Thesis:

Advanced Micro Devices, Inc. (NASDAQ:AMD) has served as one of the world’s 10 largest hyper-scalers for the significant portion of two decades, and is number one on Top500, Green500, and HPL-AI supercomputers, an incredible feat. AMD moving into the fourth generation and fifth generation of the EPYC CPUs with plenty of remaining momentum in the third generation of CPUs. AMD predicts the fourth generation to have two times the solutions of the third. So, roughly 2000 total solutions.

AMD’s roadmap for the future is accelerating past the likes of Intel Corporation (NASDAQ:INTC). That said, new CEO Pat Gelsinger, who has served in numerous roles at Intel throughout the years, can potentially get the company back on track to tighten the race with AMD. The next few years will be interesting to watch. AMD’s full year 2022 guidance is also impressive, with expected revenue to be nearly $26.3 billion. This amount represents an increase of 60% from 2021 versus Intel, which expects revenue of $76 billion, up just 2% year-over-year, while adjusted free cash flow is expected to be negative $1 billion to $2 billion.

With that said, my outlook is to bet on AMD, not Intel.

Financial Metric Comparison

AMD Financial Segments

For the period of Q1 2022, which ended on March 26, 2022, AMD displayed another round of impressive numbers. AMD reported Q1 22 revenue of $5.9 billion, which represents year-over-year growth of 71 percent, and 22 percent growth quarter over quarter. Net revenue for the Computing and Graphics (CG) segment came in at $2.8 billion, up 33 percent in a year-over-year period from $2.1 billion, driven by AMD Ryzen and AMD Radeon processor sales. Enterprise, Embedded and Semi-Custom (EESC) brought in $2.52 billion in revenue, up 88 percent year over year from $1.345 billion. This also represent a 13 percent increase since last quarter.

This revenue was driven by AMD EPYC and semi-custom products sales. Xilinx represented $559M in revenue in a Pro Forma since the month the acquisition finalized, attributing growth across all major market categories of Xilinx offerings. AMD notably repurchased $1.9 billion of stock, and currently has $8.3 billion remaining in authorized purchases.

In May 2021, AMD’s Board of Directors approved a stock repurchase program of up to $4 billion. Then again, in February 2022, the Board of Directors approved a new stock repurchase program. The new program authorizes $8 billion of outstanding common stock. During the first months ending on March 26, 2022, AMD purchased $15.8 million shares of common stock from the previous $1.9 billion authorization. As of March 26th, $8.3 billion remained for stock repurchases.

For the second quarter of 2022, AMD stated that they expect revenue to be approximately $6.5 billion with a buffer (plus or minus) $200 million. This would represent an increase of nearly 69 percent year over year and roughly 10 percent quarter over quarter. The increase is expected to be attributed to by the addition of Xilinx products, higher server, semi-custom, and client revenue. The quarter increase is expected to be from Xilinx and higher server revenue. AMD is now expecting non-GAAP gross margins to be approximately 54 percent for Q2 2022. Full year 2022 guidance is also impressive with expected revenue to be nearly $26.3 billion. This amount represents an increase of 60 percent from 2021.

Be mindful this is an increase in previously given guidance of 31 percent, which AMD now attributes to the closing and addition of Xilinx.

Dr. Lisa Su, AMD chair and CEO, said:

From the cloud and PCs to communications and intelligent endpoints, AMD’s high-performance and adaptive computing solutions play an increasingly larger role in shaping the capabilities of nearly every service and product defining the future of computing today.”

She continued that:

The close of our transformational acquisition of Xilinx and our expanded portfolio of leadership compute engines provide AMD with significant opportunities to deliver continued strong revenue growth with compelling shareholder returns as we capture a larger share of the diverse $300 billion market for our high-performance and adaptive products.

Intel Financial Segments

Q1 2022 revenue came in at $18.4B, down 7 percent from Q1 2021. Gross margins came in at 50.4 percent, down 4.8 percentage points from Q1 2021. Desktop revenue was $2.6 billion, down $130 million from $2.77 billion in Q1 2021. Desktop sales decreased 11 percent due to lowered demand in consumer/education markets.

