Tomwang112/iStock via Getty Images

Introduction To The Thesis

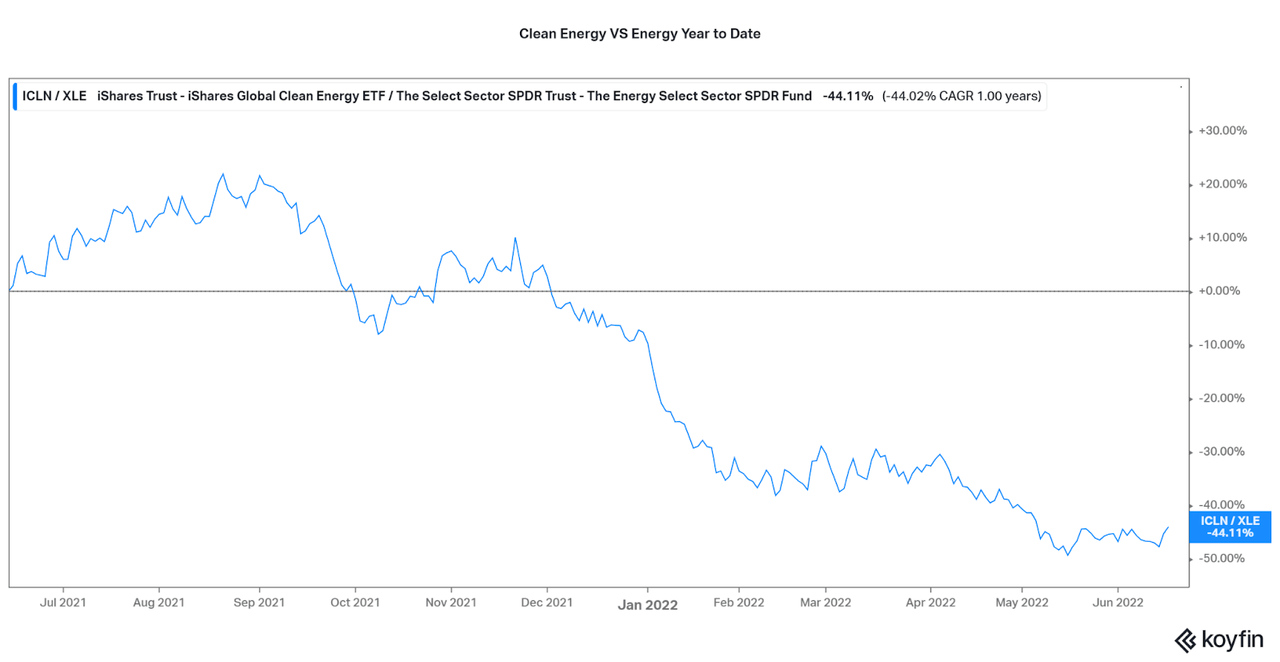

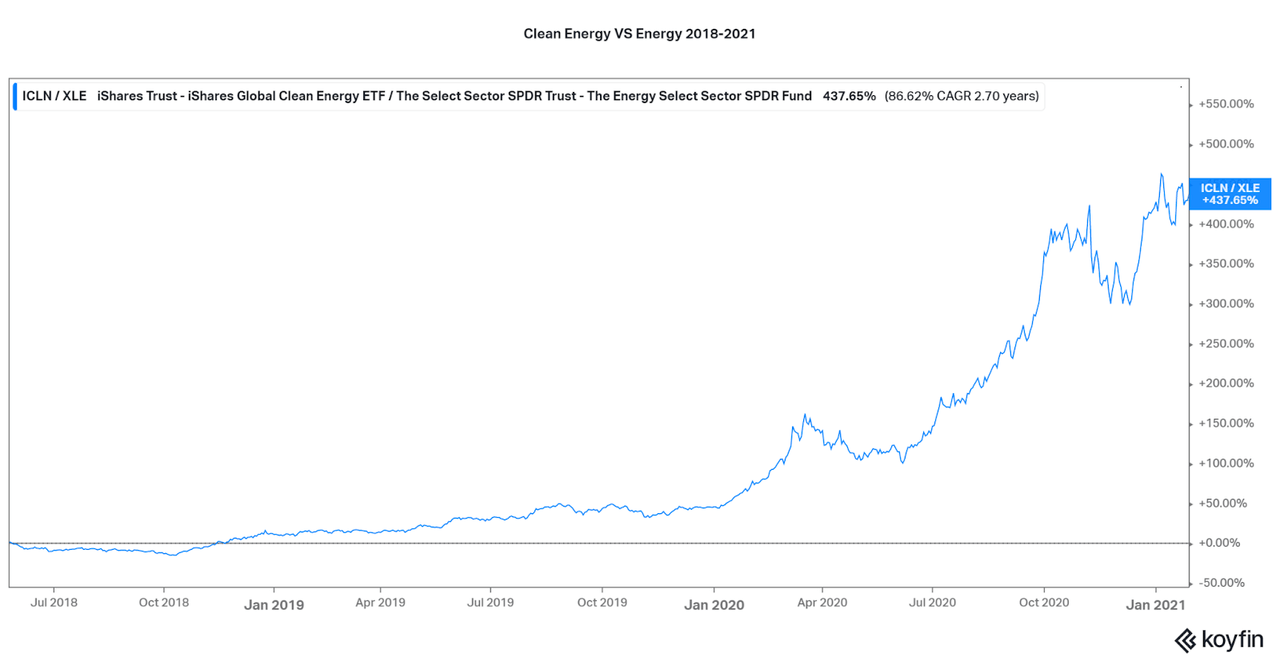

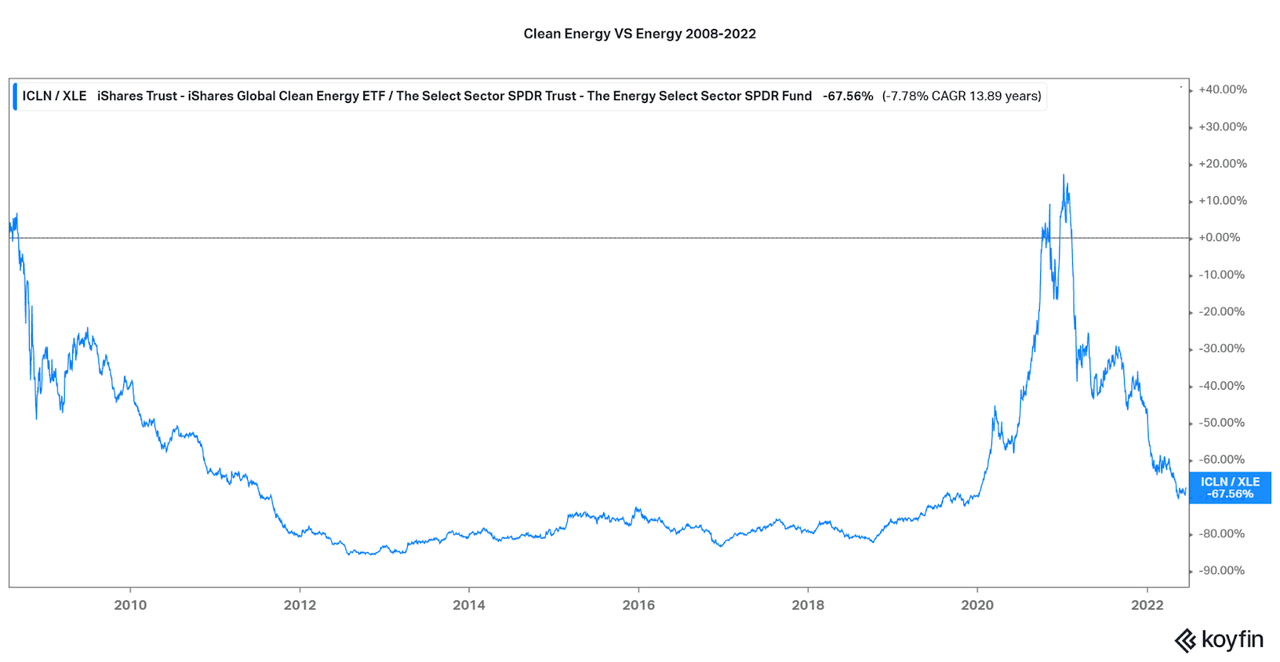

The trades betting for or against natural resources such as oil and gas or renewable technologies have been extremely cyclical the last few years. The early stages of the pandemic were certainly a time of easy money and forward thinking, allowing renewables to continue the pattern of outperformance that was established after the GFC. However, as interest began to rise, energy resource supply and demand became out of balance and geopolitics threw a smoke bomb on logistics outlook. This allowed the prices and valuations of those in the energy industry to outperform until mid-June. Just take a look at the two charts below.

Koyfin Koyfin

As you can see, the iShares Clean Energy ETF (ICLN) has underperformed by nearly half year-to-date when compared with the SPDR Energy ETF (XLE). However, XLE was left in the dust between 2018 and 2021. While some may argue that the 4x beat is better than underperforming by half, that is not the point. I want to leverage a trade that takes into consideration both the chance for upside and limited downside. Can this even occur by investing in renewables and shorting energy? I am not so sure, and the long-term comparison chart, shown below, is the major problem that arises: cyclicality between the two forms of energy production. At the moment, it looks like clean energy will have their turn to outperform again.

Koyfin

The Elephants in the Room

There are a gamut of issues I must address first before people start ranting in the comments (please don’t). I don’t even have the time to cover all of them, so I will cover the most important points. Fossil fuels are regarded as non-renewables for a reason, there is limited supply. In essence, no matter what, oil and gas are most likely eventually going to meet their doom. Especially as the natural process that develops hydrocarbons typically takes millions of years. I will not even dive into the environmental drawbacks, as there is no need to cause a commotion. The point I am trying to make is that no matter what, sometime this century our natural resources will begin to dry up (although there is always the chance for new discoveries or production technologies, at a cost).

