Joe Raedle/Getty Images News

In July, Unilever PLC (NYSE:UL, OTCPK:UNLYF) implemented a new, “category focused,” operating model.

This replaced the “matrix structure” it previously used.

Under the previous structure, Unilever would report divisional results for:

- Beauty & Personal Care

- Home Care

- Foods & Refreshment

Additionally, it reported the aggregate geographical results for:

- The Americas

- Europe

- Asia Pacific / Africa (includes Russia and Middle East)

From now on, the company will instead publish detailed results for five categories, and will stop publishing a geographic breakdown of its results.

Why it matters

It’s important news for a couple of reasons. Firstly, and most obviously, it changes the information that will be available for investors to analyze.

But secondly, it reflects an underlying change in how Unilever views and manages its businesses.

From now on, each category – known as a Business Group – will have full responsibility for its own strategy, growth and profitability.

This implies more autonomy for each Business Group to make its own decisions globally, instead of centralized decision-makers sending out instructions and ideas to each product in each geographical area.

If Unilever can get the incentive structure right, this should allow for each Business Group to take a more entrepreneurial approach, which could include focusing resources where growth and profitability are higher and removing capital from areas where it is generating lower returns.

Capital allocation will hopefully become more intelligent, resulting in improved financial performance. As I’m about to show, there are one or two categories where this is badly needed.

The new categories are:

- Beauty & Wellbeing (2021 sales: €10.1 billion)

- Personal Care (€11.7 billion)

- Home Care (€10.6 billion)

- Nutrition (€13.1 billion)

- Ice Cream (€6.9 billion).

This table gives an indication of some of the biggest brands in each category:

Unilever’s new categories (unilever.com)

Restated Figures

Unilever has helpfully published a document that lays out its historic performance using the lens of this category-focused operating model.

Let’s dig into this and see which categories are over-achieving, and which ones need improvement.

Underlying Sales Growth

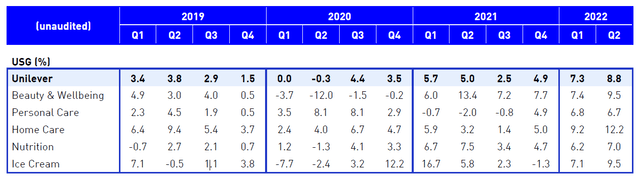

Unilever USG by category (unilever.com)

Putting this in chart format, I get the following (all figures are year-on-year):

Unilever USG by category (Author, using data from unilever.com)

As you can see, underlying sales growth for Unilever as a whole (grey) has taken off in H1 2022, and is on a rising trend after bottoming in FY 2020.

Within categories, we saw a sharp dip in Beauty & Wellbeing (yellow) during the Covid crisis of 2020.

This was followed by weakness in Personal Care (blue) in 2021. However, both categories have since strongly recovered.

In addition, Home Care (green line) has been particularly strong in H1 2022. All categories are growing by at least 6%.

Underlying Volume Growth

Unfortunately, much of the increased spending post-Covid is due to inflation, (and some would argue that the extent of global inflation is itself at least partially caused by central bank policies during Covid).

This makes it difficult to argue that we’ve seen a full post-Covid recovery at Unilever. While it’s true that spending on the company’s products has recovered, inflation-driven spending does not signify real organic growth.

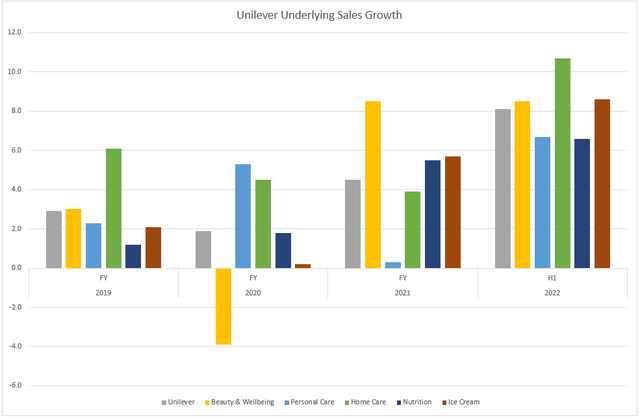

Therefore, let’s look at the company’s underlying volume growth (UVG) in each category. This lets us strip away the effects of inflation on sales growth.

The results are less than inspiring:

Unilever UVG by category (Author, using data from unilever.com)

Volume growth paints a very different picture. Unilever as a whole has seen a reduction in UVG in H1 2022, with three of its five categories shrinking. These figures stand in stark contrast to the growth in underlying sales.