Notebook revenue was $6.0 billion, down $997 million from $6.95 billion in Q1 2021. Notebook unit sales decreased 35 percent driven by lower demand in the consumer and education market segments following a supply chain inventory digestion cycle compared to COVID-driven highs in Q1 2021, partially offset by an increase in ASPs of 32 percent due to an increased mix of commercial and consumer products, and lower mix of education.

DCAI Revenue was $6.03 billion, up $1.1 billion from Q1 2021 The increase was primarily driven by an increase in server revenue. DCAI revenue increased 22 percent on higher server volume due to demand from hyperscale customer-related products and continued recovery from COVID-driven lows in Q1 2021, partially offset by lower server ASPs due to customer and product mix.

Network and Edge 2.2B vs. 1.79B Revenue was $2.2 billion, up $414 million from Q1 2021, driven by increased demand for cloud networking and post-COVID transformation of the edge. Mobileye Mobileye revenue was $394 million, up $17 million from Q1 2021. Operating income was $148 million, down $23 million from Q1 2021.

Intel declared a quarterly dividend of $0.365 per share. Intel has an ongoing authorization from the year 2005 in which Board of Directors amended to repurchase shares of common stock. For quarter ending April 2nd, 2022, no shares were purchased. As of the end of Q1 2022, Intel was authorized to $7.2 billion remaining in shares.

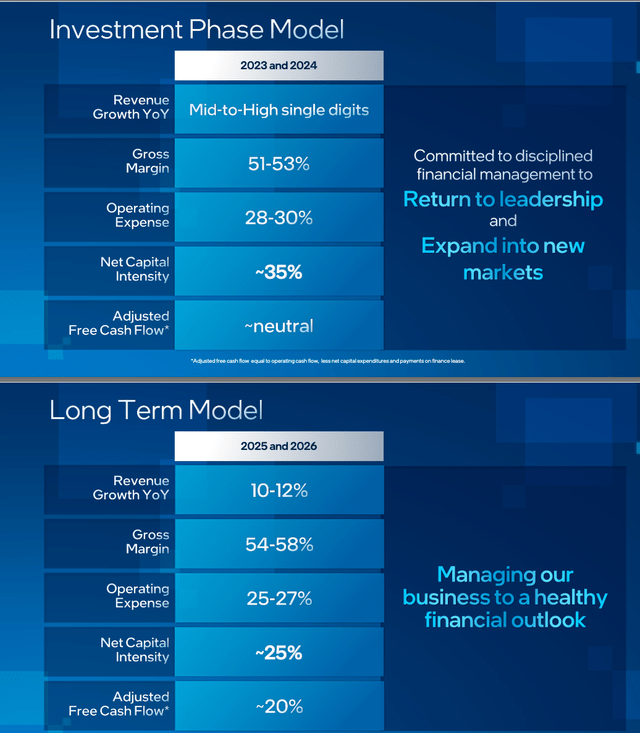

For 2022, Intel expects revenue of $76 billion up roughly two percent year over year. And the longer term outlook, Intel expects year-over-year revenue growth moving to the mid- to high-single digits in 2023 and 2024, with year-over-year growth ramping to 10 percent to 12 percent by 2026.

Future Opportunities

Intel

Intel now predicts their total addressable market (“TAM”) to be near $300 billion for 2024 outlook. Of that, $70 billion is in PC and $230 billion in data centric. To accelerate their future investment strategies within this TAM, they plan to invest over $30 billion. The $30 billion will go to building two new fabs located in Arizona, Ohio, New Mexico, and Malaysia. The funding will aid in leading edge fabs, advanced packaging manufacturing, with two new fabs in Arizona, and two new fabs in Ohio. Intel also said is to invest $10.5 billion in equip our Rio Rancho, New Mexico, and Malaysia sites for enhancing advanced packaging manufacturing

As of June 23rd, a CNBC article showed that the Ohio-based plant form Intel could be delayed due to funding from the government’s CHIPS Act. Intel stated it was still committing the $20 billion investment. However, the large sum of $100 billion investment is now uncertain and delayed due to the CHIPS Act not being passed yet.