Then, consider the fact that we are in the 111th anniversary year of the breakup of Standard Oil. Our modern society was built upon, and relies on, these hydrocarbon feedstocks. It is nearly impossible to separate our planet from the industry without technological regression. You cannot rip off the bandaid all at once (although some groups believe it works like that). The Oil & Gas industry has had many years of developmental progress over renewable resource design and development, leading to significant price advantages over the current phase of renewables. However, the price advantage is evaporating rapidly. The thoughtful article, “Why Are Fossil Fuels So Hard To Quit?”, summarizes some of the major issues:

“Electrify everything” is a great plan, so far as it goes, but not everything can be easily electrified. Certain qualities of fossil fuels are difficult to replicate, such as their energy density and their ability to provide very high heat. To decarbonize processes that rely on these qualities, you need low-carbon fuels that mimic the qualities of fossil fuels.

Is it fair to bet against such an essential group of resources? Or is it wrong to bet for a group of resources that has an end date in sight, perhaps even in my own lifetime? These are the questions one must think about on your own, tying in factors such as investment timeline, risk tolerance, etc., to find your own answer. This article just reflects what I believe will work out for my own investment desires. That is why I will be shorting a risky bet on the fossil fuel industry, and go long with an equally risky renewable company that is set to rebound.

The Short: Oil Via Ring Energy

Let’s start with the short. First, while I believe all fossil fuels will face headwinds over the coming years, I believe that crude oil faces more pressure. There are multiple reasons for this, which I will address in a moment. However, this leaves me to focus on companies focused on the crude oil side of the market rather than natural gas or diversified companies. This would put companies such as Magellan Midstream (MMP) at risk, but thankfully, they have size and diversity on their side. Therefore, I decided on risk and underperformance in Ring Energy (NYSE:REI). Here’s why:

-

The company is a Permian Basin play, but their current proven assets are 85% oil. This is too much exposure to the weaker oil side of the industry.

-

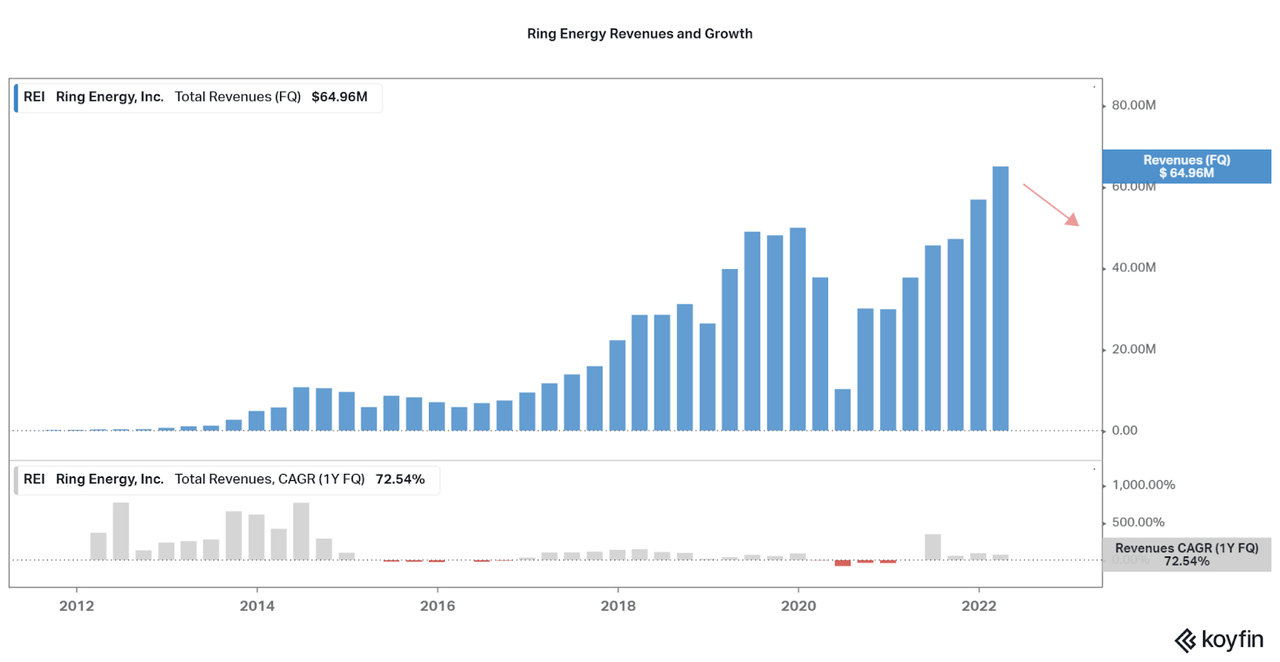

Revenues are extremely cyclical, even as the company attempts to make their full proven reserves operable. If oil prices fall, so will their revenues.

-

As shown with pandemic performance, any decline in market demand may wreak havoc on the company’s finances.

