cynoclub/iStock via Getty Images

Foreword

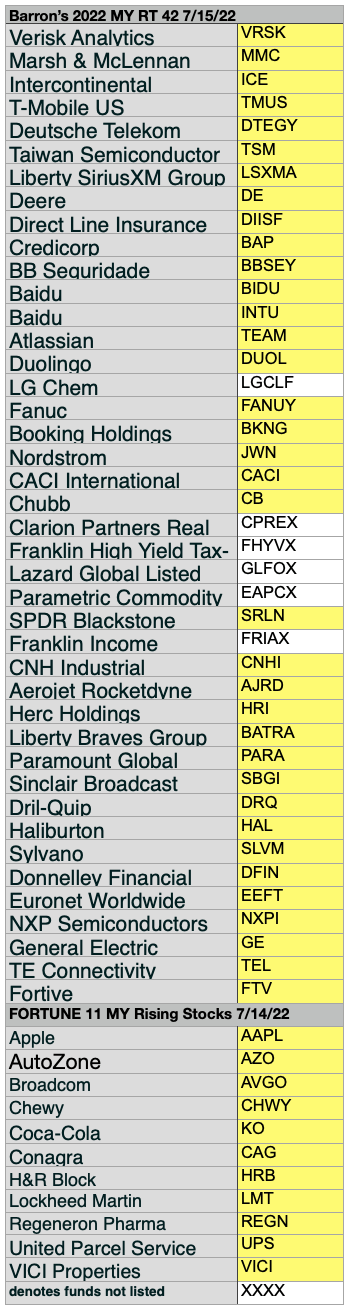

This article is based on Barron’s mid-year (MY22) convening of 10 principal investment advisors from major investment firms, aimed at pinpointing their recommendations for equities they see as promising for the rest of 2022. That information is supplemented by the mid-year Fortune Quarterly Investment Guide.

Specifically, the Barron’s MY article, published July 15, 2022 by Lauren R Rubin, was titled, “What to Buy Right Now: 42 Picks From Barron’s Roundtable Pros.” Fortune’s MY quarterly investment guide article, titled “11 steady rising stocks to beat the bear market and beyond,” was penned by Larry Light and published July 14.

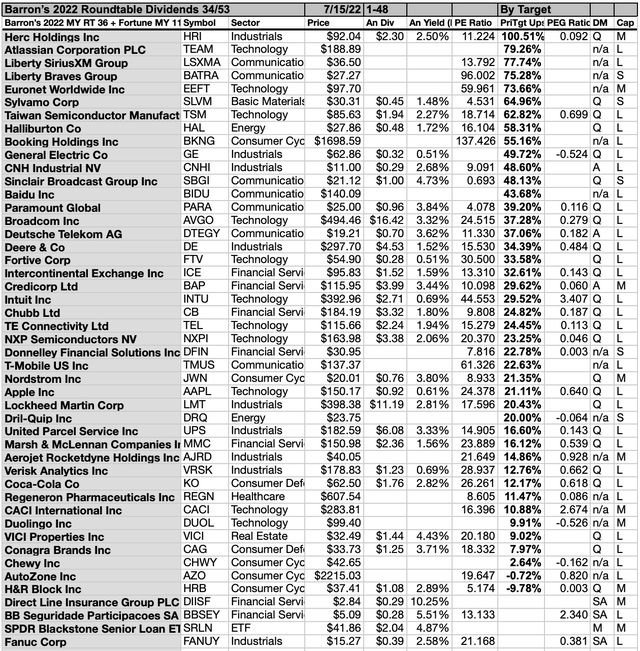

Any collection of stocks is more clearly understood when subjected to yield-based (dogcatcher) analysis, this collection I’ve called the MY22 are perfect for the dogcatcher process. Below are the July 15 data for those 53 expert recommendations of which 32 pay dividends.

