Darya Komarova/iStock via Getty Images

Introduction

ASML’s (NASDAQ:ASML) CTO, Martin van den Brink, gave an interview last week where he shared some interesting insights about the future of ASML. We recommend reading the entire interview, but we decided to write an article with some highlights here with our commentary.

Without further ado, let’s get started.

Is hyper-NA possible?

The main highlight of the interview, which gives its title, is that Mr. van den Brink doesn’t think hyper-NA, the next generation of EUV, will ever be possible:

We’re researching it, but that doesn’t mean it will make it into production. For years, I’ve been suspecting that high-NA will be the last NA, and this belief hasn’t changed.

Source: Martin van den Brink, ASML’s CTO, during his latest interview

For context, high-NA is currently the most advanced lithography system in the world and ASML is its sole manufacturer. The system is expected to go into high-volume manufacturing of the most advanced chips in 2025. Hyper-NA would be even more advanced and allow the manufacture of chips with even greater computational power.

High-NA is already an extremely complex system, but the main roadblock for hyper-NA is not physics or technology; it’s the economics of the system. The system could be manufactured, but would it be economically viable? That’s the question ASML must answer:

Theoretically, it can be done. Technologically, it can be done. But how much room is left in the market for even larger lenses? Could we even sell those systems? I was paranoid about high-NA, and I’m even more paranoid about hyper-NA. If the cost of hyper-NA grows as fast as we’ve seen with high-NA, it will pretty much be economically unfeasible. Although, in itself, that’s also a technological issue. And that’s what we’re looking into.

Source: Martin van den Brink, ASML’s CTO, during his latest interview

ASML’s strategy to manufacture hyper-NA is different than that of high-NA. With the latter, the company aimed to achieve it whatever its cost, but with hyper-NA, they will only pursue it if it’s economically feasible:

So that’s a radical departure from our approach to high-NA. We were going to make sure that high-NA would happen. For hyper-NA, we’re accepting that there may be an insurmountable cost constraint, not in the least because transistor shrink is slowing down.

Source: Martin van den Brink, ASML’s CTO, during his latest interview

ASML has a long history of making the impossible possible, so we can’t lie that we are optimistic that the company might pull this one off too. One of ASML’s head of research, Vadim Banine, said the following a couple of weeks ago:

EUV has a lot of things which look like magic. The pellicle was just one of the many ‘impossible’ things that turned out to be possible.

Of course, this is just our feeling, and we don’t know if hyper-NA will end up getting to the market, nor should our investment thesis rely on this potential achievement.

What seems clear is that if it’s possible, it will be ASML who gets it first. A decade-long advantage allows the company to focus on hyper-NA while competitors have not even managed to come up with an alternative to low-NA, the first and least advanced EUV system. The road is long, and there are many roadblocks, but there’s only one participant in the race.

If no hyper-NA, what then?

In this scenario, the obvious question that should come to any investor’s mind is:

If hyper-NA is not possible, what comes after high-NA?

The straight answer is that we don’t know, but this was already the case when we invested in the company. There’s good news, though. ASML will not stand still while it tries to get hyper-NA right, and neither will its financials.

The first focus point will be making EUV much more productive until it achieves the same performance as systems that operate in 193 nanometers. This might be a decade-long of work:

As long as the performance isn’t yet at the level of 193-nm lithography, there’s a lot of room for improvement. We can still gain a lot in transmission, for example, possibly a factor of two. And we’re not yet squeezing every nanometer of resolution out of the optics. With 193-nm scanners, we’re at the limit thanks to the manipulation of the illumination system. EUV scanners do not yet have the same level of sophistication.

Source: Martin van den Brink, ASML’s CTO, during his latest interview

Of course, this improved performance will come with benefits for the company. ASML will increase prices as EUV gets more efficient, following a value-based pricing model:

…the biggest contribution to potential margin improvement will remain the value we continue to bring to our customers. And it’s very difficult to give you a number. I know you’re looking for the exact number. But I will stick to the principle I gave you, which is if we continue to be able to improve productivity by 10%, 15%, every generation, we do expect some margin improvement as a result of that.

Source: Goldman Sachs Global Semiconductor Virtual Conference with ASML’s VP of EUV, Christophe Fouquet

ASML will also be able to grow in volume because, as chips become more advanced, more layers will require EUV technology, and customers will need more systems. There’s obviously an opportunity for increased tech penetration worldwide, which will drive increased demand for chips for years to come.