Investment outlook (2022 Investor Meeting )

AMD

AMD sees their TAM at $300 billion as well. The $300 billion is broken down to the following:

- Data Centers – $125B

- Gaming – $37B

- PC’s – $50B

- Embedded – $33B

- Automotive – $27B

- Communications – $32B.

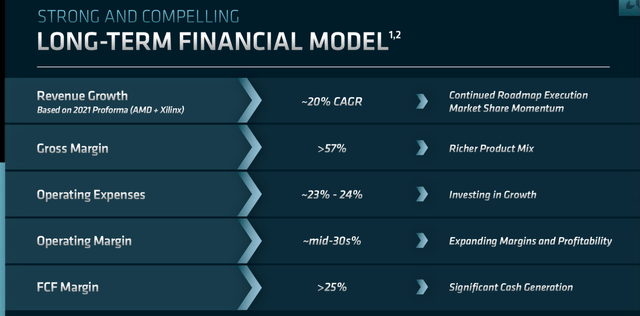

AMD’s revenue mix just for Data Centers, which is where they are putting the majority of growth efforts, now makes up 25 percent of revenue. This is now at $16.4 billion, up from $6.7 billion just in 2019. This same segment has shown a 95 percent CAGR since 2019, while PC’s have shown a 46 percent CAGR since 2019, and Gaming with a 50 percent CAGR since 2019. This averages out to a total 56 percent CAGR. This is outpacing expectations from Intel for their 2023-2026 CAGR outlook of just mid-teens. AMD’s outlook for long term CAGR is 20 percent. Again, AMD wins here in my book.

Starting in Q2 2022, AMD is updating its financial reporting segments to align directly to reflect the following:

- Data Center: Server CPUs, GPUs for Data Centers, and to include Xilinx revenue pertaining to Data Center the portions of Xilinx revenue related to the data center business

- Embedded: Including the Xilinx embedded business plus the AMD embedded business

- Client: Including the traditional desktop and notebook PC business

- Gaming: Including the discrete graphics gaming business and the semi-custom game console business.

This should directly reflect in increased earnings over the next few quarters as Xilinx continues to perform. If AMD can remain in line or beat its expected ~20 percent CAGR, AMD will continue to significantly beat Intel on market returns for investors.

Investing Outlook (2022 Financial Analyst Day)

Valuation Comparison

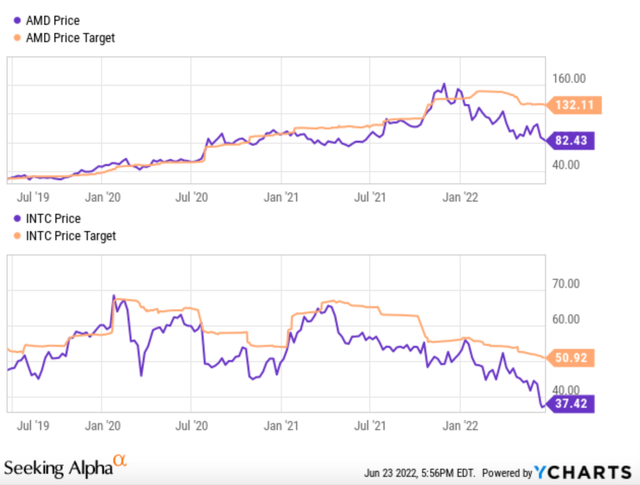

When comparing the valuations AMD is the winner as long as you are willing to pay up for the growth. Intel is a pure value play at these levels, with a dividend of $1.46 per share, or 3.9 percent yield. AMD sits at a market cap of $132.18B. AMD’s valuations are a P/E Non-GAAP (FWD) of 19, P/E GAAP (TTM) of 31, Price/Book (TTM) of 2.5 and EV/EBITDA (TTM)of 27. So, by no means is AMD cheap on a valuation point. But the revenue growth, momentum, and market share expansion all make all make AMD’s higher valuation reasonable. Intel appears to be the cheaper valuation play, but offers less growth. Siting at a $151.16B market cap, Intel’s P/E Non-GAAP (FWD) is 10.75, P/E GAAP (TTM) of Price/Book (TTM) 1.5, EV/Sales (TTM) of 1.9, and an EV/EBITDA (TTM) 4.7.

