Wolterk

Introduction

As a dividend growth investor, I am looking for attractively valued income-producing assets, mainly stocks. I’m buying stocks monthly to increase my dividend stream. Sometimes I add shares to existing positions when I believe they are relatively cheap. On other occasions, I start new positions to further diversify my holdings to new sectors and industries.

One of the most exciting sectors during times of higher volatility, as we see now, is the consumer staples sector. Shares in that sector tend to be less volatile, with a beta lower than 1. Some investors find them to be a haven in times of uncertainty. I will look into General Mills (NYSE:GIS), one of my first positions in the sector.

I will analyze the company using my methodology for analyzing dividend growth stocks. I am using the same method to make it easier to compare researched companies. I will examine the company’s fundamentals, valuation, growth opportunities, and risks. I will then try to determine if it’s a good investment.

Seeking Alpha’s company overview shows that:

General Mills manufactures and markets branded consumer foods worldwide. The company operates in five segments: North America Retail, Convenience Stores & Foodservice, Europe & Australia, Asia & Latin America, and Pet. It offers ready-to-eat cereals, refrigerated yogurt, soup, meal kits, refrigerated and frozen dough products, dessert and baking mixes, bakery flour, frozen pizza, pizza snacks, snack bars, fruit, and salty snacks, ice cream, nutrition bars, wellness beverages, and savory and grain snacks, as well as various organic products, including frozen and shelf-stable vegetables. The company also sells pet food.

Fundamentals

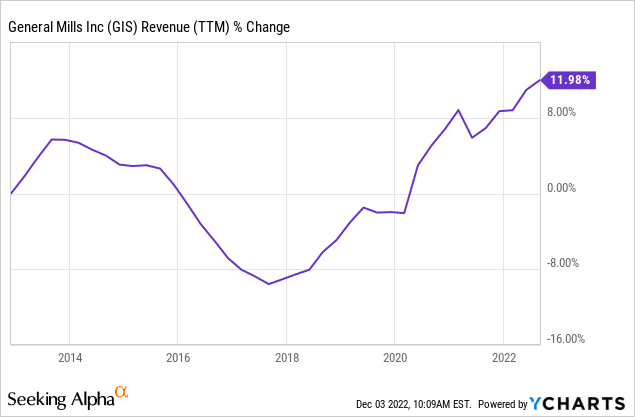

Revenues over the last decade have almost stagnated. In the previous decade, sales have increased by 12%. That figure equates to ~1% annually. Over that decade, sales grew slower than inflation. However, there has been a change about five years ago. The company accelerated repositioning its portfolio with the acquisition of Blue Buffalo to push for faster sales growth. Since the lows of 2017, sales have been up more than 20%. In the future, analysts’ consensus, as seen on Seeking Alpha, expects General Mills to keep growing sales at an annual rate of ~2.5% in the medium term.

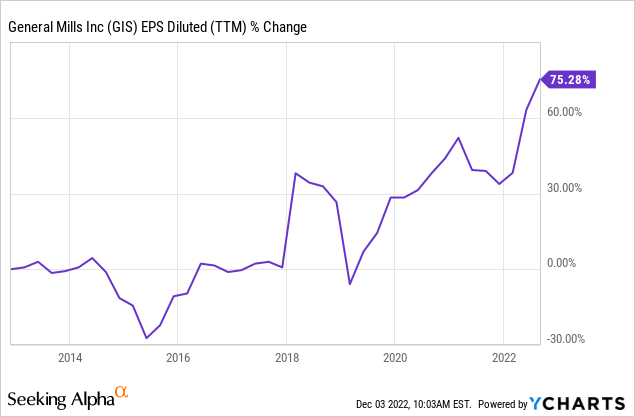

EPS (earnings per share) has increased at a much faster pace compared to sales. Until 2018 EPS was flat, and as the company repositioned its portfolio, it shifted towards brands with better pricing power and higher margins. The combination of the sales growth and the margin expansion led to a 75% increase in EPS since 2018. In the future, analysts’ consensus, as seen on Seeking Alpha, expects General Mills to keep growing EPS at an annual rate of ~5% in the medium term.