The prices of eleven of these 32 dividend-paying MY22 stocks made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

Those eleven are: Direct Line Insurance Group plc (OTCPK:DIISF), a financial service; BB Seguridade Participacoes S.A. (OTCPK:BBSEY), also a financial service; SPDR Blackstone Senior Loan ETF (SRLN), an ETF; Sinclair Broadcast Group Inc (SBGI) from communication services, VICI Properties Inc (VICI) in real estate, Paramount Global (PARA), another communication services member; Nordstrom Inc (JWN), from consumer cyclical; Conagra Brands Inc (CAG), a consumer defensive selection; Deutsche Telekom AG (OTCQX:DTEGY), a communication service stock; CNH Industrial N.V. (CNHI), an industrial; and Fanuc Corp (OTCPK:FANUY), another industrial. All eleven live up to the ideal of having their annual dividends from a $1K investment exceed their single share prices. Many investors see this condition as a buy signal. The Dogcatcher calls this his ‘ideal dividend return rule’.

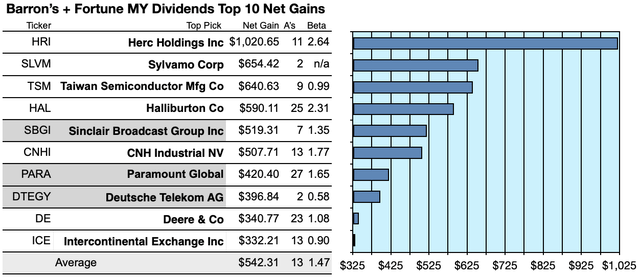

Actionable Conclusions (1-10): Analysts Estimated 33.22% To 102.07% Net Gains For Ten Top MY22 Dogs

Three of 10 MY22 by yield were also among the top 10 gainers for the coming year based on analyst one-year target prices (they are tinted gray in the chart below). Thus, the yield-based forecast for these M22 dogs was graded by Wall St. Wizards as 30% accurate.

Barron’s.com/YCharts.com/Fortune.com

Estimated dividends from $1,000 invested in each of the highest yielding stocks plus their aggregate one-year analyst median target prices, as reported by YCharts, created the 2022-23 data points. Note: one-year target prices by lone analysts were not applied. Ten probable profit-generating trades projected to July 15, 2023 were:

Herc Holdings Inc (HRI) was projected to net $1020.65, based on dividends, plus the median of target price estimates from eleven analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 164% greater than the market as a whole.

Sylvamo Corp (SLVM) was projected to net $654.42 based on dividends, plus the median of target estimates from two brokers, less transaction fees. A Beta number was not available for SLVM.

Taiwan Semiconductor Manufacturing Co Ltd (TSM) was projected to net $640.63, based on dividends, plus the median of target price estimates from nine analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 1% under the market as a whole.

Halliburton Co (HAL) was projected to net $590.11, based on dividends, plus median target price estimates from twenty-five analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 131% greater than the market as a whole.

Sinclair Broadcast Group Inc (SBGI) was projected to net $519.31, based on dividends, plus the median of target price estimates from seven analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 35% above the market as a whole.

CNH Industrial N.V. was projected to net $507.71 based on the median of target price estimates from 13 analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 77% over the market as a whole.

Paramount Global was projected to net $420.40, based on the median of target estimates from twenty-seven analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 65% greater than the market as a whole.

Deutsche Telekom AG was projected to net $396.84, based on dividends, plus median target price estimates from 2 analysts, less broker fees. The Beta number showed this estimate subject to risk/volatility 42% less than the market as a whole.

Deere & Co (DE) was projected to net $340.77, based on the median of target price estimates from twenty-three analysts, plus annual dividend, less broker fees. The Beta number showed this estimate subject to risk/volatility 8% greater than the market as a whole.

Intercontinental Exchange Inc. (ICE) was projected to net $332.21, based on the median of estimates from thirteen analysts, plus dividends, less broker fees. The Beta number showed this estimate subject to risk/volatility 10% less than the market as a whole.

The average net gain in dividend and price was estimated at 54.23% on $10k invested as $1k in each of these ten stocks. These gain estimates were subject to average risk/volatility 4% greater than the market as a whole.

The Dividend Dogs Rule

Stocks earned the “dog” moniker by exhibiting three traits: (1) paying reliable, repeating dividends, (2) their prices fell to where (3) yield (dividend/price) grew higher than their peers. Thus, the highest yielding stocks in any collection became known as “dogs.” More precisely, these are, in fact, best called, “underdogs”, even these “top dogs.”