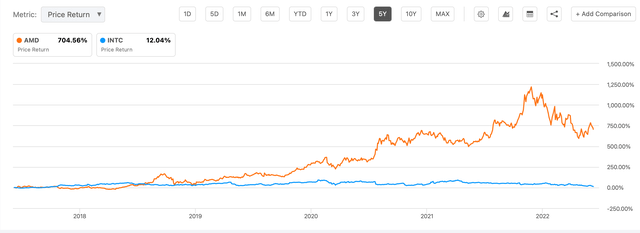

AMD vs INTC chart (Seeking Alpha/YCharts)

As depicted by the chart above, the current average price targets alone would render a higher return for a $10,000 investment. Based on the prices at the close on the 23rd of June 2022, $10k would purchase you roughly 267 shares of Intel OR about 121 shares of AMD. If both stocks were to hit the current average price targets you would get the following results:

- $10K AMD – 121 shares X $132.11(price target) = $15,985.31

- $10K INTC – 267 shares X $50.92 (price target) = $13,595.64 (without dividends)

- The decision to invest in intel would return you $2,389.67 more than you investments in Intel.

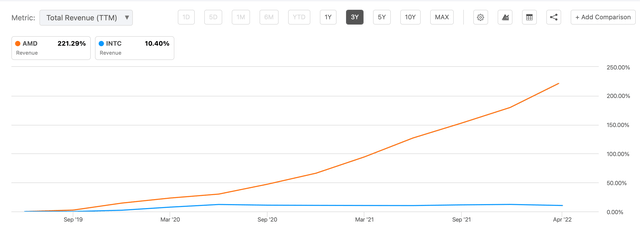

Returns for the last 3 years can be seen in the images below:

TTM Toal Revenue Growth (Seeking Alpha)

jiefeng jiang/iStock via Getty Images

Revenue increased over 220 percent for AMD and roughly 10.5 percent for Intel. Meanwhile, a 5 year investment in Intel would have returned roughly 12 percent returns and AMD 700 percent.

AMD vs Intel Price Return (Seeking Alpha )

Competition at large

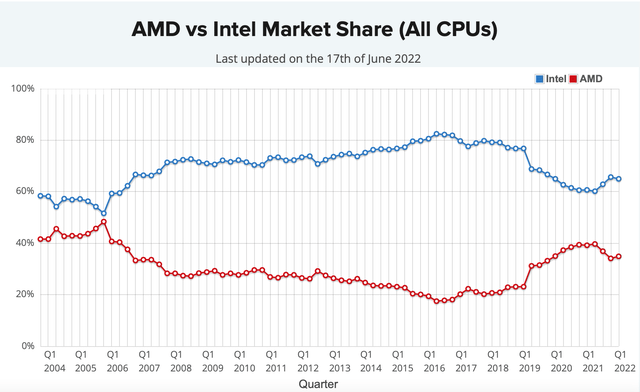

The Latest Mercury Research report showed AMD had reached a high of a 27.7 percent market share in the processors space. AMD’s share of 27.7 percent is up form 20.7 percent during the same period last year in 2021. This means that in the past year alone, AMD has taken 7 percent more market share from Intel.

This includes all x86 silicon, meaning not just desktop, laptop and server processors, but also custom-built chips for the likes of game consoles. AMD’s x86 share in the first three months of 2022 grew 2.1 points from last quarter. In a comparison to a year ago period, the current levels are up seven points. The growth is attributed to segments of servers and laptops. In the servers segment, AMD’s share grew 2.7 points year-over-year to 11.6 percent. This represents the 12th consecutive quarter of growth within this segment. For laptops, AMD’s share jumped to 22.5 from 4.4 points in a year ago period.