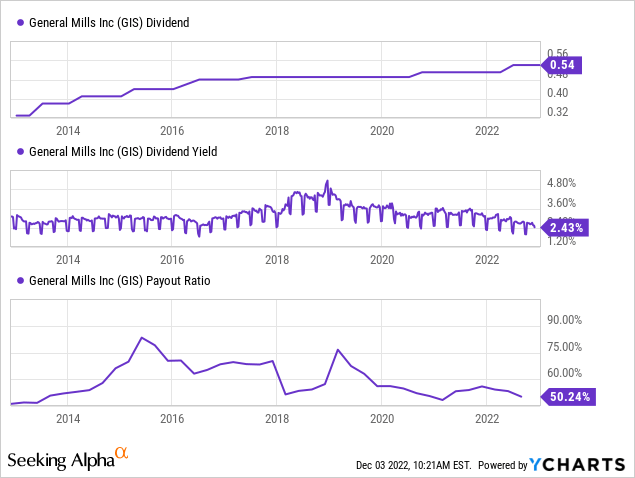

The company is probably one of the most impressive dividend growth companies. The company froze its dividend following the Blue Buffalo acquisition to deleverage its balance sheet. However, the company enjoys an impressive streak of 124 years without reducing dividends. The dividend seems relatively safe as the payout ratio stands at 50%, and the initial yield is almost 2.5%, in line with the average yield over the last decade.

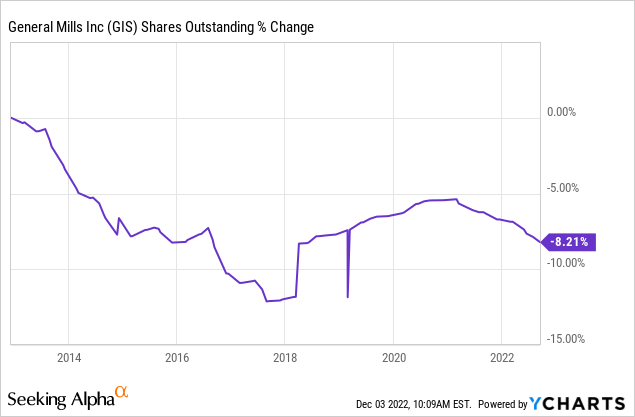

In addition to the dividends, General Mills rewards shareholders by buying back its shares. Share repurchase plans support EPS growth as they lower the number of shares outstanding. Over the last decade, General Mills decreased the number of shares by 8%. Buybacks are highly efficient when the company is attractively valued. Following the Blue Buffalo acquisition, General Mills issued shares and is on track to repurchase them.

Valuation

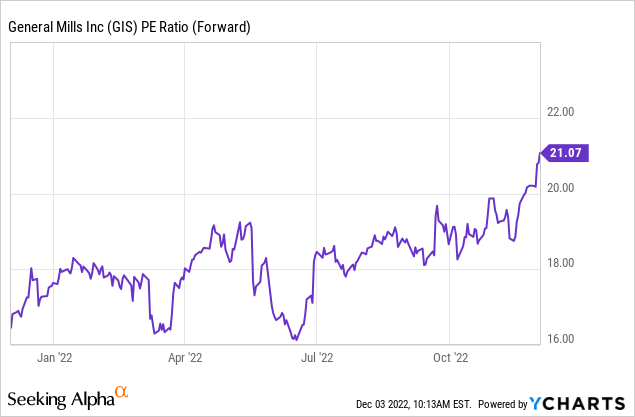

The P/E (price to earnings) ratio of General Mills has increased over the last twelve months. The current P/E ratio, when using the forward EPS forecast, stands at 21, significantly higher than the 16.5 we saw just a year ago. The valuation expansion can be associated with the safety and low volatility of the company. Yet Paying 21 times forward earnings for a company that grows at 5% annually may be risky.