43 Barron’s + Fortune MY22 Selections By Target Gains

Barron’s.com/YCharts.com/Fortune.com

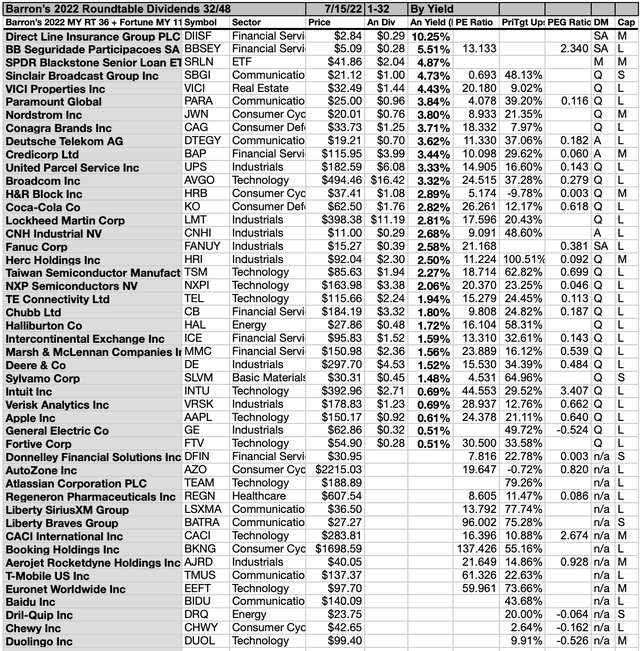

32 Barron’s + Fortune MY22 Picks By Yield

Barron’s.com/YCharts.com/Fortune.com

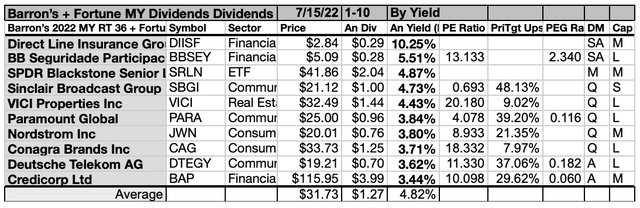

Actionable Conclusions (11-20): Ten Top MY22 Stocks By Yield

Top 10 MY22 Stocks, by yield, represented six of 11 Morningstar sectors, plus one ETF.

The first place stock was the first of three from the financial services sector, Direct Line Insurance Group plc [1]. The other financials placed second, and tenth, BB Seguridade Participacoes S.A. [2], and Creditcorp Ltd (BAP) [10].

In third place was the lone exchange traded fund [ETF], SPDR Blackstone Senior Loan ETF [3]. Then, three communication services representatives took the fourth, sixth, and ninth slots, Sinclair Broadcast Group Inc [4], Paramount Global [6], and Deutsche Telekom AG [9].

A single real estate sector representative placed fifth, VICI Properties Inc [5].

The consumer cyclical representative placed seventh, Nordstrom Inc [7]. Finally, a consumer defensive member claimed eighth Conagra Brands Inc [8], to complete the MY22 top 10 by yield.