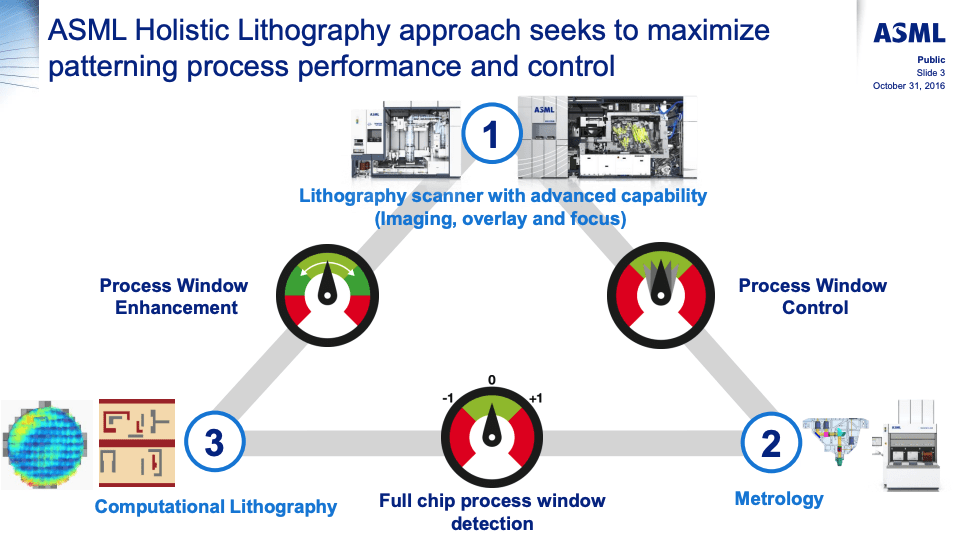

The second focus point for ASML will be holistic lithography. The lithography process goes beyond just “printing” the pattern on the silicon wafer. A 360º approach is necessary to ensure defects are kept to the minimum and yield (the number of chips in the wafer that are in usable condition) is optimized. ASML presented its approach to holistic lithography in a 2016 presentation:

ASML 2016 presentation

ASML dominates number 1, especially in EUV, where there’s no competition. There are competitors in numbers 2 and 3, but ASML is leveraging its system dominance to incentivize the use of its proprietary software and its metrology systems.

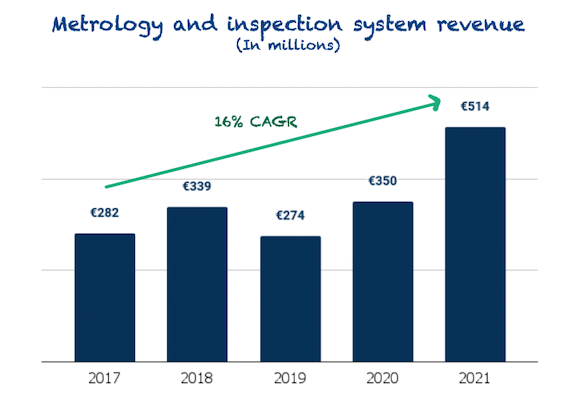

It seems to be playing out quite well for metrology and inspection revenue, which has enjoyed a 16% CAGR since 2017:

Made by Best Anchor Stocks

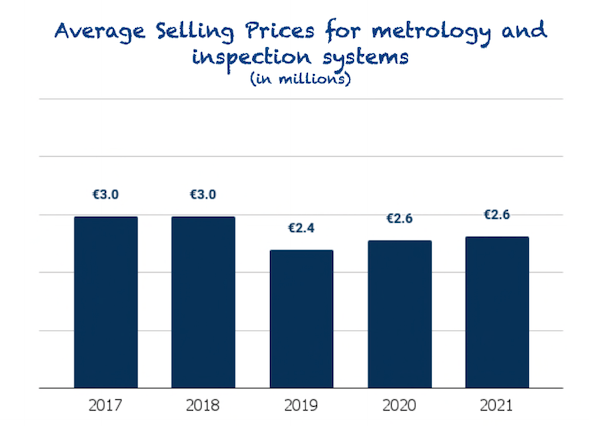

It’s true, though, that the revenue growth was achieved through more units rather than price increases, showing that competition is more intense outside lithography systems:

Made by Best Anchor Stocks

However, as the industry shifts to EUV (which only ASML manufactures), the company might be in an even stronger position to pursue this strategy.

Regarding software, we can’t precisely measure the success of the strategy from the financial statements, as it’s bundled together with service sales in service and field option sales revenue. However, in an expert call, we read the following:

Because they’re the ones selling the machine, then they limit the data access to their tool. They have control of the data because they manufactured the tool. They try to play the game from that angle to actually limit the data access and they then tell client that they should use their software. Of course, sometimes customers are unhappy with this.

Source: Former Chief Product Owner at ASML (Alphasense)

It’s still early to know if this approach will be successful over the long term, but early signs suggest ASML might become an important player in capturing adjacent revenue to pure lithography printing. It’s undoubtedly easier to dominate the end-to-end process if you enjoy a monopoly in one of the key parts.

Conclusion

High-NA might be the limits of lithography, but there’s a slight possibility that ASML can continue to make possible what seems impossible. However, our investment thesis in ASML doesn’t rely on this, and we should take it more as some sort of optionality. Nonetheless, ASML still has many years of work to do on existing systems, and secular tailwinds are as strong as they have ever been.

In the meantime, keep growing!

Be the first to comment