-

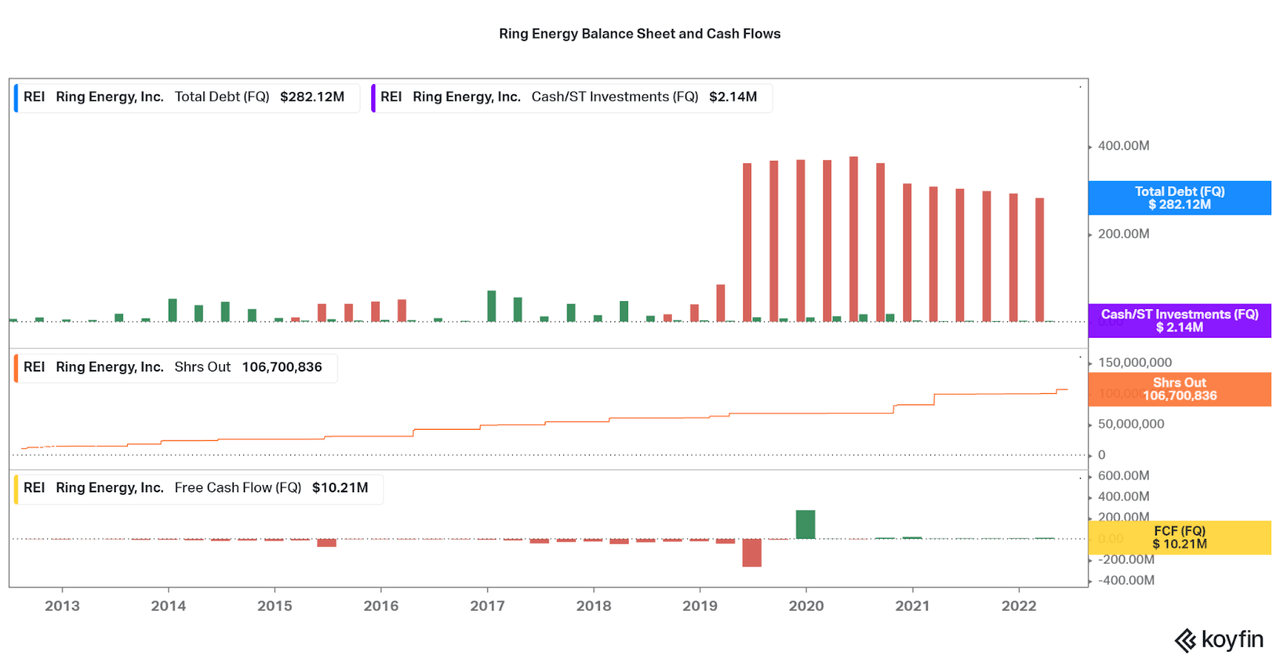

Extremely leveraged, with only $2 million in cash, tons of dilution, and a history of losses when oil prices are low leads to significant risk.

-

Leverage is used to acquire more provable assets, but these could come at an extreme price and hurt returns in a low oil price environment.

-

Even oil & gas investors frown upon the stock as short interest is over 20%. I recommend following their lead.

Why focus on oil companies as the risk point? Well, crude oil faces stiff headwinds due to the shift towards cleaner natural gas consumption for energy and transportation, along with the fact that crude oil has many competitive applications. Examples include increasing plastic recycling (see PureCycle (PCT), etc.), viscous oil recycling (see Vertex Energy (VTNR), Heritage-Crystal Clean (HCCI), etc.), and the rise of alternative fuels (see Gevo (GEVO), Green Plains (GPRE), Rex American (REX), etc.). Natural gas is often considered an alternative for oil across most end points, so reliance on the segment is only natural. Thanks to the quote by the EIA below, I will remain focuses on the removal of oil from our society sooner, rather than natural gas.

“Although crude oil is a source of raw material (feedstock) for making plastics, it is not the major source of feedstock for plastics production in the United States. Plastics are produced from natural gas, feedstocks derived from natural gas processing, and feedstocks derived from crude oil refining.”

Revenues

As with all cyclicals, it is always difficult to predict where revenues will end up. However, current oil pricing suggests that a top may be in for the commodity. As such, I expect revenues to begin flattening out over the next few quarters, then decline as interest rates destroy demand. This can already be seen as occurring here in mid-June, but it is better to wait until a long-term trend is clear. If anything, I expect a plateau in revenues at the very best and this will not be enough to support the current share price and current operational expenses.

One risk to consider is the rise in production, as the company is fairly new. Approximately 50% of Ring Energy’s assets have not been developed, but are due to come online over the next decade. Due to their leveraged deposit acquisitions and investments into establishing drilling, I do expect revenues to have organic underlying growth. However, oil prices will have more control over revenues and investor sentiment, so I do not believe production increases will outpace the decline in revenues and valuation.

Koyfin

Balance Sheet

Along with a cloudy revenue outlook, another major catalyst for poor performance is the weak balance sheet. As discussed earlier, the company is saddled with debt and has little cash on hand. While the company does claim to have up to $100 million in liquid assets, these are not listed in the same categories as most other companies. Therefore, take them with a grain of sand. Either way, debt remains the dominant force. Further, shareholders can look forward to more dilution as the company finds a way to fund further investments. If the oil market begins to fall over the next few quarters, look for more debt and dilution, along with a return to negative FCFs. When combined, Ring Energy will be forced to hold an unfavorable valuation and the share price will fall.

