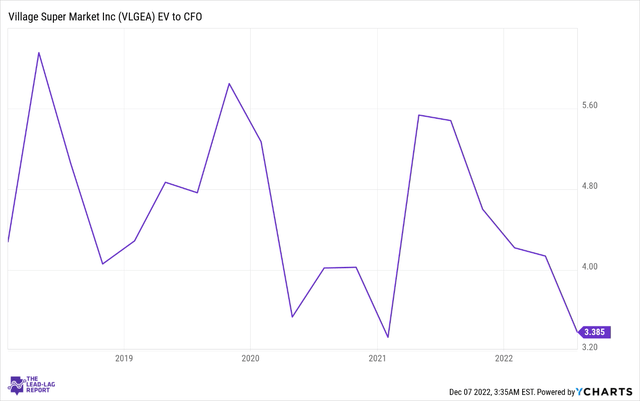

The strong operating cash flow generation in recent periods makes the VLGEA stock rather attractively valued. At the current level of operating cash flows, VLGEA only trades at 3.38x, a 26% discount to the 5-year EV/CFO average of 4.57x.

Then there’s also the dividend angle, which brings a further degree of security to the VLGEA narrative. As noted in the Leaders-Laggers section of my subscription research, I believe dividend stocks could receive plenty of attention in 2023 particularly as treasuries continue to advance. At VLGEA’s current price levels, you can pocket a fairly high yield of 4.22% which is higher than the stock’s long-term average of 3.93%. Also note that VLGEA has been paying dividends for 11 straight years now, so there’s a degree of consistency that can be relied on. If you’ve listened to the recent Lead-Lag Live podcast episode with Mark Roussin, we touched upon how liberating dividend plays could be for attaining financial freedom.

Risks

So far, I’ve been waxing lyrical about Village Super Market, Inc., but there’s one sub-plot that could potentially dampen sentiment, and that’s the small-cap link (VLGEA’s market cap is less than $400m). As pointed out in The Lead-Lag Report, traditionally, a rising Fed Funds rate over time has correlated with small-cap outperformance. We may not be there as yet, but when the Fed decides to pivot, this correlation could reflect unfavorably on Village Super Market, Inc. as sentiment towards small-caps drop.

Be the first to comment