niphon/iStock via Getty Images

One of the most integral components of the cryptocurrency movement has been the existence of the DEX. DEX is short for decentralized exchange. These are the applications that allow for coins to be swapped without a custodian. For instance, if someone is holding Ethereum (ETH-USD) but they want to swap to a stablecoin like USCoin (USDC-USD), they can use a DEX to make that trade without needing a custodial exchange like Coinbase (COIN) or Binance (BNB-USD).

On the Ethereum chain, there are numerous different DEX applications one could choose from if they wanted to swap tokens. Uniswap (UNI-USD) is one of the most popular decentralized exchanges and currently has the largest market capitalization of all of the Ethereum DEX tokens with a $3.9 billion valuation of the circulating supply.

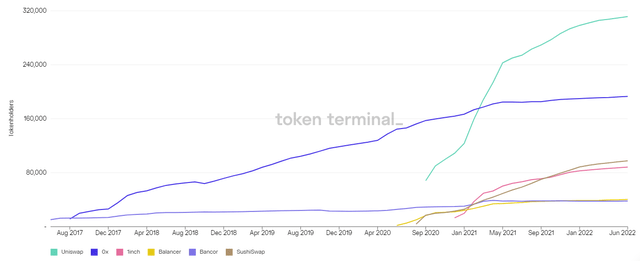

Holders and Circulating Supply

Compared to other decentralized exchange peers on the Ethereum chain, UNI is one of the most widely held DEX tokens with over 300k unique wallet holders.

While DEX tokens can often lack strong tokenomics, they do generally have governance baked in for holders. Governance gives the token holders the ability to vote on community proposals and participate in the direction the platform takes. Because governance is the main reason to hold many tokens, max supply and circulating supply become important for prospective token holders to consider. If you’re considering buying an asset for governance purposes, you don’t want a high level of inflation or possible dilution. With the exception of 0x (ZRX-USD), most of the other DEX tokens have less favorable circulating supply stories than Uniswap.

| Market Cap | MC Rank | Token | Circulating Supply |

|---|---|---|---|

| $3.9b | 20 | UNI-USD | 73% |

| $420m | 79 | (1INCH-USD) | 36% |

| $402m | 82 | (CRV-USD) | 16% |

| $278m | 105 | ZRX-USD | 85% |

| $205m | 129 | BAL-USD | 42% |

While not a complete picture of the DEX landscape, Uniswap does have a much more favorable circulating supply metric than most peers with 73% already in circulation. This might be one reason why the token has a significantly higher market cap than the other DEX protocols listed. Another potential reason for the larger cap is the TVL story from Uniswap’s DeFi footprint.

Total Value Locked Trend

With over $5 billion in Total Value Locked, Uniswap is the top Ethereum DEX by TVL according to Defi Llama.

| Protocol | Token | TVL | Mcap/TVL |

| Uniswap | UNI-USD | $5.03b | 0.49 |

| Curve | CRV-USD | $4.47b | 0.07 |

| Balancer | BAL-USD | $1.27b | 0.14 |

| SushiSwap | (SUSHI-USD) | $506m | 0.45 |

| Bancor | (BNT-USD) | $196m | 0.61 |

Source: Defi Llama, 6/28/22

What’s interesting is looking at the year to date trend in each of these top 5 Ethereum DEX protocols. At the beginning of the year, Curve had nearly triple the TVL of ETH as Uniswap. Six months later, Uniswap is the top DEX on the network.

| Protocol | TVL 1/1/22 | TVL 6/28/22 | YTD |

| Uniswap | 2,260.0 | 4,380.0 | 93.81% |

| Curve | 6,300.0 | 4,310.0 | -31.59% |

| Balancer | 870.6 | 1,110.0 | 27.50% |

| SushiSwap | 1,440.0 | 564.6 | -60.79% |

| Bancor | 343.8 | 164.2 | -52.24% |

Source: Defi Llama, 6/28/22. TVL figures in 000s of ETH.

And Curve’s TVL drop in ETH by percentage isn’t even the worst of the top 5 ETH protocol; SushiSwap has seen a 61% drop in TVL year to date. Bancor has given up over half of its TVL as well. With the largest Total Value Locked of the five protocols mentioned, Uniswap is among the most valuable DEX governance tokens in the entire cryptocurrency space.

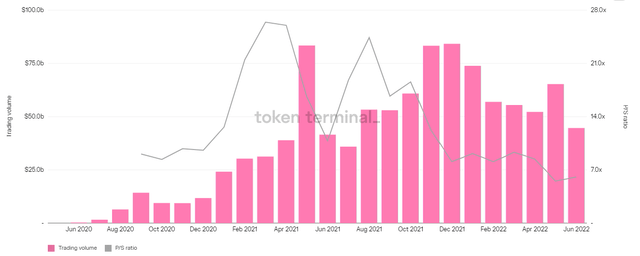

Exchange Usage Trend

From a protocol revenue standpoint, Uniswap is still seeing strong trading volume happening on the exchange. While the total trading volume on Uniswap has come down quite a bit from the highs back in November and December, the platform has already seen a year over year trading volume increase of 7% for the month of June and there are still two full days remaining in the month.

The increase in platform trading volume has helped to decrease Token Terminal’s price to sales ratio for Uniswap from 10.8 last June to just 6.1 today. You can see in the chart above that the long-term trend in trading volume is still positive overall while the value of the governance token has declined. This has led to a very large decline in the token’s P/S valuation multiple.

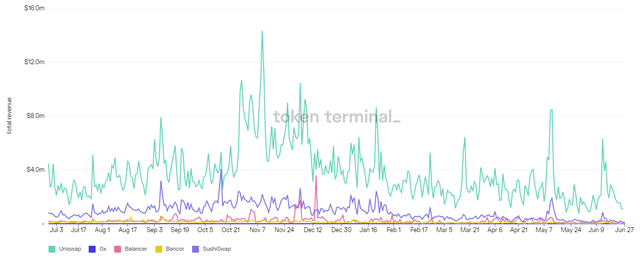

The revenue story is pretty clear. Uniswap is still doing between $1 million and $1.5 million in daily revenue over the last few weeks. Even though there has generally been a decline in total revenue over the last several months as a result of widespread crypto market declines, Uniswap’s revenue is still well ahead of the previously mentioned peers.

Summary

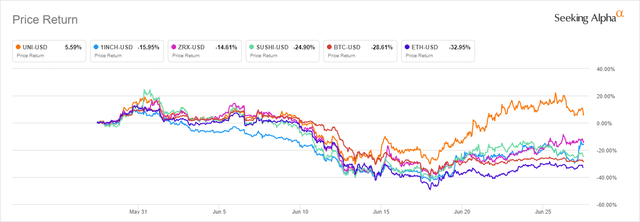

I added UNI to my BlockChain Reaction portfolio as part of my month-end update for May 2022. Since that addition, UNI has been one of the best-performing assets in the cryptocurrency market. It’s actually up 5% over the last month while Bitcoin (BTC-USD), Ethereum, and many of the other DEX tokens mentioned in this article are down 15-30%.

Crypto Winter is upon us. I don’t know what the bottom will be in Bitcoin or Ethereum. But I strongly believe this bear cycle will be a phenomenal opportunity to buy or add to core crypto positions in solid projects and networks. If you want a DEX governance token in your portfolio, UNI might not be a bad pick. After an 87% retrace from the token’s all-time high, I’ve taken a position in the Uniswap token, and I plan to hold that position for the foreseeable future. There are other tokens that I have added to my portfolio that I’ll be sharing in my June update for BlockChain Reaction subscribers.

Be the first to comment