Koyfin

Valuation

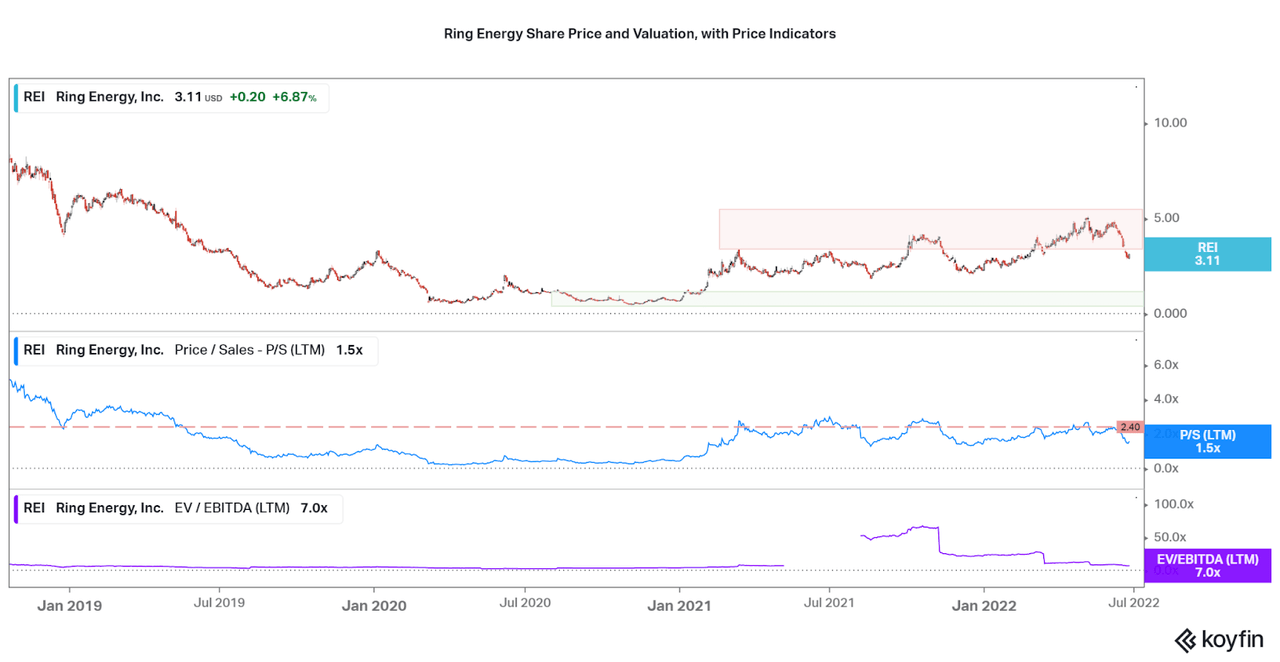

**Please note that I began this research over a week ago and the share price has fallen by nearly 30% (and rebounded again). I believed I had more time before initiating the trade. While the short thesis remains, I would recommend performing extra due diligence before attempting the riskier strategy. That includes investing in industry hedges, which I will discuss next. I have updated the valuation chart with ranges to consider.

While on the surface Ring Energy may look to have a low valuation, this is common for cyclical companies. This pattern is visible across multiple industries, such as shipping, housing builders, and raw material companies. However, unlike oil & gas, we can see that as commodity prices and demand have fallen over the past few months, share price performance has been poor for other cyclical industries. I expect this to occur soon for the oil & gas industry, as it is only natural for cyclical industries to fall from all-time highs. I will not predict where oil prices will end up, but I believe poor performance by Ring Energy will cause the share price to fall.

Looking at Ring Energy’s chart below, we can see a few patterns. First, volatility leads to multiple shorting opportunities per year. Sell points correspond to share prices over $4.00 and a P/S ratio of 2.4x, or higher. I would not recommend shorting below those margins of safety due to the risk of volatility. The earnings data is less useful as profits change quickly as REI’s production increases and investments are offset. When I first began writing this article, the share price was in the risk zone and was worth a short, but I now find the risk to be higher and will wait. This also allows the secular decline in fossil fuels to begin again in earnest as alternatives come to market over the next few quarters. I will be covering many over the coming years.

Koyfin

The Hedges

To offset the risk associated with shorting Ring Energy in the event that energy prices remain high, I recommend keeping some exposure to the industry. For me, this includes:

-

Aspen Aerogels (ASPN) has legacy clients that are predominately in oil & gas sectors (Aspen is also looking to expand into EV and battery applications).

-

Aris Water Solutions (ARIS) provides water recycling services to companies such as ConocoPhillips (COP) and Chevron (CVX) in the Permian Basin. This is thanks to a growing partnership with Texas Pacific Land (TPL).

-

And, engineering pioneer KBR (KBR) continues to provide R&D, optimization, and low-carbon solutions in the fossil fuel industry and beyond.

Along with the oil replacement technologies I discussed earlier in the article, I find that the companies I invest in are diversified and not reliant on a single side of the industry. However, all focus on making the industry more efficient, and sustainable, which is necessary as long as fossil fuels remain in our society. Further, as an investor in other fossil fuel companies, especially the giants such as ExxonMobil (XOM), Chevron, and Occidental (OXY), you gain access to investments in alternative energy production techniques such as carbon capture and hydrogen.

Whether through their own choices, realizations, or by force, the large cap fossil fuel companies seem to be shifting away from using fossil fuels, especially energy usages. This is a major reason why I believe it unwise to bet against the large-cap fossil fuel companies as they currently have the income available to invest away from their own industries. Also, the topic has entered the public spotlight over the weekend as a result of interviews with Exxon Mobil CEO Woods:

When Faber asked Woods what Exxon Mobil will look like in 10 years, he predicted that the company may continue to participate in oil and gas exploration, although it will also engage in renewable energy solutions like biofuels.