AMD vs Intel CPU market share (Techpowerup)

Acquisitions To Excel Growth

Intel

On March 31st 2022, Intel announced they were in an agreement to acquire the company Granulate Cloud Solutions Ltd. This is a company based of out Israel and develops real time software for optimization. This is a well-timed acquisition in my opinion if the company wants to keep up with the likes of AMD and Nvidia (NVDA) in Data Center segments. Granulate will aid Intel in both customers of cloud and data center to increase compute workload, performances and reduce infrastructure and cloud costs. Deal terms are not being disclosed; the transaction is expected to close in the second quarter of 2022, subject to typical closing conditions. Adding Granulate to Intel’s product portfolio will reduce application costs and improve cloud and data center performances.

AMD

On February 14, 2022, AMD finalized the acquisition of Xilinx. The total purchase was worth $48.8 billion. The addition of Xilinx advanced AMD’s product portfolio. The new AMD will now include improved hardware platforms, which will enable innovation and hardware accelerations spread across numerous technologies and product offerings. The addition of Xilinx adds a loyal brand with strategic partnerships that span across the wired and wireless communications segments. Additionally, automotive, industrial, aerospace and defense help bolster AMD current partnerships and will lead to improvements across not only the PC and Data Center segments, but along all other product offerings.

Dr. Lisa Su, Chair and CEO said,

The acquisition of Xilinx brings together a highly complementary set of products, customers and markets combined with differentiated IP and world-class talent to create the industry’s high-performance and adaptive computing leader. Xilinx offers industry-leading FPGAs, adaptive SoCs, AI inference engines and software expertise that enable AMD to offer the strongest portfolio of high-performance and adaptive computing solutions in the industry and capture a larger share of the approximately $135 billion market opportunity we see across cloud, edge, and intelligent devices”.

In addition to Xilinx, on May 26th, 2022 AMD announced the closing of its acquisition of Pensando Systems. The acquisition cost AMD roughly $1.9 billion. Pensando will expand Data Center products within AMD’s portfolio. AMD’s data center product portfolio will be complemented by high-performance data processing units combined with software stacks. Pensando and AMD already have products implemented in numerous major growth companies.

Risks

In terms of risk and competition, both companies reference each other in their 10-Qs and 10-Ks. Intel mentions that the competition of its products is represented by AMD and Qualcomm (QCOM). Additionally, Intel says that they face Nvidia in the GPU market. As stated in another section, AMD took 7 percent market share in the past year alone from Intel.

AMD states that the competition against Intel is challenging and that they hold the majority of market share. AMD acknowledges that Intel’s longstanding position makes it hard to compete on numerous fields. Since Intel has held the position so long, they control the x86 microprocessors and can offer better price points, incentives for customers, and could potentially take market share back from AMD.

Again, a common factor between both semiconductor companies, recent and future global impacts, could impact balance sheets. For Intel, Russia contributed less than .5 percent of direct sales revenue for the year 2021. Intel’s total sales outside the U.S. accounted for 82 percent of revenue for year 2021. China contributed 27 percent of total revenue.

It is worth noting that Intel has 61 total facilities, with 29 outside the United States. AMD has operations, sales, and marketing around the world including the United States, Canada, Europe, Australia, Latin America, and Asia. It relies on third-party wafer foundries in the United States, Europe, and Asia. Nearly all product assembly and final testing of products is performed at manufacturing facilities operated by third-party manufacturing facilities, in China, Malaysia and Taiwan. It also depends on third-party subcontractors to provide shipment services. AMD’s international sales were 69 percent of net revenue for the first quarter of 2022 with international sales trends to remain a similar fashion. Lastly, supply chain issues, third party manufacturing and sellers, and COVID lockdowns all play a role in potential risks to both companies.

Final Thoughts

Despite AMD’s recent growth in market share success, Intel still stands as the majority leader for market share. It may also be premature to call Intel or AMD the clear winner. If Intel can take back market leader status and take share from the likes of Nvidia, AMD, and others, they will have perhaps the best turnaround story in the industry. With a “new” CEO running Intel, they may be able to take share back.

However, AMD has seen 12 consecutive quarters of growth. I believe that the momentum behind AMD, AMD’s CEO track record, share buybacks, long term CAGR outlook, and overall growth opportunities makes AMD stand out as the clear Buy between these two stocks. Again, I rate AMD as a Buy and Intel as a sell. And for the most aggressive investors, buy AMD and short Intel.

Be the first to comment