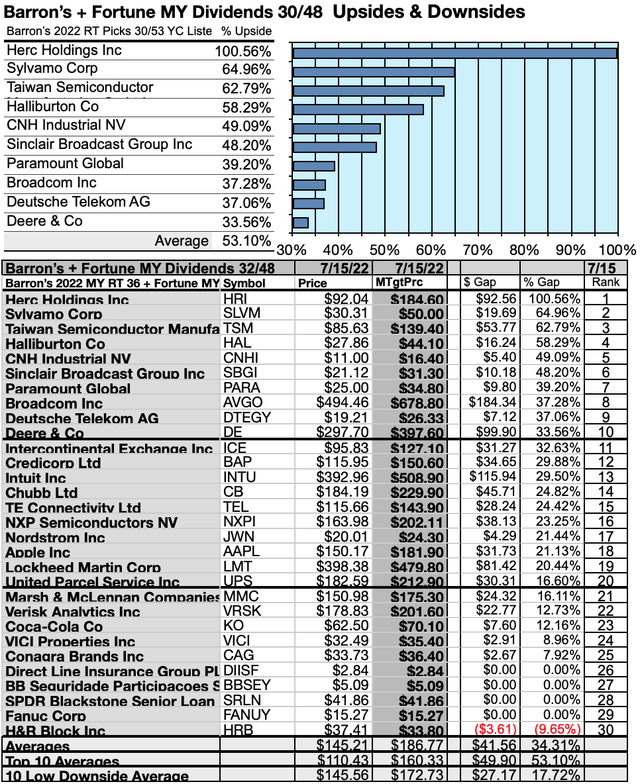

Actionable Conclusions: (21-30) 10 Top MY22 Showed 33.56%-100.56% Upsides

Barron’s.com/YCharts.com/Fortune.com

To quantify top dog rankings, analyst median price target estimates provide a “market sentiment” gauge of upside potential. Added to the simple high-yield metrics, median analyst target price estimates became another tool to dig out bargains.

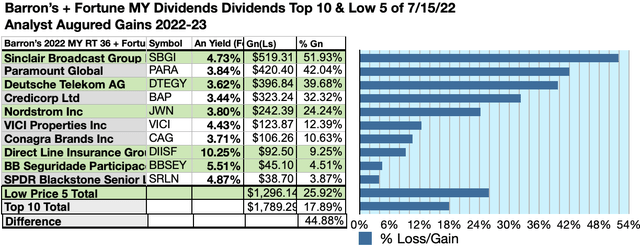

Analysts Forecast A 44.88% Advantage For Five Highest Yield, Lowest Priced of 10 Top MY22 Stocks To July 2023

Ten top MY22 were culled by yield for this update. Yield (dividend / price) results provided by YCharts did the ranking.

Barron’s.com/YCharts.com/Fortune.com

As noted above, top 10 MY22 screened 7/15/22, showing the highest dividend yields, represented six of 11 Morningstar sectors plus one ETF.

Actionable Conclusions: Analysts Predicted Five Lowest-Priced Of The 10 Highest-Yield MY22 Dividend Stocks (31) Delivering 25.92% Vs. (32) 17.89% Net Gains by All 10 Come July 2023

Barron’s.com/YCharts.com/Fortune.com

$5,000 invested as $1K in each of the five lowest-priced stocks in the top 10 MY22 kennel by yield was predicted by analyst 1-year targets to deliver 44.88% more gain than $5,000 invested as $.5K in all ten. The fifth lowest-priced selection, Sinclair Broadcast Group Inc was projected to deliver the best net gain of 51.93%.

Barron’s.com/YCharts.com/Fortune.com

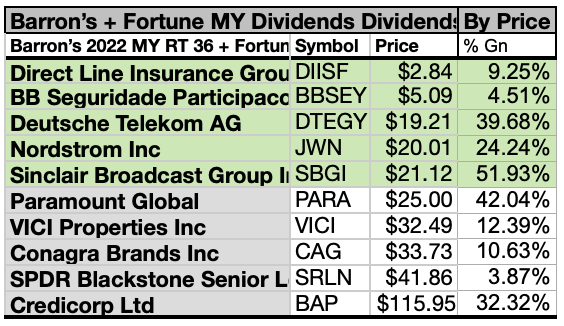

The five lowest-priced top-yield MY22 as of July 15 were: Direct Line Insurance Group plc, BB Seguridade Participacoes S.A., Deutsche Telekom AG, Nordstrom Inc, Sinclair Broadcast Group Inc, with prices ranging from $2.84 to $21.12.

Five higher-priced MY22 Picks as of July 15 were: Paramount Global, VICI Properties, Inc, Conagra Brands Inc, SPDR Blackstone Senior Loan ETF, Creditcorp Ltd, whose prices ranged from $25.00 to $115.95.

The distinction between five low-priced dividend dogs and the general field of 10 reflected Michael B. O’Higgins’ “basic method” for beating the Dow. The scale of projected gains based on analyst targets added a unique element of “market sentiment” gauging upside potential. It provided a here-and-now equivalent of waiting a year to find out what might happen in the market. Caution is advised since analysts are historically only 20% to 90% accurate on the direction of change and just 0% to 20% accurate on the degree of change.

The net gain/loss estimates above did not factor in any foreign or domestic tax problems resulting from distributions. Consult your tax advisor regarding the source and consequences of “dividends” from any investment.