As Exxon Mobil navigates the energy transition, Woods emphasized his commitment to balancing existing demands for affordable energy with “the needs of the future as well, which is lower emissions.”

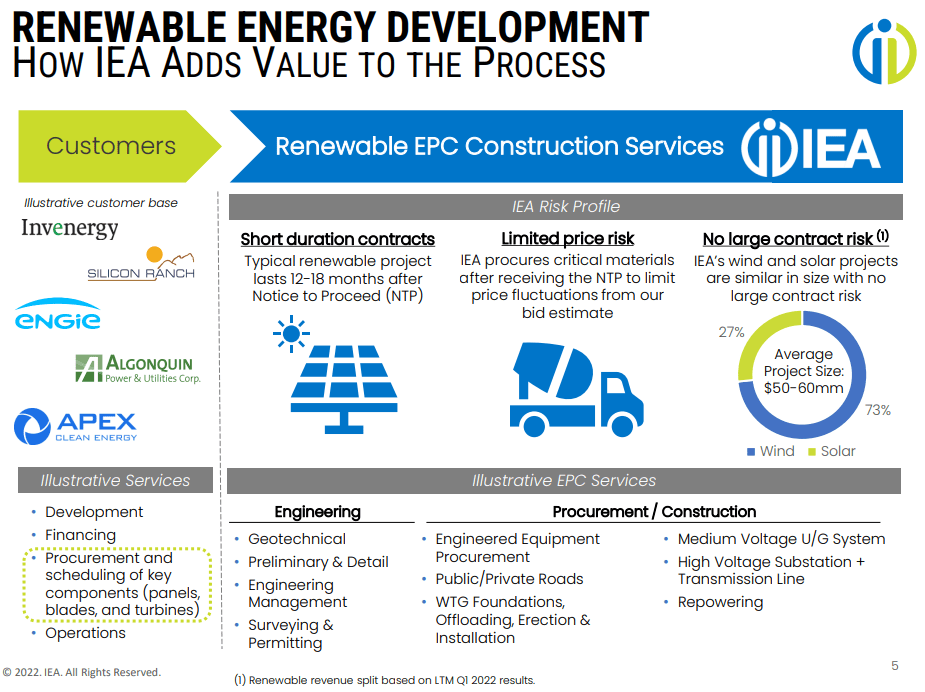

The Long Play: Renewables via IEA

While there are many renewable energy plays I am a fan of, I decided to contrast REI with a similar company in the contrasting field: Infrastructure & Energy Alternatives (NASDAQ:IEA). For a complete summary, see my prior article here. While REI develops their assets to produce oil, IEA is a contractor who builds renewable energy projects, along with civil engineering and environmental remediation projects. Customers include many private and public utilities, such as Engie (OTCPK:ENGIY) and Algonquin Power (AQN).

I would say it would be unfair to contrast REI with names such as Enphase (ENPH) or Tesla (TSLA), as the scope of each business is extremely different. IEA is quite similar, financially and in terms of being a highly focused participant in their perspective industry. Due to the tailwinds available for the industry, I believe IEA will outperform in the intermediate to long term while Ring Energy falters.

