Justin Sullivan

Meta’s (NASDAQ:META) strategic pivot is a surprise to no one at this point. Besides the name change, part of Meta’s strategy involves reporting financials as two separate segments: 1) Family of Apps which includes Facebook, WhatsApp, Instagram, and Messenger; 2) Reality Labs – which provides augmented and virtual reality products like Horizon Worlds, Quest, Portal, and Spark.

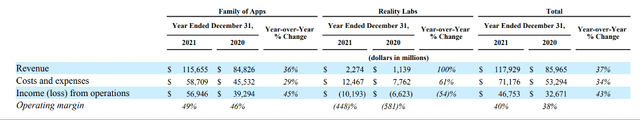

If not for the conscientious effort to prioritize the metaverse through its rebranding, this article would likely have a different tone. As seen in the consolidated financial statement below from Meta’s 2021 Annual Report, revenue growth in the Family of Apps segment came in at an impressive 36%. Reality Labs, meanwhile, is experiencing a $4.48 loss for every $1 of revenue generated according to its operating margin. Reality Labs is currently on track for even greater losses in 2022.

Consolidated Financials (Meta Platforms, Inc. Form 10-K (2021))

Meta’s management and bullish analysts would likely contend that this is a classic J-curve. The first part of the J-curve is the capital intensive, negative ROI portion as the technology is built out. Once complete, the adoption and scale of that technology will put the company on a path of higher revenue and much higher margins due to minimal capital expenditures required for software. However, there is reason to believe that adoption will be underwhelming.

What is the metaverse anyway?

Author and venture capitalist Matthew Ball defines the metaverse as “a massively scaled and interoperable network of real-time rendered 3D virtual worlds that can be experienced synchronously and persistently by an effectively unlimited number of users with an individual sense of presence.” Though this is the most robust definition that exists, it does not capture the convergence of multiple technologies required to make it happen like computing scale, augmented reality, and virtual reality.

Massively scaled, immersive worlds

According to Raja Koduri, Senior Vice President at Intel, a digital world massive enough to host billions of users in real-time would require “a 1,000-times increase in computing efficiency from today’s state of the art.” John Carmack, founder of Oculus, claims we are “five to ten years away.” Simply stated, what many imagine as the metaverse from science fiction novels like Ready Player One and Snow Crash are not technically feasible today. There is a reason why Massive Multiplayer Online games limit the amount of people playing on the same server at any point in time. There would otherwise be sacrifices in graphics and latency that dampen the experience.

Despite this, there are multiple steps along the road to a massively scaled, real-time rendered virtual worlds. Unfortunately, many of them face barriers in consumer adoption.

V/R and A/R consumer adoption

Family of Apps can easily find a consumer base due to mobile penetration rates around 80% in the developed world and 50% in the developing world. People are on their smart phones literally all the time. The same cannot be said for virtual reality headsets. To be fair, V/R and A/R can still be experienced in a non-immersive way – imagine gaming worlds, real estate walkthroughs, and snapchat filters. These integrate with already existing computer and smartphone devices.

Despite this, usage is still low. Virtual reality (headset and non-headset) penetration rates are only 16% in the United States and mostly for gaming. Though I believe the future of online interactions will become more immersive over time, it requires a different user experience than just downloading an application on your smart phone that you use every day. It requires a paradigm shift in the way we currently interact online, which constitutes web and smartphone-based applications. Some consider this paradigm shift a few years away. I believe it is a generation away. Reality Labs may be a black hole for longer than some expect.

Is blockchain Meta’s Achilles heel

There is one more important point. Even if all of the assumptions above are true and we will all be in the metaverse in five years, why Meta’s Horizon Worlds and product suite over Decentraland or The Sandbox or a family of applications centered around avatar integration like Ready Player Me?

In the above counter examples, users can own their clothes, in-game items, land, real-estate, and more as non-fungible tokens. A digital world where things are owned by users is more akin to the physical world. The alternative is a digital world owned by Meta. This is the public versus private metaverse debate that is currently raging. In my opinion, it is akin to the internet versus intranet debates of the mid-1990s. I believe the metaverse – whenever it comes to fruition, will be open and ownable through blockchain.

Conclusion

The numbers point to Meta’s Reality Labs being a black hole. Cash goes in, paltry revenue numbers come out. However, is this a J-curve dynamic where a huge payout will occur in a few years’ time?

The stock has been punished enough, down 63% YTD even after a 32% price increase in the last thirty days. This may still be an adequate entry point even with the Reality Labs anchor weighing it down. However, if you believe in a future where online interactions are immersive and Meta has the network effects to capitalize and grow Reality Labs in addition to its Family of Apps business, this is a great entry point.

I’m less optimistic. In terms of technical requirements and consumer adoption, we are farther away from the metaverse experience than anyone thinks. Even so, there is no guarantee that users will choose Meta’s rendering of this world over open ones.

Be the first to comment