Afterword

If somehow you missed the suggestion of the four stocks ready for pickup at the start of the article, here is a reprise of the list at the end:

The prices of eleven of these 32 dividend-paying MY22 stocks (listed by yield as of January 28) made the possibility of owning productive dividend shares from this collection more viable for first-time investors.

Those eleven are: Direct Line Insurance Group plc, a financial service; BB Seguridade Participacoes SA, also a financial service; SPDR Blackstone Senior Loan ETF, an ETF; Sinclair Broadcast Group Inc, from communication services; VICI Properties Inc in real estate; Paramount Global, another communication services member; Nordstrom Inc, from consumer cyclical; Conagra Brands Inc, a consumer defensive selection; Deutsche Telekom AG, from communication services; CNH Industrial NV, an industrial; Fanuc Corp, another industrial.

All eleven live up to the ideal of having their annual dividends from a $1K investment exceed their single share prices. Many investors see this condition as a buy signal. The Dogcatcher calls this his ‘ideal dividend return rule’.

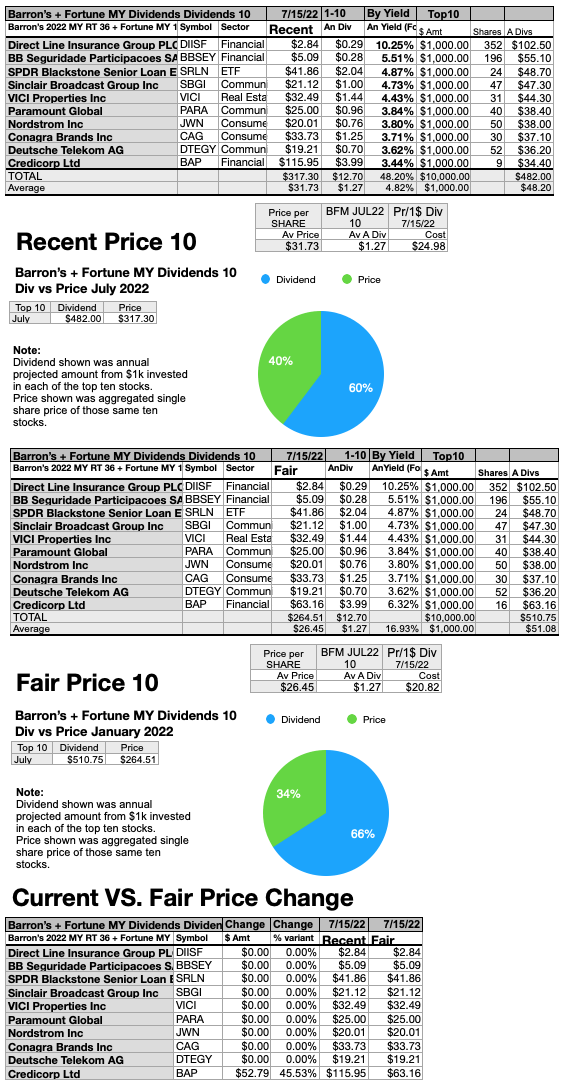

Price Drops or Dividend Increases Could Get All 10 Top MY22 Dogs Back to “Fair Price” Rates For Investors

Barfrons.com/YCharts.com/Fortune.com

The charts above retain the recent dividend amount and adjust share price to produce a yield (from $1K invested) to equal or exceed the single share price of each stock. As you can see, this illustration shows nine fair-priced dogs and one out-of-bounds-priced stock (BAP). The outlier needs to trim its price by fifty-three dollars to realize the 50/50 goal for share prices equaling dividend payouts from $10K invested.

The alternative, of course, would be that companies raise their dividends. That, of course, is a lot to ask in these highly disrupted, dollar-flooded, inflationary times.

MY22 Picks (by Sources)

Barrons.com/YCharts.com/Fortune.com

Stocks listed above were suggested only as possible reference points for your purchase or sale research process. These were not recommendations.

Graphs and charts were compiled by Rydlun & Co., LLC from data derived from www.indexArb.com; YCharts.com; Barrons.com; finance.yahoo.com; analyst mean target price by YCharts.

Be the first to comment