courtneyk/iStock via Getty Images

A Quick Take On Similarweb

Similarweb (NYSE:SMWB) went public in May 2021, raising approximately $176 million in gross proceeds in an IPO that priced at $22.00 per share.

The firm operates an online Web analytics platform for businesses via a SaaS revenue model.

Until management can make meaningful progress in reducing high operating losses, I’m on Hold for SMWB.

Similarweb Overview

Tel Aviv-Yafo, Israel-based Similarweb was founded to assist companies of all sizes in analyzing their website traffic to improve their online marketing results.

Management is headed by co-founder, and CEO Or Offer, who was previously a founding partner at AfterDownload which was later acquired by IronSource.

The company’s primary offerings include:

-

Digital Research – understand trends

-

Digital Marketing – increase user acquisition

-

Shopper Intelligence – improve conversion rates

-

Sales Intelligence – increase sales pipeline

-

Investor Intelligence – monitor investment opportunities

The firm offers a free version and paid levels based on feature set, geographic coverage and number of users to a variety of business sizes.

The company tracks digital activity for hundreds of industries in more than 190 countries and obtains a large percentage of its annual recurring revenue [ARR] from customers who spend $100,000 per year or more.

Similarweb’s Market & Competition

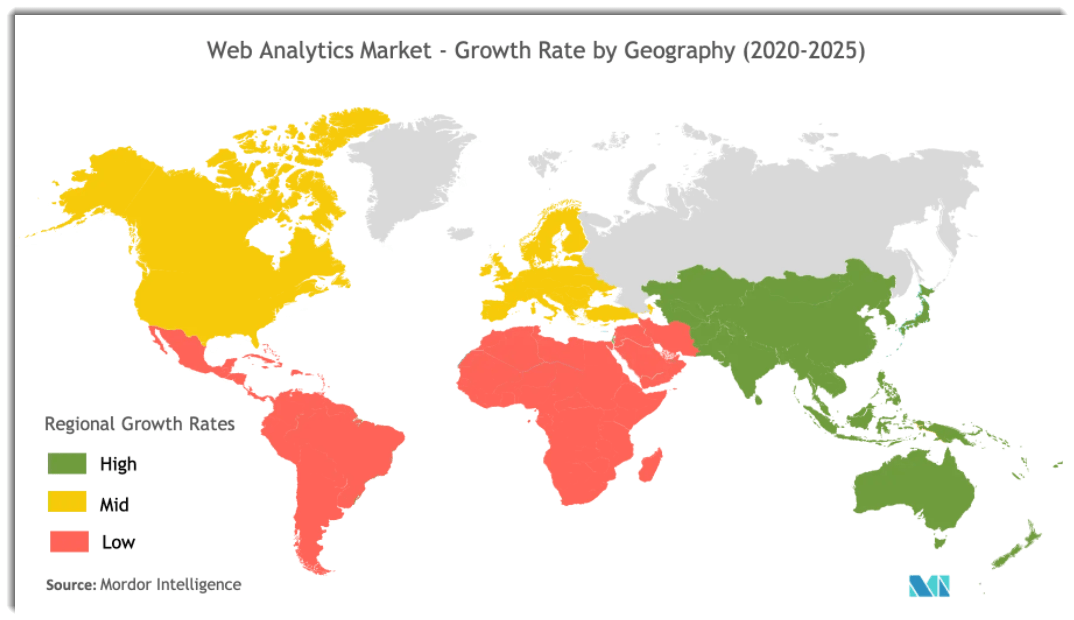

According to a 2021 market research report by Mordor Intelligence, the global market for web analytics was an estimated $3 billion in 2020 and is forecast to exceed $7 billion by 2026.

This represents a forecast very strong CAGR of 15.2% from 2021 to 2026.

The main drivers for this expected growth are a continued rise in the automation of online marketing and growth in online shopping by consumers and businesses.

Also, the COVID-19 pandemic will likely provide a significant boost to web analytics providers as businesses demand more information about their online properties to cater to more customers performing buying activities online.