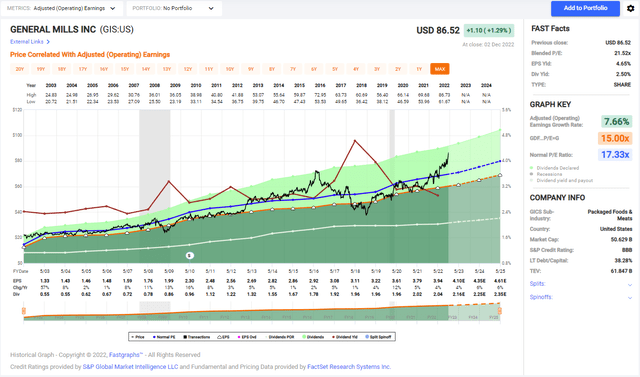

The graph below from FAST Graphs emphasizes how the share price detached from the valuation. Over the last twenty years, the average P/E of General Mills was 17.3. The current valuation is significantly higher, and it expanded recently as the company delivered solid results and its position as a haven for investors during volatile times. The expected growth rate is lower than the average growth rate of 7.66%, making this valuation questionable.

To conclude, General Mills has undergone a transformation to deal with its stagnation. Its fundamentals today are solid as the top, and bottom lines grow steadily. The company uses its free cash flow to reward shareholders with dividends and buybacks. However, the valuation seems a bit out of touch as the company trades for more than 21 times its forward earnings.

Opportunities

The first opportunity is a short-term opportunity. Consumer staples companies and General Mills, among them, are great for recession times. The low beta implies that when the market is down, it will outperform the broad market. General Mills outperformed the market in the 2008 financial crisis as it was down only 12%. It is only a short-term opportunity, but it may appeal to some investors.

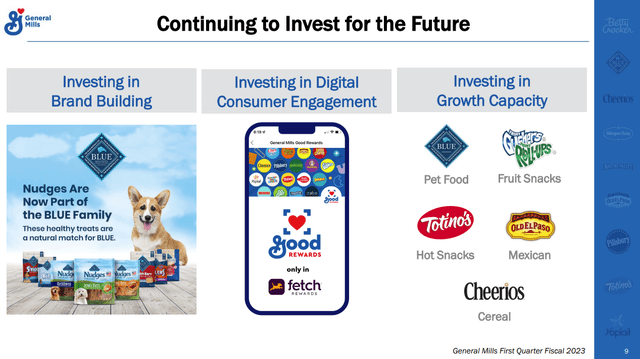

The company invests in the future and expands to achieve faster high-quality growth. The company invests in its digital assets. It allows it to sell directly and maintain a direct connection with the consumers. Moreover, the company also invests in its pet food business as people are willing to buy more expensive and high-quality food for their pets.

Focusing on pet food with the Blue Buffalo brand is only one way General Mills adapts its portfolio to this era. Even during 2022, General Mills keeps improving its portfolio. The N.A. Main Meals & Side Dishes divestiture, together with the N.A. Foodservice Dough Acquisition is part of the constant reshaping of the portfolio. The goal is to stay current, so the company keeps growing.

Risks

The first risk that General Mills is dealing with is competition. General Mills competes with branded products produced by companies like Kellogg (K) and private label products like Walmart (WMT). It is a significant challenge as there is a shallow barrier to entry in this business. Therefore, General Mills should always advertise and ensure that consumers love the products and their quality.

Another risk for General Mills in the current business environment is inflation. Inflationary pressures increase the costs for companies, and it is even more critical in a competitive realm like consumer staples. Companies will have to either raise prices and risk losing market share or find their already low margins shrink even more. It may have a short-term impact on companies in the industry.

High inflation is why central banks worldwide are increasing interest rates. It is another risk for General Mills. The company is not too leveraged following its deleveraging process in the past five years. However, the company finds itself competing with an old competitor, government bonds. For the last decade, there were almost no alternatives for dividend-paying stocks. However, with 10-year bonds yielding ~3.5%, investors may favor them. It may put pressure on the price of General Mills and its peers.

Conclusions

General Mills is a decent company. The company has successfully turned itself around and found a new path for growth. It offers solid fundamentals with stable growth even during challenging times. The company also has several growth opportunities within its core business as it constantly reshapes it. It also investors in growing outside of its core in the pet food business, and the move looks promising.

However, the current valuation of General Mills is challenging. The company trades for a high P/E ratio as investors prefer safer assets during volatile times. However, the problem is not just the lack of margin of safety but also the fact that there are genuine risks. The inflation, the higher rates, and the competition pose risks for General Mills. Therefore, I believe the company is a HOLD at the current price.

Be the first to comment