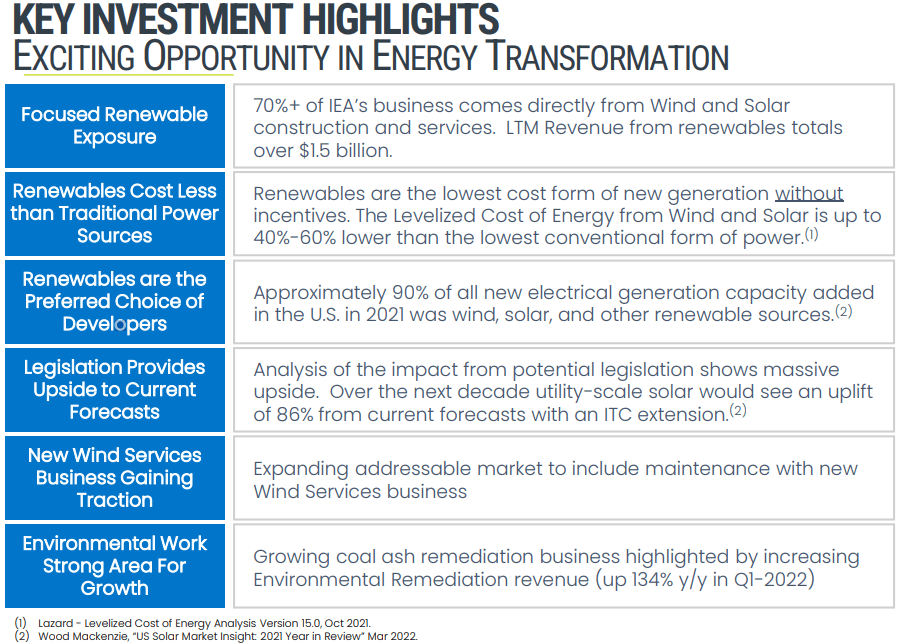

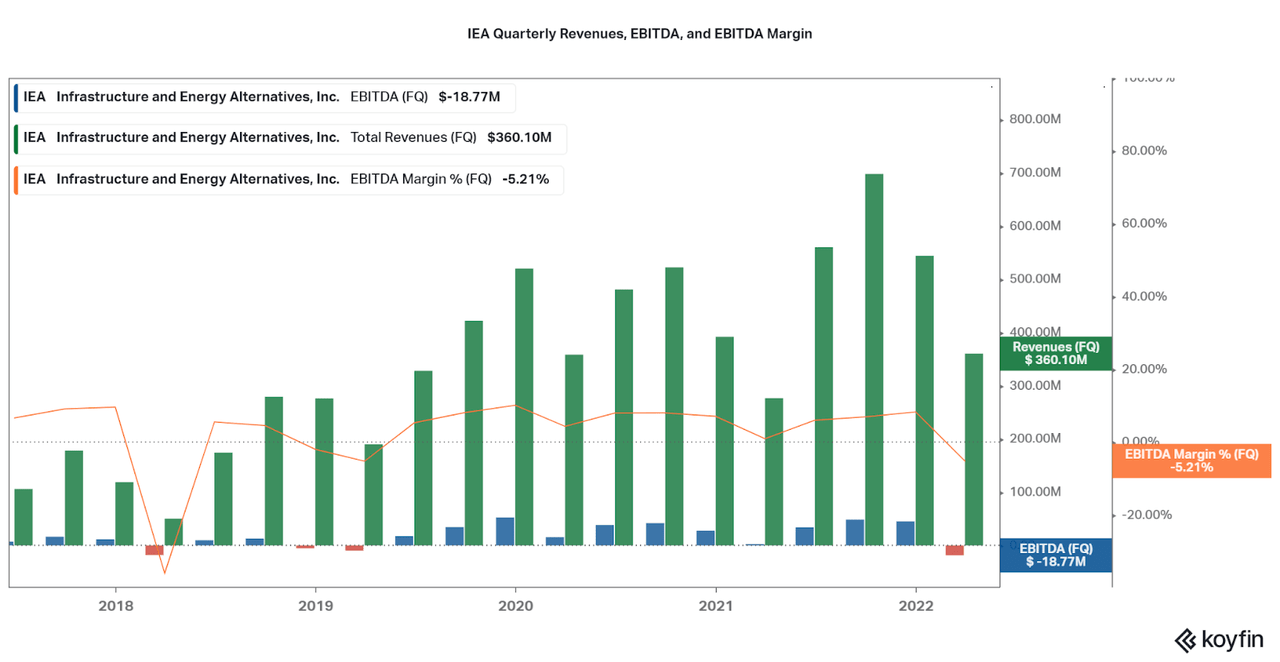

IEA IEA

IEA currently is facing issues with both revenue growth and profitability. While acquisitions over the past few years have aided in revenue growth, organic growth is lacking at the moment. At the same time, mostly due to being an EPC company, margins are strained due to supply chain costs. When fiscal stimulus increases the amount of projects and higher interest rates, lower commodity prices, I believe improvements both top and bottom metrics will be forthcoming. Look at the company as a cyclical and buy when performance is weak and has room to improve to find the most upside potential.