Personal Care, Home Care and Nutrition all saw underlying volumes shrink in H1 2022 (using year-on-year comparisons). Personal Care volumes also shrank in 2021. Could it be that this category is where customers are most willing to switch to cheaper, private label alternatives? Remember that it includes household staples like Surf, Cif and Domestos.

Only Beauty & Wellbeing and Ice Cream have remained positive in H1 2022, though both of these categories are now growing at a much lower rate than they were before.

Underlying Profitability

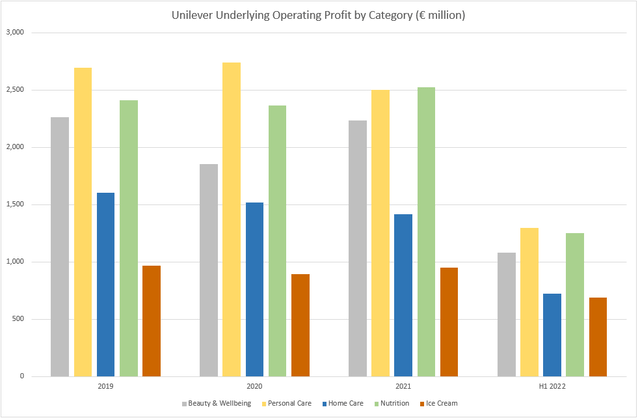

Finally, let’s see which categories are the most profitable, and check the trends in underlying profitability:

Unilever underlying operating profit by category (Author, using data from unilever.com)

Firstly, Personal Care and Nutrition are the stand-out contributors. Personal Care shows negative annual trends, while Nutrition is improving.

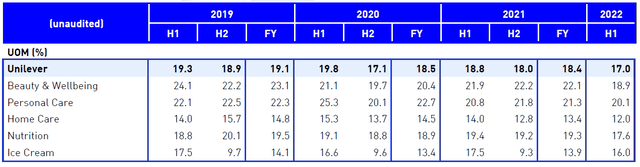

Personal Care is also the most valuable category from the point of view of underlying operating margin:

Unilever underlying operating margin by category (unilever.com)

Home Care, the category with the second-worst underlying volume growth over the past 18 months, is also the category with the lowest margins. Its margins have worsened each year since 2019 and are now materially lower than every other category – even Ice Cream, which used to be Unilever’s low-margin category!

Conclusions

The Home Care category is need of a reboot. With weakening margins and shrinking volumes, it has become reliant on inflation for underlying sales growth. This is not a formula for long-term success.

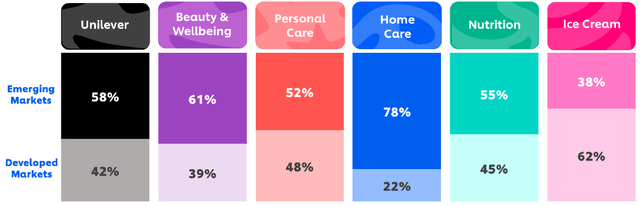

I should mention that one factor that may be working against it is its exposure to emerging markets. Home Care’s biggest markets are India, China and Brazil (all other categories have the USA as their largest market):

Sales at Unilever by category (unilever.com)

It’s noteworthy that the Ice Cream segment, where margins have been improving, is also the Unilever category with the lowest exposure to emerging markets.

Ice Cream’s biggest markets are the USA, Germany and the UK. And unlike the other categories, Ice Cream does not have much exposure to India.

(The Indian economy is still growing in 2022, but it has slowed down significantly versus 2021. Furthermore, retail inflation has spiked to 7%, which is likely to have a bigger impact on consumer spending patterns than high inflation rates in the USA and Europe.)

The good news is that under Unilever’s new operating model, the Home Care division will be able to tackle these challenges independently of the other Business Groups.

This could mean adopting an EM-specific strategy that reflects the difficulty of selling branded household products, such as bleach, in particular countries during periods of higher inflation.

Personal Care, while less exposed to emerging markets, also needs a reboot after 18 months of declining volumes.

Hopefully, we can look forward to fresh thinking from Unilever’s managers under the new operating model, as they navigate their way through these turbulent economic times.

Unilever’s forward P/E is around 18x, roughly in line with the sector, but the company has excellent quality metrics (Seeking Alpha awards it a profitability grade of A+).

With an average stock valuation, above-average quality, and a new operating model that will hopefully reward entrepreneurial thinking and lead to more dynamic strategies, I currently rate these shares as a Buy.

Be the first to comment