North America is forecast to continue to provide the highest demand of any region worldwide, although the Asia Pacific is expected to grow demand at the fastest rate through 2025 as the chart shows below:

Global Web Analytics Market (Mordor Intelligence)

Major competitive or other industry participants include:

-

Semrush

-

AppAnnie

-

Google

-

Facebook

-

Microsoft

-

Adobe Systems

-

SAS

Similarweb’s Recent Financial Performance

-

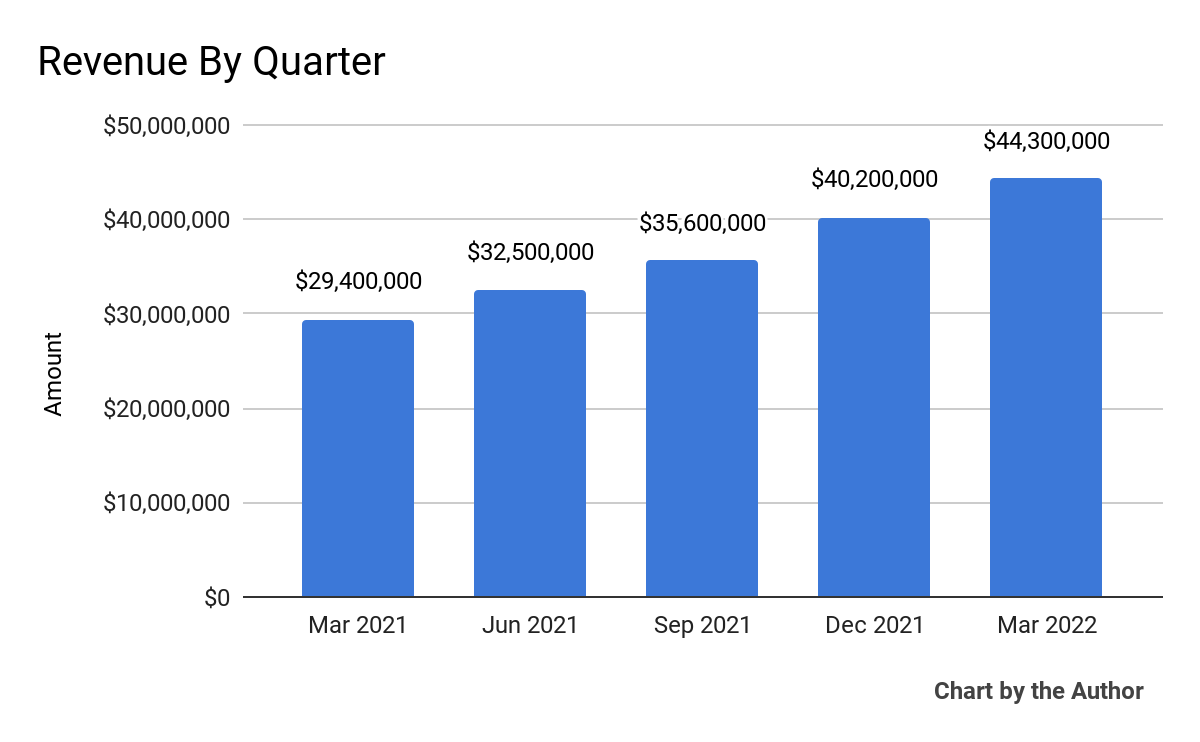

Total revenue by quarter has grown impressively and steadily over the past 5 quarters:

5 Quarter Total Revenue (Seeking Alpha)

-

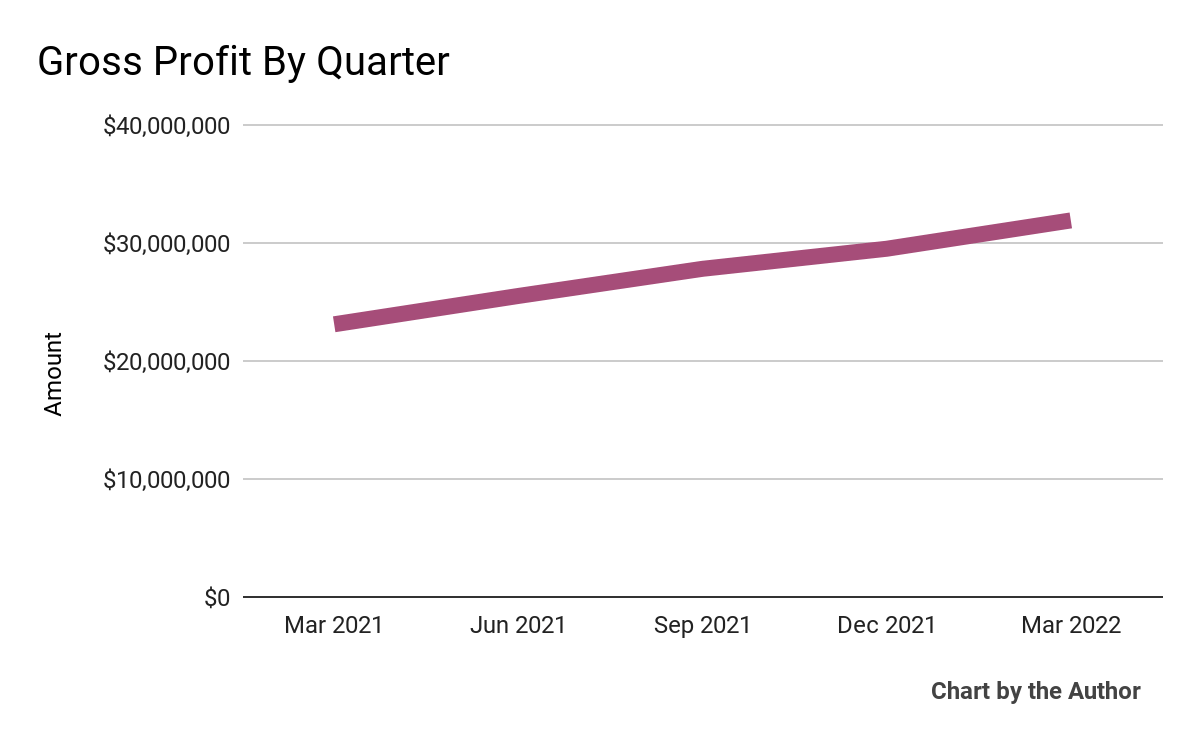

Gross profit by quarter has produced a similar growth trajectory:

5 Quarter Gross Profit (Seeking Alpha)

-

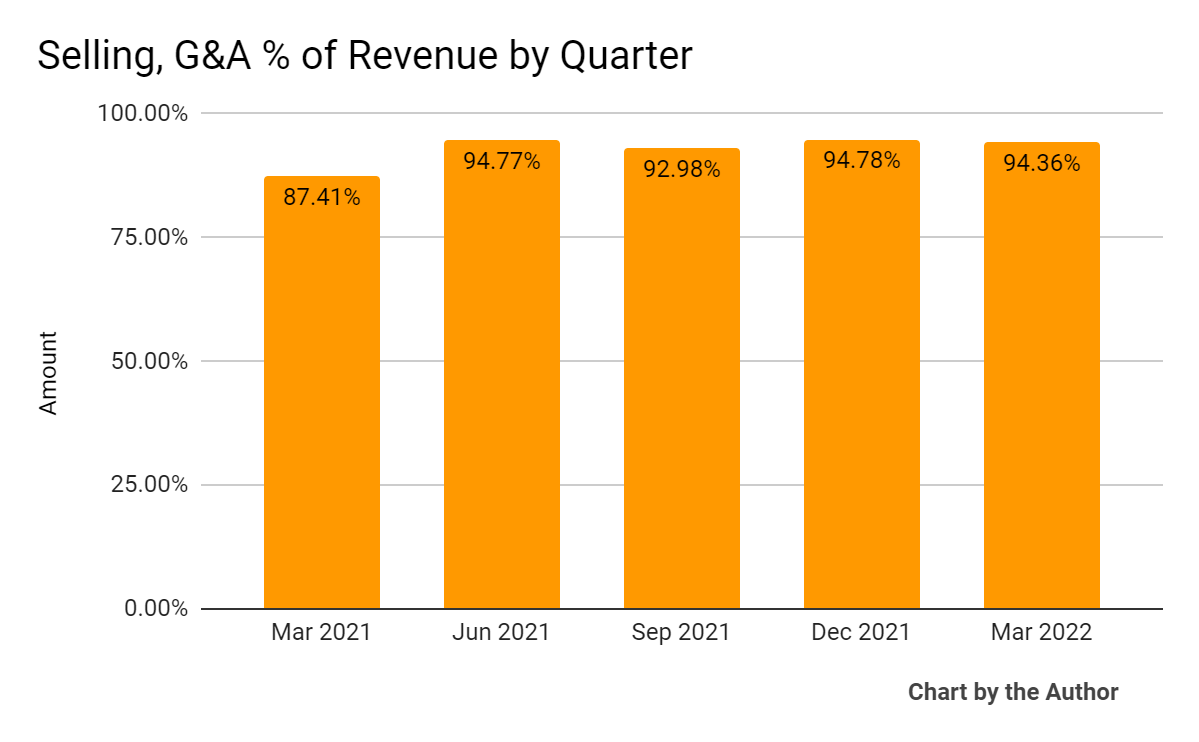

Selling, G&A expenses as a percentage of total revenue by quarter have remained elevated over recent reporting periods:

5 Quarter Selling, G&A % Of Revenue (Seeking Alpha)

-

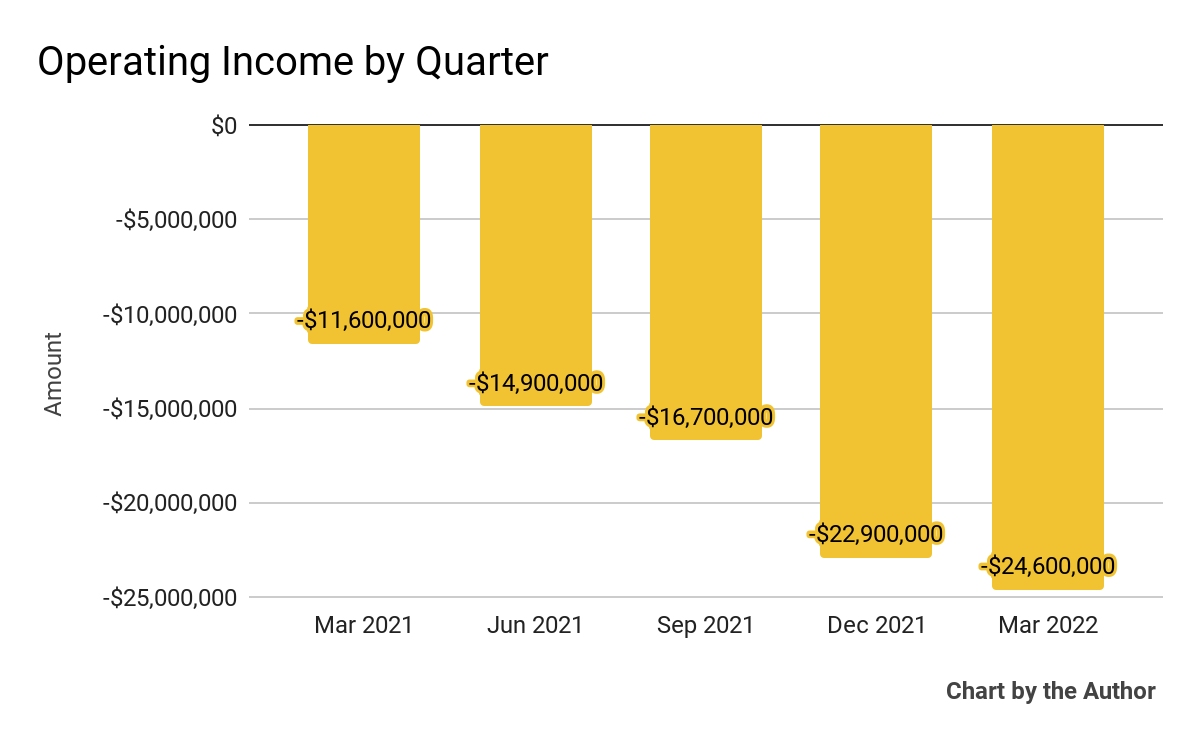

Operating losses by quarter have worsened:

5 Quarter Operating Income (Seeking Alpha)

-

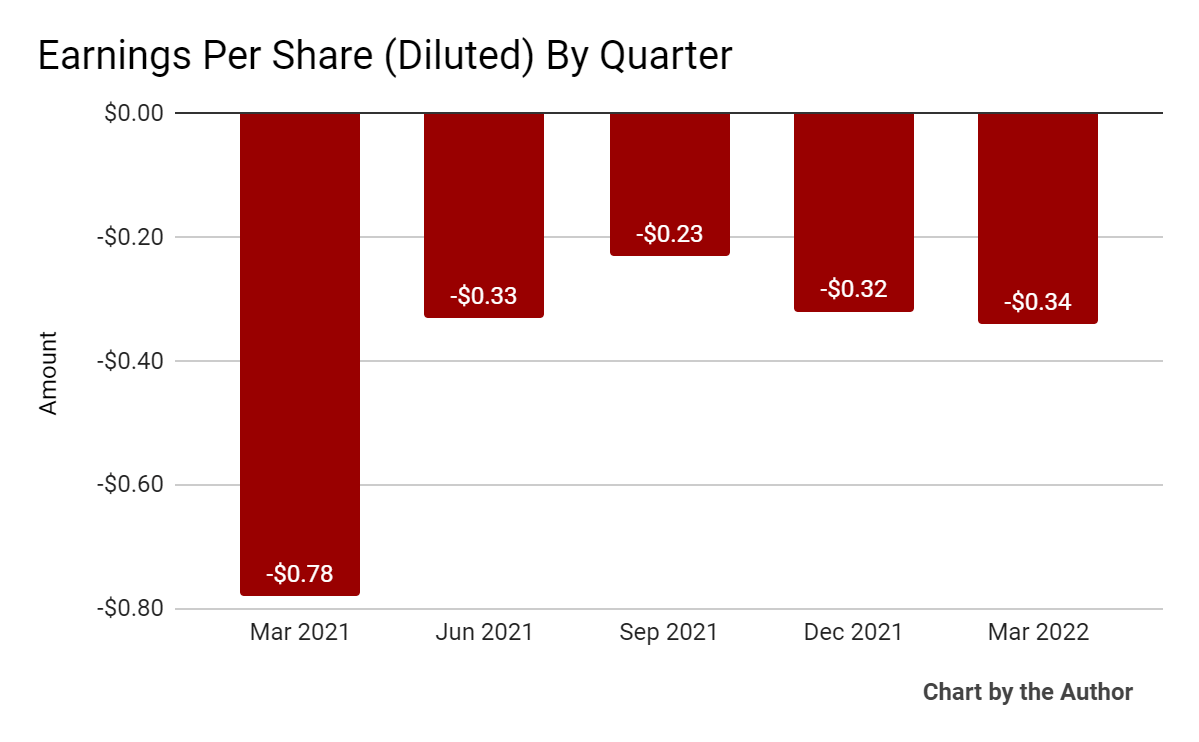

Earnings per share (Diluted) have remained significantly negative over the past 5 quarters:

5 Quarter Earnings Per Share (Seeking Alpha)

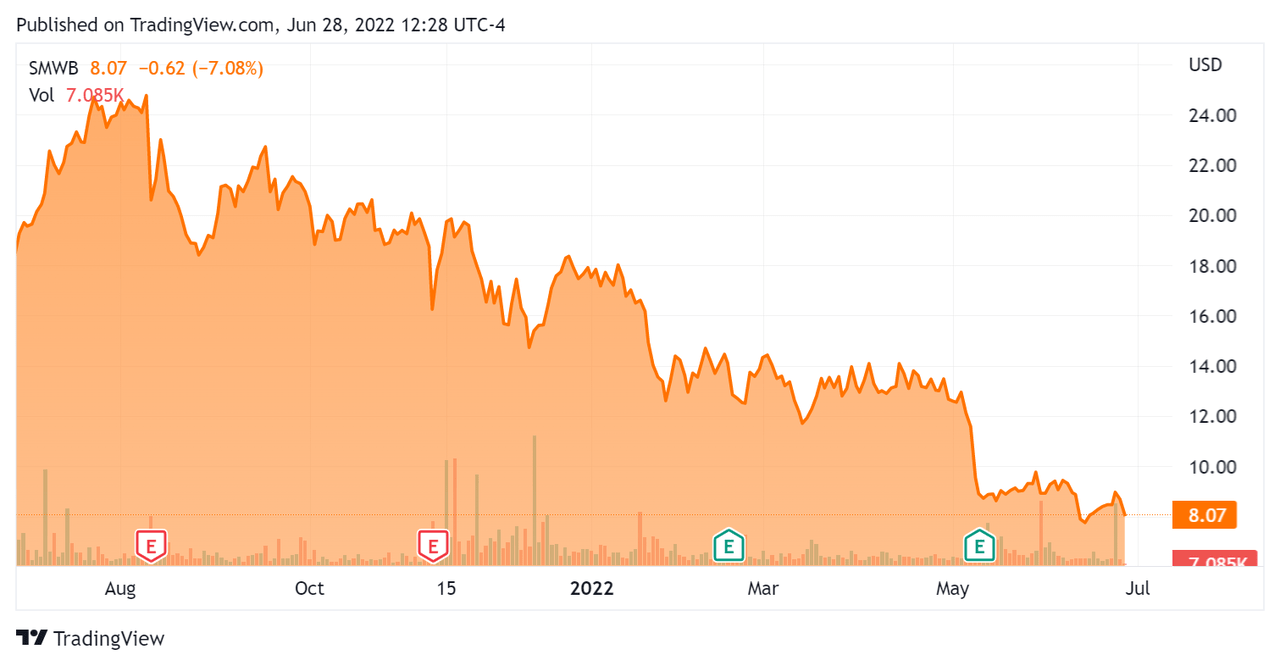

In the past 12 months, SMWB’s stock price has fallen 56.3 percent vs. the U.S. S&P 500 index’ fall of around 10 percent, as the chart below indicates:

52 Week Stock Price (Seeking Alpha)

Valuation Metrics For Similarweb

Below is a table of relevant capitalization and valuation figures for the company:

|

Measure |

Amount |

|

Market Capitalization |

$676,290,000 |

|

Enterprise Value |

$576,700,000 |

|

Price / Sales [TTM] |

3.88 |

|

Enterprise Value / Sales [TTM] |

3.78 |

|

Operating Cash Flow [TTM] |

-$29,040,000 |

|

Revenue Growth Rate [TTM] |

49.11% |

|

Earnings Per Share |

-$1.22 |

(Source – Seeking Alpha)

As a reference, a relevant public comparable would be Semrush (SEMR); shown below is a comparison of their primary valuation metrics:

|

Metric |

Semrush |

Similarweb |

Variance |

|

Price / Sales [TTM] |

9.32 |

3.88 |

-58.4% |

|

Enterprise Value / Sales [TTM] |

8.27 |

3.78 |

-54.3% |

|

Operating Cash Flow [TTM] |

$22,780,000 |

-$29,040,000 |

-227.5% |

|

Revenue Growth Rate |

49.6% |

49.1% |

-1.1% |

(Source – Seeking Alpha)

Commentary On Similarweb

In its last earnings call (Source – Seeking Alpha), covering Q1 2022’s results, management highlighted the growth of the firm’s customer base by 27% year-over-year, with an average customer spend of almost $60,000 per year.

Also, a majority of its revenue comes from customers based outside of the United States and 35% of its customer base sign multi-year contracts, adding to a more predictable revenue stream.

As to its financial results, revenue during the quarter exceeded previous guidance and the company’s dollar-based net retention rate [NRR] grew sharply to 115% versus 103% in Q1 2021.

The NRR is an important metric that shows both the product/market fit and the firms’ efficiency in generating more revenue from the same cohort of customers as they purchase additional product solutions.

However, despite strong growth and retention results, operating losses continue to worsen, which is no doubt the basis for the market punishing the stock as technology companies generating high operating losses are in disfavor in the current rising interest rate market environment.

Looking ahead, management expects the firm to be ‘positive free cash flow as we exit 2024,’ which is more than two years into the future.

Regarding valuation, compared to partial comparable Semrush, the market is valuing SMWB at significantly lower major multiples.

The primary risk to the company’s outlook is a reduction in corporate spending as the global economy enters a period of slow growth or potential outright recession in the coming months.

While management has guided higher as to revenue, operating losses will likely remain high, with non-GAAP operating losses for 2022 projected to be up to $83 million.

Given the market’s dour disposition toward tech companies with high operating losses, the stock will likely languish in the months ahead.

Until management can make meaningful progress in reducing operating losses, I’m on Hold for SMWB.

Be the first to comment