Koyfin

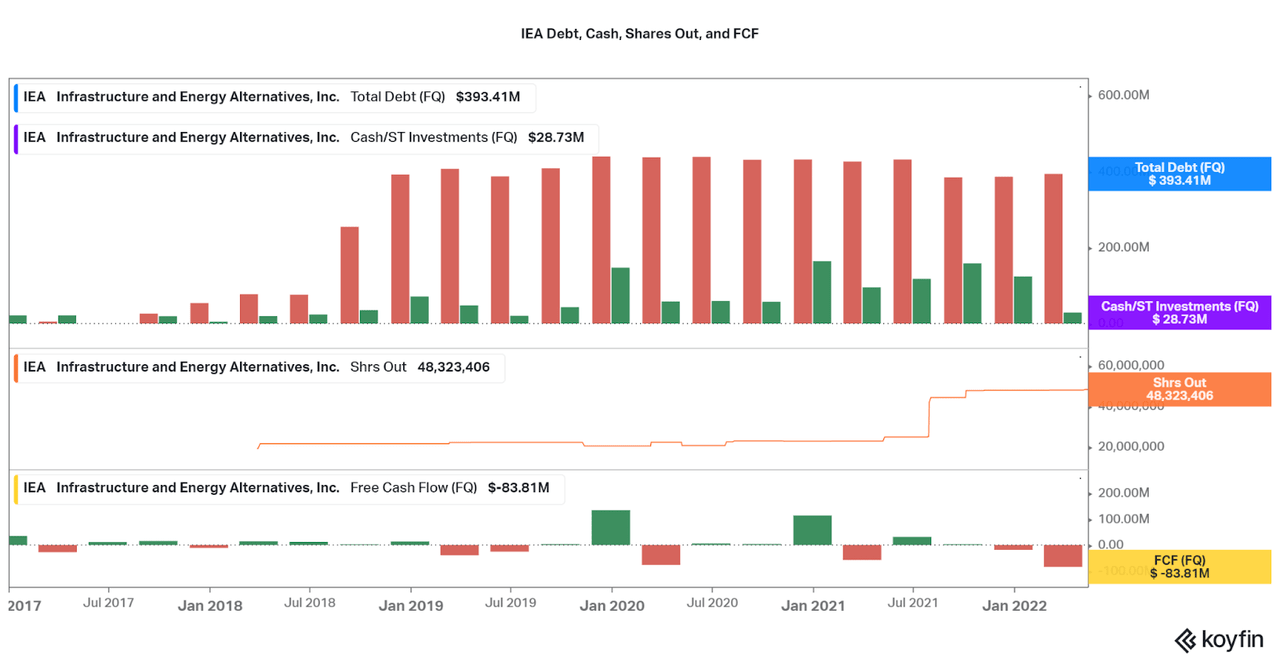

Along with profitability issues in a poor market environment, IEA also suffers from debt issues like Ring Energy. The uplisting from OTC to the Nasdaq last year did little to improve the balance sheet, whether through investments or debt reduction. Further, FCF has been volatile over the past few years. I liken IEA’s current performance to REI’s during the pandemic when oil prices were low and profitability was weak. As I expect the renewables industry to pick up soon thanks to the infrastructure bill and other tailwinds, IEA’s performance will soon improve and bolster the balance sheet. Then, a move towards a premium valuation will aid the share price in outperforming fossil fuel assets.

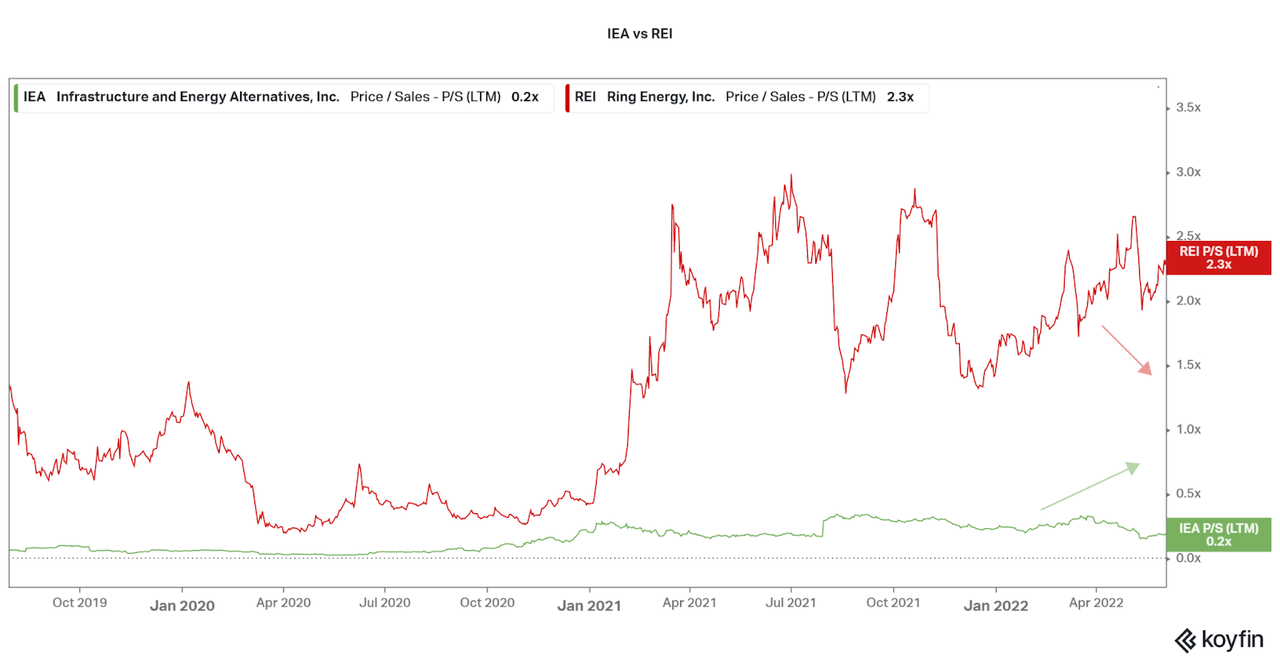

Koyfin

When comparing the two companies, we can see that each is in a contrasting cycle. While Ring Energy is performing well and offers a high valuation, IEA is suffering and sees a low valuation. Since the underlying balance sheets are similarly weak between the two companies, I then expect the roles to flip as the cycles shift. Of course, this also causes me to rely on the future performance of the renewables industry and is certainly a riskier bet than I would normally take. However, I personally believe in the necessity of renewable energy, and hope to see the industry grow accordingly.

Koyfin

Conclusion

Wherever your views lie, it is important to consider the risk points of your own investments. While Ring Energy is an easy choice to bet against due to the leverage issues and high short interest, IEA also offers similar risks. However, data suggests that oil prices will fall as demand falls. I think the most important fact is that while oil prices are higher than the pandemic, demand remains below pre-pandemic levels. This creates economic forces that will bring REI down that do not even consider the environmental implications.

At the same time, IEA has the benefit of a huge infrastructure package being passed that will allow for more renewable and civil infrastructure projects to commence, even as consumers face recession. However, look for significant volatility over the next few months as the narrative plays out. However, if REI rises higher in price, another strong opportunity to short will arise for those who choose to face the risk.

Thanks for reading. Try to persuade me otherwise in the comments.

Be the first to comment